OCBC Launches Instant Transfers to WeChat & Alipay

Hey Payment Fanatic!

OCBC Bank is the first bank in the Asia Pacific region to enable instant money transfers to WeChat Pay and Alipay users in China. Imagine cutting down on the usual 2-5 day wait—now, with Visa Direct integration in the OCBC mobile app, customers can send funds in seconds!

This move couldn't come at a better time. With a 50% surge in remittances from Singapore to China, driven by a wave of individuals moving from China to Singapore, the demand for fast, secure, and hassle-free cross-border payments is at an all-time high.

Sunny Quek, OCBC's Head of Global Consumer Financial Services, shared, “Our wider goal is to become the go-to app for cross-border transactions in Greater China, ASEAN, and even globally.” OCBC’s users can now send up to CNY 50,000 daily and CNY 300,000 annually with just the recipient's China ID name and mobile number—and it’s all free of charge.

And the future looks even brighter: OCBC plans to expand its reach by 2026, including digital wallets like GoPay, Ovo, GCash, PayMaya, and Coins.

Keep reading more payments news below, enjoy your weekend, I'll be back on Monday.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 Explore Worldpay's "Global Payments Report - How Consumer Choice is Changing Commerce" to see how consumer preferences are evolving into trends and what these trends mean for the future of businesses. Get the full report here

PAYMENTS NEWS

🇦🇪 Network International partners with Tamara to offer flexible payments at point of sale. This collaboration empowers merchants to offer flexible, Sharia compliant payment solutions at the point of sale (POS). Keep reading

🇫🇷 TheFork and Mastercard form partnership for ‘Booming Experience Economy’. The multiyear partnership, which will launch next year, will enable eligible cardholders worldwide to gain access to exclusive benefits, Mastercard said in a news release.

🇳🇱 CAB Payments shares plunge after StoneX ditches bid talks. The firm’s shares dropped by 17.5% The firm’s shares dropped by 17.5% after U.S. rival StoneX confirmed it would not pursue an offer for the London-listed cross-border payments company.

🇿🇦 FNB launches near real-time cross-border payments with BankservAfrica, making it the first bank in Southern Africa to facilitate real-time cross border payments across the Common Monetary Area of South Africa, Namibia, Lesotho and Eswatini.

🇲🇽 dLocal and Viva Aerobus expand payment options. The collaboration aims to simplify local payment processing for travelers across Mexico, the United States, Central, and South America, allowing customers to book flights using their preferred payment methods.

🇸🇬 Liquid Group rolls out roamQR to Link E-Wallets and QR Networks. This initiative aims to streamline payments for both consumers and merchants by supporting e-money “push” transactions from e-wallets and card-linked “pull” QR payments from bank accounts.

🇸🇬 Boxo and Nium launch customisable white-label remittance platform. This collaboration empowers mobile apps to seamlessly integrate international money transfer services into their existing platforms, allowing users to send money across borders effortlessly and at competitive rates.

🇬🇧 BR-DGE appoints Chun Ong as Chief Operating Officer. In his new role, Chun will support BR-DGE's growing demand by taking on a key leadership role focused on scaling operations and improving cross-functional collaboration. Read on

🇪🇺 EU questions retailers in Visa and Mastercard fee controversy. The European Commission has reportedly launched a probe into whether Mastercard and Visa’s fees are harming merchants. Responses from questionnaires sent to retailers and PSPs could help build an antitrust case, potentially leading to fines of up to 10% of a company’s global revenue.

🇳🇱 Adyen shares slide as payments giant’s transaction volume growth slows. Adyen reported third-quarter net revenue of €498.3 million, marking a 21% YoY increase. Despite strong sales, shares dropped over 6% Thursday off the back of a slowdown in transaction volume growth.

🇨🇭 UBS pilots blockchain-based payment system. UBS announced it has successfully piloted its blockchain-based UBS Digital Cash system to enhance cross-border transaction efficiency. The pilot involved transactions with multinational clients and banks, including domestic Swiss and cross-border payments in USD, CHF, EUR, and CNY.

🇦🇺 GoCardless expands partnership with Big Red Cloud for payment solutions. Big Red Cloud is integrating GoCardless' payment solutions into its platform, enabling users to collect and reconcile recurring payments via Direct Debit, simplifying the process for accountants and SMEs.

🇸🇬 Ant International drives AI in cross-border payments to boost global expansion. The firm’s AI model predicts currency exchange rates on an hourly basis, helping businesses reduce transaction costs. Continue reading

🇹🇭 Nium and Kinexys partner to enhance cross-border payment accuracy. This partnership enables financial institutions to verify beneficiary account details before payments, reducing errors, misrouted transactions, and fraud. Read on

