Pix Expands Again: Contactless, Bolepix, and Automation

Hey Payments Fanatic!

Brazil’s instant payment system, Pix, is evolving (again). Since its launch in 2020, it has reshaped digital transactions, making instant transfers the standard for millions, reaching in December a record of 240 million transactions in a single day. Now, three major updates promise to strengthen Pix’s role in the daily lives of Brazilians.

Starting in March, "Pix por Aproximação" (Contactless Pix) will let users pay simply by tapping their phone on a compatible terminal—no need to open a banking app. The feature has been tested since November 2024 via Google Pay and uses NFC technology, the same applies to contactless card payments. Security measures include biometric authentication, encryption, and transaction limits.

Two additional features are on the way: Bolepix merges traditional bills with Pix, enabling faster payments for utilities, school fees, and financing installments, while Pix Automático simplifies recurring transactions, allowing subscriptions and bills to be paid automatically each month.

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

INSIGHTS

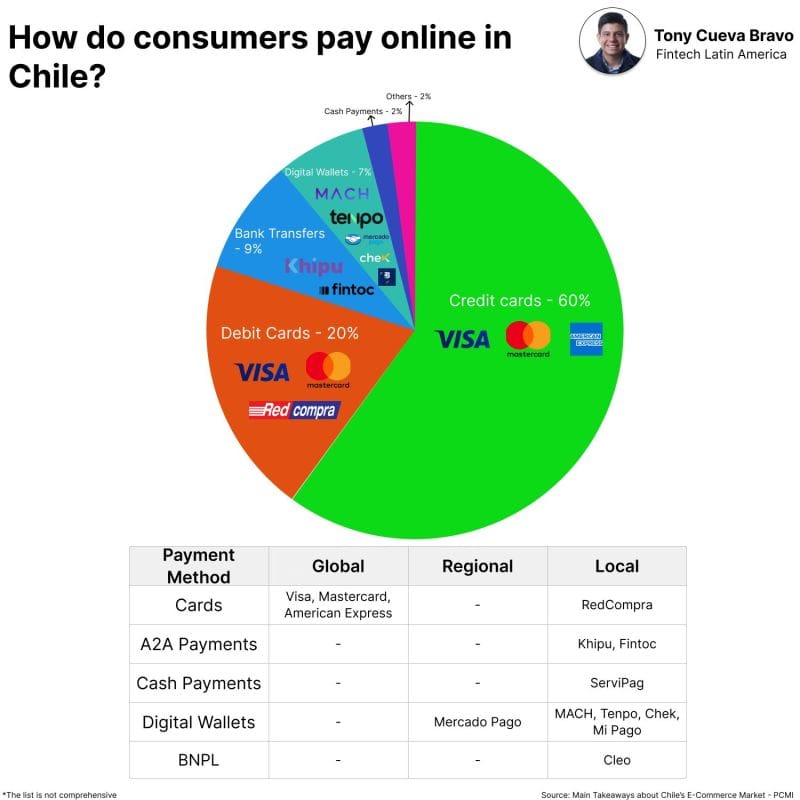

🇨🇱 How do consumers pay online in Chile?

PAYMENTS NEWS

🇺🇸 Block shares plunge 18%, for worst day on market in 5 years after earnings miss. Block reported earnings of 71% per share, falling short of the average analyst estimate of 87 cents. Block’s Q4 revenue grew 4% to $6.0 billion ($230 million miss), while gross profit grew 14% to $2.3 billion, slightly below expectations.

🇮🇳 PhonePe, India’s payments FinTech backed by Walmart, has begun preparations for a public listing on Indian stock exchanges. This move makes PhonePe the third major FinTech to go public in the country in the past 5 years. Continue reading

🇧🇷 Claro receives IP license, with capital of over R$ 263 million. The telecommunications operator has received authorization from the Central Bank to operate a regulated Payment Institution. The approval allows Claro Pay to operate in the roles of electronic money issuer and Payment Transaction Initiator.

🇬🇧 UK government issues £49m tender for payment services provider to underpin GOV.UK Pay platform. The move is part of the government’s push for open banking, highlighted in its National Payments Vision, which urged “the FCA and PSR to consider its commitment to developing open banking to drive delivery of seamless account-to-account payments.”

🇬🇧 Mastercard wins UK court nod for £200m deal to end £10b class action claim. The Competition Appeal Tribunal approved the deal rejecting the litigation funder Innsworth Advisors Ltd.’s allegation that the settlement undervalued the claim.

🇺🇸 Chase to restrict use of Zelle for purchases through social media. Chase told customers that it will add some restrictions on their use of the peer-to-peer payment network Zelle with Chase. The new provisions include that it may delay, decline, or block Zelle payments that originate from contact through social media.

🇬🇧 Klarna to be rolled out in 600 Euronics stores across UK. The rollout is happening in two stages, starting with Klarna being live on Euronics.co.uk, allowing customers to split their purchases at checkout. Next, it will launch in up to 600 Euronics stores across the UK.

🇺🇸 FinTech Finzly streamlines Live Oak Bank wire services via STP with Fedwire Solution. The partnership with Finzly gives the bank payment infrastructure the flexibility to adapt to customers’ needs, while also allowing it to streamline operations for our internal teams.

🇺🇸 Corpay Cross-Border named the official FX Payments supplier of the FIG. Through this partnership, the FIG will be able to utilize Corpay Cross Border’s innovative solutions to help mitigate foreign exchange exposure from their day-to-day business needs.

🇺🇸 Galileo enables brands to offer co-brand debit rewards cards. The program will initially focus on the hospitality and travel sectors. By enabling them to quickly offer loyalty-driven debit cards, Galileo helps boost customer engagement and drive increased spend.

▶️ Agents and LLMs can now understand, query, and execute Stripe with its new MCP server. Watch the video to see it in action, enabling voice-powered subscription management. (Source: Jeff Weinstein on X)

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()