Kivra & Trustly Reinvent Autogiro—Faster, Smarter, and More Secure

Hey Payments Fanatic!

Sweden’s automatic payments just got a major upgrade! Kivra and Trustly have launched an enhanced version of Autogiro, making it easier than ever to set up direct debits. With just a quick BankID confirmation, users can activate payments instantly—no more manual data entry, no more errors.

Trustly officials see this as a game-changer: “Sweden’s fintech ecosystem is the perfect testing ground for new payment technologies. Our collaboration with Kivra is all about creating a smarter, more efficient model for digital payments.” Businesses will benefit too—improved cash flow, fewer administrative tasks, and more on-time payments.

Launched at Stockholm Fintech Week, the upgraded Autogiro service is already live with energy provider GodEl. With seamless automation and real-time processing, this could set a new standard for hassle-free payments in Sweden. Who’s next to adopt it? Stay tuned for more!

Read more global payments updates below 👇 and I'll be back tomorrow!

Cheers,

INSIGHTS

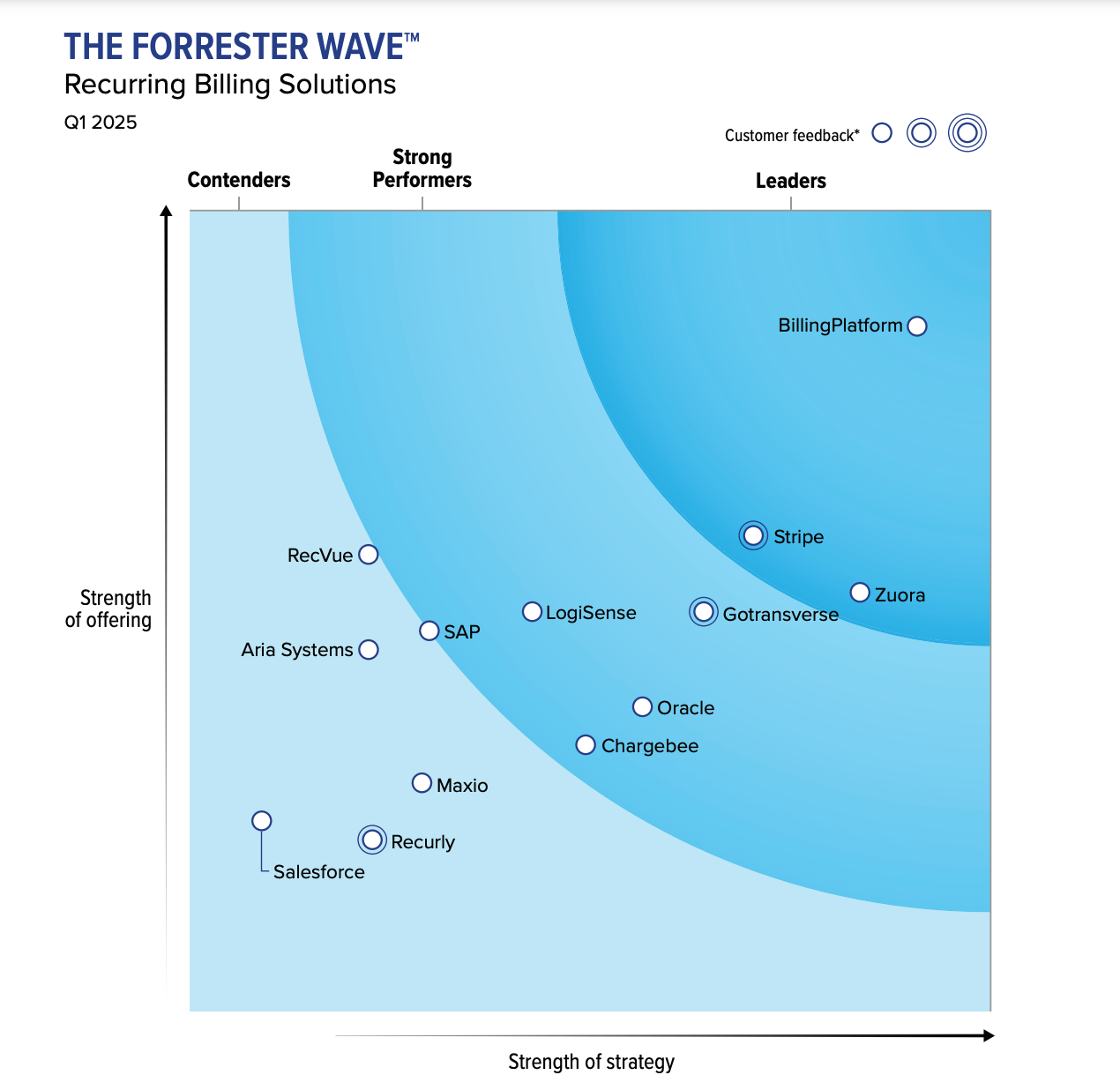

📰 The 13 𝗥𝗲𝗰𝘂𝗿𝗿𝗶𝗻𝗴 𝗕𝗶𝗹𝗹𝗶𝗻𝗴 Payments Solutions Providers that matter the most (according to Forrester..) and how they stack up 👇

PAYMENTS NEWS

🇺🇸 ACI Worldwide earns membership in 95-Plus Composite Rating Club. The stock earns a 95 EPS Rating, which means the company is now outperforming 96% of all stocks in terms of the most important fundamental and technical stock-picking criteria.

