Mollie launches Tap to Pay on iPhone

Hey Payments Fanatic!

Mollie, the fast-growing European financial services provider has just rolled out Tap to Pay on iPhone for its 200,000 customers in The Netherlands, France, and Germany. This feature enables businesses of any size to accept contactless payments directly through the Mollie app on iPhone—no extra hardware required.

According to Mollie CEO Koen Köppen, “We are laser-focused on ensuring our customers are able to offer a seamless checkout experience and offer all of the relevant payment methods - whether online or in-person. We are excited to offer Tap to Pay on iPhone, allowing businesses to give their customers more choice and flexibility.” For businesses, this means flexibility, convenience, and a secure way to complete transactions on the go.

With Tap to Pay, merchants simply prompt the customer to hold their contactless payment near their iPhone, completing the transaction securely via NFC technology. This integration supports PIN entry and includes accessibility options, staying true to Mollie’s mission of making money management effortless for every business across Europe.

Scroll down for more interesting Payments industry news updates and I'll be back in your inbox tomorrow!

Cheers,

P.s. Want to boost your brand's visibility in the digital banking, FinTech, and payments sectors? Join us as a partner and connect with a highly engaged audience eager for industry-leading insights. This is a unique opportunity. to showcase your brand directly to decision-makers and innovators in the space.

Ready to make an impact? Sign up here, and let's take your brand to the next level!

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

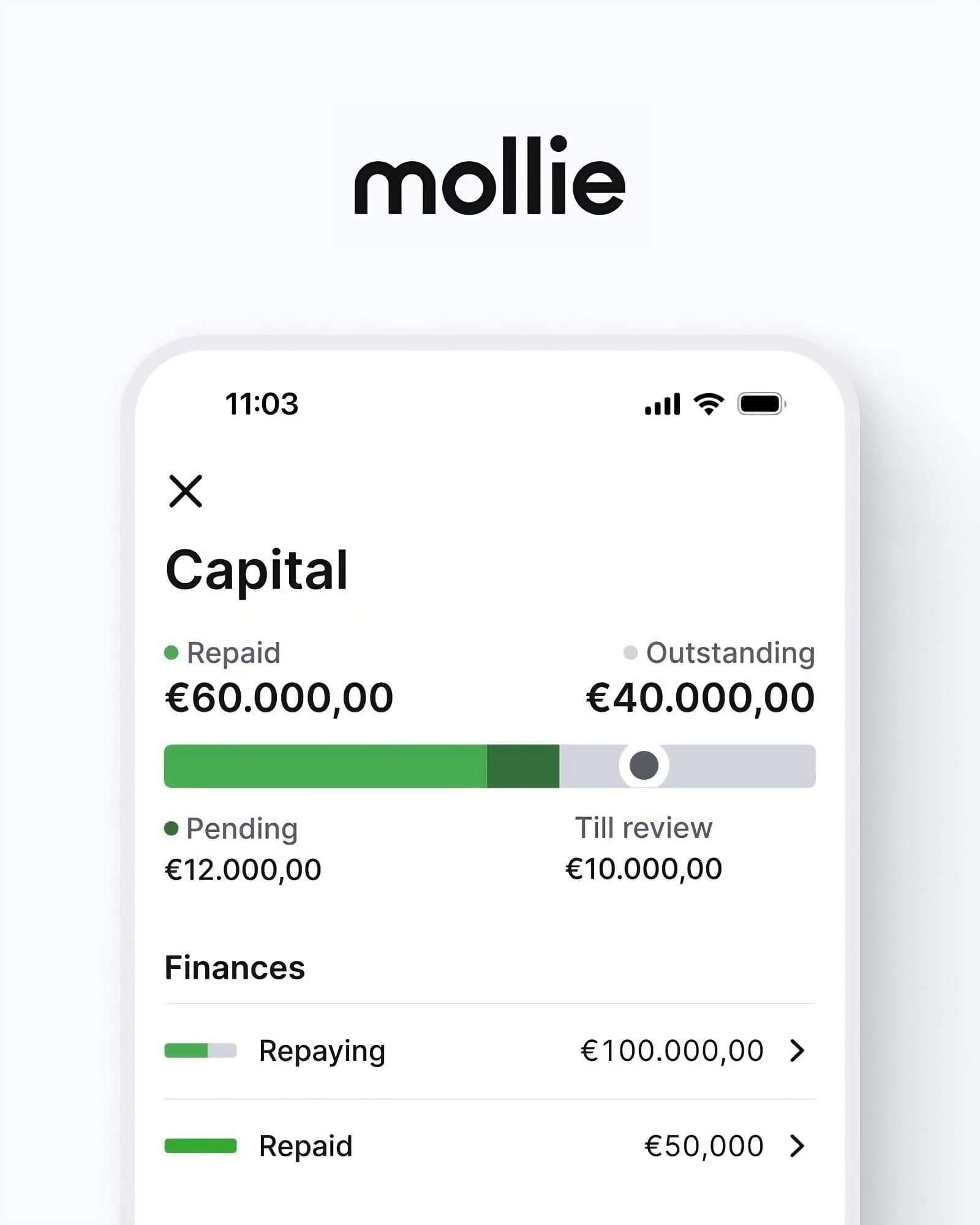

📱 With Black Friday around the corner, balancing cash flow amid extra expenses is challenging. In the past, companies seeking funds faced long waits and heavy paperwork for uncertain bank decisions.

