Mollie & Qonto Team Up to Simplify Business Payments

Hey Payments Fanatic!

About 47% European businesses face challenges with late payments. While the reasons vary, fragmented payment systems and slow processing remain key hurdles for SMEs. Against this backdrop, Mollie and Qonto have joined forces to address the issue head-on.

Mollie and Qonto have announced a two-way collaboration that aims to streamline both sides of the financial equation, payments and banking. Qonto, a FinTech serving over 400k SMEs and freelancers across Europe, now integrates Mollie’s embedded payments solution. This enables Qonto customers to accept payments through secure links directly from invoices, or shared as standalone links, simplifying how they get paid.

Mollie’s platform, which supports over 250k businesses across Europe, powers the infrastructure behind this new feature. Through ‘Mollie Connect’, Qonto users can generate payment links, track their status in real time, automate reconciliation, and receive funds directly into their Qonto account.

Instead of managing multiple providers or dealing with delays and high fees, businesses can now rely on a single embedded solution that links payment collection and financial management, available in France, Germany, and the Netherlands.

The collaboration also goes in the other direction. Mollie is integrating Qonto’s embedded banking solution, Qonto Embed, to offer its own customers business accounts with real-time insights, fast payouts, and access to tools like SEPA transfers, physical and virtual cards, and spending controls.

“This partnership with Mollie marks a milestone in our mission to simplify finance management for European businesses,” said Alexandre Prot, CEO & Co-Founder at Qonto. “Together, we’re uniting our strengths to build fintech champions that can compete on a global level.”

“This partnership is a game-changer for SMEs seeking fast, seamless, and fully integrated financial services,” added Koen Köppen, CEO at Mollie.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

PAYMENTS NEWS

🇬🇧 Checkout.com launches face authentication to strengthen digital identity verification. The new feature enables businesses to securely verify and re-authenticate returning users in seconds using live video and facial matching, helping to remove friction from critical user flows such as password recovery, employee onboarding, and secure platform access.

🇬🇧 Ecommpay opens Neurodiversity training to merchants and FinTechs. The sessions led by Cressida Stephenson will focus on building a neuro-inclusive culture by enhancing understanding of neurodivergence, recognising common traits, and providing guidance on supporting neurodivergent individuals throughout the job application, interview, and employment journey.

🇸🇪 ACI Worldwide announced as a sponsor for NextGen Nordics. Renowned for powering real-time payments globally, ACI helps banks, FinTechs, and intermediaries accelerate their modernisation efforts. With a robust suite of solutions addressing fraud, open banking, and instant payments, ACI empowers institutions to innovate securely and at scale.

🇺🇸 Mastercard unveils Agent Pay, pioneering agentic payments technology. The solution will enhance generative AI conversations for people and businesses by integrating trusted, seamless payment experiences into the tailored recommendations and insights already provided on conversational platforms.

🇺🇸 Mastercard unveils end-to-end stablecoin capabilities. The move comes as stablecoins gain wider acceptance beyond crypto trading, with regulators providing greater clarity on their use. The payment giant’s approach covers wallet enablement, card issuance, acceptance, and settlement options.

🇺🇸 Mastercard and Corpay Cross-Border Payments announced a partnership. Mastercard takes a minority stake and invests in the company. Corpay will become the exclusive provider of currency risk management and integrated high-value cross-border payments solutions to Mastercard’s financial institution clients.

🌍 Trustly and Paytweak announce new innovative payment solution for European merchants. This collaboration gives rise to a unified payment offering that complies with European regulatory requirements, combining simplicity of use, security, and operational efficiency for businesses across the continent.

🇬🇧 DECTA launches FinTech Fast Track to support emerging FinTechs. The company’s new product aims to help early-stage FinTech scale faster, allowing them to leverage its team that launched card and acquiring programmes across Europe, MENA, APAC, and LATAM.

🇬🇧 Railsr and Equals Group merge. By integrating cross-border transaction expertise with next-generation embedded finance solutions, the newly combined group offers businesses a seamless way to embed financial services into their products, enabling them to launch, scale, and operate globally with confidence.

🇮🇹 Nexi and Planet partner to provide a superior payment experience in hospitality. The partnership will leverage the best capabilities of both parties, combining Nexi’s pan-European expertise and local footprint, including best-in-class acquiring, omni-acceptance for local schemes and alternative payment methods, and digital customer operations.

🇦🇪 Circle secures in-principle regulatory approval from ADGM’s FSRA. This IPA marks a significant step towards Circle securing a Financial Services Permission under ADGM’s progressive regulatory framework and reinforces the company’s commitment to enabling compliant innovation in digital finance throughout the Middle East and Africa.

