MoonPay Acquires Helio for $175M to Dominate Crypto Payments Space

Hey Payments Fanatic!

MoonPay has acquired blockchain payment processor Helio for $175 million, its largest acquisition to date. Helio, launched in 2022 on the Solana blockchain, provides on-chain payment solutions for platforms including Shopify, Discord, and SolanaPay.

Ivan Soto-Wright, Co-founder and CEO of MoonPay announces: "Today, I've got a big announcement for you. 2024, as you know, big year for MoonPay. 2025 is going to be even bigger. And we're kicking it off with a bang—the acquisition of HelioPay. HelioPay is the leading crypto commerce solution powering thousands of merchants inside some of your favorite integrations."

The acquisition positions MoonPay to compete with Coinbase Commerce in the U.S. crypto payment sector, with plans to integrate Helio's technology into its existing payment infrastructure.

I've compiled more updates from the global Payments industry for your perusal below👇

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

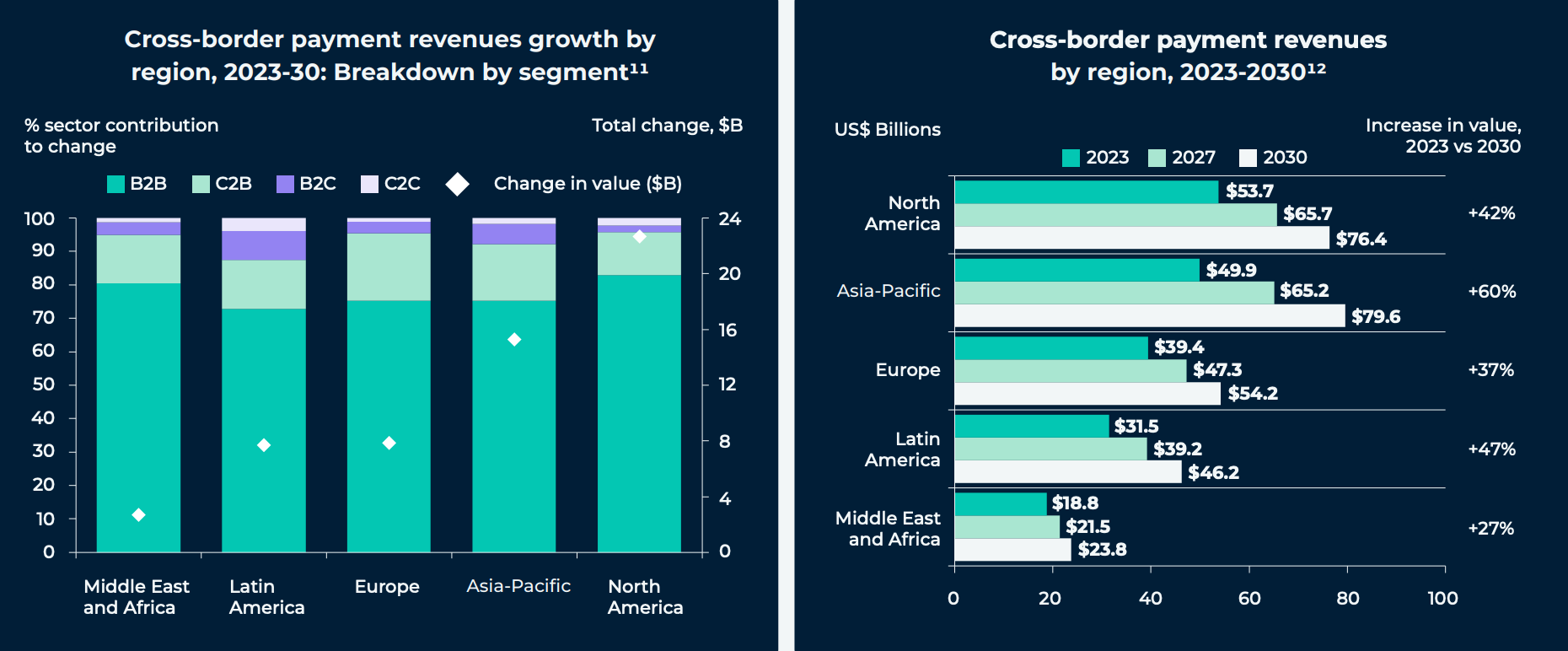

📊 FinTech 2025+ report: Trends, Technology, and Transformation in Global Commerce by Convera.

PAYMENTS NEWS

🇶🇦 TESS Payments and Alfardan Exchange unite to redefine digital payments. This collaboration aims to deliver revolutionary digital payment channels, allowing both institutions to expand their reach and impact, while also supporting Qatar’s national vision for digital innovation.

🇺🇸 Brex teams with Citi and TPG Angelo Gordon to accelerate card product growth. The modern corporate card and spend management platform for startups and enterprises announced the closing of a two-year, $235 million revolving credit facility.

🇸🇬 Reap gets in-principle approval for Singapore payment license. The approval is a step forward for Reap Singapore, the company’s local entity, as it works toward meeting the conditions required to obtain the full license. Reap intends to allocate necessary resources to support its Singapore operations and strengthen compliance standards.

