Clip Money & Green Dot Expand Business Deposit Network

Hey Payments Fanatic!

Clip Money and Green Dot have announced a partnership that will expand Clip Money's deposit network by 4,000 retail locations across the U.S. The collaboration enables businesses to make over-the-counter cash deposits at major retailers including Walmart, Walgreens, and CVS.

Joseph Arrage, CEO of Clip Money, stated: "Achieving our mission to build the largest and most convenient business deposit network in the U.S. marks a significant milestone." The network leverages Green Dot's infrastructure, which places deposit locations within three miles of 96% of the U.S. population.

Crystal Bryant-Minter, SVP of Money Movement at Green Dot, added: "We are thrilled to partner with Clip Money to deliver more seamless and accessible financial services to businesses." The partnership aims to provide an alternative solution for businesses as traditional bank branches continue to close nationwide.

If you’re interested in reading more about what’s been happening in Payments, keep scrolling!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

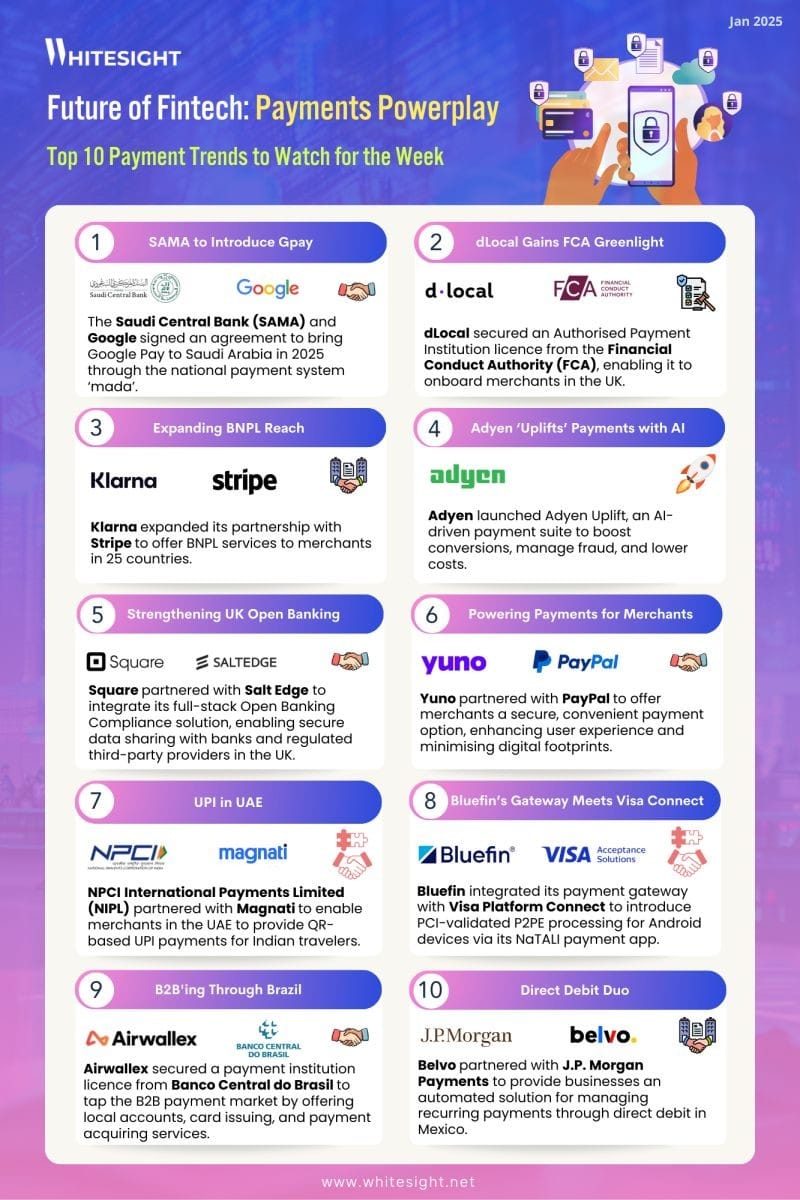

📊 𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬, 𝐒𝐦𝐚𝐫𝐭, 𝐚𝐧𝐝 𝐒𝐜𝐚𝐥𝐚𝐛𝐥𝐞: 𝐓𝐡𝐞 𝐍𝐞𝐰 𝐄𝐫𝐚 𝐨𝐟 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

PAYMENTS NEWS

🇬🇧 GetYourGuide partners with Checkout.com. This partnership underscores Checkout.com’s commitment to helping digital-first businesses to thrive. By leveraging Checkout.com’s modular payments infrastructure, GetYourGuide gains access to: high performance payments across borders, localized payment options, and data-driven insights.

🇲🇽 Wise launches in Mexico. The company seeks to capture a slice of the country’s vast remittance market. Users will be able to send money from Mexico to more than 40 currencies and 160 countries, including transferring Mexican pesos to US dollars, it said in a statement.

🇬🇧 Sokin secures $15m funding from BlackRock. The funding will enable Sokin to further grow its market share, develop new products which enhance its proposition and significantly scale its team including new offices in London, New York, Toronto and Dubai.

🇺🇸 Visa to use ServiceNow dispute management tools. The company will use the solution to power its Visa Dispute Management Service (VDMS) and Visa DPS Dispute Analysis and Support (DAS). The ServiceNow platform includes artificial intelligence (AI) capabilities that help solve dispute issues.

🇩🇪 Payone: BaFin cracks down hard. A recent audit by Germany’s financial regulator, BaFin, uncovered significant shortcomings in PAYONE’s anti-money laundering (AML) measures and IT processes. The institution has not fully complied with the Payment Services Supervision Act requirements, according to a special audit from 2022.

