PayPal Ventures Backs Brazilian Startup Ume with $15M Investment

Hey, Payments Fanatic!

PayPal Ventures is back in action, this time investing $15 million in Ume, a Brazilian startup shaking up the market with its smart use of the Pix payment system.

Ume’s buy now, pay later (BNPL) services are already partnered with 6,000 businesses and reach 220,000 consumers. Impressively, 85% of purchases through Ume’s BNPL option come from repeat customers!

Pix, Brazil’s national payment system, has been a game-changer since 2020, and Ume’s integration has rapidly expanded its merchant base and customer loyalty. PayPal Ventures sees Ume as a future leader in Brazil’s payments industry.

PayPal Ventures has been busy globally, with recent investments in AI firm Rasa and the Miami-based MELI Kaszek Pioneer. With $850 million invested in 70 startups since 2017, they remain a FinTech powerhouse.

Ume’s strategy focuses on leveraging Pix to offer flexible payment options and attract customers. With 80% of its transactions offline, Ume is tapping into Brazil’s retail core.

Stay tuned for more payments industry updates!

Cheers,

INSIGHTS

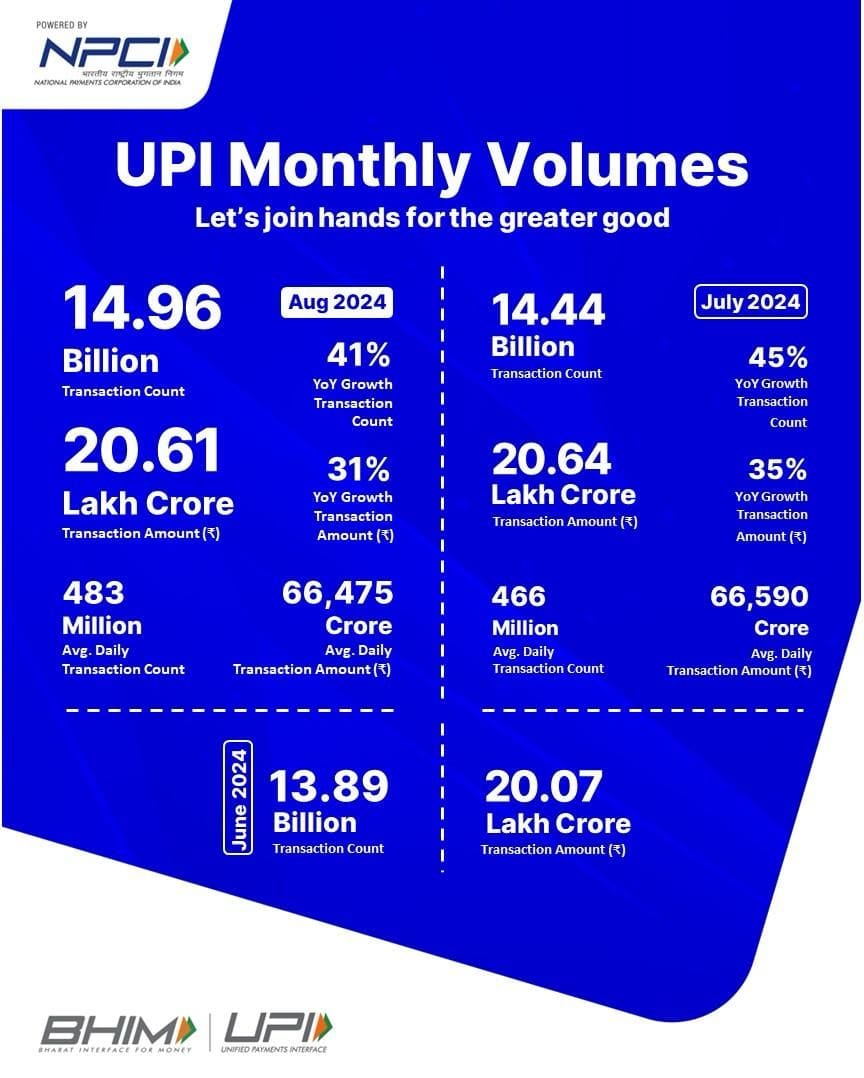

UPI Monthly Volumes.

