NAB and Amazon Roll Out PayTo® for Seamless Bank Payments in Australia

Hey Payments Fanatic!

NAB and Amazon have teamed up to launch PayTo, a payment option that lets customers pay directly from their bank accounts—no more entering card details.

With PayTo, shoppers can securely authorize payments through their online banking and use it for one-off or recurring purchases with just a click. The goal? More control, better security, and a frictionless checkout experience.

Shane Conway, NAB’s Executive of Enterprise Payments and Technology Modernisation, called the move a win for both Amazon customers and sellers, simplifying payments while cutting costs for businesses.

“By integrating our new Pay by Bank (PayTo) capability, Amazon is giving customers an easy and secure way to pay, while also offering businesses a cost-efficient, instant payment solution.”

Sujit Misra, APAC Payments Director at Amazon, added that the e-commerce giant is following customer trends toward instant banking payments.

“This ensures our customers have choice and can pay according to their preferences when they check out on Amazon.”

Stay tuned for more Payments updates below 👇. Talk soon!

Cheers,

Level up your banking knowledge. Subscribe now for the latest in digital banking, delivered weekly.

INSIGHTS

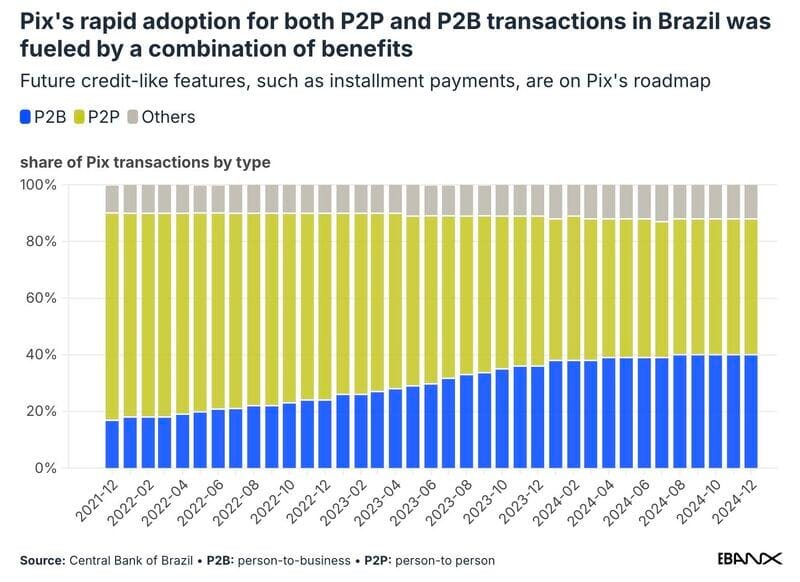

📊Pix is used by 𝟭𝟱𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 Brazilians reaching 91% of the adult population 🤯

Another interesting movement of Pix in Brazil 🇧🇷 is the rise of P2B transactions👇

PAYMENTS NEWS

🇸🇬 Thunes appoints Jane Jackson as CPO. Jane will lead Thunes’ People strategy, shaping culture, boosting organisational effectiveness, and enhancing talent development across 14 international locations.

🇮🇳 Flipkart goes live with Credit Card Bill Payments. This aims to enable convenient payments for millions of Flipkart customers while driving growth for the Recharges and Bill Payments category on Flipkart Pay via the Bharat Bill Payment Service (BBPS).

🇮🇳 Runa expands into India to streamline Instant Payments for Businesses. With this expansion, Runa allows its business customers the ability to easily send instant, domestic, and cross-border payouts to consumer recipients in India.

🇧🇷 AstroPay continues global expansion with payment institution license. The license, from the Central Bank of Brazil, underscores AstroPay’s commitment to delivering secure, compliant, and user-friendly cross-border payment solutions.

🇬🇧 Taxpayers pay HMRC over £12bn using Pay by Bank. Pay by Bank allows to make secure account to account payments between banks, and is based on open banking APIs and banking infrastructure. Using it means taxpayers do not have to manually enter as much sensitive financial information.

🇺🇸 Stampli to Roll Out Procure-to-Pay Solution. Stampli Procure-to-Pay is designed to eliminate the challenges finance teams face when dealing with disconnected systems and conversations that take place across email, chat and meetings, according to the release.

🇺🇸 CFPB urges Wise to ‘be truthful’ following $2m penalty. The penalties stem from misleading advertising about fees, and failure to disclose exchange rates properly. Wise failed to provide accurate fee information to customers funding prepaid accounts via Apple Pay or Google Pay when using a credit card.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()