Mastercard Launches Pay Local

Hey Payment Fanatic!

Ahead of the highly anticipated Singapore FinTech Festival, Mastercard has just unveiled Mastercard Pay Local. This new service bridges the gap between cardholders and digital wallet payments, simplifying cross-border spending.

With Mastercard Pay Local, consumers—whether local residents or globe-trotting travelers—can link their credit or debit cards directly to local digital wallets and shop at participating merchants without the hassle of setting up or preloading prepaid accounts.

Leading wallets across Asia Pacific, including DANA in Indonesia, Touch ‘n Go in Malaysia, Bakong in Cambodia, and LankaPay in Sri Lanka, are pioneering this service, expanding reach to over 35 million merchants in the region.

Mastercard’s latest offering comes with a powerful promise: seamless integration that benefits everyone. As Sandeep Malhotra, Executive Vice President of Products & Innovation at Mastercard Asia Pacific, put it, “With Pay Local, Mastercard is extending its global network to partner wallets and expanding acceptance... This creates a low-cost, simple, stable, and secure connection between over 35 million merchants in Asia Pacific and two billion Mastercard cardholders.”

Not just Asia Pacific—this innovation resonates beyond, reaching regions like Latin America, Eastern Europe, and the Middle East. The impact? MSMEs gain broader market access, tourists pay as they do at home, and digital wallet operators grow their user base with minimal friction.

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

🇩🇪 The Payments Market Map Germany

Anyone missing in this overview? 👇

PAYMENTS NEWS

🎤 In my latest Q&A, Kent Henderson, VP, Product Management at Mangopay, discusses key challenges businesses face in cross-border payments, including hidden fees, FX rate fluctuations, and slow transactions, all of which impact profitability and growth. Dive into our conversation to learn more about his insights and strategies for optimizing cross-border payments.

StraitsX, Grab, and Ant International further partnership to simplify cross-border payments. The partnership enables users of Alipay+ payment partners to transact in local currencies at GrabPay merchants, with immediate SGD settlement for merchants via a Singapore dollar-denominated stablecoin.

🇱🇧 TerraPay and Suyool join forces to enable instant and secure money transfers to anyone in lebanon. This collaboration is set to transform how Lebanese residents send and receive money, addressing the pressing demand for fast, secure, and convenient remittance services.

Ingenico and Crypto.com launch global crypto payment solution for millions of merchants. Through this partnership, the companies aim to bring secure crypto payment solutions to global merchants, offering seamless integration and broader accessibility.

🇧🇷 Pix by Proximity is introduced. The Central Bank of Brazil has launched a contactless payment system for Google Wallet users, with a full rollout to all Pix users by February 2025, allowing payments via linked bank accounts by tapping phones near a terminal.

🌐 Swift, UBS Asset Management, and Chainlink complete pilot for settling tokenized fund transactions via Swift network. This initiative enables digital asset transactions to settle with fiat systems across 11,500+ financial institutions in over 200 countries and territories.

🇮🇳 Mastercard and PayMate partner to streamline B2B payments in EEMEA. The collaboration aims to streamline payment operations for organisations in these regions by introducing digital solutions designed to improve speed, security, and convenience in B2B transactions.

🇰🇪 Mastercard signs 10-year agreement with Diamond Trust Bank. The partnership focuses on developing a wider range of financial tools for individuals and businesses, aiming to enhance both convenience and security in the region’s digital transactions.

🇬🇧 NatWest and Mastercard launch mobile virtual card solution for business. NatWest plans to enable companies to issue virtual cards for their employees worldwide, eliminating the need for physical cards and enhancing flexibility, control, and security in corporate payments.

🇮🇹 Visa expands partnership with Intesa Sanpaolo. As part of their expanded partnership, the companies plan to focus on advancing the digital transition of payments and intend to continue their existing projects and introduce new products and services for the latter’s customers.

🇬🇧 Standard Chartered taps Wise Platform for cross-border payment service upgrade. Through this collaboration, StanChart states that SC Remit customers in Asia and the Middle East can transfer funds internationally in 21 currencies, including EUR, GBP, USD, CAD, SGD, JPY, and HKD, "in seconds."

🇬🇧 Klarna now available at John Lewis & Partners. The companies are committed to making it easier for customers to manage their budgets with a range of flexible and secure ways to pay. Continue reading

🇮🇱 Nium and HyperGuest join forces to streamline payments for the travel and hospitality industry. The integration of Nium’s virtual card solution into HyperGuest’s platform will facilitate faster, more secure, and transparent payments for travel businesses globally.

🇬🇧 Payabl appoints Marios Tsiailis as new Group Chief Financial Officer (CFO). With over a decade of experience in finance, Marios steps into this role to drive initiatives that optimize payabl.’s financial framework and foster sustainable growth.