PAYMENTS NEWS

🇧🇷 PayPal joins group investing $15M in Brazilian startup. PayPal’s venture arm and other investors are injecting $15 million in Ume, a Brazilian payment services provider that caters to small and mid-sized merchants, according to a press release.

🇬🇧 DNA Payments brings on new CFO, former Trust Payments Finance Director. The company has appointed Preete Janda as new Chief Financial Officer. The firm, an independent payment provider in the UK and EU, made this decision to strengthen its finance and leadership teams.

🇯🇵 JCB and BINDO launch world's first metal JCB card. In addition to its premium metallic feel and look, the Wonder x JCB Metal Corporate Card has various innovative and bespoke features, including: Fast Virtual Card Issuance, Beneficial Services, and other benefits.

🇮🇳 PayU unveils push provisioning platform to enable seamless card tokenisation between banks & merchants. The new platform allows customers to tokenize their credit and debit cards for multiple merchants directly through their bank's portal, eliminating the need to save card details with each merchant.

🇮🇳 Zoho forays into FinTech, rolls out Payment Gateway. According to media reports, the payment solution, Zoho Payments, gives end users a seamless checkout process, significantly lowering the cart abandonment rate and preventing revenue leakage.

🇬🇧 Wirex launches decentralized payment method, Wirex Pay. This blockchain-based payment method allows users to make transactions using cryptocurrencies at more than 80 million merchants in more than 200 countries, the company said in an Aug. 28 press release.

🇬🇧 Payments regulator probes banks over APP fraud. The Payments Systems Regulator has hit firms with a letter to check whether they are ready for new rules that could force them to pay millions in compensation to fraud victims, Financial News has learned.

🇺🇸 FinTech Affirm outpacing industry rivals, including Klarna, CEO Max Levchin said. Affirm had a "killer quarter" as the industry gets more competitive. Levchin joined Ed Ludlow and Caroline Hyde on "Bloomberg Technology," to discuss Affirm's latest earnings report. Watch here

🇸🇬 Crypto.com bolsters transaction capabilities with Standard Chartered. Crypto.com’s launch of its global retail services seeks to accelerate the transferring of funds on the platform from more than 90 countries, improving on the efficiency and utility of the crypto-to-fiat, or fiat-to-crypto transaction process.

🇮🇪 SumUp Limited appoints CEO, CFO, and new board members at its Dublin office. Niall Mac an tSionnaigh is now CEO of SumUp Limited, while Alastair Nolan has been appointed Head of Finance. Claire Gillanders takes on the role of Head of Compliance, and Jessica Cotta is the new Chief Risk Officer. Gareth Walsh moves to a non-executive director position, and Siona Meghen joins as an independent non-executive director.

🇱🇹 Nium grows presence in Lithuania with local team and office expansion. The cross-border payments leader has moved to a new, larger, state-of-the-art office in Vilnius as it continues to hire more local talent and strengthen its operational risk and compliance teams.

🇺🇸 Narmi goes live with the FedNow® Service in receive mode with Grasshopper. Through FedNow, Grasshopper is positioned to provide its on-core FinTech clients with the option to receive payments in real-time, offering enhanced cash flow management, immediate access to funds, and improved operational efficiency.

🇿🇦 India’s UPI changing FinTech landscape globally – South Africa enables UPI QR. At Global FinTech Fest 2024 in Mumbai, Indian and South African counterparts signed a landmark agreement to enable UPI QR code acceptance in South Africa, revolutionizing digital payments.

🇺🇸 Shopify welcomes new CTO Mikhail Parakhin. As CTO, Mikhail will oversee engineering and data organizations and push Shopify to the cutting edge, not just in ML and AI, but in everything they’re building to make commerce better for everyone.

