Mastercard and PayPal Redefine Secure Online Shopping

Hey Payments Fanatic!

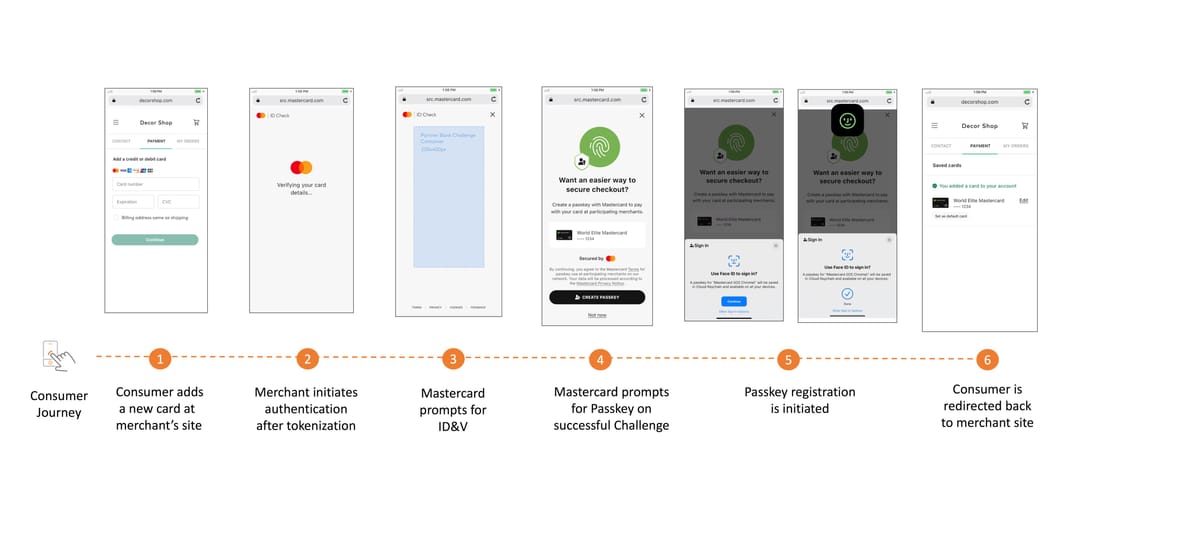

Mastercard has globally launched its Payment Passkey Service in India, introducing a secure, biometric-based authentication system to streamline online shopping.

This service replaces traditional passwords and OTPs with fingerprint and facial scans, reducing fraud risks in a market where online scams have surged by 300% in two years. In partnership with major Indian payment players and banks, Mastercard’s service secures transactions using tokenization.

Meanwhile, PayPal has expanded its partnership with Fiserv in the U.S., introducing Fastlane by PayPal. This initiative simplifies guest checkouts by integrating PayPal and Venmo services, offering businesses enhanced security and efficiency.

Never a dull moment in the Payments industry 😉 Enjoy more updates I listed for you below and enjoy your weekend!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

👇

PAYMENTS NEWS

🇺🇸 Pat Reed has joined VGS as Sr. Director of Account Management. With an impressive background in leading client and partner success teams at Wells Fargo and Discover Financial Services, Pat brings a wealth of experience and a proven track record of driving client satisfaction and business growth.

🇺🇾 Dlocal partners with Grey to drive expansion into new emerging markets. Through the partnership with dLocal, Grey will provide cross-border payouts to wallets and bank accounts, expanding its services into new markets such as Brazil, Indonesia, Mexico, the Philippines, and South Africa.

🇮🇳 OPEN partners with NPCI Bharat BillPay Limited to Launch Bharat BillPay for Business. With this partnership, OPEN has become one of the first Indian FinTechs to offer Bharat Billpay for businesses, streamlining business-to-business (B2B) payments for over 40 lakh businesses using the Open Money platform.

🇮🇳 PayMate partners with NBBL to launch BBPS-B2B platform. The platform seeks to enable large-scale digitization of commercial processes related to invoicing, payments, and collections across India while fostering an interoperable ecosystem between buyers and suppliers.

🇺🇸 emerchantpay and Novalnet AG expand successful European partnership to the US market. This partnership aims to enhance Novalnet's capabilities and maximise its merchant growth across the US by facilitating payment acceptance with our innovative payment solutions.

🇳🇱 Silverflow powers up POS provider Halo Dot. The partnership will create a solution for clients to launch their own SoftPOS offerings with a pre-integrated solution significantly reducing time-to-market. Both companies share a tech-first DNA, driving innovation and efficiency in the payments industry.

🇸🇬 Unlimit partners with Alchemy Pay to streamline fiat-to-crypto purchases worldwide. Through this partnership, Alchemy Pay will streamline settlements and offer a wide range of global and local payment methods, including Visa, Mastercard, SEPA, and Google Pay, to consumers worldwide, guaranteeing a high level of security and service for individuals.

🇸🇪 Swedish investment platform SAVR speeds up payments on its cutting-edge investment platform with Brite Payments. With Brite Instant Payments, SAVR’s customers can authenticate larger transfers using BankID, reducing manual data entry and speeding up payment completion.

🇺🇸 Stripe CTO David Singleton to step down after seven years to start own company. The outgoing CTO praised his engineering team’s “tremendous strength”, highlighting the company’s ability to handle over $1 trillion in transactions annually. Read on

🇨🇴 Mexican FinTech startup Stori said it plans to spend $𝟭𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 on its expansion into Colombia over the next three years. Stori, which provides payment cards and high-interest deposit accounts focusing on the underbanked population, will offer credit lines starting at 200,000 pesos ($50) to Colombian users with or without a credit history, the company said Thursday in a statement. The firm also announced that it appointed Carlos Ayalde to lead its Colombia venture.