🇮🇳 PayU partners with AdvantageClub.ai to unlock employee rewards. This collaboration aims to enhance employee engagement by offering a seamless experience across rewards, wellness solutions, sales incentives, and more, all on a single platform.

🇵🇹 Ripple expands crypto payments to Portugal with Unicâmbio. This collaboration will make it easier and cheaper to send money between Portugal and Brazil using Ripple. Portuguese businesses can benefit from Ripple’s blockchain technology, enabling faster and more affordable international transactions.

🇲🇾 Earned wage access provider Payd secures $400,000 seed extension. This investment will accelerate Payd’s mission to enhance the financial well-being of employees across Southeast Asia. Continue reading

🇺🇸 Union sues Trump admin over CFPB shutdown attempt and DOGE access. Office of Management and Budget Director Russell Vought was hit with two union lawsuits after he issued directives freezing much of the Consumer Financial Protection Bureau's (CFPB) work.

🇺🇸 Conferma and WEX simplify B2B payments for Concur® Invoice Customers. This integration enables instant payments and allows businesses to manage working capital more effectively by utilizing WEX's credit terms. The collaboration aims to streamline payment operations, reduce costs, and provide greater control over financial activities.

🇧🇩 Trust Bank and TerraPay launch an international payment solution for Bangladeshi students going abroad to study. It offers a secure, completely digital, and frictionless process for international transactions, addressing the increasing demand for faster, more efficient cross-border payments.

🌍 iPiD launches AI-Powered name Matching Solution for verification of Payee, thanks to Microsoft collaboration. This uses the power of Microsoft Azure OpenAI Service to address critical challenges in name matching and comply with Europe’s evolving Verification of Payee (VoP) requirements, set to take effect in October 2025.

🇺🇸 Klarna is targeting an 𝗜𝗣𝗢 in the US. The buy-now, pay later credit company is preparing to unveil its listing plans in 𝗔𝗽𝗿𝗶𝗹 with a valuation of up to $𝟭𝟱𝗯𝗻. Klarna has narrowed its losses in the past year and appears on track to return to annual profitability.

