Mollie Secures EMI License – What’s Next?

Hey Payments Fanatic!

Mollie has quietly secured an EMI license, a move that could reshape its position in the payments industry. This license grants the company the ability to issue e-money, offer local IBAN accounts, and expand its payment services—potentially signaling a bold new strategy.

Could this be the start of a broader FinTech expansion? A major product launch? Or is Mollie gearing up to challenge neobanks and redefine the PSP landscape? One thing’s for sure—this is a major step forward with huge potential.

Check out more global Payments updates below👇, and I’ll see you again on Monday!

Cheers,

PS: Quick favor—A good friend of mine is looking to connect with businesses that want to optimize their payments. If that sounds like you (or someone you know), and you want to unlock higher success rates and reduce friction in every transaction.👇click here to get started.

Level up your banking knowledge. Subscribe now for the latest in digital banking, delivered weekly.

INSIGHTS

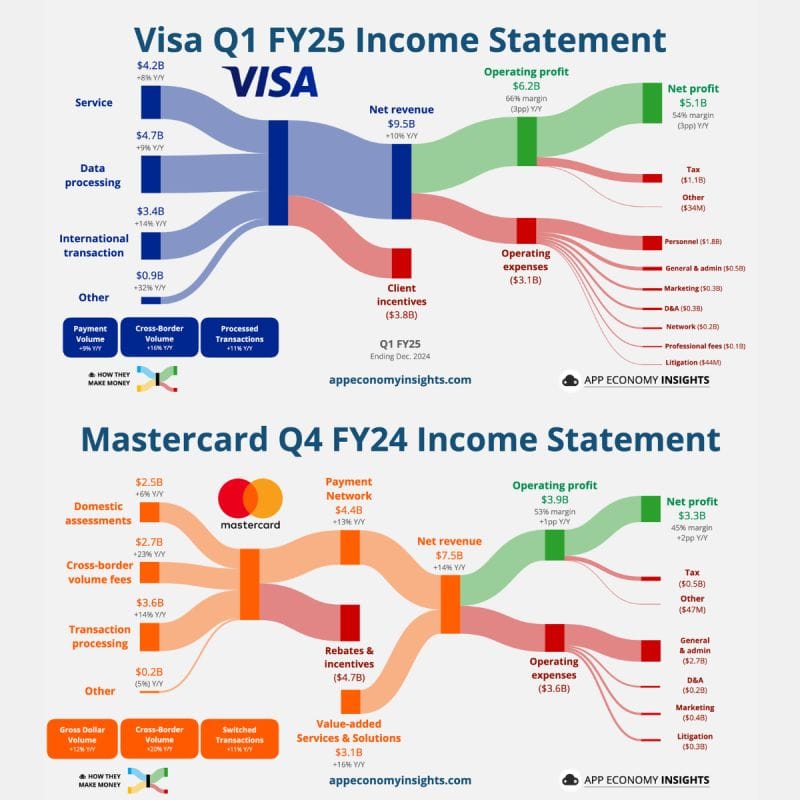

Mastercard 🆚 Visa : Who dominated this quarter?

PAYMENTS NEWS

🇬🇧 ACI Worldwide extends FinTech partnership with Banfico. Through the partnership, ACI will support UK and European banks and payment service providers (PSP) to comply with mandates to offer Confirmation of Payee (CoP) and Verification of Payee (VOP) services.

🇨🇴 Multi currency cards: Insights from Diego Quesada, Country Manager of Pomelo Colombia & Perú. "With around 6 million Colombians traveling abroad each year, the possibility of using a single card to make all types of payments in different currencies has increased. It is the issuers in the FinTech sector, retailers, and new brands that are joining traditional players in offering this service," Quesada said.

🇺🇸 Joseph Hurley is joining Aeropay's Advisory Board. Joe’s 30+ years in financial services have been spent pushing the envelope for action and innovation. He’s held leadership roles at Discover Financial Services, Crown Agents Bank, and Diners Club International.

🇸🇪 How Klarna CEO spends his fortune taking big bets on fast-growing startups. Flat Capital, managing Sebastian Siemiatkowski's wealth, has been expanding its AI startup portfolio. Flat is shifting focus from later-stage growth companies, partly driven by Siemiatkowski's personal interest in AI. This AI-focused strategy marks a departure from the firm's previous investment approach.

🌎 Kuady partners with BridgerPay. The collaboration will make Kuady’s payment services available to all businesses and companies using BridgerPay’s platform, providing a frictionless, secure, and localised payment experience in Chile, Peru, Mexico, Ecuador, and Argentina.

🇪🇺 iPiD partners with iBanFirst. This integration aims to streamline the process of payee verification within cross-border payments, offering an advanced solution with iPiD Validate, which is intended to improve both payment security and customer experience.

🇧🇭 LuLu Exchange partners with FinTech Galaxy. By enabling A2A transfers, LuLu has become a cross-border payments company to offer services using Open Banking infrastructure. Galaxy is licensed by the Central Bank of Bahrain to offer account information services and payment initiation services in the Kingdom.

🌍 XTransfer and Ecobank Group forge landmark partnership. Through this partnership, XTransfer will leverage Ecobank’s vast African banking network, enabling Chinese traders to collect funds in local African currencies allowing them to send payments in their local currencies without incurring high foreign exchange losses.

🇲🇽 Western Union and Penny Pinch launch international money transfer services. This enables customers in the country to send and receive money globally, based on their convenience and needs. They also have the flexibility to send funds to bank accounts and mobile wallets worldwide, as well as for cash pick-up at locations abroad.

🇬🇧 FXellence launches multimarket cross-border payment solution. Available initially in the UK, the new platform caters to business clients, addressing common challenges faced when sending money abroad. Customers will be able to hold over 30 currencies in a single digital wallet, enabling payments to more than 100 countries.

🌍 Decta payments gateway opens the door to Klarna. DECTA clients can now offer customers frictionless, flexible payment options that enhance the shopping experience and drive higher conversion rates. Merchants can attract customers, increase average order values, and improve checkout conversion rates.

🇬🇷 JPMorgan Chase’s $𝟵𝟭𝟳 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 investment in a Greek FinTech company. JPMorgan bought Viva.com to boost an international expansion that aimed to create a tech hub in Greece but went so wrong that the bank last year offered to sell back half of its stake at a valuation of $𝟭𝟳𝟱 𝗺𝗶𝗹𝗹𝗶𝗼𝗻.

🇺🇸 Coinbase pushes US to pave way for bank-crypto partnerships. “It’s important for regulators to make clear that banks can work with third-party providers in providing trading and exchange services to their customers,” said Coinbase Chief Policy Officer.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()