Mastercard Expands U.S. Installments Program for Smoother Checkout Flexibility

Hey Payments Fanatic!

I’m currently in Las Vegas for Money20/20, and the event started strong yesterday with engaging meetings and vibrant happy hours. It was fantastic catching up with my good friend Harvey Hudes and many others at The FR’s Fin&Juice happy hour.

There’s been a lot of talk about AI in FinTech over some beers here, and I’m curious to hear from you, too: which early-stage AI company do you think has the most potential in the FinTech space? Especially Early Stage. Asking for a friend 😉

My news of the day comes from Mastercard, which is expanding its U.S. Installments Program to increase payment flexibility at checkout.

With a single, seamless platform, merchants, financial service providers, payment processors, and digital wallets can now offer installment payment options to consumers using any eligible credit card from participating issuers.

This expansion allows consumers to split purchases into manageable installments on pre-approved credit cards, making it easier to spread out payments over time. Participating issuers can extend these installment options across various payment channels, including compatible digital wallets, connected POS systems, and other digital payment methods.

Merchants, by connecting to Mastercard’s API-based platform, gain access to millions of pre-approved offers, enabling them to provide installment options to consumers without requiring new applications. Consumers benefit from the flexibility to pay using their existing cards.

Leveraging Mastercard’s personalization features, issuers and merchants can offer customized installment payment plans, giving eligible consumers more control over large expenses—whether for travel, shopping, or other needs.

Wishing you a great start to the week, and I’ll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

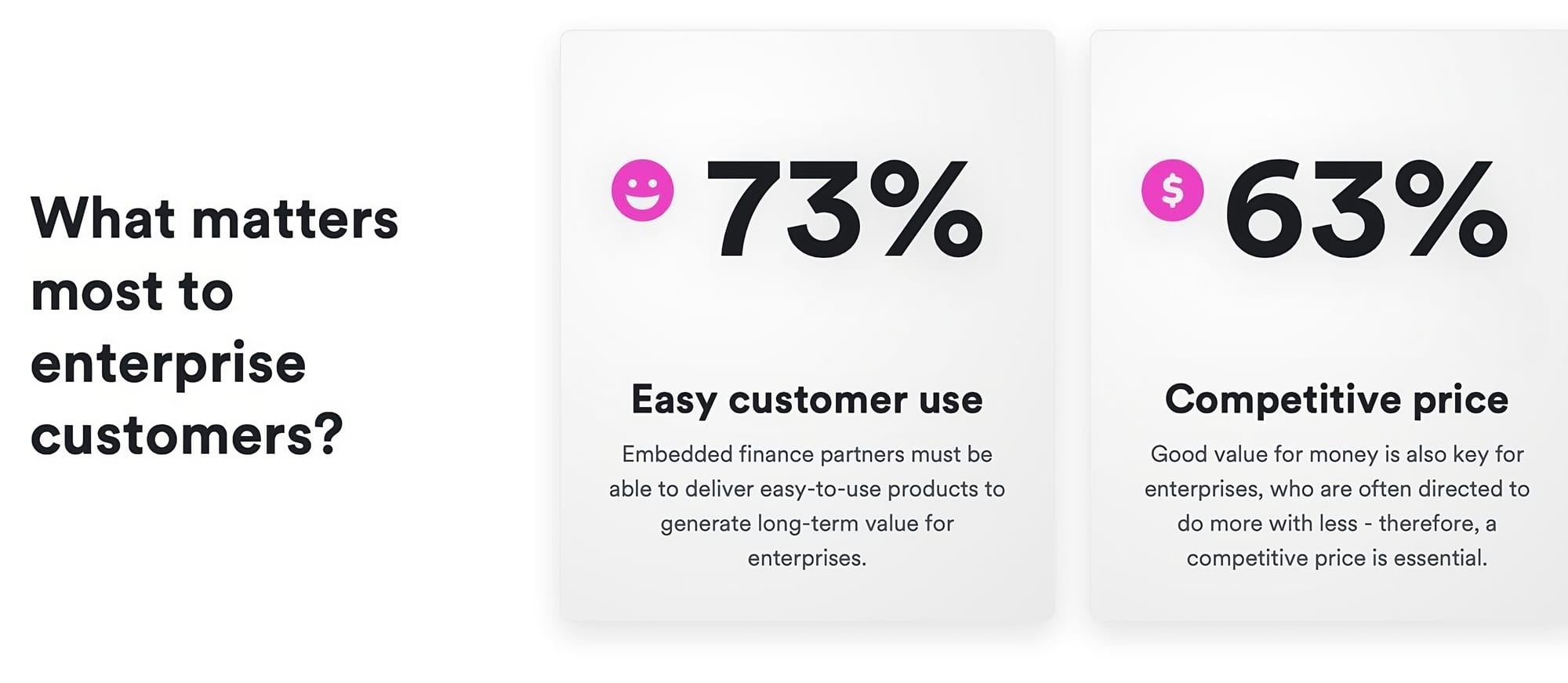

📊 Scaling Embedded Finance. Learn about the challenges and opportunities in embedding financial services as an enterprise with Airwallex’s report, in partnership with NewtonX. Download the full report here

