Mastercard and Unzer Boost Open Banking in Europe

Hey Payments Fanatic!

The European payments landscape is evolving as Unzer selects Mastercard as its strategic open banking partner across Germany, Austria, and Denmark.

This collaboration aims to enhance account-based payments through Unzer's payment gateways, enabling direct bank-to-merchant transactions with built-in biometric verification.

The partnership leverages Mastercard's open banking infrastructure to streamline digital payments, with a focus on e-commerce transactions. Pascal Beij, Chief Commercial Officer at Unzer, emphasizes their commitment: "By tapping into Mastercard's trusted open banking infrastructure, we can drive innovation and empower merchants with faster, more convenient payment experiences that meet the needs of today's digital economy."

Valerie Nowak, EVP, APEMEA Open Banking at Mastercard, highlights the potential impact: "We're thrilled to drive the evolution of an account-based payment solution that will streamline online transactions, enhance security, and broaden payment options through our collaboration with Unzer."

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

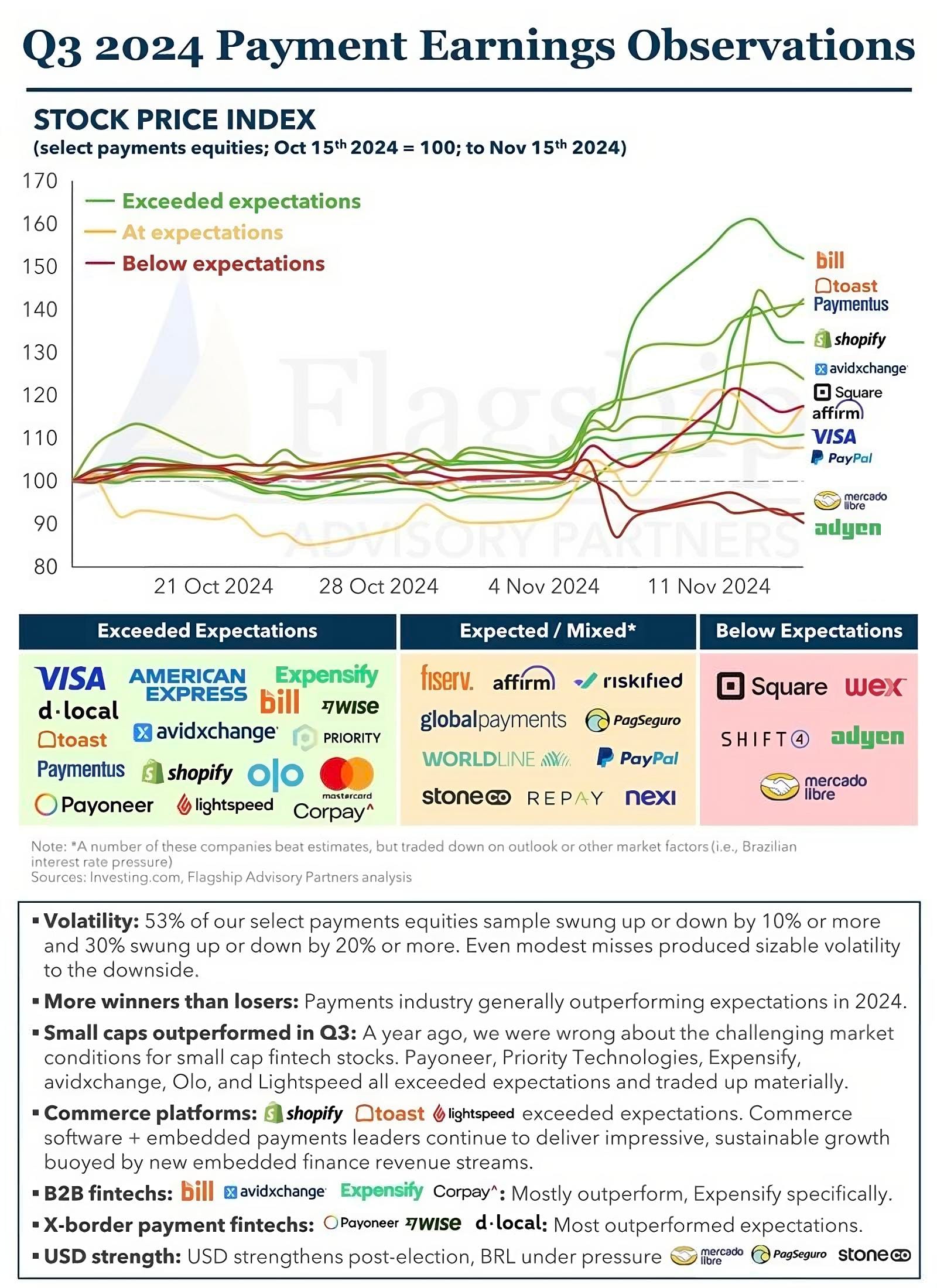

Q3 2024 Payment Earnings Observations 👇

The Key Takeaways:

PAYMENTS NEWS

🇺🇸 The Rise of Real-Time, Cross-Border, Embedded Payments: A New Era in Global Payouts, by PayQuicker. In 2025, the payments industry will undergo a radical transformation that will reshape the way businesses operate, especially when it comes to global payouts. Read the complete article here

