PayPal Introduces Fastlane for Faster Guest Checkouts for U.S. Merchants

Hey Payments Fanatic!

PayPal announced that its guest-checkout solution, Fastlane, is now available to all U.S. merchants after a test phase. Initially, businesses must use PayPal’s payment services like Braintree or Complete Payments to access Fastlane.

Launched in January, Fastlane stores customer data such as names, emails, phone numbers, shipping addresses, and payment details. When shopping on a merchant’s site, customers can autofill this data by entering a verification code sent via email.

PayPal uses signals like phone numbers or emails to fetch data from Fastlane, offering enrollment options during checkout for new users.

A Capterra study found 43% of customers prefer guest checkout, and 72% opt for it even with an account. Frank Keller, EVP at PayPal, noted that Fastlane boosts conversion rates by speeding up guest checkouts.

During testing, Fastlane increased guest checkout conversions by 80% and sped up the process by 32%.

Fastlane competes with Stripe Link, Checkout.com, OurPass, and Deuna, and PayPal plans to expand the service globally.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

PAYMENTS NEWS

📣 Unlimit and Yuno join forces to enhance payments for businesses worldwide. This strategic partnership will enable businesses of all sizes to streamline their online payments, reduce transaction costs, and improve the purchasing experience for their customers – no matter where they are in the world.

🇺🇸 Stripe launches No-Code adaptive pricing for businesses globally. Stripe users globally on Checkout or Payment Links can turn on Adaptive Pricing with one click in their dashboard. Stripe supports merchants in 50+ countries with Adaptive Pricing, enabling them to present in local currencies to buyers in 150+ countries around the world.

🇬🇧 Orenda Finance partners with Tribe Payments. Orenda is an embedded financial service ecosystem, offering a suite of configurable products and services, including no-code embedded financial services and an end-to-end programme manager.

🇺🇸 Transak first to introduce wire transfer to buy Crypto in US. The introduction of wire as a payment method to purchase cryptocurrencies is a notable step towards enhanced accessibility and convenience for cryptocurrency enthusiasts across the nation.

🇺🇸 Flywire has announced plans to acquire Invoiced, aiming to strengthen its B2B payments division. This move is expected to enhance Flywire’s software suite for its global clients and target market. Flywire estimates this market to encompass around $10 trillion in global payment volume.

🇩🇴 Apple Pay has officially launched in the Dominican Republic! Now, thanks to partnerships with Banco de Reservas, Qik Banco Digital Dominicano, Banco Popular Dominicano and Banco BHD, Mastercard cardholders can enjoy fast, convenient, and secure payments both in-store and online.

🇸🇪 Klarna, the Swedish "buy now, pay later" company, is preparing for a major tech IPO next year. But first, it aims to test if investors value it above the $𝟲.𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 valuation from its last fundraising. The Sequoia Capital–backed startup has been in preliminary discussions with investment firms about their interest in buying shares held by existing shareholders, said a person approached by the company’s representatives and a person who has talked to the company’s leaders.

🇪🇺 Bitstamp announces a partnership with Stripe to support Stripe's fiat-to-crypto onramp in EU. Through this partnership, Bitstamp will manage fiat-to-cryptocurrency conversions and transfers to consumers, expanding Bitstamp-as-a-service and solidifying cryptocurrency's role in digital payments.

🇳🇱 Mondu BV secures an EMI License from De Nederlandsche Bank (DNB) in the Netherlands. The license will accelerate Mondu’s expansion across Europe while enabling the company to evolve even faster, support more customers, and launch complementary payment services like eWallets and Credit Cards.