PAYMENTS NEWS

🇪🇸 SeQura partners with Stripe to boost merchant growth with flexible payments. With this partnership, seQura will seamlessly integrate into Stripe’s ecosystem, allowing merchants to offer flexible payment options directly through Stripe’s platform. seQura and Stripe merchants can now offer flexible payments, all managed within a single, unified dashboard. Click here to learn more

🇺🇸 Visa and USAID are working together to drive inclusive digital government ecosystems and payment digitization. Visa and USAID will work together for five years to focus on developing programs to assist governments in creating and adopting platforms that connect their constituents with local government services.

🇨🇱 Getnet launches e-commerce payments solution in Brazil, Argentina, Mexico and Chile. This solution gives merchants in these countries access to Getnet’s payment services through a single, direct integration. Getnet by Santander is the only bank in Latin America offering this feature.

🇺🇸 Sezzle partners with Shoplazza to offer flexible payment options to merchants. This collaboration enables Shoplazza merchants in the US to offer flexible payment options through Sezzle, enhancing customer experience and driving business growth.

🇩🇪 FinMont and The Payments Group partner to expand travel payment solutions. This collaboration enhances FinMont's payment ecosystem by integrating TPG’s cash and e-voucher solutions, streamlining B2C and B2B payments for its global travel merchants.

🇨🇦 Plooto launches Pay By Card unlocking instant access to short-term financing for SMBs. Developed in collaboration with Visa, Pay by Card gives businesses instant access to short-term financing via their commercial credit card providers that offer rewards and other benefits.

🇺🇸 DailyPay secures additional $100 million credit commitment from Citi. The secured credit facility will provide DailyPay access to significant funding to service its ever-growing roster of clients. Read more

🇺🇸 Global Partners launches E-ZPass enabled payment service in eight states. The firm has partnered with PayByCar, a mobile payments company that provides pay-by-text payment solutions at c-stores in Massachusetts, to extend the company’s program to more than 300 Global Partners sites across New England, New York and Virginia.

🇬🇧 Link Pay newest feature available in Lloyds mobile app. Lloyds customers can now request money with a secure unique link or from friends and family, quickly and easily, using the new Link Pay feature in the mobile banking app. Read on

🇭🇰 Fiserv has partnered with foodpanda. This strategic partnership will facilitate secure e-commerce payments across online, mobile, and digital wallets, positioning Fiserv as foodpanda's primary acquirer in Singapore and Hong Kong.

🇨🇴 Nu Colombia will be offering Bre-B in Colombia. Bre-B is an instant payment system coming to Colombia in 2025, enabling transactions in seconds. It works between any bank or digital wallet, regardless of the financial institution. Designed by Banco de la República, Bre-B allows all Colombians to move their money easily, quickly, and securely at any time.