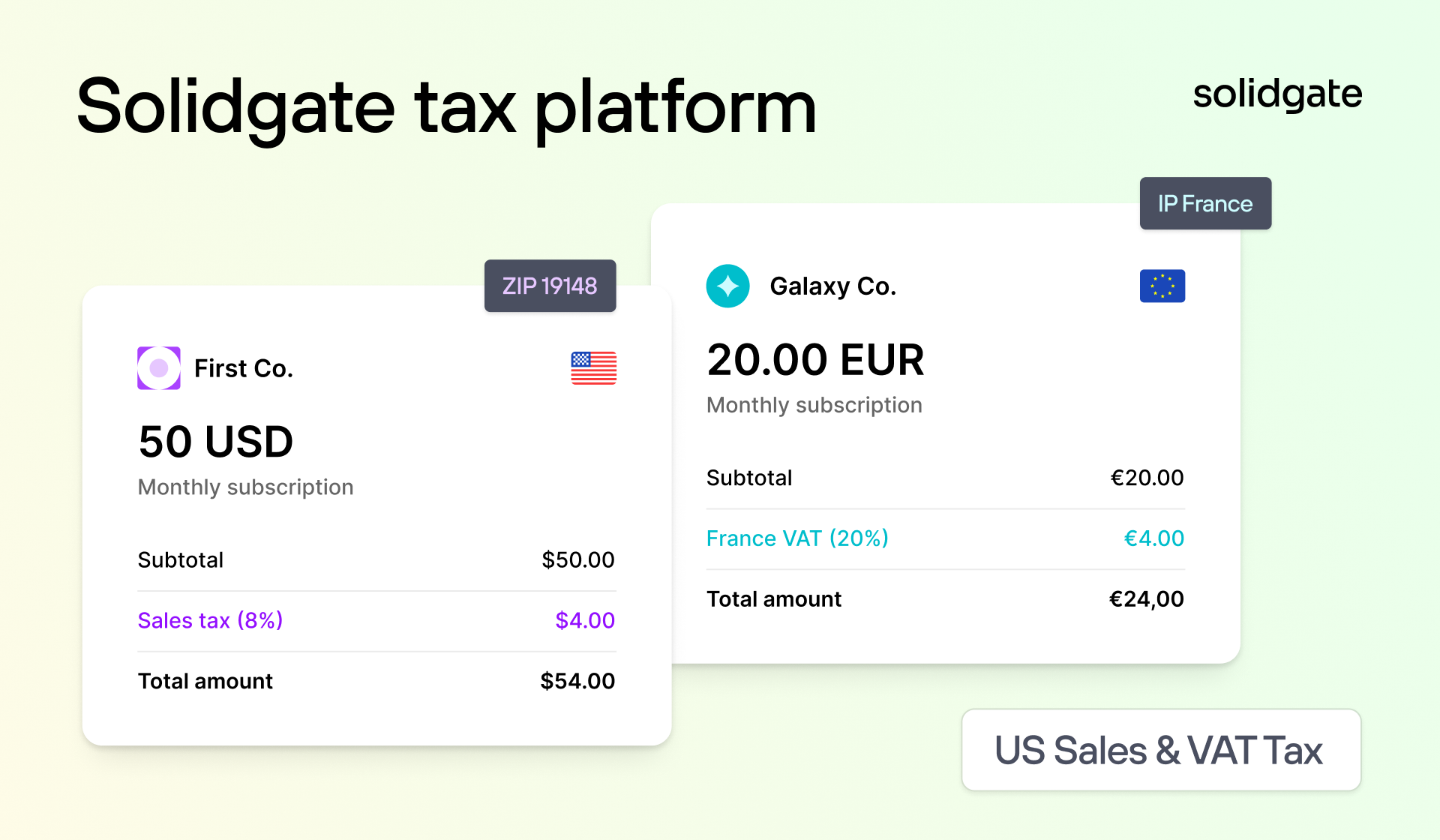

🇬🇧 Solidgate Tax: Simplifying tax compliance globally. Solidgate Tax simplifies indirect and sales tax management for online merchants worldwide, addressing the complexities of VAT and sales tax compliance across regions. Discover more

🇸🇪 Klarna inches closer to profitability as public debut nears. The Stockholm-based FinTech reported a pretax loss of 2 million kronor ($180,000), a significant improvement from 1.77 billion kronor last year, with total revenue up 23% to 20.3 billion kronor.

🇸🇪 Klarna and Lenovo partner to expand payments in Europe. As part of the collaboration, customers in 15 European countries gained access to Klarna's payment options, including interest-free Buy Now, Pay Later (BNPL) plans, for purchases made on Lenovo's website.

🇸🇪 Klarna's Q3 results are out, and it's another strong quarter with profit and growth: SEK 216 Million Profit in Q3 202, 4.57% increase year-on-year in revenue, GMV is up 16%. Click here to learn more

🇻🇳 9Pay and MSB join forces to advance cross-border payments. Together, the two organizations aim to support advancements in international payments, remittances, and merchants, offering business customers lower costs, faster transfers, optimized processes, and increased transaction frequency.

🇮🇳 Bizom, Accion, Mastercard partner to deliver credit to Indian SMEs. The collaboration will help power financial access and usage of small businesses at the last mile in one of the fastest-growing countries in the world. Read on

🇺🇸 Tassat partners Veuu for DLT-based health insurance payments. Tassat provides a private blockchain solution for instant payments between bank clients using tokenized deposits. It has now partnered with Veuu, an AI-driven startup focused on streamlining healthcare insurance claims processing and payments. More here

🇸🇪 The Riksbank is opening up its payment system RIX-INST to more types of instant payment. The Riksbank’s payment system, previously limited to Swish payments, now supports instant payments of this type. The Riksbank itself provides only the underlying infrastructure. Find out more

🇳🇱 Amsterdam’s NORBr raises €3M; CEO Nabil Naimy on empowering global payment operators, revenue projections, hiring plans, and more. The company will use the funds to support expanding its omnichannel solutions, including advanced features for managing payment terminals, operational efficiency (payops), and compliance.

🇬🇧 HSBC UK enters Point of Sale finance market with Flexipay. HSBC Flexipay is designed to help consumers break down the cost of large purchases into manageable payments directly at the point of sale. It will be available to customers of its merchant partners, even if they do not have an existing relationship with HSBC.

