Mastercard Introduces ‘One Credential’ Amid Payment Rivalry

Hey Payments Fanatic!

Last year, Visa made the first move toward a new level of digital payments with its flexible credentials. Now, Mastercard responds with One Credential, a unified digital payment system that allows consumers to manage debit, credit, prepaid, and installment payments under a single credential.

The push for One Credential comes as consumers demand greater control over their finances. Mastercard reports that 65% of Gen Z users prefer managing all payments in one place, with digital convenience shaping their choices. As Mastercard’s Chief Product Officer, Jorn Lambert, puts it, “Today’s consumers expect to be in the driver’s seat.” Now, with One Credential, users can set automated payment rules—debit for everyday purchases, credit for larger expenses, and installments for significant buys all in one app.

Explore more Payments updates below, and I'll be back with more news tomorrow!👇

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

INSIGHTS

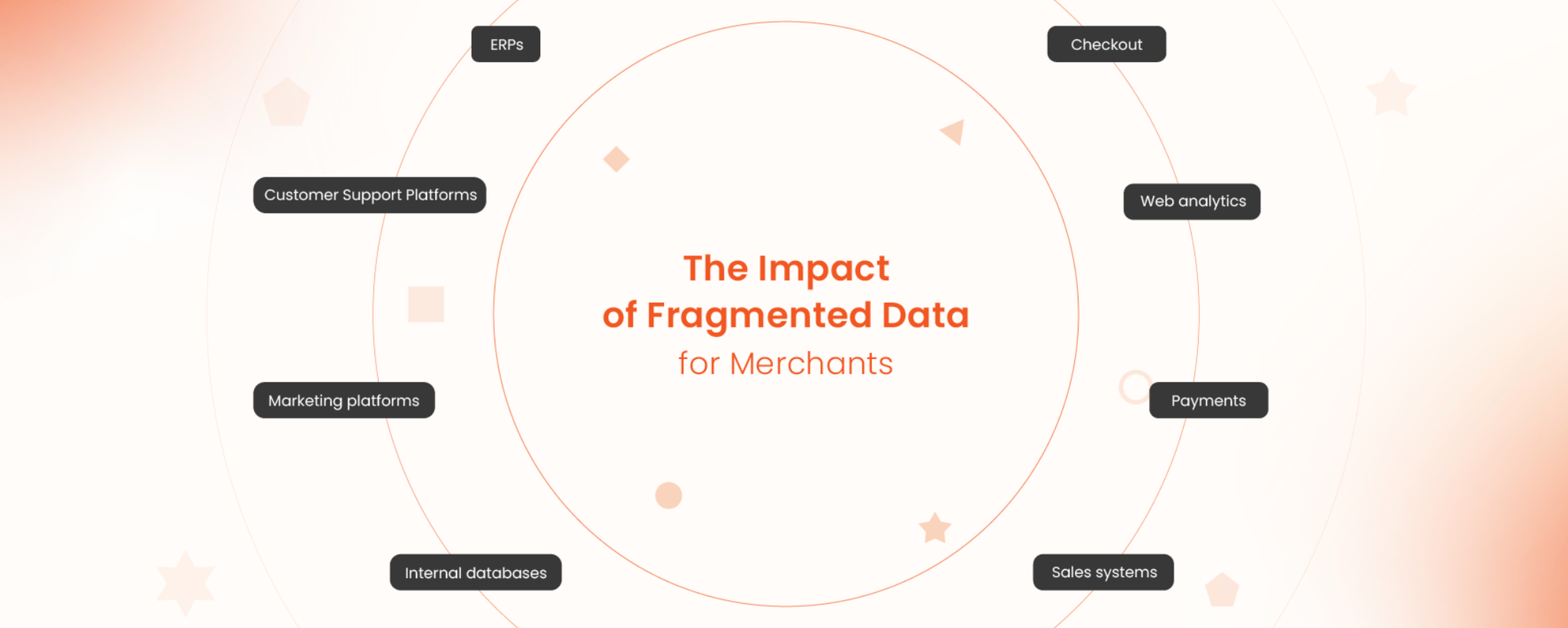

Fragmented Data: The Silent Threat Undermining Business Performance, by DEUNA. In today’s digital commerce, data flows from multiple sources—checkout systems, ERPs, marketing platforms, and payment networks. Learn how top organizations tackle data fragmentation. Download and read the full report to explore strategies for turning data into a strategic asset.

PAYMENTS NEWS

🇺🇸 Solidgate introduces Verifi RDR Decision API (beta): Smarter, faster dispute resolution for merchants. This is an innovative dispute resolution tool that helps merchants handle disputes instantly and automatically without manual intervention. This solution is currently in beta, allowing early adopters to experience the benefits of real-time dispute management before full-scale rollout.

