Worldpay Acquires Ravelin to Boost AI Fraud Prevention

Hey Payments Fanatic!

Worldpay is making a major move in AI-driven fraud prevention with its acquisition of Ravelin, a London-based fraud prevention platform. This deal enhances Worldpay’s portfolio, equipping merchants with cutting-edge AI tools to combat fraud and drive e-commerce growth.

Charles Drucker, CEO of Worldpay, emphasized the importance of innovation: “Equipping merchants with next-generation AI-powered fraud prevention products is vital, and we believe Ravelin’s technology and expertise will significantly enhance Worldpay’s overall value proposition.”

Martin Sweeney, CEO of Ravelin, shared his excitement: “Worldpay’s scale and reach will be an immense asset as we accelerate Ravelin’s momentum and advance our mission to eradicate fraud from the internet.”

The partnership aims to revolutionize fraud detection at scale, helping merchants stay ahead of increasingly sophisticated threats.

If you’re interested in reading more about what’s been happening in Payments, keep scrolling!

Cheers,

Level up your banking knowledge. Subscribe now for the latest in digital banking, delivered weekly.

INSIGHTS

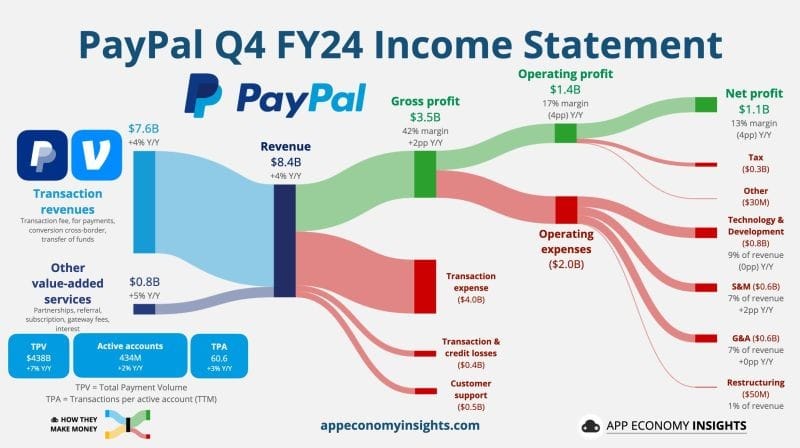

💰 PayPal reported slowing growth in its card-processing business even as fourth-quarter earnings topped analysts’ estimates.

PAYMENTS NEWS

🇺🇸 ACI Worldwide recognized by Datos Insights in a report that highlights ACI's Enterprise Payments Platform for its expansive global reach, cloud-native architecture and robust payment capabilities that support all payment types, including cards and account-to-account. It also emphasizes ACI's innovative platform, modern APIs and modular services, which allow for intelligent payments orchestration.

🇦🇷 What are the areas with the highest growth potential in the FinTech world for 2025? Santiago Witis, Country Manager of Pomelo in Argentina, assures that the FinTech sector will grow significantly in 2025, but there are specifically two areas with exceptional potential: digital payments and loans/credit.

🎤 In my latest Q&A, Drew Edwards, CEO of Ingo Payments, shares his insights on the evolving FinTech and banking-as-a-service (BaaS) landscape in 2025. He highlights that success will hinge on risk management, not just sleek UX. Many BaaS providers have prioritized speed over compliance, leading to regulatory scrutiny and failures. Click here to learn more

🇦🇷 MercadoLibre's payment processor offers Pix. The company is offering transactions using its payment processors in Argentina through Pix, the Brazilian instant payment system, as Brazilian tourists flock to the neighboring country for vacation.

🇺🇸 Stripe closes $1.1 billion Bridge deal. It paid a hefty price for a two-year old company, an amount that was about three times higher than Bridge’s valuation in a funding round in August. The deal gives Stripe a firm foothold in crypto, a market where it previously struggled to gain traction.

🇬🇧 Mastercard partners with Payrails. The company aims to accelerate digital payment transformation and offer services tailored to the needs of large enterprises, also provides efficient payment solutions that enable global businesses to improve complex transactions, boost flexibility, and optimise financial operations.

🇺🇸 Fiserv profit beats estimates as consumer spending remains robust. The firm beat Wall Street estimates for fourth-quarter profit, helped by strong demand in its banking and payments processing unit, sending its shares up 3.2% in premarket trade.

