PayPal is launching an advertising platform based on user data

Hey Payments Fanatic!

PayPal is expanding its executive team to launch an advertising platform.

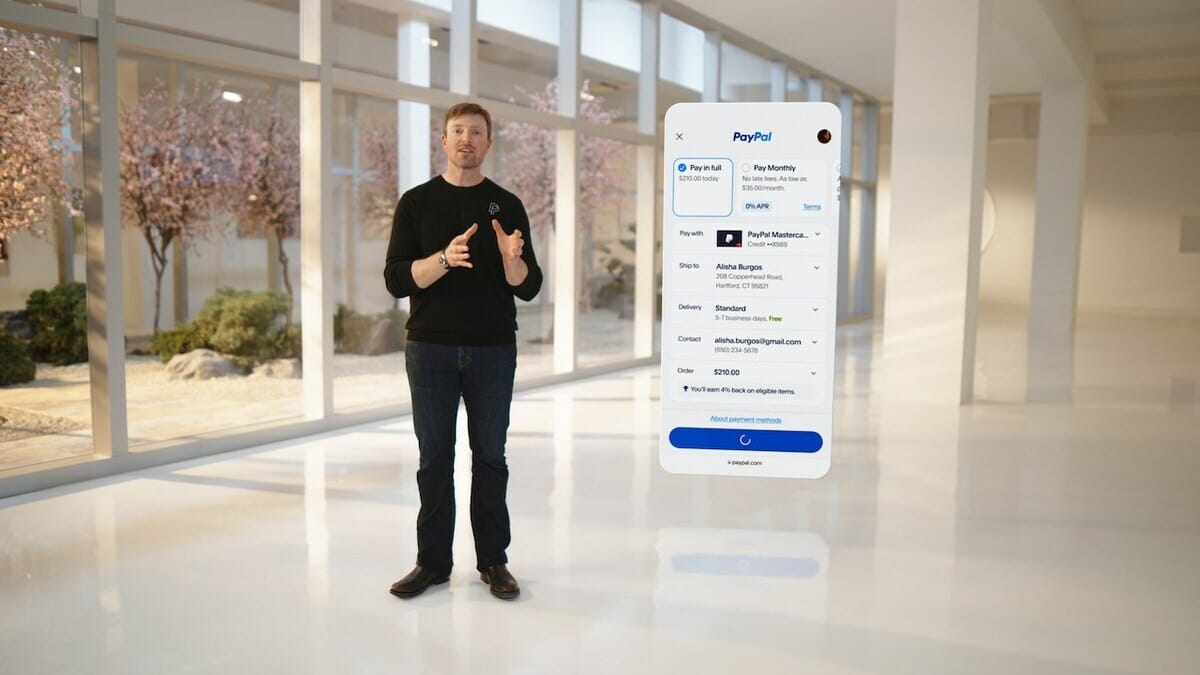

Following JPMorgan Chase's creation of Chase Media, PayPal has announced its own advertising division, PayPal Ads. This new division aims to leverage PayPal’s extensive user data to help advertisers target specific audiences.

The ad network will use data from PayPal and Venmo user purchases and spending patterns. The advertising business will feature the PayPal advanced offers platform, which will provide personalized offers based on unique customer insights, tracking purchases down to the SKU and individual product level.

Angela Strange famously quoted "Every company will become a FinTech company" a few years ago. Nowadays it seems we can change that statement to "Every FinTech company will become a Media company..."

Cheers,

INSIGHTS

How Does FinTech Giant Paytm Make Money?

Let’s break down Paytm’s Financials to understand:

PAYMENTS NEWS

🇺🇸 Paystand, a blockchain-enabled B2B payments company, announces the appointment of Allison Grieb as chief sales officer. Grieb brings her years of sales roles at high-growth tech companies to the new position. Read more

🇮🇳 Indian conglomerate Adani is reportedly in discussions to enter the eCommerce and payments space. The company is considering applying for a license to take part in India’s Unified Payments Interface (UPI) network, the Financial Times reported Tuesday (May 28).

🇨🇦 FinTechs Canada responds to Bank of Canada retail payments policies and guidance. In its response, the association identified parts of the Bank of Canada’s policies and guidance that required clarification and would be difficult to implement. Find out more

🇬🇧 Gnosis Pay inks partnership with Visa to help connect the Web3 ecosystem with traditional payments. For Gnosis Pay, this partnership ensures digital currencies can be used easily for everyday transactions, reducing inefficiencies and offering a more agile user experience.

🇬🇧 Paymentology, a global issuer-processor announced the appointment of Tim Joslyn as its Chief Technology Officer (CTO), succeeding interim CTO James Letley. As CTO, Tim will be at the helm of overseeing the development and deployment of next-generation technology solutions to customers, and partners.

🇬🇧 DNA Payments adds Alipay+ to POS portfolio. Alipay+ will allow over 50,000 UK merchants using DNA Payments’ POS terminals to accept direct payments from global tourists, mostly from Asia, quickly and conveniently, benefiting sectors such as hospitality, tourism, travel and more.

🇬🇧 Swiipr, a travel paytech company transforming the airline industry’s outdated and inefficient disruption payments systems, has secured £6m in Series A funding. Launched in 2020, Swiipr is used by 26 airlines in 70 countries, including a major flag carrier with 4,000 staff across 167 airports.

GOLDEN NUGGET

What do PayPal, Stripe, and Square do exactly? Let’s dive into the Payments Ecosystem!

The diagram below by ByteByteGo shows a bird eyes views of the payments ecosystem👇

Steps 0️⃣-1️⃣: The cardholder opens an account in the issuing bank and gets the debit/credit card.

The merchant registers with ISO (Independent Sales Organization) or MSP (Member Service Provider) for in-store sales.

ISO/MSP partners with payment processors to open merchant accounts.

Steps 2️⃣-5️⃣: The acquiring process.

The payment gateway accepts the purchase transaction and collects payment information.

It is then sent to a payment processor, which uses customer information to collect payments.

The acquiring processor sends the transaction to the card network. It also owns and operates the merchant’s account during settlement, which doesn’t happen in real-time.

Steps 6️⃣-8️⃣: The issuing process.

The issuing processor talks to the card network on the issuing bank’s behalf. It validates and operates the customer’s account.

I highly recommend signing up for ByteByteGo’s newsletter to get more great updates like this in your inbox.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()