GOLDEN NUGGET

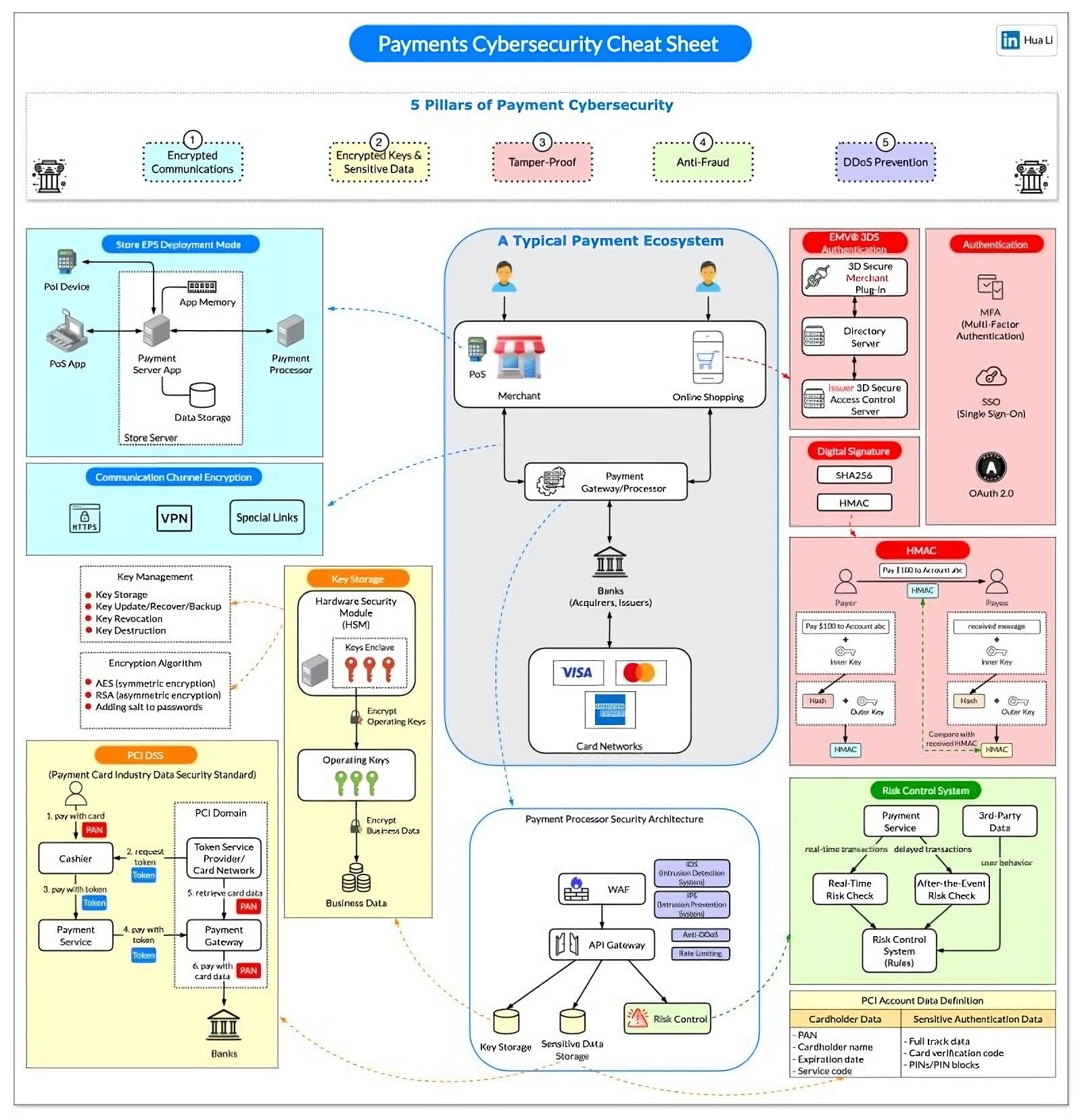

A Cheat Sheet for Payment Cybersecurity.

Payment cybersecurity is a crucial aspect of the modern financial ecosystem. The cheat sheet below outlines 5 pillars of secure payment systems with a typical payment data flow.

🔹 1. Encrypted Communication Channels

Unencrypted data transmitted over the internet can be intercepted, leading to data breaches or theft. Using protocols like HTTPS for web transactions or VPNs for internal corporate communication further reduces vulnerabilities.

🔹 2. Encrypted Keys and Sensitive Data

Use Advanced Encryption Standard (AES) for data encryption and RSA or Elliptic Curve Cryptography (ECC) for securing key exchanges. Implement Hardware Security Modules (HSMs) to securely manage and store cryptographic keys.

Data masking and Tokenization can further enhance the protection of sensitive payment information by replacing real data with dummy values.

🔹 3. Tamper-Proof

Payment systems must be resistant to tampering, both physically and digitally, to prevent fraud, data theft, or unauthorized access.

3D Secure (3DS): This is an authentication protocol designed to provide an additional layer of security in online credit card transactions, helping to prevent fraud.

MFA is a key component in making systems tamper-proof by requiring more than one authentication method.

OAuth 2.0 is an open standard for access delegation, commonly used to grant websites or applications limited access to user information without exposing passwords.

HMAC is crucial for ensuring that messages or data within a system are not tampered with. Any attempt to modify the message without knowing the secret key will result in an invalid HMAC.

🔹 4. Anti-Fraud & Risk Control

Use a combination of Multi-Factor Authentication (MFA), biometrics, and tokenization to secure user authentication.

Implement real-time monitoring and machine learning-based anomaly detection systems that track transaction patterns and flag unusual activity.

🔹 5. DDoS Prevention

Distributed Denial of Service (DDoS) attacks aim to overwhelm payment systems with massive traffic, rendering them inoperable.

Employ Web Application Firewalls (WAFs) and Intrusion Detection Systems (IDS) to detect and mitigate DDoS attacks. Cloud-based DDoS protection services, such as CDNs or services like AWS Shield, can absorb and filter malicious traffic. Rate limiting and geo-blocking are also effective strategies to prevent large volumes of unwanted traffic from overwhelming systems.

I highly recommend following Hua Li for more interesting insights like this one.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()