Mastercard & eNovate Collaborate to Modernize Payments in Egypt

Hey Payments Fanatic!

Mastercard announced a strategic move in Egypt - they're partnering with eNovate (formerly eCards, part of eFinance Investment Group) to roll out Card-as-a-Service solutions. This means banks, universities, and FinTechs across Egypt will have access to ready-to-use digital payments infrastructure and white-label solutions.

What makes this noteworthy is the scope of services - from prepaid card integration to customizable white-label wallet solutions, aimed at youth and family banking.

Through this initiative, businesses can leverage Egypt's latest financial regulations while driving digital transformation across a market of 100M+ people.

"Our collaboration with eNovate will help deliver innovative platforms and offer businesses out-of-the-box digital solutions that can be implemented to develop scalable, seamless and secure solutions to their customers," explains Adam Jones, Executive Vice President and Division President for West Arabia at Mastercard.

Which other African markets do you see as the next big opportunity for Card-as-a-Service solutions? Share your thoughts in the comments below 👇

Read more global Payments industry updates below👇 and I'll be back tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

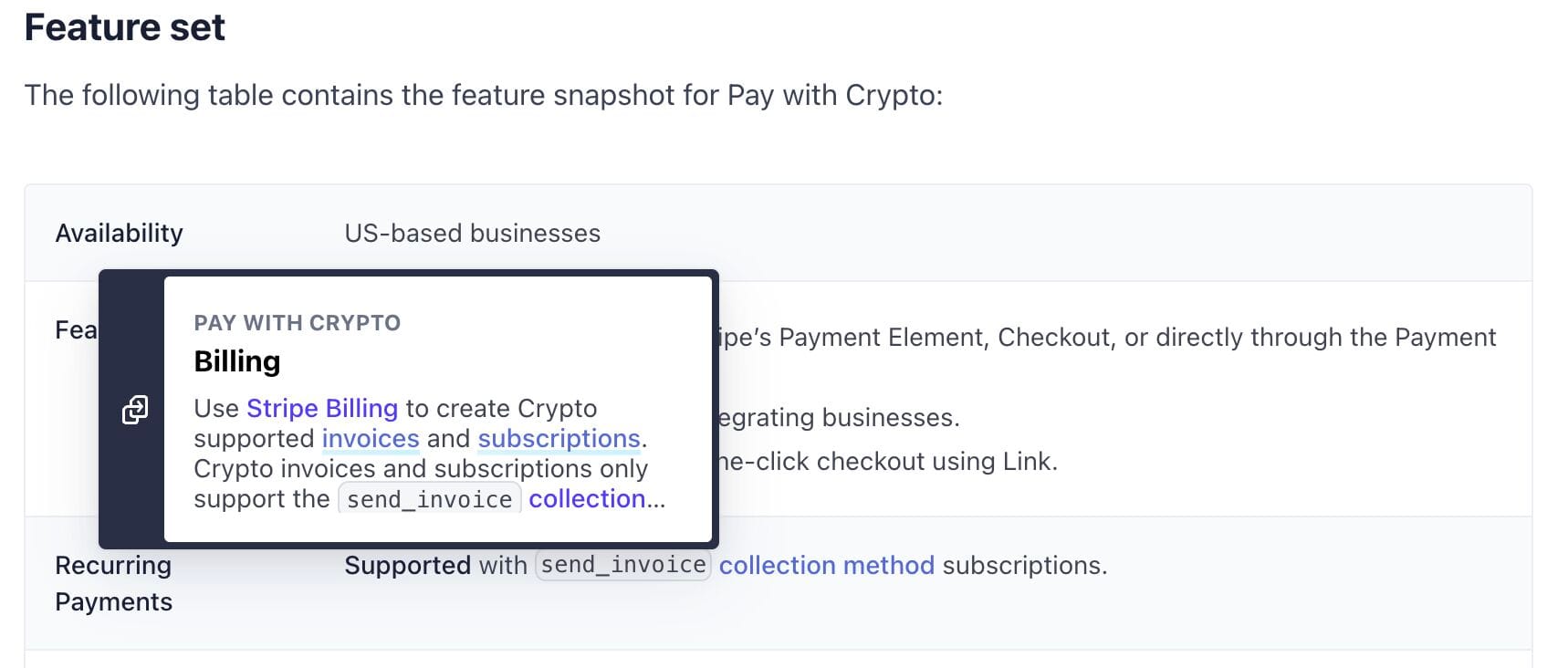

Stripe's Pay with Crypto product now supports invoicing.

PAYMENTS NEWS

🇬🇧 Getting a payment strategy ready for the festive rush. Amid fierce Black Friday and holiday competition, Ecommpay helps merchants optimize checkouts, reduce drop-offs, and tackle failed payments. Chief Revenue Officer Moshe Winegarten highlights how even small checkout delays can cost sales. Ecommpay's new free e-book offers practical tips, including using alternative payment methods, open banking, and tokenization to increase conversions and minimize chargebacks.

