Mastercard Unveils Next-Gen AI Digital Assistant to Boost Customer Value

Hey Payment Fanatic!

At Money 20/20, Mastercard unveiled its new AI-powered digital assistant aimed at transforming the customer onboarding experience. With a focus on streamlining processes and making transactions faster and more intuitive, this new tool is set to raise the bar for financial services.

Partnering with Databricks, Mastercard developed this AI solution as part of a broader suite designed to bring smarter, real-time responses to customers and businesses alike.

Built on Databricks' Data Intelligence Platform, the tool uses Retrieval Augmented Generation (RAG) to deliver precise, context-specific answers based on Mastercard’s proprietary data. And it doesn’t stop there—the assistant learns continuously with a “human-in-the-loop” approach, ensuring responses stay accurate and relevant.

AI, like other advanced technologies, is a critical enabler for Mastercard’s mission to power economies and empower people.

What other key announcements did you hear at Money 20/20? Let's share them in the comments.

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

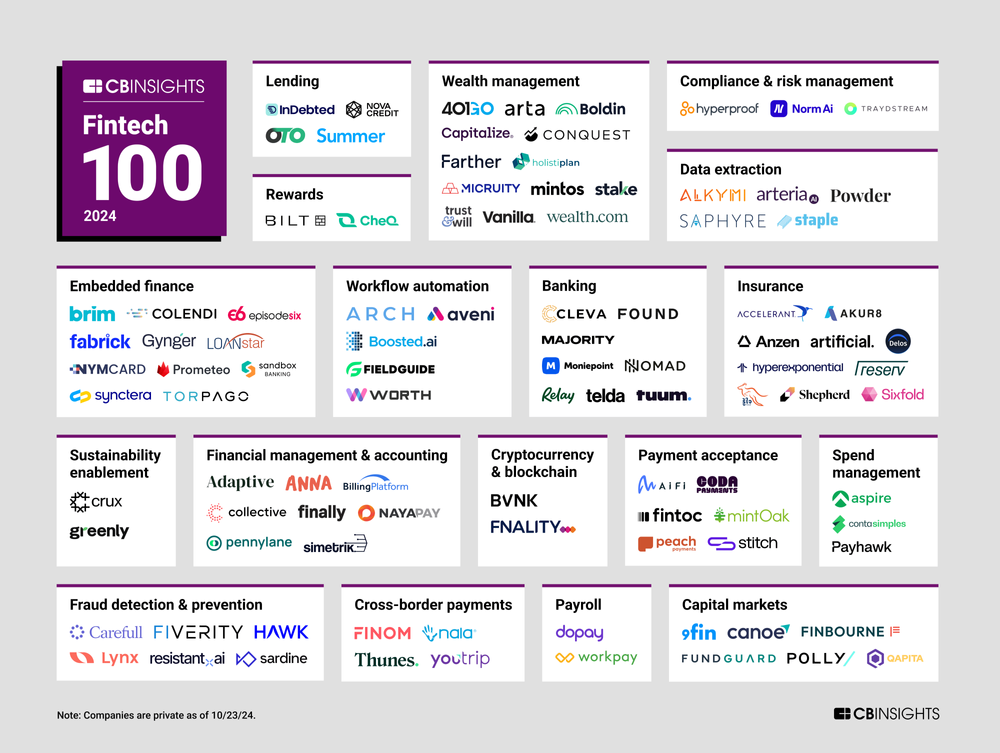

Here is a summary of the 2024 FinTech 100 cohort highlights:

PAYMENTS NEWS

🔁 Success With Subscriptions: How businesses can meet customer expectations. Solidgate’s latest survey, featuring insights from 1,000 subscription customers, provides a deeper understanding of what customers truly value—and what frustrates them. Explore now

🇪🇺 Solidgate partners with Nova Post to power its international expansion. Through its partnership with Solidgate, Nova Post now offers EU clients a seamless payment experience, allowing secure one-click payments with high acceptance rates.

💰 Airwallex seeks funding at $6 billion value. Airwallex is in talks to raise about $200 million to support growth, targeting a $6 billion valuation. The firm hit $500 million in annual revenue in August and aims to close the funding round by year-end, according to sources.

🌐 Visa plans to lay off around 1,400 employees and contractors 🤯 Visa is restructuring its global operations and will cut roughly 1,400 roles by year-end, according to sources familiar with the decision, as part of its effort to streamline international business.