🇬🇧 GoCardless and Financial Cloud partner. The interface will allow businesses to manage payments and customer data in one place, providing actionable insights into customer behaviors and payment trends. The integration also enables merchants to scale -- collections and payment reconciliation remain manageable, even as volumes grow in line with their customer base.

🇺🇸 MoneyGram Announces Luke Tuttle as CTO. In this role, Tuttle will lead product development and technology, overseeing engineering, platform operations, information security and emerging technologies like blockchain.

🇺🇸 Square selects Peach to power credit card programme. This collaboration enables Square to integrate the credit card directly with its broader ecosystem of solutions, allowing sellers to manage their cash flow from the same platform they use to run their business.

🇺🇸 Checkbook deploys Push to Card with Visa Direct. This strategic enhancement means customers can use Visa Direct to deposit funds to bank accounts linked to over 4 billion debit cards in real-time. Read more

🇪🇺 Numeral introduces Verification of Payee. The company announces fully managed verification solution to ensure seamless compliance for financial institutions ahead of the fast-approaching October 9, 2025 deadline. This mandates that payment service providers provide payers with verification details before initiating credit transfers.

🇮🇳 Krafton leads Cashfree’s $53M funding at $700M valuation. “Krafton is a large organization, very active in the digital content space over the internet and payment companies like us see a sizable market opportunity alongside e-commerce, travel and other financial services,” Co-Founder and CEO of Cashfree, said.

🇺🇸 FIS unlocks second half of FedNow® potential with new send certification. The company announced it is certified to enable sending capabilities for credit transfers. This will enable FIS’ clients to fully harness the entire FedNow service by providing consumers and commercial borrowers with a modernized and unified digital payment experience.

🇸🇬 Tazapay aims to triple revenue in 2025 with stablecoin bet. Revenue hit US$3.5 million in Q4 2024 alone, giving the company an annualized run rate of US$14 million. Tazapay aims to boost revenue by 3x this year on the back of stablecoins becoming a “major growth driver”.