🇬🇧 Crown Agents Bank teams up with Visa on FX and ‘last mile’ payments in emerging markets. Crown Agents Bank (CAB) and Visa announced a collaboration to enable fast, efficient and reliable payments and FX, especially across the ‘last mile’ – a term for the final and most complex stage in the payment process.

🇸🇪 Klarna's CEO Sebastian Siemiatkowski said that the company is shutting down its software as a service provider (SaaS) Salesforce and within a few weeks will shut down Workday.

Siemiatkowski added that with the help of AI, the company is able to standardize and create a more lightweight tech stack to operate more effectively with higher quality.

"We are shutting down a lot of our SaaS providers, as we are able to consolidate," he said on a conference call.

GOLDEN NUGGET

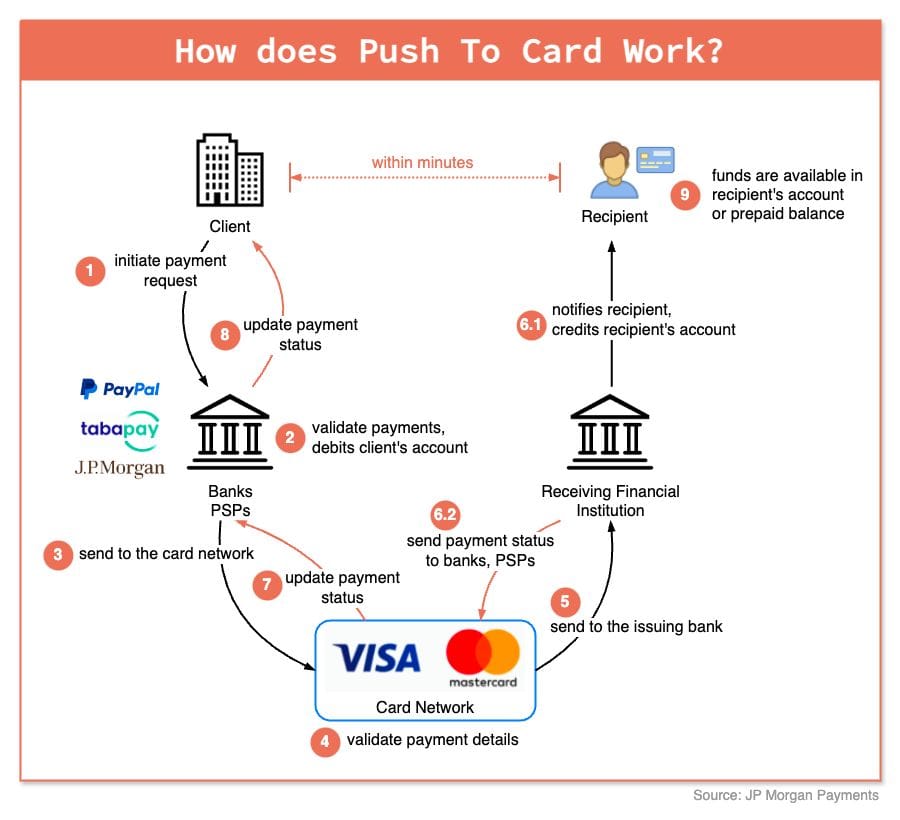

💳 How does Push To Card Work? How is it different from regular payments?

How does Push To Card Work? How is it different from regular payments?

Here is a step-by-step guide:

► Step 1 - The client initiates a payment request.

► Step 2 - The banks or PSPs (Payment Service Providers) validate payment details and debit the client’s account.

► Step 3 - The transaction is sent to the card network (Visa, Mastercard).

► Step 4 - The card network validates the payment details.

► Step 5 - The transaction is sent to the issuing bank.

► Step 6.1 - The issuing bank notifies the payment recipient and credits the recipient’s account.

► Steps 6.2, 7, and 8 - The payment status is returned to the card network, banks, and the client.

► Step 9 - Funds are now available.

Use Cases:

- Gig economy payouts

- Payments via digital wallets

- Loyalty

- Fund disbursements

- Merchant settlements

Sources: Hua Li & JP Morgan Payments Docs

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()