🇺🇸 Visa profit beats expectation on resilient consumer spending. Visa exceeded Wall Street's fourth-quarter profit expectations on Tuesday, as consumers eased concerns about a slowing economy and increased spending on travel and dining, boosting its shares by 2% in after-hours trading.

🇺🇸 Visa Unveils new Push-to-Wallet capabilities to cover virtual card use. This allows users push virtual cards to mobile wallets such as Apple Pay and Google Pay with the ability to set spending limits and monitor transactions for fraud and unauthorized expenditures.

🇺🇸 Affirm updates BNPL app ahead of holiday shopping season. The app update prioritizes what consumers want the most: to quickly discover their favorite credit offers from Affirm, seamlessly manage their payments, and see their real-time purchasing potential, according to Senior Vice President of Product Vishal Kapoor.

🇬🇧 Aevi and Paydock team up for Omnichannel Payment Orchestration. This partnership unites Paydock’s expertise and agnostic infrastructure in digital payments with Aevi’s advanced in-store payment solutions. Keep reading

🇬🇧 Klarna and Worldpay expand partnership to unlock global merchant network. Under the expanded partnership, Klarna will be a preferred payment method for Worldpay’s merchants worldwide, alongside traditional card payments. Read on

🇺🇿 TBC Uzbekistan announces strategic partnership with Mastercard. The partnership enables TBC Bank Uzbekistan to introduce Mastercard cards and expand payment options, enhancing customers' online shopping, international purchases, and money transfers.

Banco Santander, Lloyds Banking Group, and UBS successfully settle pilot uncleared margin transfers in the Sterling Fnality Payment System. This proof-of-concept demonstrates Fnality’s use of £FnPS for bilateral margin payments, marking the first regulated DLT system for settling inter-bank derivatives margin.

🇮🇹 BNPL provider Scalapay strikes a deal with BNL BNP Paribas to finance up to $3 billion of current and new credits. Scalapay’s CEO Simone Mancini said: “We aim to become the most user-friendly financial platform in Southern Europe.”

🇺🇸 PayPal sees a 20% increase in BNPL revenue and more than one million debit card accounts added. The company reported a 9% year-over-year increase in total transaction volume for Q3, reaching $422.6 billion, largely due to growth in Venmo and PayPal digital payments.