GOLDEN NUGGET

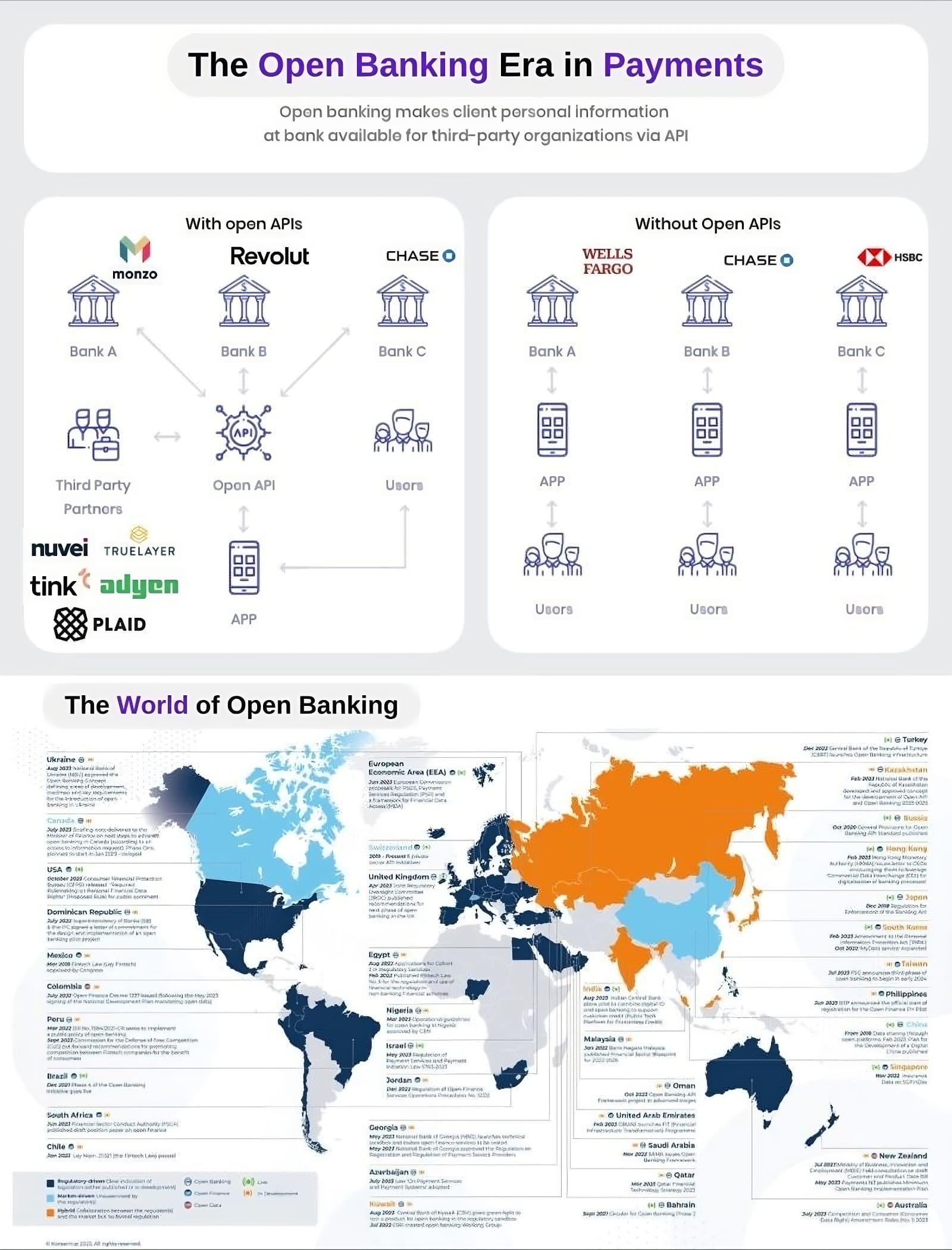

The Open Banking Era in Payments.

Let’s drive in:

Today, in 2024, still most transactions happen using Cash or Cards.

The card schemes, Visa and Mastercard have been controlling the payment realm for decades as card transactions run on their network.

👉 Open Banking disrupts that.

With access to payments data, Banks (Chase, Monzo Bank) and Payment Service Providers (Nuvei, Adyen) and 3rd-party providers (Plaid, Tink) can disrupt the traditional card payment model and cut out intermediaries by settling directly from the consumers bank account to the Merchants.

Before Open Banking became available, consumer financial data was controlled by big banks.

Now, consumers can manage their financial information and access it across different platforms — receiving a smoother, more personalized experience in the process.

Open banking uses Application Programming Interfaces (APIs) which are software intermediaries that let two programs communicate with each other.

While there are risks of using open banking platforms, APIs provide a measure of safety when sharing financial information.

Once a 3rd-party provider receives the data from your bank, it can use the information to offer you personalized solutions.

Apps like MINT aggregate your data using open banking APIs, which consumers consent to when accepting the T&Cs.

From a Merchant perspective, this will:

► Reduce fraud tremendously by making sure the funds are available

► Increase margins by cutting out the middle-man (one less fee).

► Improve conversion rates while improving the customer experience.

► Enhance security related to Payments for their consumers

Etc.

Other organizations such as Thunes are leveraging that same Open API through a collaboration with TrueLayer to create an agnostic payment network that connects consumers to banks, merchants, digital wallets and neobanks.

Open API’s will ultimately enable more FinTech services to be offered seamlessly.

I highly recommend the complete deep dive article by Konsentus & my partner at Connecting the dots in payments..., Arthur Bedel 💳 ♻️ 👈

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()