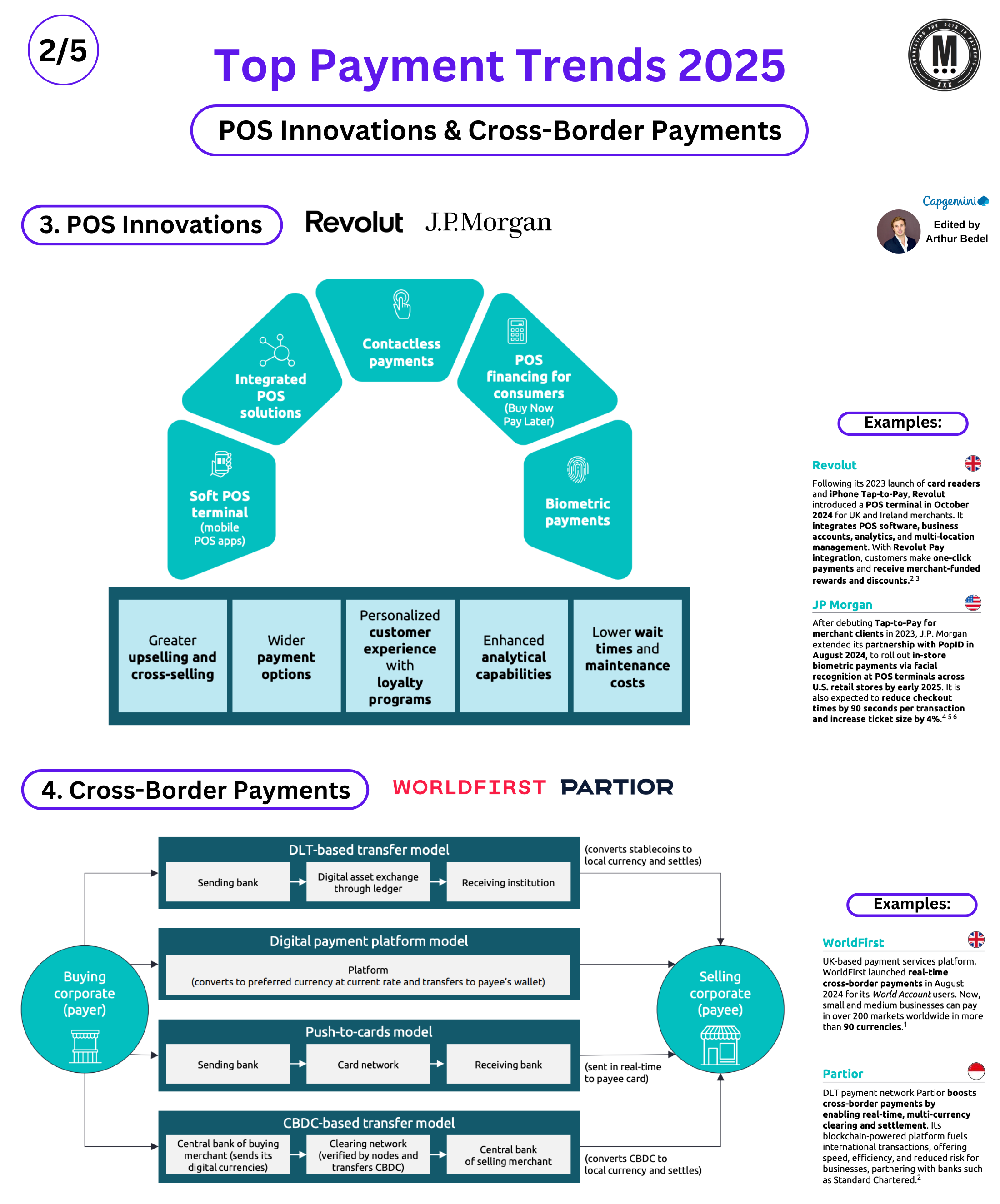

GOLDEN NUGGET

𝐓𝐨𝐩 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 by Capgemini (Part 2) — POS Innovations & Cross Border Payments

Let the series continue (2/5)! Deep dive into the latest changes for in-store and the complex Cross-Border ecosystem!

3: 𝐏𝐎𝐒 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝:

Point-of-sale (POS) innovations are driving the future of payments, with a focus on the rise of contactless payments, mobile wallets, and biometric authentication at POS terminals.

𝐊𝐞𝐲 𝐈𝐦𝐩𝐚𝐜𝐭𝐬:

► Retailers — Reduced transaction times, lower hardware costs, and a better in-store experience.

► Consumers — Faster, more secure, and convenient payments.

► Financial Institutions — Increased transaction volumes and data insights for personalized offerings.

𝐊𝐞𝐲 𝐀𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐨𝐫𝐬:

► Contactless Payments

► Mobile POS Solutions

► Biometric Authentication

► Cloud-based POS

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬:

► Businesses — Fast, secure checkouts and enhanced customer loyalty programs.

► Consumers — Seamless and quick payments for everyday purchases.

► Retailers — Enhanced inventory and sales tracking through POS systems integrated with back-office systems.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬:

🔸 Square: Enabling small businesses with mobile POS solutions and integrated payment tools.

🔸 Stripe: Offering POS innovations for e-commerce and in-store payments through integrated solutions.

4: Cross Border Payments

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝:

Cross-border payments innovation focuses on reducing transaction costs, improving speed, and ensuring security while dealing with multiple currencies and regulations.

𝐊𝐞𝐲 𝐈𝐦𝐩𝐚𝐜𝐭𝐬:

► Banks & FinTechs — New revenue streams through cross-border transaction services.

► Businesses — Enhanced global reach, real-time payments, and reduced foreign exchange fees.

► Consumers — More affordable and faster international money transfers.

𝐊𝐞𝐲 𝐀𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐨𝐫𝐬:

► Blockchain Technology (incredible cross-border network)

► Payment Platforms: PayPal, Wise, Payoneer and Revolut are making cross-border payments cheaper & faster.

► Instant Cross-Border Payments

► Regulatory Harmonization

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬:

► Businesses — Global trade, international supplier payments, and faster receivables.

► Consumers — Remittances, cross-border e-commerce, and travel-related payments.

► Financial Institutions — Partnerships with payment hubs and cross-border clearinghouses.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬:

🔸 Wise: Offering transparent, low-cost international payments for both businesses and consumers.

🔸 Ripple: Leveraging blockchain to streamline cross-border payments with lower fees and faster settlement times.

🚨 This #2 out of a series of 5 posts — next up 🚨

5️⃣ — Composable cloud-based Payments Hubs

6️⃣ — Multi-rail Payment Strategy

Get ready, it is just the beginning!

Source: Capgemini

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()