🇬🇧 Solidgate pre-dispute alerts for PayPal. Solidgate's pre-dispute alert solution streamlines PayPal chargeback management by offering full visibility into pre-dispute alerts for Visa and Mastercard. With real-time monitoring, automated prevention, and strategic insights, it reduces dispute fees, mitigates chargeback risks, and enhances refund workflows.

🇳🇿 Airwallex launches ‘Airwallex for Startups’ in New Zealand to support the next generation of Kiwi startup successes. The initiative has been created to empower Kiwi entrepreneurs scale efficiently by offering tools and tips to manage finances effectively from the start of their business journey.

🇺🇸 From boardroom brawls to IPO ready: Inside Klarna’s wild year. Klarna's boardroom drama this year felt like a soap opera—and now it might become one. A Swedish production company, known for Netflix features, has acquired rights to portray Klarna's rise from a payment startup to an IPO sensation. Explore more

🇭🇰 DBS Bank unveils the world’s first UnionPay Multi-Currency Diamon debit card. The card supports direct payments in 14 currencies eliminating multi-currency conversion fees for cardholders and aiming to significantly enhance the cross-border payment experience.

🇺🇸 Celero Commerce buys Precision Payments. The acquisition of Precision is set to solidify Celero’s presence within the multi-lane retail industry and expand its network of sales professionals serving local communities across North America.

🇬🇧 Barclays Bank in talks over giving away 80% stake in merchant acquiring business. The Bank is in early talks with Brookfield Asset Management to sell an 80% stake in its merchant acquiring division, while retaining a 20% share, according to Sky News. Read on

🇦🇪 Network International partners with National Bank of Fujairah. The partnership will enable NBF to offer Network’s omni-channel payment services, including online and in-person payment solutions, to its corporate clients, enhancing customer experience with secure, comprehensive payment tools.

🇺🇸 Blackhawk Network (BHN) and Mastercard announce global environmental sustainability initiative. BHN is transitioning its open-loop prepaid products from plastic to paper-based materials, supporting Mastercard's goal to eliminate first-use PVC plastics from its cards by 2028 to reduce environmental impact.

🇪🇸 Spanish banking community joins instant cross-border payments plan. As part of this program, banks can tap into Iberpay’s service, instant payment technology, standards and processing capabilities to allow for instant cross-currency payments. Read more

🇯🇵 Boku and Amazon Japan ink payments deal. The new agreement with Amazon JP allows Boku to process payments for sales on the amazon.co.jp website. Boku’s revenue from the partnership will be based on the transaction value processed, potentially triggering the vesting of warrants issued to Amazon.com, Inc.

🇵🇱 Revolut just announced its first stage integration with BLIK, the most popular Polish 🇵🇱 merchant (online and in-store), P2P and ATM payment system, and they’ve already onboarded over 180,000 users. Find out more

🇳🇱 Amsterdam-based Payaut acquired by Ryan Reynolds-backed FinTech company Nuvei. “Payaut is entering a new phase. We’re now part of the Nuvei family. Thank you, Phil Fayer and the Nuvei team, for your trust. Looking forward to the next phase, where I will stay on as CEO of Payaut, Nuvei Group,” CEO Ernst Van Niekerk has said.