🇬🇧 Cashflows moves into programmable payments with Raimac Financial Technology. This collaboration will enable Cashflows to implement programmable payments, which allow customers to choose how and when they pay, making the purchasing experience smoother and more personalised.

🇧🇪 EPI enrolls 14 million users to wero wallet. The release of the figures coincides with the EPI's launch of its Wero wallet in Belgium—following an initial rollout in France and Germany—and its preparation for introducing a standalone P2P payments app.

🇬🇧 Guavapay and Rangers Football Club announce New Multi-Year Partnership. Guavapay will become an Official Partner of Rangers Football Club, as well as the Official Ibrox Stadium Payment Processing Partner, as part of the agreement.

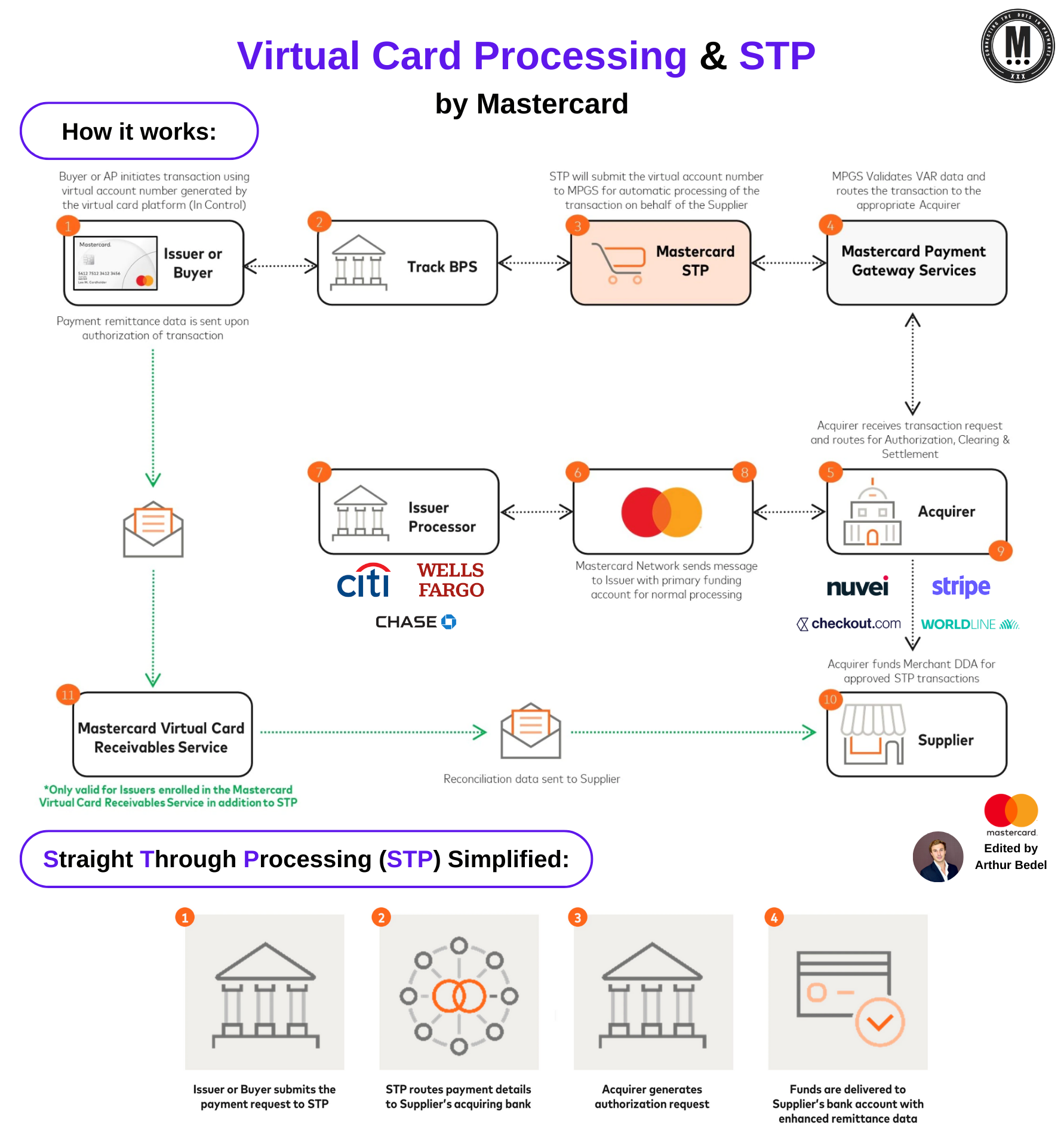

GOLDEN NUGGET

𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐜𝐚𝐫𝐝𝐬 are becoming more popular. Mastercard's 𝐒𝐭𝐫𝐚𝐢𝐠𝐡𝐭 𝐓𝐡𝐫𝐨𝐮𝐠𝐡 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 (STP) solution increases their acceptance by Merchants 👇

The Global Virtual Cards market was valued at $11.20B in 2021 alone with Europe and Asia being the largest and fastest growing markets.

𝐒𝐭𝐫𝐚𝐢𝐠𝐡𝐭 𝐓𝐡𝐫𝐨𝐮𝐠𝐡 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 (STP):

A value-added service designed to increase virtual card account acceptance by Suppliers. With Mastercard's STP, suppliers no longer need to manually enter each card account number into their POS to accept payment. The acquirer, automatically generates an authorization request on behalf of the supplier and delivers the funds to the supplier's bank account.

𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐥𝐨𝐰 𝐰𝐢𝐭𝐡 𝐒𝐓𝐏:

1️⃣ An Issuer, Buyer or Accounts Payable initiates transaction using virtual card account number generated by the virtual card platform - Mastercard's is called In Control Commercial Payments (ICCP).

