Paytm Sells PayPay Stake to SoftBank for $279.2M

Hey Payments Fanatic!

Paytm has reached an agreement to sell its stake in Japanese payments firm PayPay to SoftBank for $279.2 million, marking another strategic divestment following regulatory challenges in India earlier this year. The transaction adds to Paytm's recent restructuring efforts, which included the $246 million sale of its entertainment ticketing unit to Zomato in August.

Paytm stated: "We are grateful to Masayoshi-san and the PayPay team for giving us the opportunity to together create a mobile payment revolution in Japan."

The company's cash reserves will increase to $1.46 billion following this sale, as it works to regain market share in India's payments sector after regulatory restrictions on its banking affiliate in January.

The deal concludes Paytm's relationship with SoftBank, which had already divested its Vision Fund shares in June. PayPay, currently led by SoftBank and Yahoo Japan parent Z Holdings, maintains its position as a leading payments app in Japan.

Enjoy more Payments industry news below👇 and I'll be back in your inbox tomorrow.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

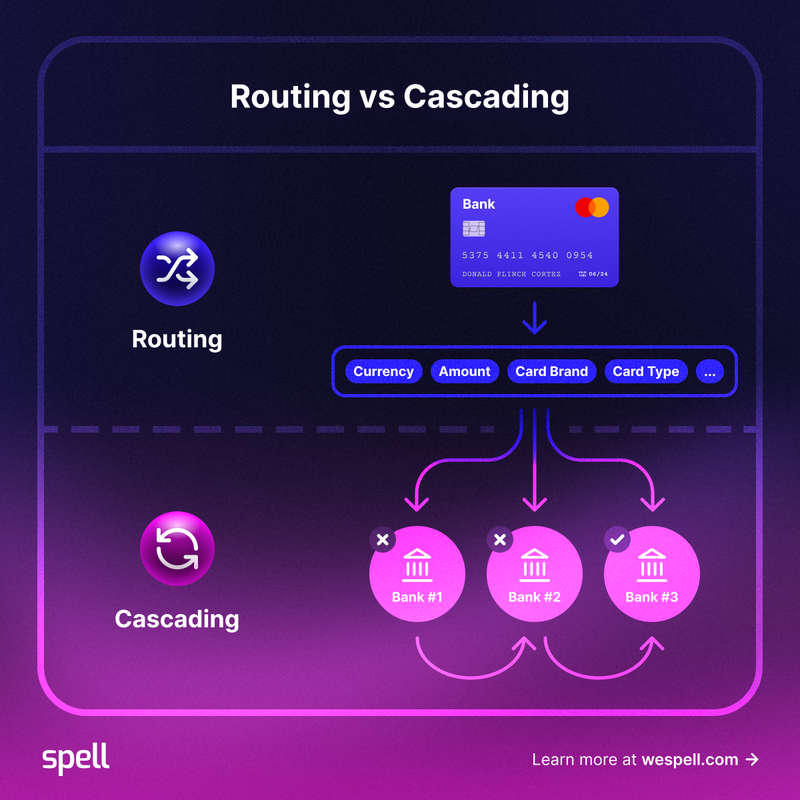

🇱🇻 Routing and Cascading Payments Explained: Techniques, Benefits, And What’s New. This article, by Spell, features some cases of how routing and cascading can optimize payments processing results for PayTech businesses. Spell offers multiple pre-built intelligent routing and cascading scenarios and are always ready to implement new custom-tailored solutions. Dive deeper—read full article

🇱🇹 How accepting crypto payments can benefit education services. The education sector is evolving rapidly, including its payment methods. In 2024, the global eLearning market reached approximately $316 billion, with a projected annual growth rate of 5.3% through 2029, expected to exceed $75.5 billion. Explore Kuna Pay's article to learn more

🇺🇸 Is “Data Is King” the New “Content Is King”? Content has been the cornerstone of SEO, marketing, and consumer engagement strategies. But as we stand on the brink of an AI-powered future, it’s time to ask: has content been dethroned? Is data the new king? Uncover the details in PayQuicker's full article.

🇺🇸 Google sues Consumer Financial Protection Bureau. The company challenged CFPB decision to place Google’s payment division under federal supervision. Google called the move burdensome and based on a “small number of unsubstantiated user complaints.” The CFPB cited consumer risk concerns.

🇸🇬 Ant International has joined the Swift program to enhance cross-border payment solutions, with a pre-pilot initiative focused on tracking transactions across banks. The program aims to improve transparency and user experience in cross-border payments. This move comes as Ant International experiences global growth, driven by expansions in Alipay+, Antom, WorldFirst, and Embedded Finance. Notably, cross-border transactions through Alipay+ have tripled in 2024, although specific transaction values have not been disclosed.