🇻🇳 TCB Pay launches a new service, ACH payments. TBC Pay’s aim is to offer a payment technology that delivers better flexibility, security and efficiency for businesses managing their own transactions. Besides the new service, TBP Pay also offers real-time analytics and customisable support for its clients.

🇵🇰 Abhi partners with UAE’s Al Ansari Financial Services. The alliance will provide EWA and SNPL services to complement Al Ansari Financial Services’ existing portfolio from the second quarter of this year, Abhi said. This will help address the varied needs of both unbanked and underbanked communities in the UAE, it added.

🇺🇸 PXP launches PXP unity. The platform transforms raw real-time transaction data into actionable insights, empowering merchants with intuitive dashboards that present important metrics—such as transaction success rates, payment methods, and scheme performance—offering clear strategic direction.

🇦🇺 Banking Circle set to purchase Australian Settlements Limited. This acquisition marks a key step in the bank’s goal of building a global hub for real-time clearing and settlement for all major currencies and accelerating its expansion. The strategy specialises in providing financial infrastructure to banks and payment businesses.

🇬🇧 BR-DGE teams up with TrueLayer. Through the partnership, BR-DGE will add Pay by Bank, which is driven by Open Banking technology, to its suite of payment options. BR-DGE said the partnership recognises the growth in Pay by Bank, particularly in the UK, but also across Europe and further afield.

🇲🇽 Kuady launches new Affiliate program. The program provides a full suite of creative assets, such as banners, logos, and landing pages, to help affiliates promote Kuady effectively and drive sign-ups. Participants can track their progress via an easy-to-use dashboard with real-time performance analytics.

🇺🇸 AIsa unveils payment network for the Trillion-Dollar AI economy. The payment network unlocks vast opportunities across industries, enabling AI agents to pay for resources by the millisecond, access data services with precision, and execute high-frequency trading strategies.

🇿🇼 Mukuru launches Mukuru Wallet. The wallet has several benefits, including its standout features: two pockets that allow users to send and receive money locally and internationally from mobile phones, safe storage of funds as well as a free cashout on international transfers.

🇬🇭 Mastercard reaffirms commitment to Ghana with new office in Accra. This strategic milestone underscores Mastercard’s commitment to supporting the country's growing digital economy by providing innovative financial products and services tailored to the market.

GOLDEN NUGGET

Apple𝐏𝐚𝐲 vs Google Pay vs 𝐒𝐚𝐦𝐬𝐮𝐧𝐠 𝐏𝐚𝐲 👇

Digital wallets have become a cornerstone of modern payment systems, offering far more than just the ability to make purchases, much more:

1️⃣ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — Purchases, bill payments, and fund transfers.

2️⃣ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — Storing driver's licenses and government IDs (where supported).

3️⃣ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐀𝐜𝐜𝐞𝐬𝐬 — Managing transportation passes, event tickets, boarding passes, loyalty programs, and even car or hotel keys.

4️⃣ and more.

Apple𝐏𝐚𝐲 vs Google Pay vs 𝐒𝐚𝐦𝐬𝐮𝐧𝐠 𝐏𝐚𝐲 — Key Facts:

► Apple𝐏𝐚𝐲:

Apple𝐏𝐚𝐲, integrated into the iOS ecosystem, focuses on delivering a secure, privacy-first digital wallet experience.

Apple's seamless integration with its devices and a strong emphasis on user privacy have made it a leader in markets like the UK 🇬🇧, where 34.4% of consumers use Apple Wallet, and the US 🇺🇸, where it captures 24% market share.

► Google Pay

Google Pay offers a comprehensive digital wallet experience designed for Android users. It combines traditional payment functionality with an enhanced usability across regions through partnerships and innovation.

Google Wallet demonstrates strong adoption in markets like Brazil 🇧🇷, where consumers value its multifaceted functionality, and France 🇫🇷, where it supports a growing base of tech-savvy users.

► 𝐒𝐚𝐦𝐬𝐮𝐧𝐠 𝐏𝐚𝐲

𝐒𝐚𝐦𝐬𝐮𝐧𝐠 𝐏𝐚𝐲 differentiates itself through its support for both NFC and MST (Magnetic Secure Transmission) technologies, allowing it to function with older payment terminals where NFC is unavailable. Samsung Pay's ability to work on legacy systems makes it a practical solution in markets with less advanced payment infrastructures.

𝐍𝐨𝐭𝐚𝐛𝐥𝐞 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬:

► 𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 — Apple Pay leads in mature markets like the UK and the US, while Google Wallet shows greater traction in Brazil and emerging economies.

► 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 — Google Pay provides a more diversified suite of services beyond payments, appealing to users who prioritize non-financial features.

► 𝐀𝐝𝐚𝐩𝐭𝐚𝐛𝐢𝐥𝐢𝐭𝐲 — Samsung Pay's MST technology gives it a unique edge in regions with legacy payment systems, where NFC adoption remains low.

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐰𝐚𝐥𝐥𝐞𝐭𝐬 are becoming central to consumer finance, but their growth extends beyond transactions. They are evolving into multifunctional hubs that connect payments, identification, and access.

Source: PYMNTS

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()