Nuvei Launches Blockchain Payment Solution in LATAM

Hey Payments Fanatic!

Through strategic partnerships with Rain, BitGo, and Visa, Nuvei is introducing a system that enables LATAM merchants to leverage stablecoins, including USD Coin (USDC), for enhanced global settlement efficiency and reduced dependence on traditional payment infrastructure.

The solution represents a fusion of traditional and innovative payment technologies, allowing merchants to utilize physical or virtual Visa cards for stablecoin payments from digital asset wallets.

This integration brings together Visa's extensive acceptance network with blockchain efficiency, streamlining corporate treasury management and accelerating cross-border transactions.

Phil Fayer, Nuvei Chair and CEO, emphasizes their mission: "By integrating stablecoin technology into our payment platform for B2B settlement we're ensuring our merchants continually receive unparalleled flexibility, security, and global reach."

The collaboration brings together key industry players, with Rain providing vertically integrated issuing capabilities and BitGo delivering institutional-grade digital asset custody services.

This initiative builds on Nuvei's expanding presence in Latin America, where they've already achieved milestones including becoming the first global payments provider offering direct local acquiring in Colombia and securing a Payment Institution license in Brazil.

It's been quite an exciting week in the payments space! Looking forward to bringing you more groundbreaking news after a refreshing weekend break.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

PAYMENTS NEWS

👉 85% of Latin American consumers prefer biometrics over passwords, and Mastercard is leading the way with Mastercard Payment Passkey Service which debuts in Latin America in January 2025 with Sympla and Yuno.

🇬🇧 British payments firm Sokin has announced its acquisition of Norwegian FinTech Settle Group AS for an undisclosed sum. Sokin's acquisition strengthens its technological capabilities and supports its growth strategy, enhancing its flagship product, Sokin Pay, while advancing its vision to transform international payments.

🇸🇬 Robinhood to launch in Asia in 2025 with Singapore HQ. The expansion comes on the heels of the Menlo Park, California-based company entering the UK this year, offering some though not all of its trademark services to those customers. Read more

🇦🇹 IXOPAY merges with Aperia to bolster payment compliance. This partnership creates a secure, compliant, and scalable payment solution to address rising cyber threats and complex regulations, meeting the demand for enhanced transaction security and streamlined operations.

dLocal and Spreedly strengthen partnership to expand global payment access in emerging markets. This renewed partnership will focus on enabling Spreedly customers to enhance capabilities and coverage in Africa and APAC, where dLocal has established a strong payments presence.

🇦🇺 Tyro’s embedded payments driving new future for POS payments in Australia. Tyro has launched the first Australian-developed embedded payments solution, enabling businesses to accept tap-to-pay payments via any device and point-of-sale (POS) system.

🇰🇪 Premier Bank and Mastercard launch Shari'ah-compliant cards in Kenya. This initiative aims to improve secure and accessible financial services tailored to meet the diverse needs of Kenya’s population and its growing digital economy.

🇳🇱 Mambu acquires payment technology provider Numeral, bolstering its market position to target new growth opportunities. Mambu’s acquisition of Numeral supports its strategic aim to enhance payment capabilities, drive market expansion, and align with long-term growth plans.

GOLDEN NUGGET

How to Avoid Double Payments?

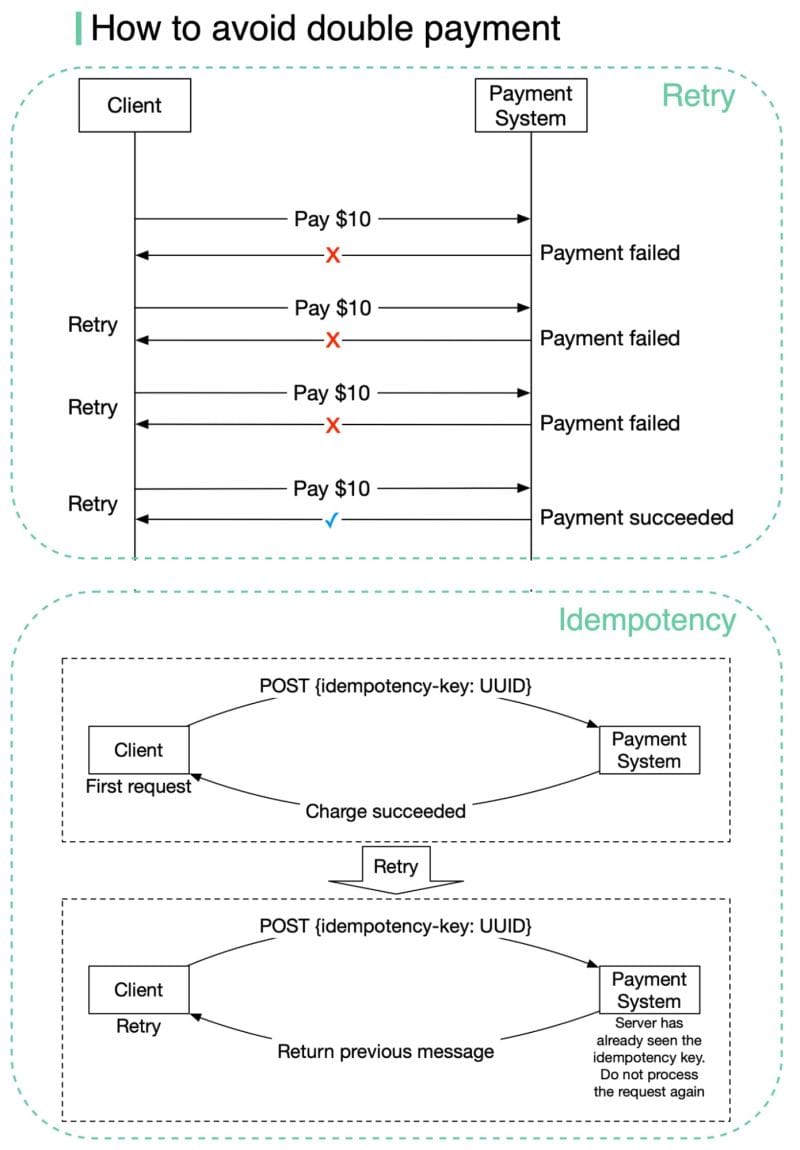

At the first glance, exactly-once delivery seems very hard to tackle, but if we divide the problem into two parts, it is much easier to solve. Mathematically, an operation is executed exactly-once if:

1. It is executed at least once.

2. At the same time, it is executed at most once.

We now explain how to implement at least once using retry and at most once using idempotency check.

𝐑𝐞𝐭𝐫𝐲

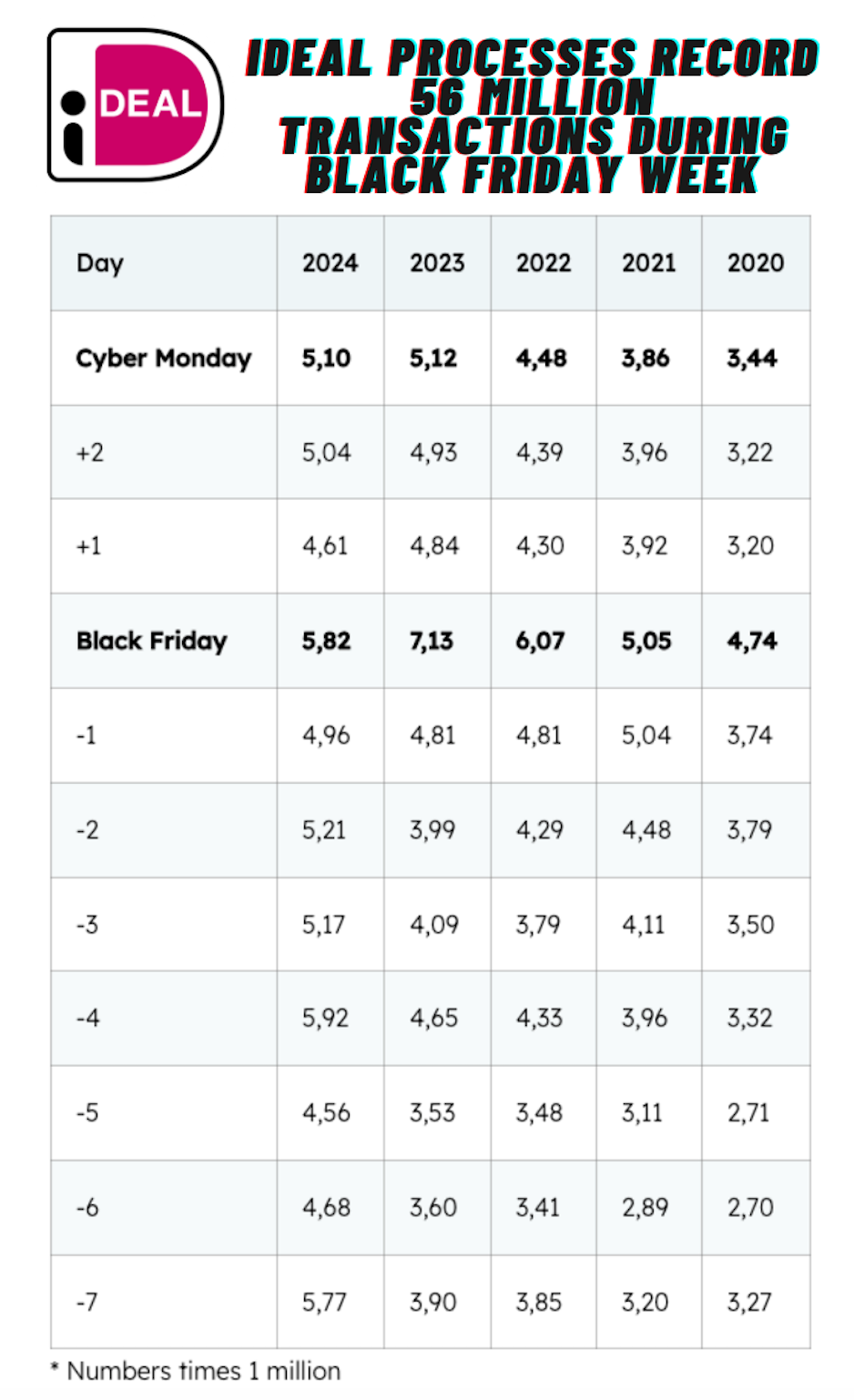

Occasionally, we need to retry a payment transaction due to network errors or timeout. Retry provides the at-least-once guarantee. For example, as shown in Figure 10, the client tries to make a $10 payment, but the payment keeps failing due to a poor network connection. Considering the network condition might get better, the client retries the request and this payment finally succeeds at the fourth attempt.

𝐈𝐝𝐞𝐦𝐩𝐨𝐭𝐞𝐧𝐜𝐲

From an API standpoint, idempotency means clients can make the same call repeatedly and produce the same result.

For communication between clients (web and mobile applications) and servers, an idempotency key is usually a unique value that is generated by clients and expires after a certain period of time. A UUID is commonly used as an idempotency key and it is recommended by many tech companies such as Stripe and PayPal. To perform an idempotent payment request, an idempotency key is added to the HTTP header: <idempotency-key: key_value>.

Source: ByteByteGo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()