🇬🇧 TrueLayer partners with Ryanair. The partnership represents an important step for both companies, as they will focus on optimising the overall customer experience and accelerate the development of travel finance. Keep reading

🇰🇪 Kenyan FinTech Leja processes $2 Billion in business transactions in 2024. This milestone reflects a 30% month-over-month growth rate and a cumulative 300% increase in B2B transactions over the course of a year. Continue reading

🇦🇺 RBA payments data shows massive surge in mobile wallets. For the first time, the RBA's latest retail payments data includes newer payment technology, revealing over 500 million payments via mobile wallets in October, totaling more than $20 billion.

🇺🇸 Circle and Pockyt join forces to simplify global payments with USDC. The integration will enable thousands of Pockyt merchants and over a million users to transition effortlessly between traditional and digital payment methods.

🇳🇴 Vipps launches an alternative solution to Apple Pay in Norway. Tap with Vipps will work on all card terminals that accept BankAxept cards, which corresponds to almost all card terminals in Norway. Access the full piece

🇺🇸 US judge won't revive rule capping credit card late fees at $8. U.S. District Judge Mark Pittman in Fort Worth declined to lift an order that has blocked a new U.S. regulation capping credit card late fees at $8, a policy challenged by business and banking groups.

🇰🇼 PayTabs to provide advanced payment solutions in Kuwait. PayTabs Kuwait, in partnership with Concept Combined Group Kuwait, will look to ‘transform’ the country’s digital payment landscape with payment orchestration solutions aimed at driving the digital transformation of its economy.

🇺🇸 MobiFin and INETCO partner to deliver cutting-edge digital banking and payments security. This partnership will enable financial institutions to maximize the security of their digital banking services while providing a seamless, unified digital banking and payment experience to the customers.

🇧🇬 IRIS Solutions launches cardless bank payment app IRISPay for merchants, providing an alternative to traditional card-based payments. IRISPay allows businesses to accept account-to-account (A2A) payments via QR codes, eliminating the need for POS terminals and card networks.

🇺🇸 Paze Checkout Solution makes online shopping fast and streamlined for BofA clients this holiday season. Just in time for the holidays, all eligible Bank of America cards now support PazeSM, which is a secure, streamlined online checkout solution that uses card tokenization to protect cardholder information.

🇪🇺 Paybis adds PayPal for crypto purchases in Europe. The Paybis integration is now live in Europe, enabling users to fund crypto purchases directly via PayPal. This simplifies the process for PayPal users, allowing them to buy a variety of tokens on Paybis and easily enter the crypto market.

INSIGHTS

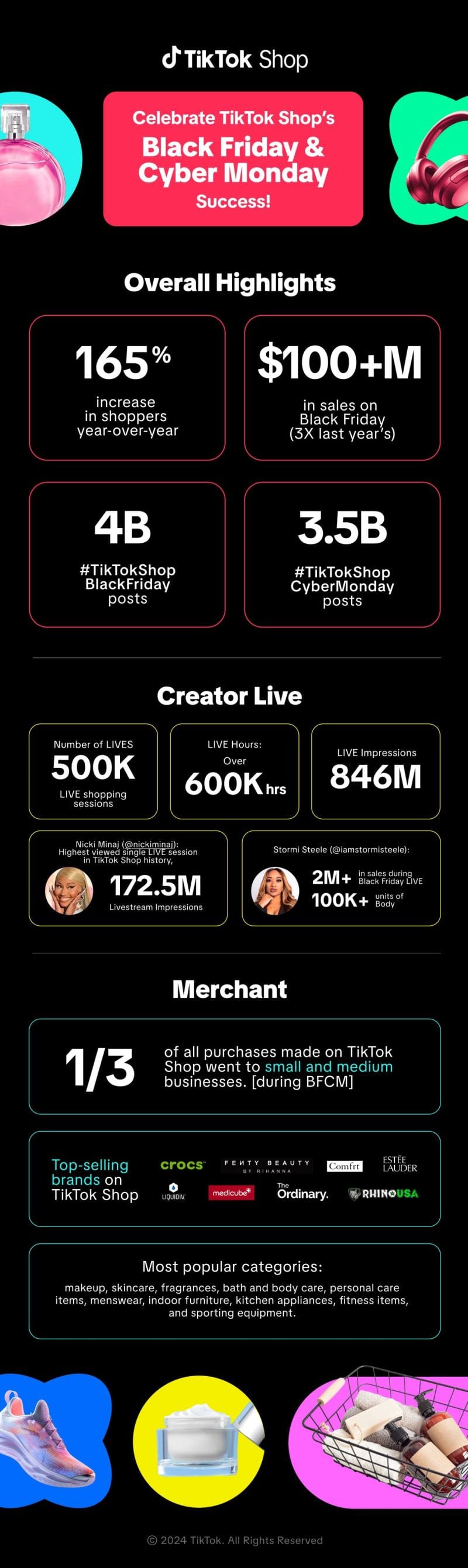

TikTok Shop Black Friday & Cyber Monday results 🤯

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()