2️⃣ Mastercard's STP receives the transaction request and passes the virtual account number to Mastercard Payments Gateway Services (MPGS) for automatic processing on behalf of the Supplier.

3️⃣ MPGS Validates VAR data and routes the transaction to the appropriate Acquirer like Checkout.com, Stripe, Chase, Worldline etc...

4️⃣ Acquirer receives transaction request and routes for Authorization, Clearing & Settlement

5️⃣ Mastercard Network sends message to Issuers with primary funding account for normal processing

6️⃣ Acquirer funds Merchant Direct Debit Account (DDA) for approved STP transactions

7️⃣ The reconciliation data is sent to Supplier (only valid for Issuers enrolled in the Mastercard Virtual Card Receivables Service in addition to STP)

8️⃣ Virtual Card Transaction completed!

► This Straight Through Processing process ultimately increase acceptance of Virtual Cards and provides benefits to both Buyers and Sellers:

𝐓𝐡𝐞 𝐒𝐮𝐩𝐩𝐥𝐢𝐞𝐫 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬:

► Increased processing efficiencies: Reduced manual entry of VCN data and exceptions handling

► Improved cash flow: Suppliers can accept more commercial card payments instantaneously

► Reduced PCI compliance costs: Mastercard handles buyer card numbers, not suppliers ► More security: No need to supply sensitive bank account information to buyers

► Automated reconciliation: Receive remittance data in flexible formats and free up accounts receivable staff to focus on more strategic opportunities

𝐓𝐡𝐞 𝐁𝐮𝐲𝐞𝐫 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬:

► Greater process efficiencies: Improve the acceptance experience of Suppliers

► More rebates: Increased acceptance leads to increased card spend

This solution is supported globally by not only Mastercard but also Visa, Discover Financial Services, American Express, Diners Club International and JCB/株式会社ジェーシービー

Source: Mastercard

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()