🌍 Flutterwave and Yellow Card join Circle Payments Network to enable global transactions using stablecoins. According to the statement, CPN will unify disparate payment networks and local currencies, enabling 24/7 real-time settlement using stablecoins.

🇲🇹 RS2 unveils AI-Powered Orchestration Layer to modernize bank legacy systems. Rather than replacing core systems entirely, RS2’s orchestration layer overlays existing platforms. This enables real-time optimization, dynamic transaction routing, and enhanced fraud protection, all without interrupting business continuity.

🇬🇧 London FinTech Navro raises $41 million. The fresh capital will be used to expand operations into more US states, Dubai, Hong Kong, and India. Navro clients can collect funds locally in 35 locations, and hold, convert and make payouts in more than 200 countries and 140 currencies.

🇺🇸 PayPal reports first-quarter earnings beat, maintains forecast. While sales increased just 1% from $7.7 billion a year earlier, PayPal said the results reflect a strategy to prioritize profitability over volume, rolling off lower-margin revenue streams. Meanwhile, PayPal said Venmo revenue grows 20%, with debit card payment volume soaring year over year in the first quarter.

🇳🇬 Nigeria’s open banking to launch in August after a four-year wait. With the CBN’s approval, customers can now consent to allow regulated financial institutions to access their data, such as account balances, transaction histories, and spending patterns, and, in some cases, even initiate transactions on their behalf.

🇺🇸 OKX Pay launched to simplify crypto payments and self-custody. The company plans to integrate traditional payment service providers like Mastercard and Stripe to expand the usability of OKX Pay at merchant point-of-sale systems. The rollout will begin with selected markets before expanding globally.

GOLDEN NUGGET

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 12 👋 Created by Arthur Bedel