GOLDEN NUGGET

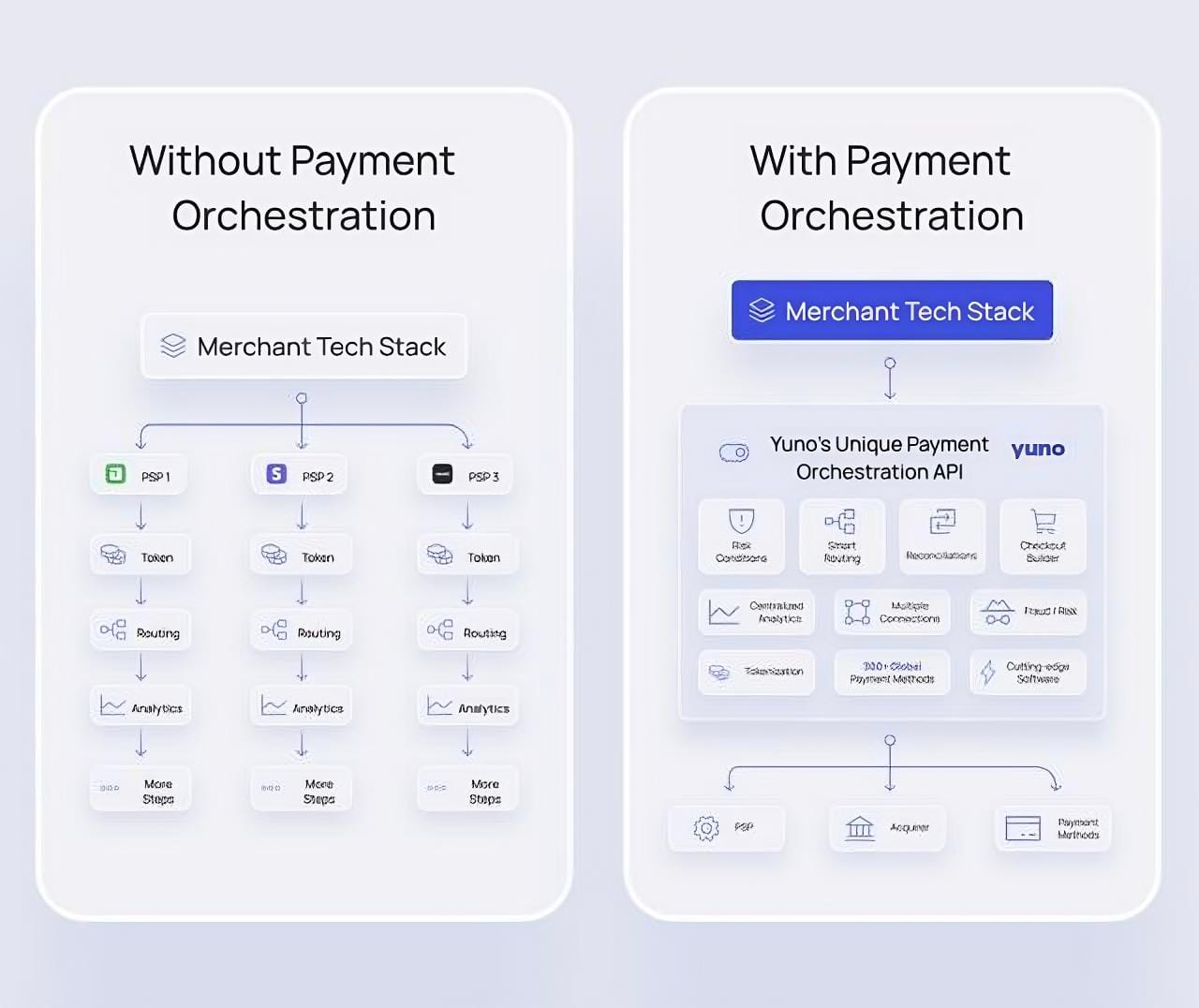

📊 The Payment Orchestration is a new rising Industry in the payments ecosystem, with expected value of over $𝟭𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 by 2026 🤯

The Key benefits of Payment Orchestration are:

► Enhanced authorization rates and business continuity through automatic routing to alternative processors.

► Improved customer experience by simplifying checkout processes and supporting preferred payment methods.

► Integration of diverse payment methods to boost conversion rates, especially in local markets.

► Reduction of processing costs by directing transactions through cost-effective routes.

► Accelerated time to market by streamlining integration efforts and providing centralized management.

► Analytics and real-time monitoring for informed decision-making and proactive issue resolution.

► Simplified payment operations and reduced integration complexities for merchants.

This E-book will help you understand:

► The shift from traditional physical payments to digital payments.

► Key trends and technologies responsible for the shift to the modern payment landscape.

► The future of seamless and secure transactions.

I highly recommend the complete deep dive article by Carol L. Grunberg for from Yuno to learn all about 'The Payment Revolution.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()