Mollie & Hyvä Team Up: Launch Hyvä Commerce

Hey Payments Fanatic!

Writing to you from San Francisco, where I’ve been meeting some fascinating folks and had the chance to check out the new U.S. office of Dutch payments pride, Adyen.

Big thanks to Davi Strazza for the invite! It was fantastic to catch up, dive deep into payments insights, and enjoy some stellar coffee in an impressive office space. ☕👌

But my biggest payments news today comes from another Amsterdam powerhouse: Mollie.

They’ve just announced a strategic partnership with Hyvä, a leader in e-commerce front-end development, with the launch of Hyvä Commerce—a game-changing product suite built on Magento.

With Mollie’s support, Hyvä Commerce is designed to tackle the main pain points for Magento users by adding modernized features to both the admin panel and storefront, plus committed platform updates.

Mollie will be seamlessly integrated, ensuring a top-notch checkout experience for businesses and their customers.

And believe it or not, there’s even more payments news beyond these big moves from Dutch companies! Scroll down for more industry updates.

Next stop: New York City. Wishing you a great weekend, and catch you on the East Coast!

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

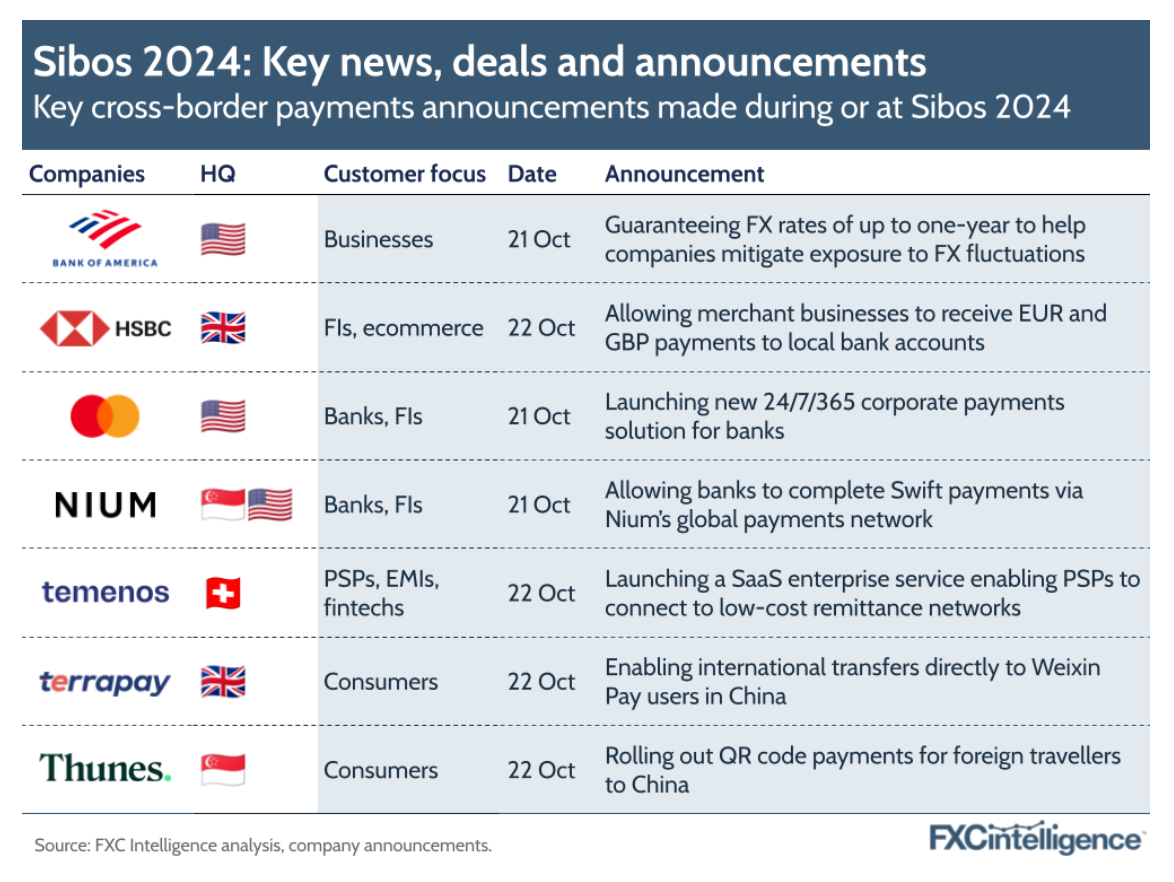

Swift’s annual Sibos conference took place in China for the first time this week, and with it came the usual flurry of deals and announcements. We were also proud to see our market size data featured in reports launched by EY and Citi to coincide with the event.