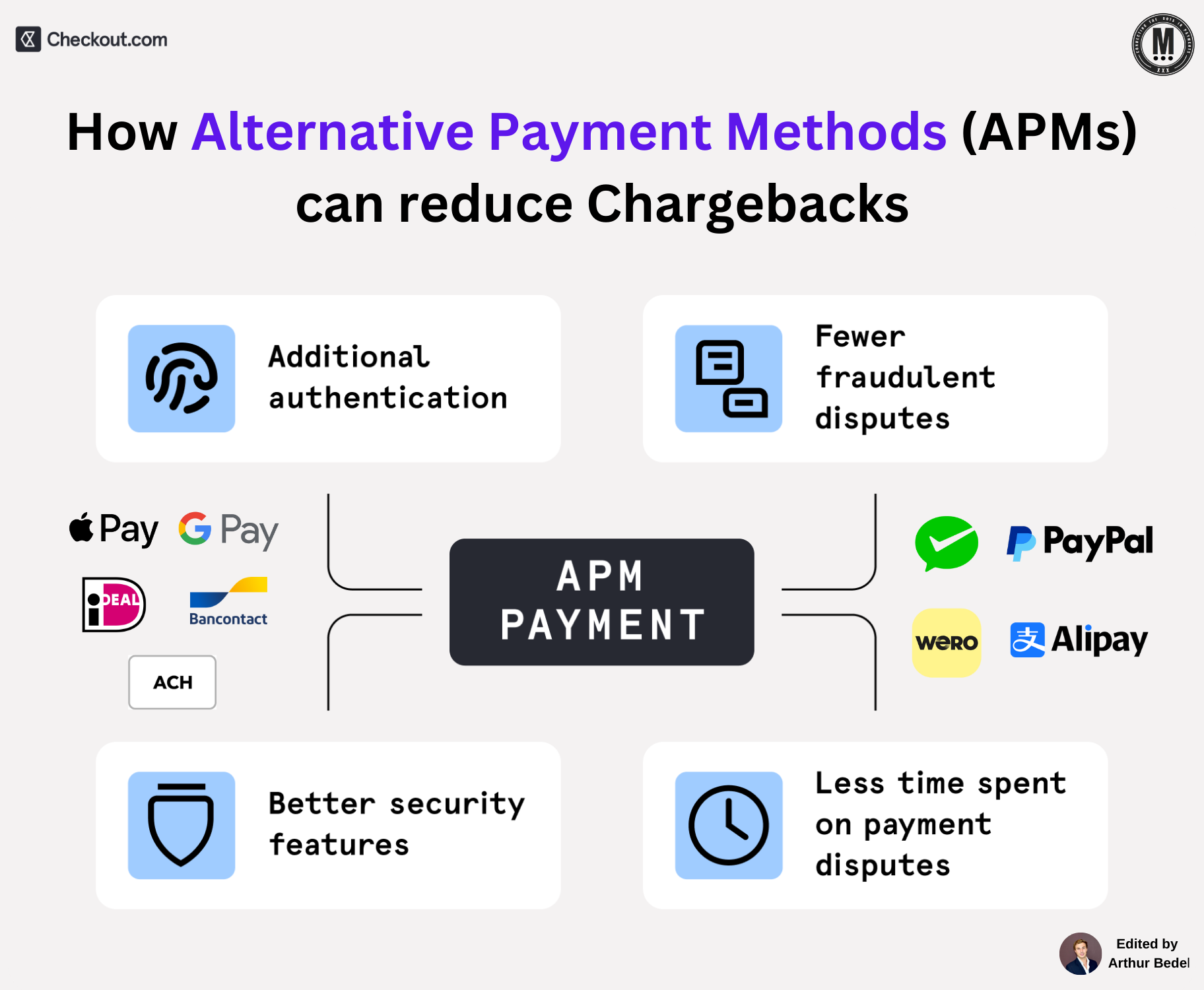

How 𝐀𝐥𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐯𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 (𝐀𝐏𝐌𝐬) can reduce 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤𝐬

► 𝐀𝐥𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐯𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 (APMs) are non-card payment options that offer consumers more flexibility while helping merchants combat chargebacks and fraud.

► They include bank transfers, digital wallets, Buy Now Pay Later (BNPL), real-time payments, stablecoins, and Wero by EPI Company

→ Note: Digital Wallets may also be wrappers for cards.

Types of 𝐀𝐏𝐌𝐬:

► 𝐁𝐚𝐧𝐤 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬: iDEAL (Netherlands), Bancontact Payconiq Company (Belgium), ACH & Aeropay (US)

► 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬: PayPal, Alipay, Google Pay, ApplePay

► 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐏𝐚𝐲 𝐋𝐚𝐭𝐞𝐫: Klarna, Afterpay, Affirm

► 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: UPI (India), Pix (Brazil), SEPA Instant (Europe)

► 𝐖𝐞𝐫𝐨: Europe's new cross-border APM by EPI Company

Next Wave:

► 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 (USDC, USDT, DAI...) and blockchain-solutions also do provide dispute systems via intermediaries.

Some of the Best APM Aggregators:

► PPRO

► CITCON

► Payplug

► Checkout.com

𝐖𝐡𝐲 𝐂𝐚𝐫𝐝 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤𝐬 𝐚𝐫𝐞 𝐡𝐚𝐫𝐝 𝐭𝐨 𝐰𝐢𝐧:

► 𝐈𝐬𝐬𝐮𝐞𝐫-𝐜𝐞𝐧𝐭𝐫𝐢𝐜: The cardholder’s bank usually drives the dispute process.

► 𝐅𝐫𝐢𝐞𝐧𝐝𝐥𝐲 𝐟𝐫𝐚𝐮𝐝: Customers falsely claim a charge was unauthorized.

► 𝐇𝐢𝐠𝐡 𝐞𝐯𝐢𝐝𝐞𝐧𝐜𝐞 𝐛𝐮𝐫𝐝𝐞𝐧: Merchants need to provide extensive documentation.

► 𝐋𝐨𝐰 𝐰𝐢𝐧 𝐫𝐚𝐭𝐞𝐬: Even with evidence, disputes often resolve in favor of the cardholder.

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐀𝐏𝐌𝐬 𝐢𝐧 𝐑𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤𝐬:

✅ 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — Many APMs require strong customer authentication (SCA), like biometrics or two-factor

✅ 𝐁𝐞𝐭𝐭𝐞𝐫 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐅𝐞𝐚𝐭𝐮𝐫𝐞𝐬 — Tokenization, real-time fraud detection, and secure checkout flows lower unauthorized transactions.

✅ 𝐅𝐞𝐰𝐞𝐫 𝐅𝐫𝐚𝐮𝐝𝐮𝐥𝐞𝐧𝐭 𝐃𝐢𝐬𝐩𝐮𝐭𝐞𝐬 — APMs bypass traditional card rails, reducing the chances of chargeback fraud. Dispute processes are often more merchant-friendly or, in some cases, not available.

✅ 𝐓𝐫𝐚𝐧𝐬𝐩𝐚𝐫𝐞𝐧𝐭 𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐇𝐚𝐧𝐝𝐥𝐢𝐧𝐠 — APMs like PayPal and Alipay offer clear dispute resolution channels, with balanced reviews between buyer and seller.

✅ 𝐋𝐞𝐬𝐬 𝐓𝐢𝐦𝐞 𝐒𝐩𝐞𝐧𝐭 𝐨𝐧 𝐃𝐢𝐬𝐩𝐮𝐭𝐞𝐬 — Because fraudulent chargebacks are rarer with APMs, merchants spend less time gathering evidence

→ Alternative Payment Methods are exploding, and have been doing so for quite some time. It's crucial to adopt them as part of your payment strategy.

Source: Checkout.com x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()