GOLDEN NUGGET

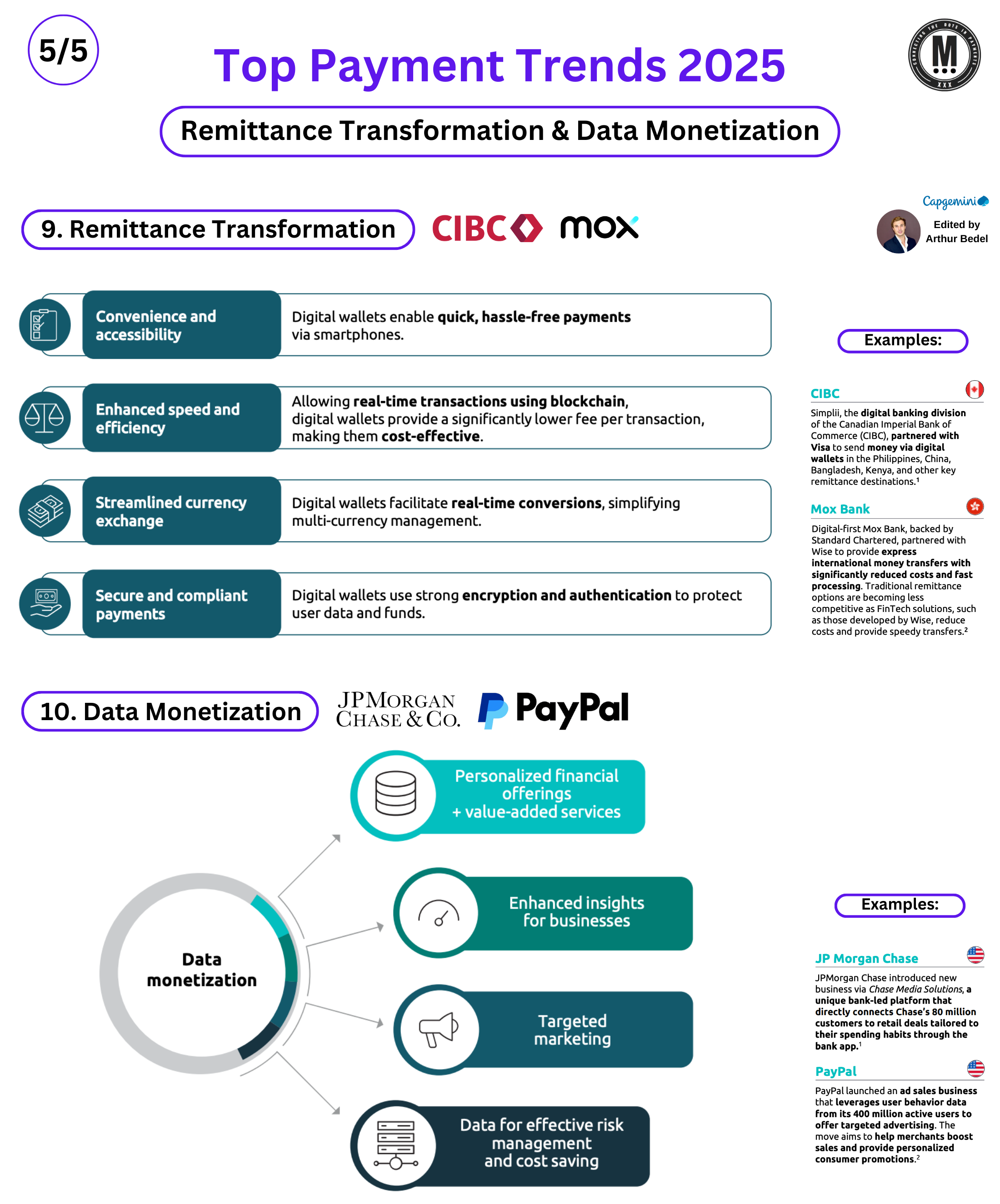

𝐓𝐨𝐩 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 2025 by Capgemini (Final) — Remittance Transformation & Data Monetization

#9: 𝐑𝐞𝐦𝐢𝐭𝐭𝐚𝐧𝐜𝐞 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝:

Digital platforms, blockchains, and mobile money solutions are reshaping the way individuals and businesses send money globally.

𝐊𝐞𝐲 𝐈𝐦𝐩𝐚𝐜𝐭𝐬:

► Consumers — Access to global financial services, particularly for underserved populations.

► Businesses — Simplified international payments

► Governments — Tracking of cross-border transactions, enabling better regulatory oversight.

𝐊𝐞𝐲 𝐀𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐨𝐫𝐬:

► Blockchain Technology: Distributed Ledger Technology helps reduce costs and speeds up remittance transfers.

► Mobile Wallets & Apps: Mobile-based remittance services allow consumers to send money across borders easily, without traditional banks.

► Real-Time Payments

► Regulatory Support

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬:

► Consumers — Sending remittances to family members, paying for services, or purchasing goods internationally.

► Businesses — Facilitating international supplier payments or setting up global payroll systems.

► FIs — Partnerships with remittance platforms for efficient, low-cost services.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬:

🔸 Wise: Providing low-cost international money transfers anywhere

🔸 Revolut: Enabling users to send money globally with competitive exchange rates

#10: 𝐃𝐚𝐭𝐚 𝐌𝐨𝐧𝐞𝐭𝐢𝐳𝐚𝐭𝐢𝐨𝐧 (MY FAV)

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝:

Data monetization refers to the process of turning data into a valuable asset, the future of #tokenization.

𝐊𝐞𝐲 𝐈𝐦𝐩𝐚𝐜𝐭𝐬:

► Businesses — New revenue streams, enhanced customer segmentation, & improved decision-making.

► Consumers — New personalized products, services and offers derived from data-driven strategies.

► Governments — Strengthened data governance policies.

𝐊𝐞𝐲 𝐀𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐨𝐫𝐬:

► Advanced Analytics: Using AI and ML to analyze large datasets and create business strategies.

► Data Aggregation: Combining data from multiple sources, including payment transactions, social media, and IoT devices, to create more comprehensive customer profiles.

► Privacy Regulations

► APIs & Open Data

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬:

► Businesses — Using data to refine marketing strategies, improve product offerings, and enhance CX.

► Consumers — Receiving personalized offers, tailored products, and loyalty incentives.

► FIs — Offering new data-driven services to customers, such as credit scoring, lending insights, and personalized financial products.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬:

🔸 Mastercard: Using transaction data to offer insights into consumer spending habits.

🔸 Plaid: Leveraging transaction data to provide FinTech services such as financial planning, lending, and payments.

🚨 Final Post — do you want an aggregated version of Part 1-5? 🚨

Source: Capgemini

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()