Here are some of the main announcements that took place both at and during the conference, share by FXC Intelligence:

PAYMENTS NEWS

🇺🇸 Google Wallet to enable contactless payments for kids on Android. This wallet will enable parents to monitor and control their children's spending by approving linked credit and debit cards and reviewing transactions through Google’s Family Link.

🇦🇪 Geidea and tpay partner to simplify digital payments in MENA. Together, the companies aim to offer an integrated suite of payment methods, including Direct Carrier Billing (DCB), card payments, and e-wallets, all accessible through a single aggregator.

🇺🇸 Mastercard's profit beats estimates on resilient consumer spending. The payments giant reported better-than-expected third-quarter profits, boosted by increased customer spending due to economic stability. Keep reading

🇬🇧 Square introduces Square Card giving UK businesses instant access to funds. This business spending card helps companies manage cash flow by eliminating the wait time between making a sale and accessing funds. Discover more

🇬🇧 Emerchantpay expands its global acquiring capabilities with Visa. This collaboration expands emerchantpay’s global acquiring capabilities and reach, providing access to integrations with established technology and infrastructure providers through a single connection.

🇧🇪 European Payments Council issues Verification of Payee API standards. These guidelines focus on standards for VOP communications, governing Requests and Responses between Payment Service Providers (PSPs). The specifications are part of an effort to create uniformity within inter-PSP communications across the European market.

🇲🇽 Kueski reaches 20 million loans disbursed, strengthening its role in Mexico’s payments ecosystem. This marks 100% growth in loans disbursed in just 18 months, further showcasing Kueski's momentum as it moves forward in its mission to improve the financial lives of Mexicans.

🇳🇱 Last week, First Data Corporation and CCV Group submitted a request to the Netherlands Authority for Consumers and Markets (ACM) for approval for the takeover of CCV by First Data. This potential acquisition could represent a major shift in the payments industry, given the importance of the POS payment terminals that CCV manages in the Netherlands.