🇺🇸 Citi Flex Pay is now available on Apple Pay. Users can make Apple Pay purchases over USD 75 using Citi Flex Pay. The default payback period is three months, with longer payback durations available with a monthly fee. Flex Pay can be used when making purchases on websites or in apps.

🇳🇬 QED seeds $9.9M in Cedar Money. With this funding, the platform plans to scale its payment infrastructure and tackle the inefficiencies in international payments. Continue reading

🇺🇸 JetBlue and Barclays launch premier credit card packed. Customers can apply for the JetBlue Premier Card and take advantage of a limited-time offer: 70,000 TrueBlue points and 5 tiles toward Mosaic qualification after spending $5,000 in the first three months.

🇬🇧 Travel Ledger integrates Revolut. This integration brings Revolut Business accounts, enabling travel businesses to use Revolut’s extensive banking services to automatically settle B2B payments with partners directly through the Travel Ledger platform.

🇺🇸 Kraken debuts instant crypto payments offering Kraken Pay. The feature allows users to choose the crypto or fiat currency in their accounts that they want to send and transmit that payment instantly. Payments are sent via a paylink and the recipient clicks on the link to accept payment.

GOLDEN NUGGET

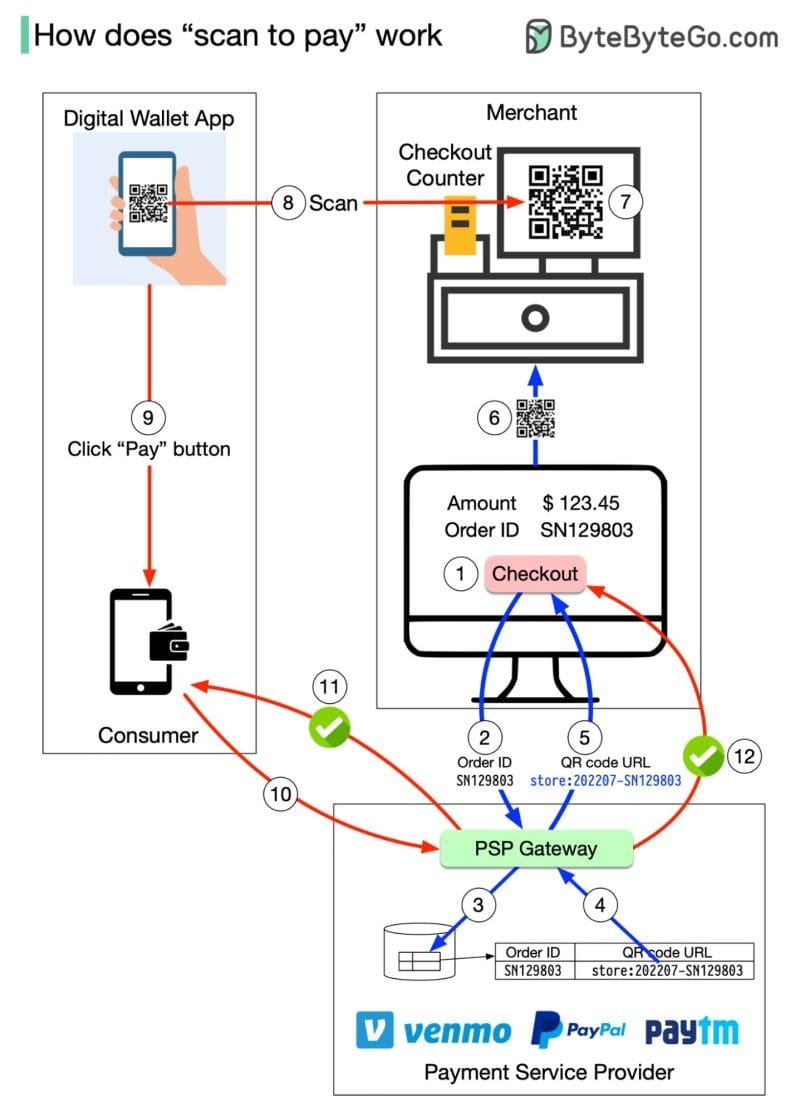

How does ‘Scan to Pay’ work (for PayPal, Cash App, Venmo, Paytm)?

Let’s break it down:

To understand the process involved, we need to divide the “scan to pay” process into two sub-processes:

► Merchant generates a QR code and displays it on the screen

► Consumer scans the QR code and pays

Here are the steps for generating the QR code:

1️⃣ When you want to pay for your shopping, the cashier tallies up all the goods and calculates the total amount due, for example $123.45. The checkout has an order ID of SN129803. The cashier clicks the “checkout” button.

2️⃣ The cashier’s computer sends the order ID and the amount to PSP.

3️⃣ The PSP saves this information to the database and generates a QR code URL.

4️⃣ PSP’s Payment Gateway service reads the QR code URL.

5️⃣ The payment gateway returns the QR code URL to the merchant’s computer.

6️⃣ The merchant’s computer sends the QR code URL (or image) to the checkout counter.

7️⃣ The checkout counter displays the QR code.

These 7 steps complete in less than a second. Now it’s the consumer’s turn to pay from their digital wallet by scanning the QR code:

1. The consumer opens their digital wallet app to scan the QR code.

2. After confirming the amount is correct, the client clicks the “pay” button.

3. The digital wallet App notifies the PSP that the consumer has paid the given QR code.

4. The PSP payment gateway marks this QR code as paid and returns a success message to the consumer’s digital wallet App.

5. The PSP payment gateway notifies the merchant that the consumer has paid the given QR code.

Sources: ByteByteGo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()