PIX Garantido: The Future of Installment Payments in Brazil

Hey Payments Fanatic!

Much is said about the impact of Pix on cards in Brazil. Introduced at the end of 2020, Pix has been highly successful in gaining acceptance among retailers and consumers.

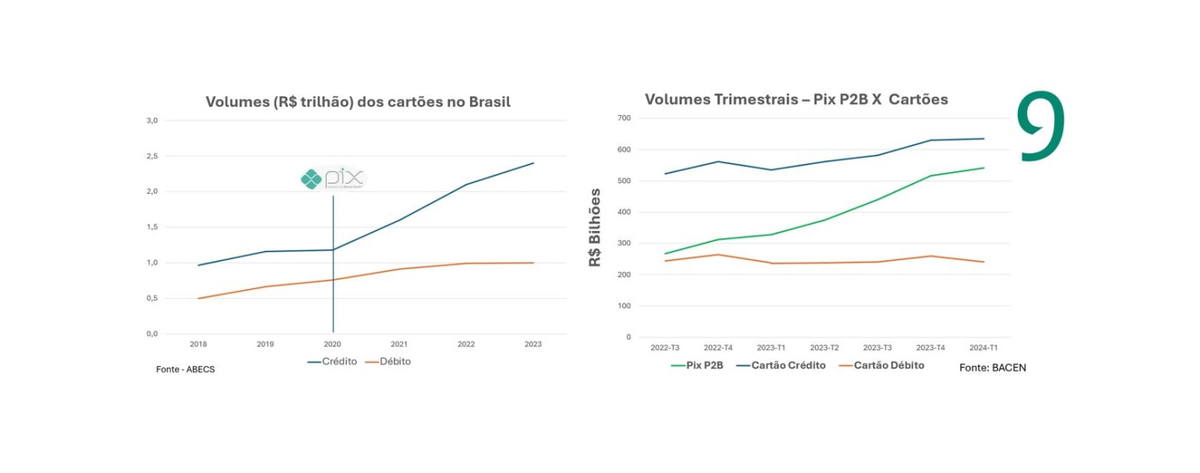

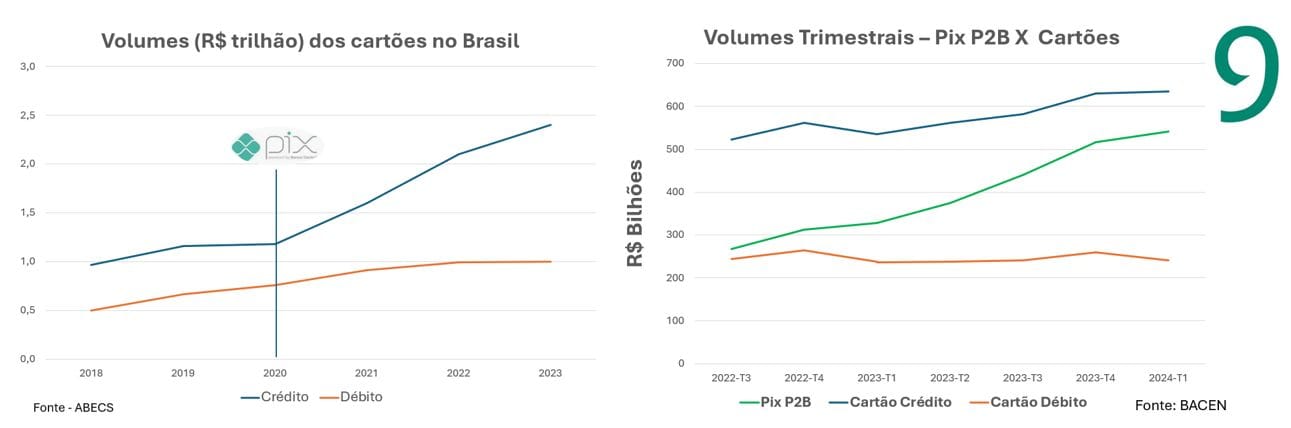

In the left graph (annual basis), we see that from the introduction of Pix (marked), the total volume curve for credit cards changed, accelerating in growth, while the same was not observed for debit cards, which show stagnation starting from 2022.

The right graph provides a more recent observation (quarterly basis), considering the total volumes of cards and also Pix in the P2B (person-to-business) mode, which is the type of transaction most comparable to card transactions.

This observation confirms a greater comparative acceleration of Pix, with a negative trend in the debit card curve. However, in the case of credit cards, growth remains steady. So far, the negative impact of Pix on cards is evident only against debit cards.

Meanwhile, The Central Bank of Brazil is working on developing the "PIX Garantido" which will enable customers to make installment payments through this payment system once it is implemented.

This feature could serve as an alternative to credit card installments, a popular method for high-value purchases. The Central Bank has not provided further details about PIX Garantido or whether interest will be charged on these transactions.

The Brazilian Federation of Banks (Febraban) explained that for PIX Garantido, customers need to have money in their checking account to make payments on the installment due dates.

In August last year, the president of the Central Bank, Roberto Campos Neto, said that PIX Garantido would offer an installment payment option to customers.

At that time, one of the proposals under discussion, which was not implemented, was the end of credit card revolving credit and the installment payment of the outstanding balance with lower interest rates. This was in line with a law passed by Congress, which limited the credit card outstanding balance effective January this year.

While working on the rules for PIX Garantido (installment payments for products and services), the Central Bank plans to launch two new modalities in October: automatic PIX and scheduled recurring PIX.

These modalities, allowing scheduled payments from customers' accounts, are similar to PIX Garantido (installments).

According to the regulation for automatic and scheduled PIX, if there are insufficient funds in the payer's account on the due date, notifications will be sent, and new attempts will be made in the following days.

