New Innovation for Banks from Mastercard

Hey Payment Fanatic!

At the annual Sibos conference in Beijing, Mastercard introduced Mastercard Move Commercial Payments, a solution that will transform commercial cross-border payments for banks and their business customers.

Mastercard’s new solution offers near real-time, predictable payments with complete transparency. Banks now have a tool to optimize liquidity, reduce counterparty risk, and give their clients the smooth cross-border experience they’ve been waiting for.

Alan Marquard, Head of Transfer Solutions at Mastercard, emphasized the significance of this innovation: “By powering fast, predictable, and transparent payments, Mastercard Move Commercial Payments will bring what is already the norm in domestic payments to the commercial cross-border payment space.”

What does this mean for the future of commercial payments? Faster transactions, around-the-clock availability, and flexible settlement options—giving banks more control and businesses more certainty. It's a significant leap forward as Mastercard bridges the gap between domestic and international payments, taking cross-border capabilities to the next level.

Read more interesting news as this one in the list I prepared for you below, I'll be back tomorrow with more!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 ACI Worldwide study reveals real-time payments to boost global GDP by $285.8 billion, create 167 million new bank account holders by 2028. ACI’s second Real-Time Payments: Economic Impact and Financial Inclusion report leverages data from 40 countries and reveals—for the first time—an empirical link between real-time payments and financial inclusion.

PAYMENTS NEWS

🇸🇬 Thunes enables banks to unlock mobile wallet payments via their existing Swift connectivity. Thunes' new capability lets Swift-connected financial institutions join its Direct Global Network, enabling fast, transparent cross-border payments to 120 mobile wallet brands globally, without requiring separate integration.

🇲🇾 PayMate launches Business Payments App for Malaysian SMEs. The app is designed to address the common challenges faced by SMEs, including cash flow issues, delayed payments, and limited access to affordable credit. Read on

🇺🇸 A financial technology trade group representing BNPL providers such as Block Inc. and Klarna Bank AB is suing to stop the Consumer Financial Protection Bureau’s rule that brings some credit card protections to the burgeoning market. The Financial Technology Association filed a lawsuit claiming the CFPB didn’t follow proper procedures in requiring BNPL firms to provide regular billing statements and refunds.

🇩🇪 The Payments Group launches and lists on stock exchange. TPG launched a group of four cooperating specialist FinTech and paytech businesses. It offers a wide range of online payment services, including embedded financial services and global payment solutions.

🇬🇧 Wise Platform boosts product suite, enabling more partners to offer faster, cheaper, secure, and convenient international payments directly from their own platforms. Among the new partners are some of the world's largest digital banking platforms

🇮🇩 BRI teams up with Nium to upgrade cross-border payment solutions. This partnership aims to enhance cross-border financial services for BRI's individual and corporate customers in Indonesia, providing modern, real-time payment solutions to over 150 million account holders, including those in remote areas.

➡️ Nium enables financial institutions to connect to its real-time payments network via Swift. This initiative enables banks to process payments through Nium using their existing SWIFT capabilities, eliminating the need for complex API integration and reducing the cost of cross-border transfers.

🇺🇸 GoodRx and Partner Pharmacies to offer Affirm BNPL option. With this new offering, approved consumers will be able to choose an Affirm payment option for select medications at participating retailers on the GoodRx platform, the company said in a press release last week.

🇪🇸 CaixaBank switches on instalment payments with Apple Pay. The bank has become the first financial institution in mainland Europe to offer BNPL services to users checking out with Apple Pay. This new functionality enables customers to view available payment options and select their preferred payment method before completing their purchase.

🇺🇸 Bank drama for PayPal, Square after Wells Fargo bows out. For over 20 years, Wells Fargo was a key player in supporting major payments companies, but its recent exit has left a gap. JPMorgan is now the only major U.S. bank still active in this space, working with PayPal, Venmo, and Square, though it's unclear how much of Wells Fargo's business JPMorgan has taken over. Discover more

