PayPal and Adyen Expand Partnership to Launch Fastlane in the U.S.

Hey Payments Fanatic!

PayPal announced that it is expanding its strategic partnership with Adyen, becoming the first distribution partner to offer Fastlane in the U.S.

Within the expanded partnership, Adyen will offer Fastlane by PayPal to accelerate guest checkout flows for its enterprise and marketplace customers in the U.S., with plans to extend this offering globally in the future.

Together, the companies expect Fastlane by PayPal to improve consumer shopping experiences and enhance conversion for businesses leveraging Adyen's platform.

Meanwhile, A federal judge has extended the deadline for US merchants to file claims in a $5.5 billion class-action settlement involving Visa and Mastercard. The new deadline, set by Judge Margo Brodie, is February 4, 2025. This extension is the second this year.

The previous deadline was August 30. The extension allows more time for claim forms to reach potential claimants, according to the plaintiffs' lawyers. Merchants can file claims online. Eligible businesses could receive amounts in the hundreds of thousands of dollars.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

🇺🇸 Stripe has been named a Leader in the 2024 Gartner® Magic Quadrant™ for Recurring Billing Applications: Discover More

PAYMENTS NEWS

📣 Bolt is finalizing a $𝟰𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 round, valuing Bolt at $𝟭𝟰 𝗯𝗶𝗹𝗹𝗶𝗼𝗻, and founder Ryan Breslow is returning as CEO to the embattled e-commerce startup, two and a half years after he stepped down. Get all the details—click here to learn more

🇮🇳 Amazon considers moving Amazon Pay into a standalone app in India. The U.S. tech giant has been contemplating decoupling its payments service from the e-commerce app for about a year and intends to proceed with the plan in the coming months, sources said.

🇮🇳 Swiggy launches ‘Swiggy UPI’ to fuel customers’ payment experience. With this integration, users can complete UPI transactions without leaving the Swiggy app, reducing the payment process from five steps to just one.

🇫🇮 Trustly and foodora join forces to offer Open Banking payments solution. This collaboration will introduce an innovative new checkout service option for foodora customers. The new payment solution will be initially launched in Finland, with imminent plans for expansion into other European markets.

🇬🇧 PXP Financial drives SoftPOS expansion in Zebra Technologies partnership. By participating in Zebra’s PartnerConnect programme, PXP Financial gains access to an innovative portfolio, along with comprehensive training and extensive marketing, sales and technical benefits.

🇳🇬 Flutterwave enables its online merchants in Nigeria to accept American Express payments. AmEx Card Members - with consumer, business, or corporate cards - will be able to make payments directly to e-commerce businesses using Flutterwave in Nigeria.

🇮🇳 PayU and Fynd to enhance payment solutions for Indian merchants. The partnership aligns well with both companies’ commitment to helping Indian merchants become digital-first and unlock new revenue opportunities.

🇬🇧 DECTA targets UK growth with new CEO, Scott Dawson. He takes over from Mark Andreev, who left in March. Dawson, who joined DECTA in December 2022 as Head of Sales & Strategic Partnerships, will focus on advancing the UK strategy, driving growth, supporting SMEs, and expanding product offerings.

🇦🇺 Doo Payment granted Australia remittance license by AUSTRAC. Doo Payment AU Pty Ltd aims to meet the diverse financial needs of individual and corporate customers and explore the unlimited opportunities in Australia’s leading financial market.

🇵🇭 PayMongo launches e-Wallet to empower Filipino SMEs. This new offering is designed to provide Filipino businesses with an easier way to manage payments, drive growth, and streamline their operations.

🇬🇧 TerraPay forms council with leading Digital Wallets to accelerate Cross-Border Payments interoperability. The company announced a collaboration with 5 of the leading wallet operators to establish the "Wallet Interoperability Council", aiming to leverage TerraPay's technology to facilitate interconnection and interoperability in cross-border transactions.

🚨 PayPal Expands Strategic Partnership with Adyen to offer Fastlane in the U.S. Within the expanded partnership, Adyen will offer Fastlane by PayPal to accelerate guest checkout flows for its enterprise and marketplace customers in the U.S., with plans to extend this offering globally in the future.

📊 Check out “Cashless Economy - How FinTech is reshaping Nigeria's 🇳🇬 Payments system” FinTech report by AGPAYTECH LTD. Read full report here

