NPCI Unveils Bharat BillPay for Business & UPI Circle

Hey Payments Fanatic!

RBI Governor Shaktikanta Das has launched two innovative digital payment solutions, developed by the National Payments Corporation of India (NPCI), at the Global Fintech Festival 2024.

These include Bharat BillPay for Business, which aims to streamline B2B transactions across various accounting platforms, and UPI Circle, enabling users to delegate payments.

Bharat BillPay for Business is set to revolutionize B2B payments by offering a unified, interoperable platform for businesses. It simplifies invoicing, automates reminders, and enhances payment processes, benefiting businesses of all sizes.

UPI Circle allows primary UPI users to delegate payment responsibilities to trusted secondary users within predefined limits, adding flexibility and convenience to digital transactions.

The solution was demonstrated using UPI-enabled apps like BHIM at the event.

These launches reflect NPCI's commitment to advancing India's digital payment ecosystem by enhancing inclusivity, security, and efficiency.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

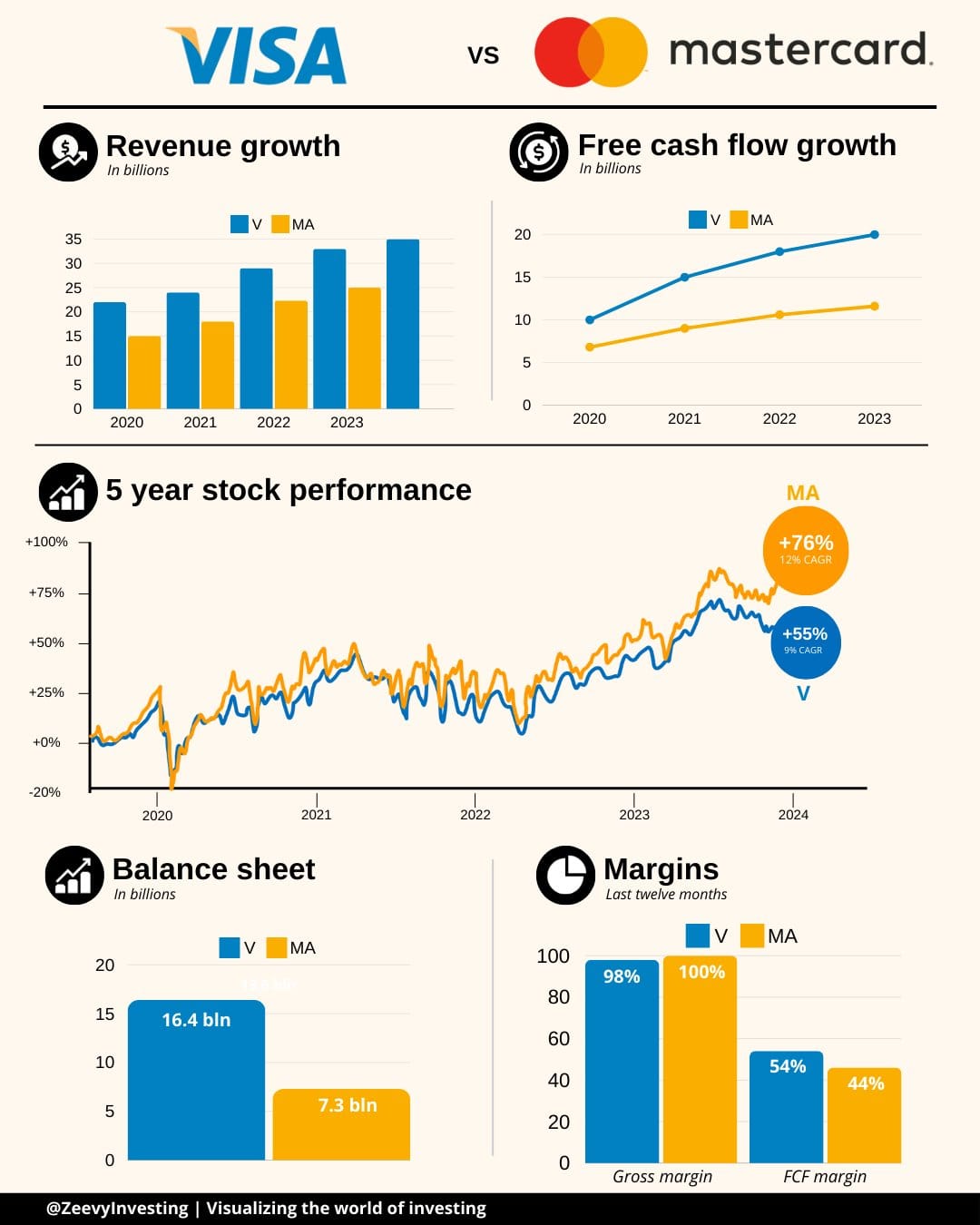

A side-by-side comparison of Mastercard 🆚 Visa.👇

PAYMENTS NEWS

🇺🇸 Aeropay targets pay-by-bank evolution in the US. The Chicago FinTech has moved from servicing small merchants to handling cannabis payments, and now it’s catering to gaming clients. Read the complete article

🇲🇽 ACI Worldwide and Mexipay extend partnership to boost instant payments adoption in Mexico. Mexipay will utilize ACI’s Digital Central Infrastructure solution, part of the award-winning ACI Enterprise Payments Platform, to address the need for enhanced real-time payment services.