GOLDEN NUGGET

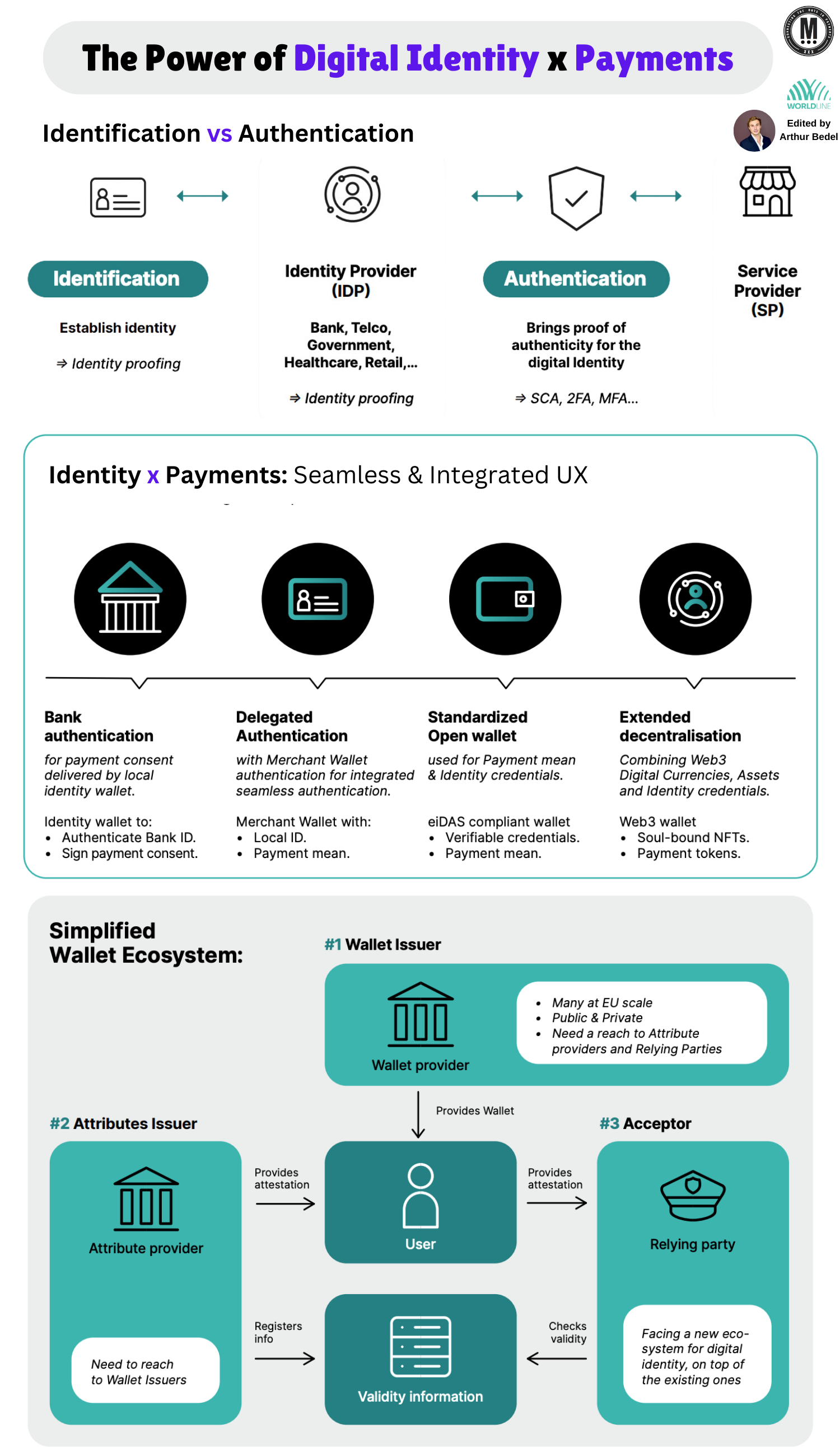

𝐓𝐡𝐞 𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐱 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 Europe is Innovating👇

The European Digital Identity Framework (EIDF) aims to unify and secure digital identity verification across all EU by introducing the European Digital Identity Wallet. This wallet will integrate identify verification with services like banking, healthcare and payments

𝐈𝐝𝐞𝐧𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 vs 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧:

𝐈𝐝𝐞𝐧𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — The process of establishing who a user is by collecting identity details (e.g., name, address, date of birth) from the user)

𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — The process of verifying the legitimacy of the identity during an interaction. It confirms that the user is who they claim to be, using tools like Strong Customer Authentication, Two-Factor Authentication, or Multi-Factor Authentication.

Identification is about "Who are you?" — Authentication is "Prove it's really you."

𝐓𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞 — 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 linked to 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐬 𝐔𝐬𝐞𝐫 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞 — Digital identity, when integrated with payments, reduces friction in the payment process by eliminating the need for repeated identity verification

𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐬 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 — The EUDIW includes mechanisms like multi-factor authentication and biometric data, ensuring secure payment processes

𝐒𝐭𝐫𝐞𝐚𝐦𝐥𝐢𝐧𝐞𝐬 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐞𝐬:

🔸 Financial institutions benefit from (KYC) processes

🔸 Loan applications and account opening are simplified

𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐳𝐞𝐝 & 𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

🔸 Merchants can use digital identity to offer personalized services

🔸 Zero Knowledge Proofs allow for age verification without revealing more personal information

🔸 Cross-border payments between EU member are simplified

How 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 and 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 are creating a 𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐝 𝐖𝐚𝐥𝐥𝐞𝐭 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦

𝐔𝐧𝐢𝐟𝐢𝐞𝐝 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 — The European Digital Identity Wallet serves as a single, unified digital wallet that can store both identity credentials (e.g., ID cards, passports) and payment methods (e.g., bank account details, payment tokens) — One-stop solution for both online and in-store

𝐊𝐞𝐲 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐏𝐚𝐫𝐭𝐢𝐜𝐢𝐩𝐚𝐧𝐭𝐬:

🔸 Wallet Issuers

🔸 Attribute Providers

🔸 Relying Parties: Businesses (e.g., e-commerce platforms, financial institutions)

𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 — Payments and identity verification happen within the same workflow

𝐔𝐬𝐞𝐫 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 & 𝐏𝐫𝐢𝐯𝐚𝐜𝐲 — Users maintain control over which attributes are shared with which service providers

Let's see how the major actors create adoption now!

Source: Worldline

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()