Fortunately those bad-old-days are firmly in the past. Today, companies can get fast, simple access to extra cash through their PSPs.

Let’s take Mollie Capital, as an example:

PAYMENTS NEWS

🇫🇷 Mirakl and Mangopay announce strategic partnership to accelerate growth of European marketplaces with Mirakl Payout. Through this partnership, Mirakl Payout integrates Mangopay’s e-wallet technology and know-your-business (KYB) capabilities, enhancing marketplace payouts.

🇬🇧 Settlements and Settlement Reconciliation with Solidgate. The company announced a new feature in its payment orchestration platform: Integrated settlements and settlement reports from multiple PSPs, acquirers, processors, and APMs — now accessible in its admin panel and API.

🇵🇹 Visa recognizes creators as small businesses. At Web Summit in Lisbon, Visa announced new commitments to digital creators, officially recognizing them as small businesses. Now, creators can securely manage payments using Visa’s financial tools, resources, and products for small businesses worldwide.

🇺🇸 The Visa 𝐅𝐥𝐞𝐱𝐢𝐛𝐥𝐞 𝐂𝐫𝐞𝐝𝐞𝐧𝐭𝐢𝐚𝐥 is now LIVE with Affirm and Liv Digital Bank. Affirm customers can now choose to pay immediately or split the payment using the Flexible Credential. Liv customers can now use their existing card to support accounts in other countries if they're expats or travel. Read on

🇧🇷 Brazil’s PicPay begins offering instant payments via Meta and Microsoft. According to a press release, PicPay believes that the combination of a trusted payment method and a widely used messaging tool in Brazil will drive the adoption of a new way to make payments with Pix.

🇬🇧 FinTech Payhawk reports 114% YoY revenue increase, gross profitability of 77%. In addition to revenue growth Payhawk reported an increase in group gross profits from “71% to 77%, driven by key strategic moves that strengthened its financial infrastructure and expanded its customer offerings.

🇰🇭 Cambodia and Mastercard roll out ‘Bakong Tourists’ app for seamless payments. The app simplifies digital payments for international tourists visiting Cambodia, allowing them to download it upon arrival and seamlessly top up their Bakong accounts using a Mastercard issued in their home country.

🇺🇸 Mastercard debuts platform to help small businesses consolidate digital tools. The Mastercard Biz360 platform provides a “one-stop shop” that allows business owners to access new features while also integrating their existing digital tools, the company said in a press release.

🇦🇪 Mastercard collaborates with Tap Payments on first global launch of ‘Click to Pay’ with Payment Passkey service for ecommerce. This partnership will help transform the ecommerce experience by merging streamlined checkout processes with enhanced security.

🇩🇪 NVIDIA & GFT: Innovating for Banks in Open-Source AI Deal. Per the deal, GFT will implement NVIDIA's suite of AI tools, including NIM microservices for model deployment, Triton Inference Server for model serving and NeMo for model development. Explore more

🇬🇧 CLOWD9 partners with Discover Global Network. The partnership follows specific demands from customers, with Discover Global Network enabling CLOWD9 to provide a third network option for FinTech companies and programme managers, scaling opportunities for cross-border card issuance.

🇺🇸 America loves instant payments, as New RTP® Network records show. The RTP® network, operated by The Clearing House, now averages over 1 million payments per day. The RTP network also set single day records of 1.46 million transactions valued at $1.24 billion on November 1.

🇺🇸 Alchemy Pay obtains four new Money Transmitter Licenses in US. The crypto payment gateway has received four new US Money Transmitter Licenses (MTLs) in Minnesota, Oklahoma, Oregon, and Wyoming bringing the company's total number of U.S. state licenses to eight.

🇧🇷 Pix Assistant: How AI reads and listens to messages for easy transfers on WhatsApp. This innovative tool allows users to initiate transfers through text, audio, photos, and screenshots, with a virtual assistant identifying data and initiating the transaction. Users then complete it in their banking app.