GOLDEN NUGGET

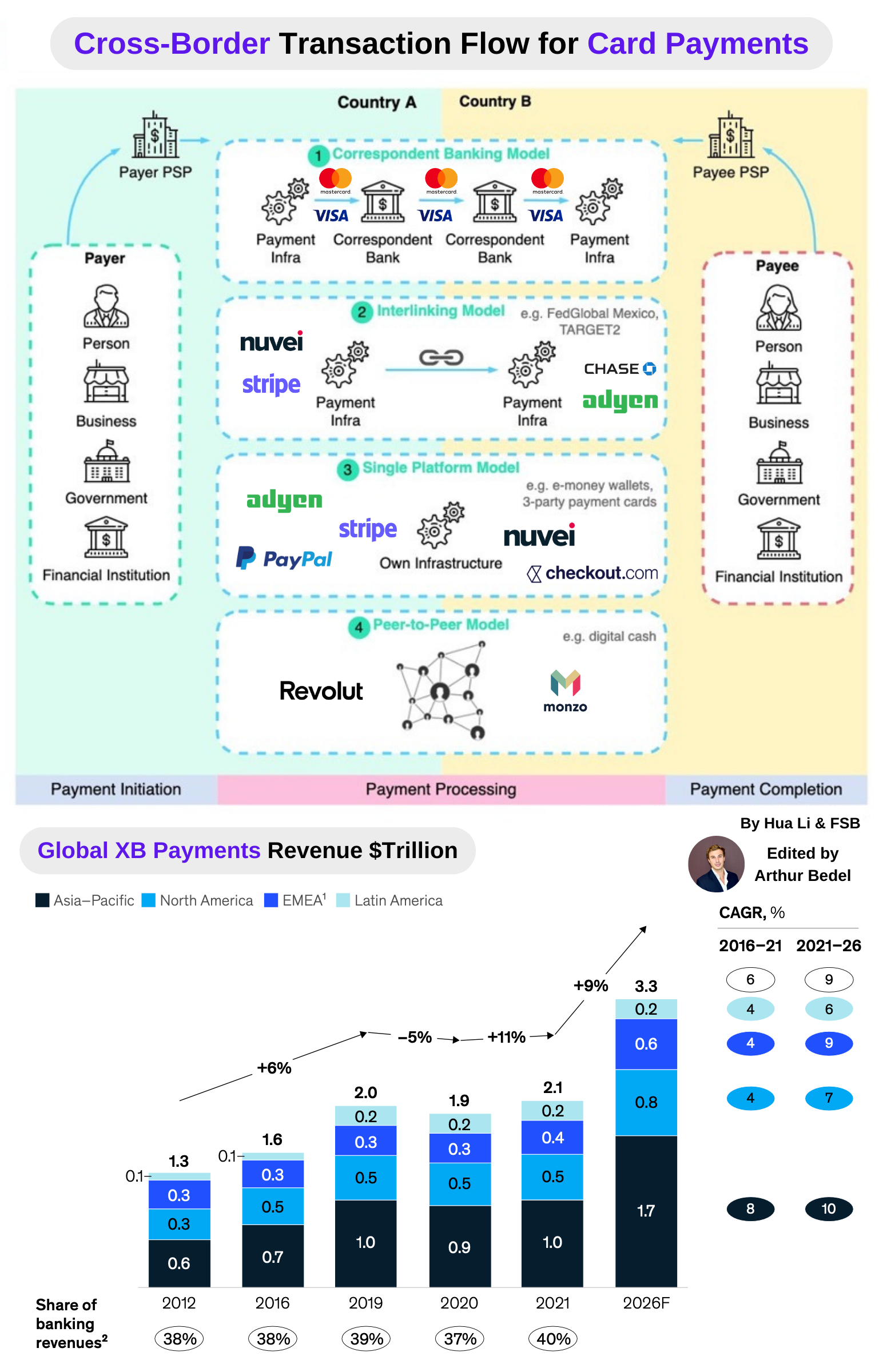

Cross-border payments (cards) need a robust architecture to deal with Foreign Exchange (FX), Multi-currency, Routing Logic and the complexity around Risk & Fraud 👇

The 4️⃣ different models for cross-border payments can be broadly classified into the following models:

1️⃣ Correspondent Banking

👉 Correspondent Banking is an arrangement under which one bank (correspondent) holds deposits owned by other banks (respondents) from other countries, enabling banks to access financial services in different jurisdictions.

👉 Under some international card schemes, Visa, Mastercard participating banks typically rely on correspondent banking for settlement (a "4-party model").

2️⃣ Interlinking

👉 It enables PSPs, like participating in the payment infrastructure of one country to send and receive payments to/from PSPs participating in another country's infrastructure.

👉 The interlinking can take place between domestic infrastructures from different countries. Where infrastructures settle in different currencies, arrangements will need to accommodate FX transactions.

👉 Interlinking can be costly and complex from a legal, operational and technical point of view, and therefore is mostly used between countries with considerable economic activity.

3️⃣ Single Platform

👉 In a Single Platform model, the payment transaction is started and completed by the same PSP -- Nuvei, Checkout.com, Adyen... -- to bridge the two jurisdictions and therefore does not rely on a connection between institutions in the two jurisdictions.

👉 This can be the case for proprietary arrangements (e.g. traditional money transfer operators), some international card schemes like American Express (i.e. "3-party model") and e-money schemes, or multinational banks that are present in the payer's and the payee's country.

4️⃣ Peer-to-Peer

👉 The peer-to-peer (P2P) model cuts out the financial intermediary PSP and enables the payer to send the payment directly to the payee. P2P payments can take a variety of forms; from direct cash payment to new ones cryptopayments using the blockchain & stablecoins.

🔸The Global Payments Market

The revenue generated by Global Payments, especially due XB transactions, is massive, $2.5+ trillion globally. It is a major revenue source for banks thanks to their ability to perform "ledger transactions", avoiding FX by holding funds in local currencies.

To provide a seamless experience across regions and channels, it's important not to forget the payment data flow, often provided via tokens to the different players within the payments ecosystem (VGS is a prime example).

APAC, a region highly digitalized, is leading the growth, followed by Europe. North America has been steady but McKinsey & Company expects LATAM and MEA to grow significantly in the upcoming years 🚀

Source: Hua Li, McKinsey & Company

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()