GOLDEN NUGGET

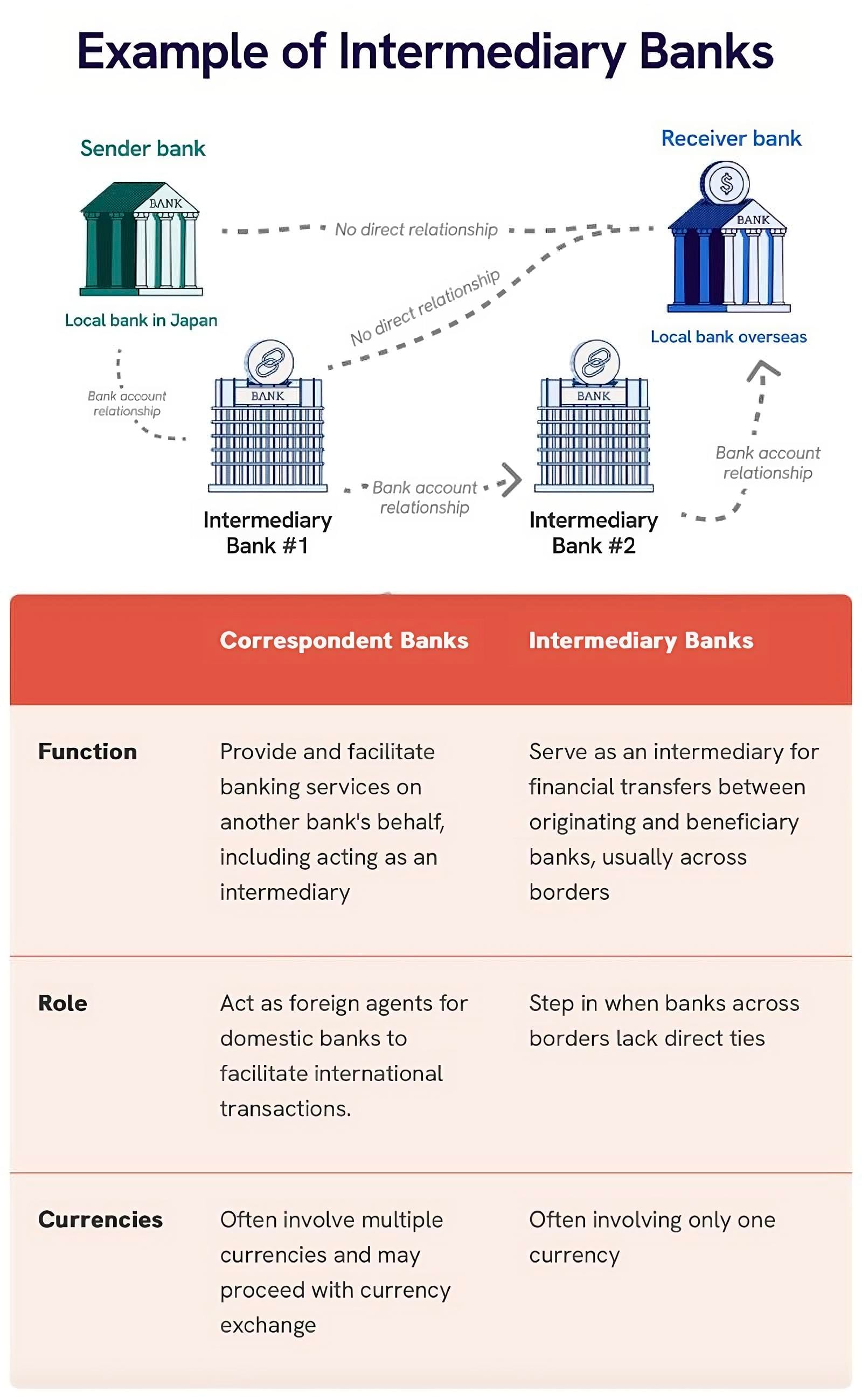

What is an Intermediary Bank & What's the difference from a Correspondent Bank?

Here is how it works:

An intermediary bank is a bank that connects two different banks to help transfer funds, acting as a "go-between," "third party," or "middleman."

They are essential when transferring money between banks that do not have a working relationship, such as between a domestic bank and a foreign bank.

An intermediary bank can handle both domestic and international transactions, but they are more common in international transfers.

Depending on the locations and banking networks involved, multiple intermediary banks may be used in a single transaction.

Retail bank customers usually don’t interact with intermediary banks, as these banks operate behind the scenes.

However, customers may notice the influence of intermediary banks through added fees or delays in their transactions.

The overview below 👇 shows how Intermediary banks work.

𝗧𝗵𝗲 𝗹𝗼𝗻𝗴 𝘀𝘁𝗼𝗿𝘆 𝘀𝗵𝗼𝗿𝘁:

► An intermediary bank acts as a "middleman" that facilitates transactions between two banks that do not have a working relationship, especially in international transfers.

► A single transaction may involve more than one intermediary bank.

► Intermediary banks charge fees in addition to those imposed by the sending and receiving banks.

Multiple intermediary banks can significantly increase the total cost of a transfer.

► The sender and receiver can choose who covers the fees.

The options are "OUR" (sender pays all fees), "SHA" (fees shared between sender and receiver), or "BEN" (receiver pays all fees).

𝗧𝗵𝗲 𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝗰𝗲 𝗕𝗲𝘁𝘄𝗲𝗲𝗻 𝗜𝗻𝘁𝗲𝗿𝗺𝗲𝗱𝗶𝗮𝗿𝘆 𝗮𝗻𝗱 𝗖𝗼𝗿𝗿𝗲𝘀𝗽𝗼𝗻𝗱𝗲𝗻𝘁 𝗕𝗮𝗻𝗸𝘀:

Both "intermediary banks" and "correspondent banks" facilitate international financial transactions and are often used interchangeably, but there are subtle differences.

In the US, correspondent banks are usually larger institutions that proceed with several currencies and handle a broader range of services beyond financial transactions, such as cash management or trade finance.

In contrast, intermediary banks are smaller and manage transactions in a single currency.

Below is the breakdown of the main differences 👇

I highly recommend reading the complete deep dive by Bertrand Theaud from Statrys for more info.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn r send me an e-mail.

Comments ()