GOLDEN NUGGET

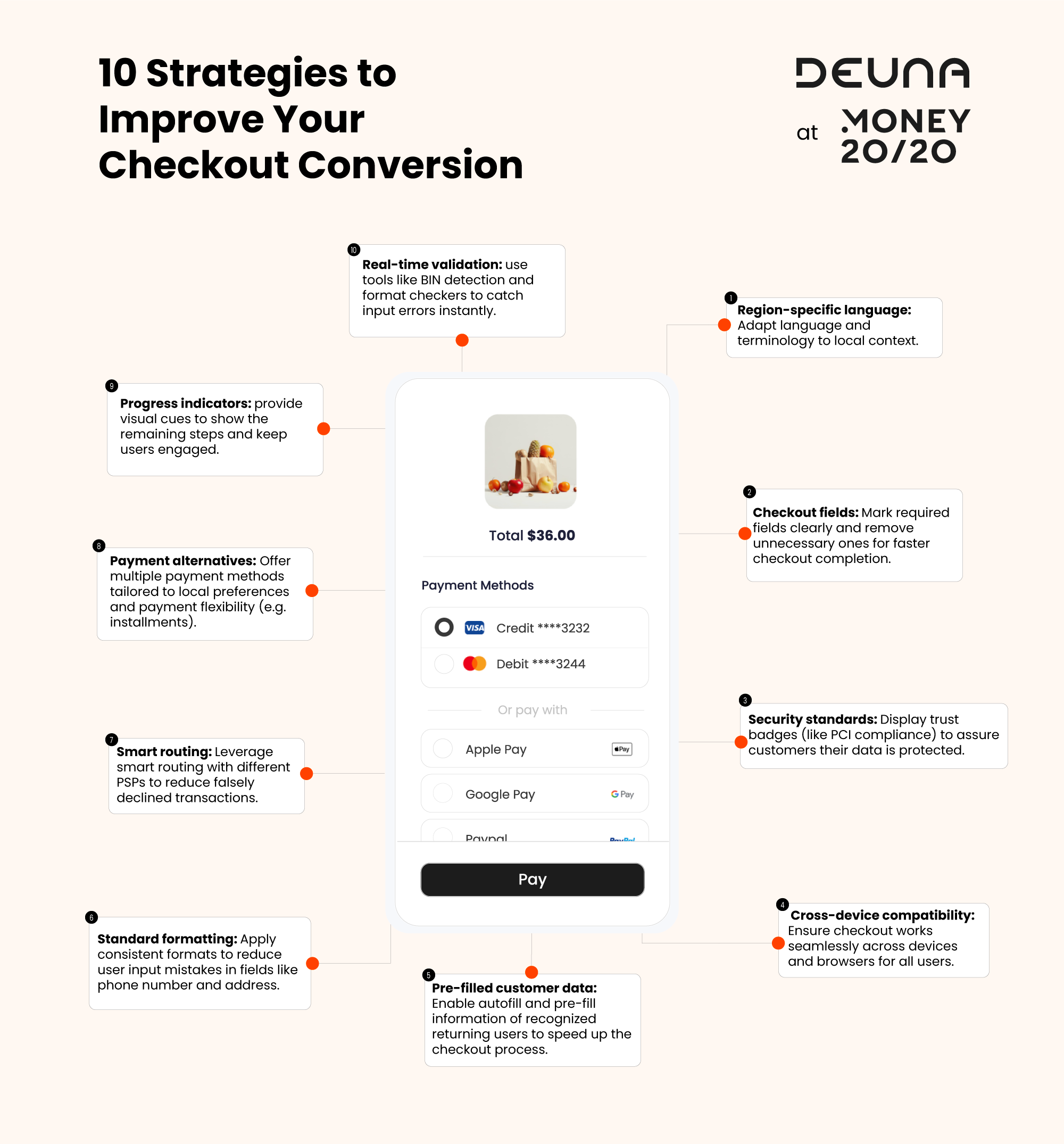

10 Strategies to Improve Your Checkout Conversion👇

The checkout process is a crucial part of the online shopping experience, yet many businesses struggle with high cart abandonment rates.

Around 70% of customers leave their carts, with 20% blaming a complicated checkout.

So let's dive in:

1️⃣ Use Clear, Region-Specific Language: Confusing terms in checkout cause cart abandonment. Each region has unique terms for ID cards; e.g., “Cédula” in Colombia, “RUT” in Chile, “DNI” in Argentina. 45% of checkouts use unfamiliar language.

2️⃣ Clarify Mandatory 🆚 Optional Fields: Clearly label required fields to reduce the 30% error rate from missed essential information or re-entry.

3️⃣ Remove Unnecessary Fields: Asking for non-essential information, like a second surname, complicates checkout and increases abandonment. Streamlining improves completion rates.

4️⃣ Ensure Cross-Device Compatibility: Optimizing checkout across devices (desktop, tablet, mobile) is essential for accessibility and convenience.

5️⃣ Simplify Password Requirements: Complex passwords drive away 19% of shoppers. Offer easier options like social login or OTP for smoother checkouts.

6️⃣ Standardize Phone Number Formats: Lack of standardized phone number formats confuses users. Standardization reduces errors and improves user experience.

7️⃣ Validate Card Numbers: Using the “Luhn Algorithm” for credit card validation prevents transaction errors by ensuring correct data.

8️⃣ Organize Card Data Entry: Arrange card fields logically (as on the card) to reduce errors by 33%.

9️⃣ Offer Diverse Payment Methods: 9% of customers abandon carts if their preferred payment method is missing. More options reduce drop-off rates.

1️⃣0️⃣ Enable Intelligent Transaction Routing: Routing transactions to another processor during failures can boost conversions by over 20%.

I highly recommend the complete deep dive article by DEUNA for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()