GOLDEN NUGGET

According to LexisNexis, declined payments could cost global businesses up to $𝟭𝟭𝟴 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 in losses annually 🤯

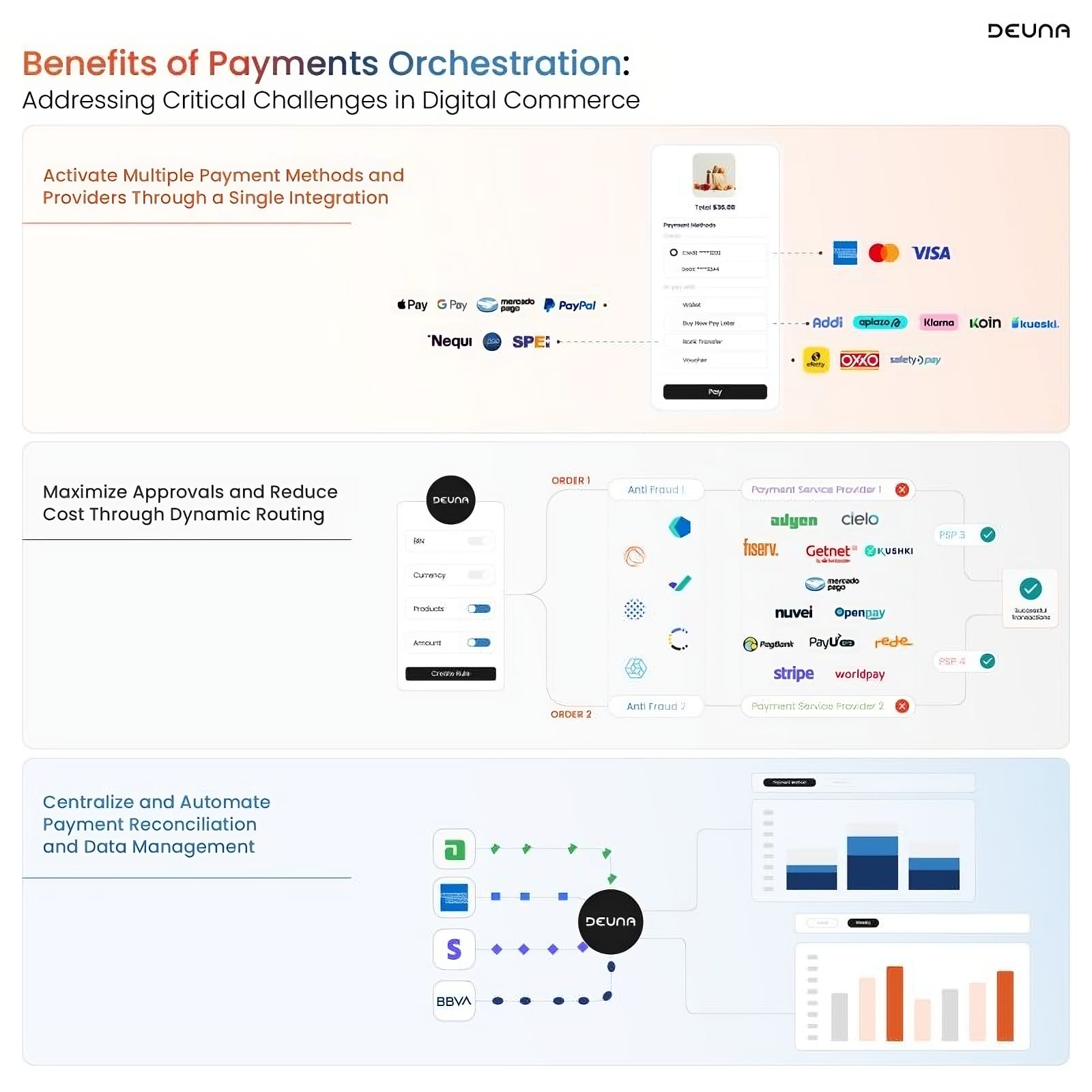

Discover how 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 can prevent this:

In today’s digital commerce landscape, efficient and secure payment processing isn't just a backend task—it's a critical, strategic component for driving business profitability.

Additionally, the demand for seamless, frictionless shopping experiences mounts pressure on commerce leaders, who must evolve and adapt to new payment technology trends without incurring excessive costs.

In this challenging context, 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 emerges as a comprehensive solution that transforms complexity into efficiency, transparency, and growth.

Here is how it works:

1️⃣ Dynamic Routing: In high-decline regions like Mexico, payment orchestrators help merchants create custom routing rules (based on transaction details, customer location, etc.) to boost acceptance rates. Failed payments can be retried through alternative gateways, optimizing routes to reduce costs and increase security by directing payments to fraud prevention engines.

3️⃣ Centralized Data Management: By consolidating data from multiple providers, payment orchestration platforms simplify reconciliation and offer end-to-end transaction traceability, reducing manual effort and enhancing decision-making capabilities.

3️⃣ Easy Integration of Payment Methods: Orchestrators streamline access to hundreds of payment providers and methods with a single integration. This flexibility allows businesses to expand geographically, offering relevant payment options per market, reducing integration complexity, and improving transaction approval rates.

I highly recommend the complete deep dive article by DEUNA for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()