🇬🇧 Salad Money seeks to make loan repayments simple with NatWest’s Payit. Salad Money customers can link their bank accounts to enable digital loan payments which is supported by Strong Customer Authentication for an added layer of security. Payit provides customers with an additional payment method that allows them to manage their loan repayments.

🇺🇸 Mastercard launches new product innovation. Mastercard Mid-Market Accelerator is its latest suite of small and medium-sized (SME) solutions designed for financial providers to meet the unique needs of their middle-market customers. Initially launching in the U.S., the new offering is expected to scale globally.

🇺🇸 Lili launches International Payments. This will enable its small business customers to both receive and send international payments in dozens of countries across North America, Europe, and Asia, helping them manage their operations and grow their businesses internationally.

🇬🇧 FCA and PSR report on digital wallets. Given the growth, the FCA and PSR engaged extensively with businesses and representative groups to assess the impact of digital wallets, finding significant benefits to consumers through greater convenience, enhanced security measures, and more.

🇸🇪 Nordic FinTechs Two and Avarda team on white-label payments service. Through this collaboration which combines Two’s expertise in BNPL for B2B with Avarda’s leading B2C payment capabilities, businesses across the Nordics, can offer both B2B and B2C payment options within a single, customizable, and branded checkout experience.

🇩🇪 Aevi and IXOPAY partner to unify global payment systems for merchants. This collaboration addresses the growing complexity merchants face in managing payments across multiple channels, providing a streamlined, flexible solution that helps businesses adapt to an evolving payments landscape.

🇨🇿 Eurowag debuts new Visa Card for fleet management. Once linked to a specific vehicle, the Eurowag Visa card offers contactless, cashless payment capabilities for refreshments and accommodation, while ensuring security against fraud. Customers can also pay for traffic violation fines using the card.

🇪🇬 XPay partners with Huawei Cloud Services to back digital payments. The collaboration aims to strengthen XPay’s role in Egypt’s digital payment sector by using Huawei’s advanced cloud technology. Read more