GOLDEN NUGGET

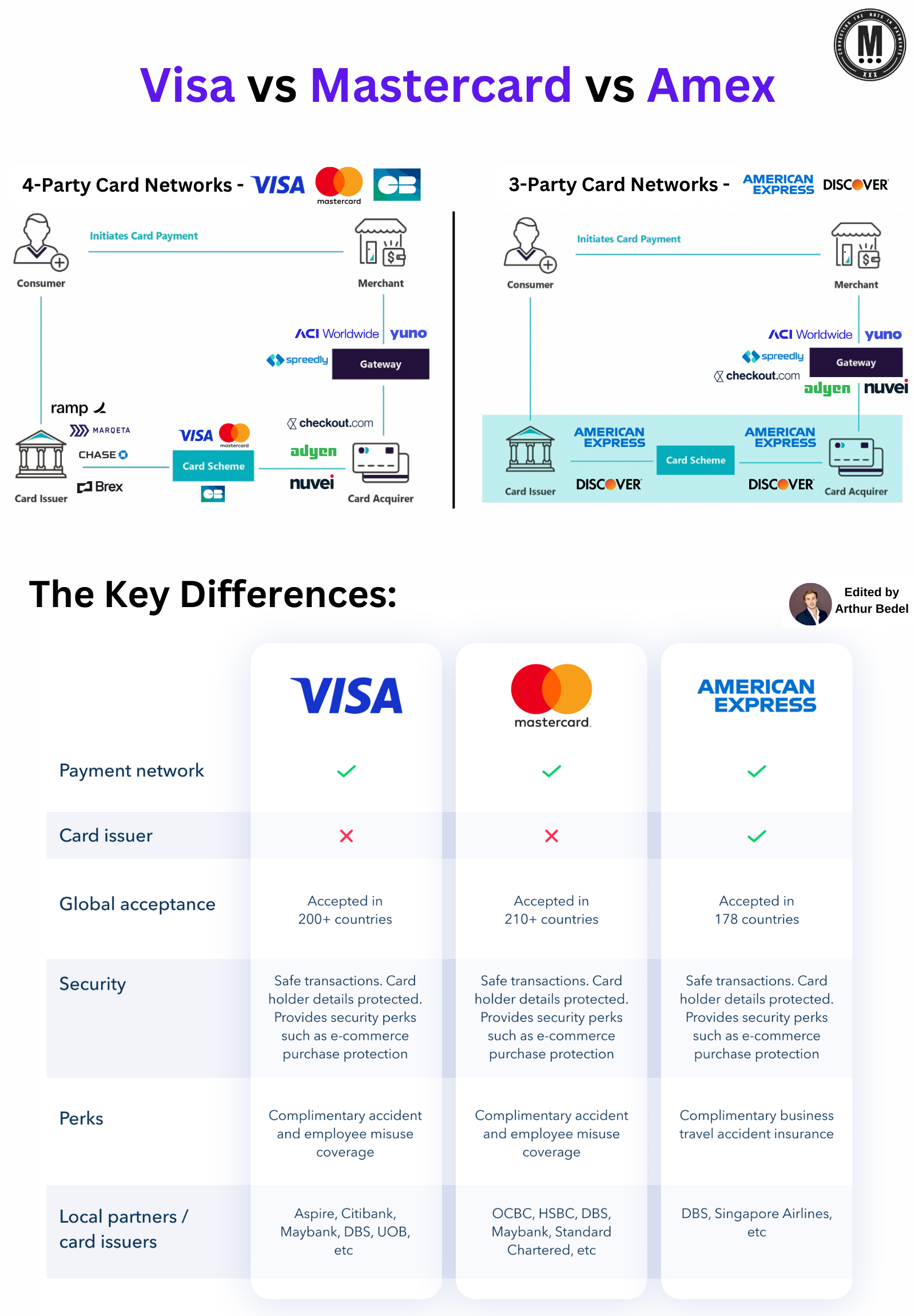

Visa vs Mastercard vs Amex:

The card networks —Visa, Mastercard, and American Express (AMEX) are the biggest players in the global payments landscape, but they operate differently.

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞𝐥𝐬:

► 4-𝐏𝐚𝐫𝐭𝐲 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (Visa, Mastercard)

* This model involves consumers, issuers, merchants, and acquirers. Merchants interact with their customers and acquirers, while card networks (like Visa and Mastercard) serve as intermediaries.

► 3-𝐏𝐚𝐫𝐭𝐲 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (American Express, Discover Financial Services)👇

* In this model, one entity acts as the issuer, acquirer, and network. This simplifies the process for merchants, who pay a single fee, but can result in higher fees compared to the 4-party model.

𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰 𝐚𝐭 𝐏𝐨𝐢𝐧𝐭 𝐨𝐟 𝐒𝐚𝐥𝐞 (4-Party vs 3-Party Model)

👉 4-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥

► The Issuing Bank, Issuer, issues a debit/credit cards to its customer.

► The cardholder wants to buy a product and swipes the credit card at the Point of Sale (POS) terminal in-store

► The POS terminal sends the transaction to the Acquirer that provided the terminal (a token is shared).

► The Acquirer sends the transaction to the card network - Visa, Mastercard, UnionPay International - The card network sends the transaction to the Issuer for approval.

► The Issuer freezes the money if the transaction is approved. The approval or rejection is sent back to the acquirer, as well as the POS terminal. The funds are then transferred in a timely manner (depends on the acquirer).

👉 3-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 — The first 3 steps are the same... but not step 4

► American Express and Discover Financial Services perform here the function of an Acquirer, Issuer and Card Network. This is also called the closed loop card model. Closed loop networks are more efficient with all functions processed in one franchisor.

► In recent years the closed loop networks have partnered with other issuers and acquirers to scale their circulations (especially acquirers).

► The approval or rejection is sent back to the acquirer, then to the POS terminal. The funds are then transferred in a timely manner.

𝐊𝐞𝐲 𝐍𝐮𝐦𝐛𝐞𝐫𝐬:

► In 2023, U.S. merchants paid ~$224 billion in fees for accepting card payments (interchange, network, and processor fees combined).

► U.S. merchants would have saved $49 billion in 2023 if fees had remained at 2009 levels.

► In Europe, 45% of the Merchant Discount Rates (MDR) are attributable to interchange fees.

𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬:

► Visa & Mastercard are payment networks, not issuers. They partner with banks and financial institutions to offer credit, debit, and prepaid cards.

► Both are widely accepted in over 200 countries. The main difference lies in their rewards and offers, depending on the bank that issues the card.

► American Express (AMEX), however, is both a card issuer and a payment network. This gives AMEX more control over customer service and rewards programs, often making it a premium choice for business travelers and high-spenders.

► While AMEX is accepted in fewer locations than Visa and Mastercard, it offers exclusive perks for its users.

Source: CMSPI

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()