GOLDEN NUGGET

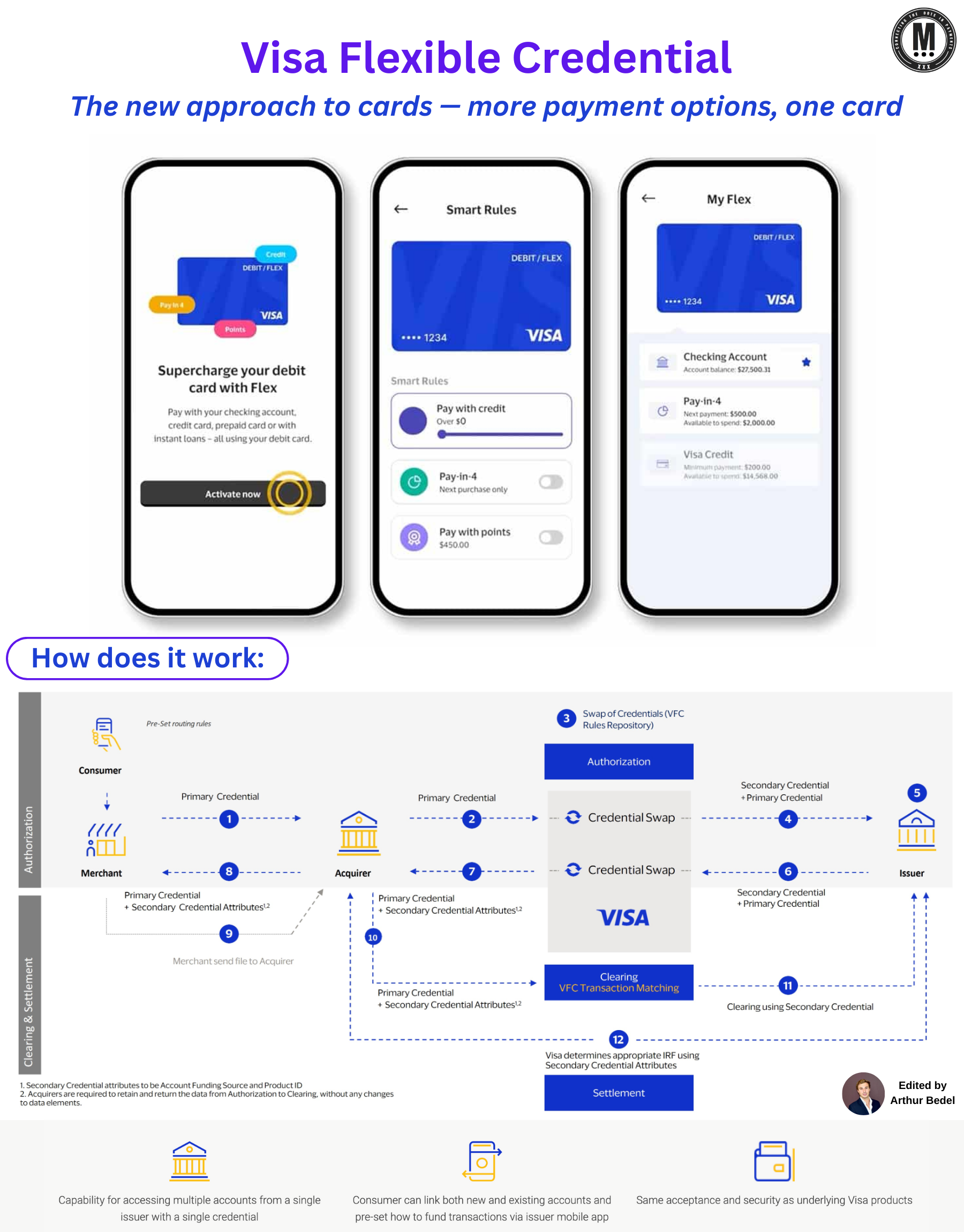

𝐕𝐢𝐬𝐚 𝐅𝐥𝐞𝐱𝐢𝐛𝐥𝐞 𝐂𝐫𝐞𝐝𝐞𝐧𝐭𝐢𝐚𝐥 — the new approach to cards, more payment options, more funding sources, one credential.

In today's fast-evolving digital landscape, Visa's Flexible Credential is redefining how consumers access funds. This innovative solution enables users to link multiple funding sources — like credit, debit, or loyalty points — to a single payment credential, allowing them to switch between accounts seamlessly during transactions. No more carrying multiple cards or worrying about balances on different accounts; a single card or digital credential can now serve as a gateway to multiple accounts, simplifying transactions for consumers and businesses alike.

► 𝐇𝐨𝐰 𝐈𝐭 𝐖𝐨𝐫𝐤𝐬

Visa Flexible Credential leverage Visa's robust infrastructure to enable real-time access to various funding sources. For example, at checkout, if a primary account lacks sufficient funds, users can instantly switch to another linked source, such as loyalty points or a credit line. This flexibility is managed through the issuer's app, giving consumers control over how they fund their transactions without having to start over or reauthorize purchases.

► 𝐓𝐡𝐞 𝐏𝐫𝐨𝐜𝐞𝐬𝐬

𝐋𝐢𝐧𝐤 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐞 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐬 𝐭𝐨 𝐎𝐧𝐞 𝐂𝐫𝐞𝐝𝐞𝐧𝐭𝐢𝐚𝐥

Consumers link various accounts — such as debit, credit, loyalty points, or installment options —to a single Visa credential.

𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐨𝐧

At the point of sale (POS) or within an e-commerce platform, the user selects their Visa credential as the payment method.

𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐒𝐰𝐢𝐭𝐜𝐡𝐢𝐧𝐠 𝐯𝐢𝐚 𝐌𝐨𝐛𝐢𝐥𝐞 𝐀𝐩𝐩

If the initial, primary account lacks sufficient funds, the user can, through the app, immediately select an alternate funding source

𝐕𝐢𝐬𝐚'𝐬 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐞𝐬 𝐭𝐡𝐞 𝐑𝐞𝐪𝐮𝐞𝐬𝐭

Visa's backend processes the funding switch in real-time. This infrastructure is designed to route and authorize payments based on the selected funding source

𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐢𝐨𝐧

Once the preferred account is selected, the transaction proceeds as usual, with funds drawn from the designated source.

The Visa Flexible Credential is an impactful step toward a versatile, frictionless payment ecosystem. It's a promising development that aligns with consumers' growing preference for flexibility in managing finances—an essential edge in the competitive payments industry.

Source: Visa

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()