💡 Disrupting the traditional payday. Instant payments are an opportunity for companies to meet overwhelming worker demand. Research has found that 60% of Americans believe that all companies should offer workers immediate access to their earned wages, and nearly 80% of Americans target job opportunities for companies that offer instant payments. Companies that don’t comply will get left behind.

Gabriel Grisham, Senior Vice President at Payout Orchestration platform PayQuicker, explains: Learn more

🇺🇸 Aghanim, a mobile gaming FinTech company, announced a strategic partnership with Adyen, which will give the Aghanim direct-to-consumer enablement platform for mobile game developers and publishers access to high value payment processing capabilities all over the world.

🇺🇸 Rellevate announces partnership with Mastercard to advance digital payments capabilities in the U.S. public sector. Together, the companies will work with local, city and state governments to create ways for their constituents to access and manage their money faster and more efficiently.

🇺🇸 PayJunction expands payment capabilities with Text to Pay. The new feature lets businesses easily integrate Text to Pay into their invoicing workflows, allowing them to accept payments via SMS. This helps businesses better meet customer expectations while improving collection rates, contributing to overall revenue growth.

🇬🇧 BR-DGE partners with Vibe to fast-track travel payments. Through a single integration with BR-DGE, Vibe’s merchants will gain enhanced global payments connectivity, stronger platform resilience and stability, more capabilities to drive acceptance optimisation, and an expedited time-to-market.

🇬🇧 Teya introduces Tap to Pay. The product, Teya Tap, allows business owners to accept payments directly with their Android phones, removing dependencies on physical card machines. It can be a cost-effective alternative to traditional card machines for business owners who trade on the go.

🇺🇸 Liberis and Sezzle partner to provide funding to small businesses across the United States. Embedded finance platform, Liberis, is partnering with Sezzle, a Buy Now, Pay Later platform, to promote Sezzle Capital, offering small to medium-sized businesses in the United States funding without giving up equity.

🇺🇸 Visa launches Money Movement Advisory Practice in North America. Visa's Money Movement Advisory Practice addresses the growing demand for seamless payments and mobile experiences, focusing on facilitating fund transfers across multiple platforms and channels.

🇺🇬 Flutterwave expands African footprint with Ugandan payments licence. Leveraging its advanced technology and deep understanding of African markets, Flutterwave offers a comprehensive suite of payment solutions tailored to the country's unique needs.

🇸🇪 Adyen announced a global partnership with Swedish home furnishing business IKEA. The new partnership with Adyen will allow IKEA to connect the dots between in-store and digital sales channels and offer better payment and loyalty experiences for customers.

GOLDEN NUGGET

"𝐓𝐡𝐞 𝐜𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐰𝐡𝐞𝐧 𝐦𝐚𝐩𝐩𝐢𝐧𝐠 𝐲𝐨𝐮𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞" - Interview of Juan Pablo Ortega, Founder & CEO of Yuno 👇

In my recent conversation with JP, we delved into 𝐭𝐡𝐞 𝐢𝐧𝐭𝐫𝐢𝐜𝐚𝐜𝐢𝐞𝐬 𝐨𝐟 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 and how to best navigate the complexities related to it. From the foundational setup of traditional systems to the emerging importance of 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧, Juan shared invaluable insights.

We explored the global and local challenges businesses face in mapping out their payments landscape. As Juan emphasized, understanding and controlling your 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐝𝐚𝐭𝐚, 𝐫𝐨𝐮𝐭𝐢𝐧𝐠 𝐚𝐧𝐝 𝐜𝐨𝐧𝐧𝐞𝐜𝐭𝐢𝐨𝐧𝐬 is crucial for creating a resilient and adaptable infrastructure.

One standout takeaway? 👇

The concept of a 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐋𝐚𝐲𝐞𝐫 — a dynamic system that seamlessly integrates various payment methods and gateways, ensuring a smoother, more efficient transaction process.

If you're building or refining your payments strategy, these are key considerations to keep in mind.

𝐖𝐡𝐚𝐭'𝐬 𝐲𝐨𝐮𝐫 𝐛𝐢𝐠𝐠𝐞𝐬𝐭 𝐜𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞 𝐢𝐧 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐭𝐨𝐝𝐚𝐲? -- think carefully and please don't hesitate to share!

Very dynamic and fun interview! Juan Pablo Ortega and Yuno, THANK YOU for the time and insights!

More to come in this format, all feedback is welcomed 🙏

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()