Automatic PIX can be used, for example, to pay:

*Water and electricity bills

*School and college fees

*Gym memberships and condominium fees

*Loan installments

These payments can already be made via direct debit, but the Central Bank believes automatic PIX will reach more people.

With automatic PIX, companies won't need to sign a contract with each financial institution, just an agreement with one bank offering this service to businesses.

Cheers,

INSIGHTS

🇸🇪 Klarna CEO Sebastian Siemiatkowski led the rise from a profitable business to their peak of almost $𝟱𝟬 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝘃𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻, in which they were burning $𝟭𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 a month. This and more in Logan Bartlett’s latest podcast episode👇

PAYMENTS NEWS

🇳🇱 Ant Group announced that it completed the acquisition of MultiSafepay, one of the leading payment service providers in the Netherlands / Belgium / Luxembourg (Benelux region) targeted at the SME and lower-end enterprise market. Through this acquisition, Ant will bolster its global capabilities in the Netherlands and across Europe.

🇺🇸 Swiftcrypt Exchange has launched a new cross-border payment solution designed to provide users with secure and cost-effective payment services. Built on blockchain technology, the solution enables instant settlement and transparent fund flow, simplifying traditional cross-border payments.

🇬🇧 UK Fintech Modulr’s embedded payments give Multifi access to real-time payment rails including faster payments, SEPA Instant in Europe. Multifi’s mission is to simplify finance for small businesses. Unlike traditional banks, its streamlined process allows businesses to obtain an indicative credit limit with just a few details entered.

🇺🇸 US start-up Arrow emerges from stealth aiming to streamline healthcare payments. Formerly known as Walnut, Arrow has emerged from stealth offering the US healthcare sector a range of tools that enable “fast and accurate” payments for both healthcare providers and payers.

🏦 Five Asian markets to link domestic instant payment schemes. The Bank for International Settlements is to move toward live implementation of Project Nexus, an initiative that seeks to enhance cross-border payments by connecting multiple domestic instant payment systems globally.

🇸🇬 Mastercard and Wilson Sonsini FinTech experts to join Pomelo Group Advisory Board. Mr Joshua Kaplan, Wilson Sonsini’s partner and former COO of Checkout.com, and Mr Sapan Shah, Senior VP of Mastercard and Head of Acceptance APAC, were appointed to the Advisory Board. They will advise Pomelo’s leadership team on strategic decisions, product, customer and partnership initiatives.

GOLDEN NUGGET

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐩 𝐭𝐨 𝐂𝐚𝐬𝐡?

"Tap to Cash" is a new feature introduced by Apple, aimed at enhancing digital transactions. It allows users to convert their Apple device into a digital wallet that supports various payment methods, including contactless payments, making financial transactions more seamless and efficient — ultimately competing with PayPal, Square, Google Pay, and many others. It enhances the utility of Apple devices by integrating more financial services.

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 & 𝐑𝐞𝐥𝐞𝐯𝐚𝐧𝐜𝐞:

🔸 𝐑𝐞𝐭𝐚𝐢𝐥 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬: Allows users to make payments at physical stores using their Apple devices.

🔸 𝐏𝐞𝐞𝐫-𝐭𝐨-𝐏𝐞𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Facilitates quick and easy money transfers between individuals.

🔸 𝐎𝐧𝐥𝐢𝐧𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞𝐬: Simplifies and secures online transactions by using Apple's secure payment infrastructure.

"𝐓𝐚𝐩 𝐭𝐨 𝐂𝐚𝐬𝐡" 𝐱 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 — 𝐇𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬

Apple's "Tap to Cash" utilizes tokenization to secure transactions. This process ensures that actual card details are not transmitted during transactions, thereby reducing the risk of fraud.

🔸 𝐓𝐨𝐤𝐞𝐧 𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧: When a payment method is added to Tap to Cash, a token is generated by the payment network.

🔸 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬: During a transaction, this token, along with a cryptographic key, is used to authenticate and complete the payment.

🔸 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Since tokens are useless if intercepted, this significantly enhances transaction security.

4 𝐌𝐚𝐣𝐨𝐫 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐭𝐡𝐞 "𝐓𝐚𝐩 𝐭𝐨 𝐂𝐚𝐬𝐡"

1️⃣ 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Tokenization minimizes the risk of fraud by not exposing actual card details.

2️⃣ 𝐂𝐨𝐧𝐯𝐞𝐧𝐢𝐞𝐧𝐜𝐞: Simplifies the payment process, making it faster and more user-friendly.

3️⃣ 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧: Works seamlessly with other Apple services and devices, enhancing user experience.

4️⃣ 𝐕𝐞𝐫𝐬𝐚𝐭𝐢𝐥𝐢𝐭𝐲: Supports multiple payment methods and use cases, from retail to P2P transactions.

𝐇𝐨𝐰 𝐌𝐏𝐀𝐍𝐬 𝐢𝐦𝐩𝐚𝐜𝐭 "𝐓𝐚𝐩 𝐭𝐨 𝐂𝐚𝐬𝐡"

When a user registers a payment card with Apple's Tap to Cash, a token is generated, and an MPAN is associated with this token. This MPAN is specific to the device and the merchant, adding an extra layer of security.

Apple's "Tap to Cash" feature marks a significant advancement in digital payments, offering enhanced security, convenience, and seamless integration. By leveraging tokenization (MPANs), it ensures safer transactions, making it a robust solution for both consumers and retailers.

Apple hit $3 in market cap showcasing its continued innovation and potential impact on the digital payment industry 🚀

Source: Apple

And I highly recommend following my partner at Connecting the Dots in Payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()