GOLDEN NUGGET

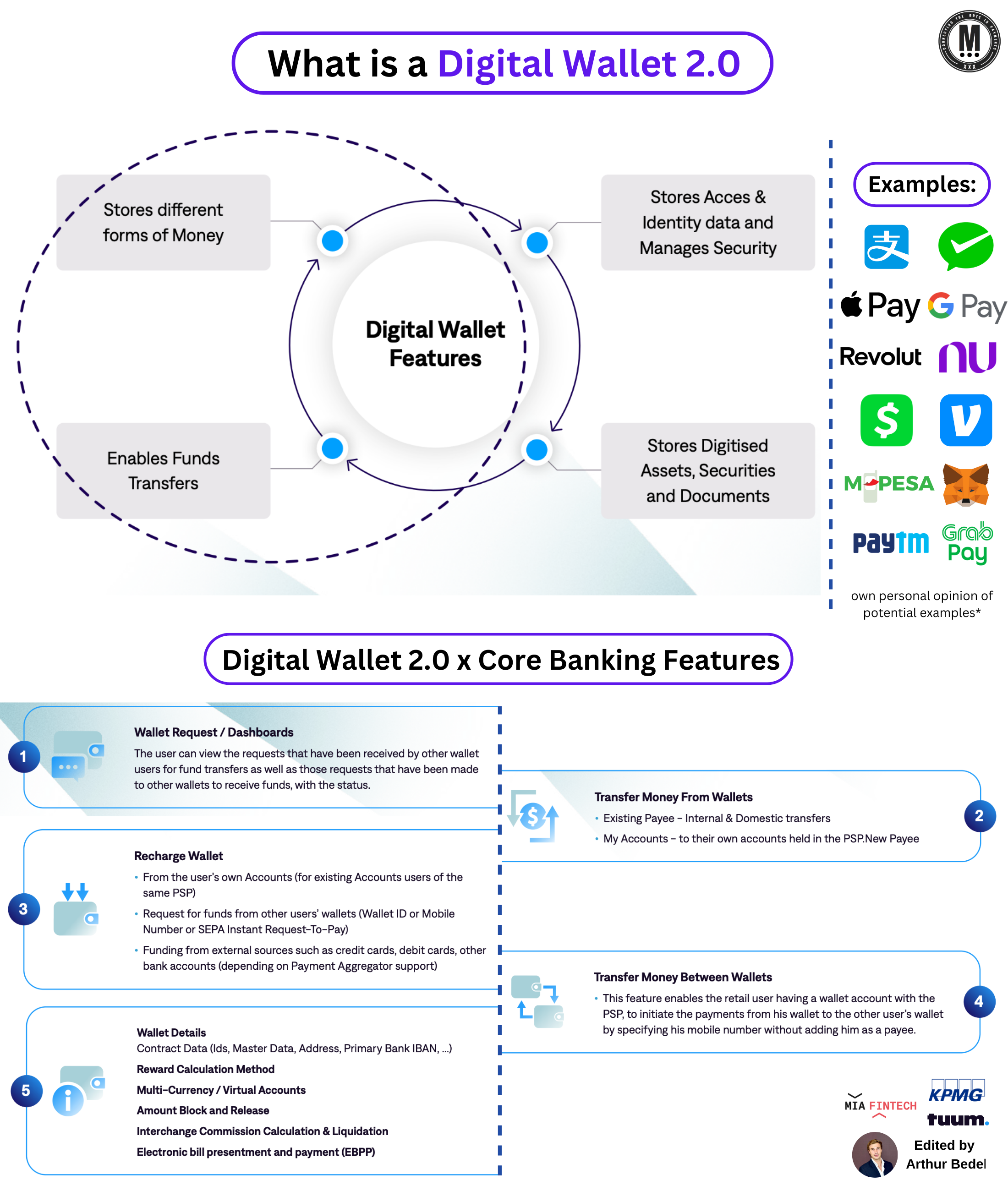

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 2.0 — adding core banking capabilities 👇

The world of payments is evolving rapidly. Digital Wallets 2.0 are not just about storing money — it's a comprehensive financial hub integrating payments, identity management, security, and even digital assets.

► 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐒𝐡𝐢𝐟𝐭

🔸 𝐈𝐒𝐎 20022 – Replaces legacy payment messaging formats with a data-rich, structured, and standardized approach for payments across banks, PSPs, and even blockchain networks.

👉 Enhances interoperability between networks, including real-time payments and digital wallets.

👉 Enables data enrichment, allowing financial institutions to analyze transaction data for fraud prevention, compliance, and better customer insights.

🔸 𝐒𝐂𝐓 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 (SEPA Instant Payments) – Mandates that all banks and PSPs offering standard euro credit transfers must also provide instant payments within 10 seconds. This requires banks to process payments 24/7 and introduces parity.

🔸 𝐏𝐒𝐃3 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐢𝐨𝐧 (PSR) – PSD3 builds on PSD2 by reinforcing open banking, fraud prevention, and consumer protection while introducing new regulatory frameworks for FinTechs and non-bank players.

Introducing:

👉 IBAN Name Matching

👉 Fraud Information Sharing: between Banks & PSPs

👉 Better API Performance & Open Banking Evolution

👉 Expands FinTech Access

► 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 x 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 — The Functionalities

1️⃣ 𝐖𝐚𝐥𝐥𝐞𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭𝐬 & 𝐃𝐚𝐬𝐡𝐛𝐨𝐚𝐫𝐝𝐬 — Users can view, manage, and track incoming and outgoing fund transfer requests in real-time.

2️⃣ 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫 𝐌𝐨𝐧𝐞𝐲 𝐟𝐫𝐨𝐦 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — Users can send money to existing payees (both internal & domestic) or to new accounts within the same PSP.

3️⃣ 𝐖𝐚𝐥𝐥𝐞𝐭 𝐑𝐞𝐜𝐡𝐚𝐫𝐠𝐞𝐬 — Users can fund their wallets from:

👉 Their own bank accounts.

👉 Other digital wallets (via SEPA Instant Request-To-Pay).

👉 External sources — credit cards, debit cards, or bank transfers.

4️⃣ 𝐏𝐞𝐞𝐫-𝐭𝐨-𝐏𝐞𝐞𝐫 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬 (Wallet-to-Wallet) — Users can transfer money between wallets within the same PSP using a mobile number

5️⃣ 𝐖𝐚𝐥𝐥𝐞𝐭 𝐃𝐞𝐭𝐚𝐢𝐥𝐬 & 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐝 𝐅𝐞𝐚𝐭𝐮𝐫𝐞𝐬

👉 Users can access contract data, including IBANs, identity details, and primary bank account information.

👉 Supports multi-currency accounts for holding different forms of money (including stablecoins).

👉 Enables reward points, interchange commission management, and electronic bill payments

► 𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬

For banks, FinTechs, and businesses looking to stay competitive in digital finance, Digital Wallet 2.0 is no longer optional — it’s a necessity.

🔸 Faster Transactions

🔸 Regulatory Compliance

🔸 New Revenue Streams

Source: Tuum, KPMG, Mia-FinTech

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()