🇧🇷 Nubank and 99 announce a strategic partnership to implement NuPay as a payment method for rides in the app. The solution will be exclusively available to the Nubank customer base in the coming weeks. Nu customers can enable the payment feature in the 99 app by registering NuPay just once.

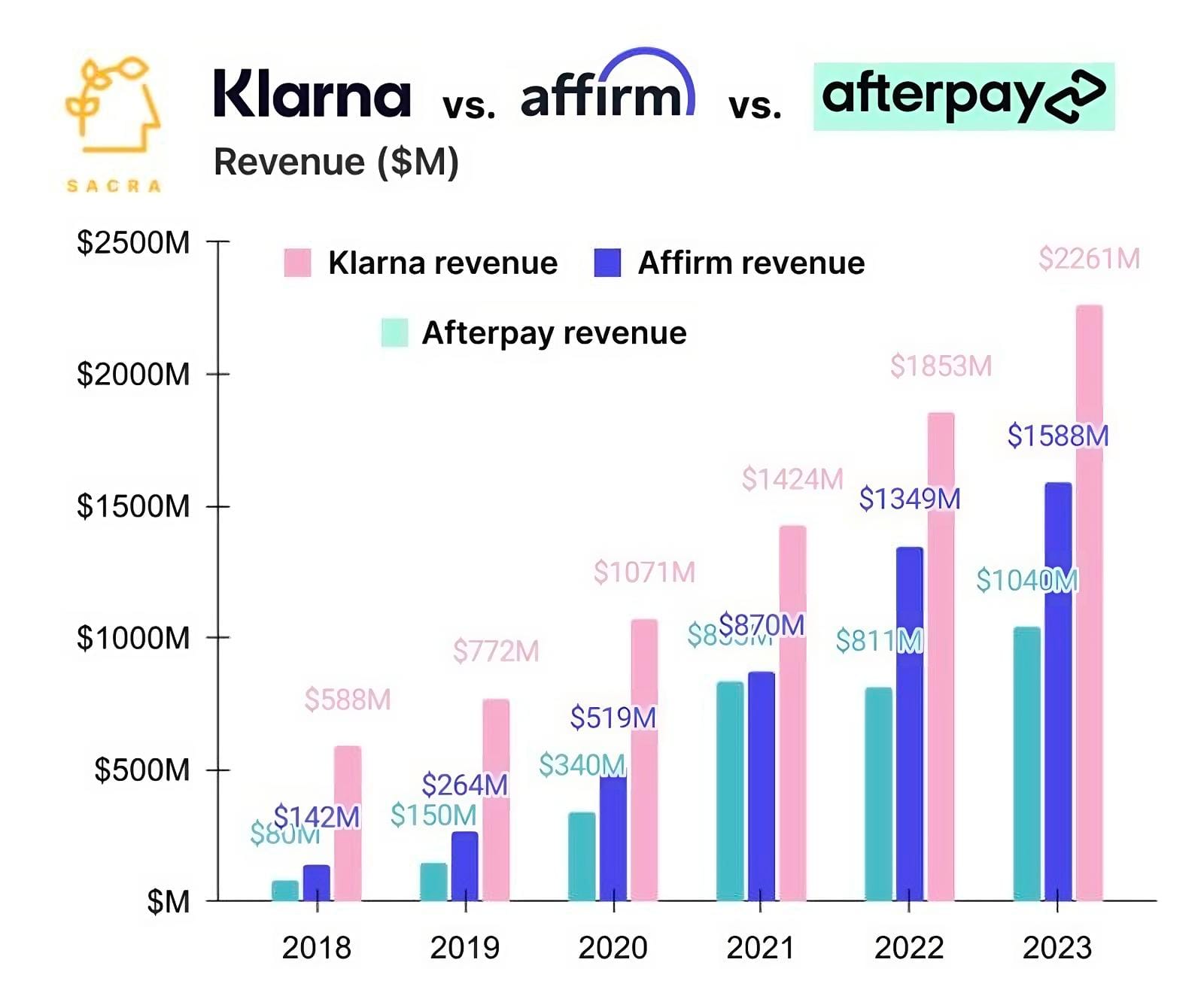

🇺🇸 WebBank to serve as Sezzle’s exclusive bank. Buy now, pay later (BNPL) firm Sezzle plans to have WebBank serve as its exclusive bank to originate and finance products offered through the Sezzle platform, including its Pay-in-2 and Pay-in-4 products.

🇬🇧 Numeral and HSBC Innovation Banking collaborate to empower innovative companies with embedded payments, announcing Qover as a joint customer. The offering is available to companies who are both a Numeral and HSBC Innovation Banking UK client.

🇺🇸 PayPal expands strategic partnership with Fiserv to streamline checkout experiences (including Fastlane) in the U.S. The expanded relationship simplifies how Fiserv clients enable PayPal, Venmo and related services, and provides these businesses with a simple connection point to Fastlane by PayPal to accelerate guest checkout flows in the U.S.

🇬🇧 CAB Payments partners with Visa to strengthen services in emerging markets. This collaboration is expected to significantly benefit sectors like remittances and charitable donations, particularly in regions with underdeveloped financial infrastructure.

🇮🇳 Pine Labs & Visa launch soundbox device for QR payments in India. The partnership aims to upgrade the in-store payment experience of millions of merchants across the country who currently rely on only printed QR codes or low-tech solutions.

🇺🇸 Crypto.com adds PayPal as payment method. Users in the U.S. can now transfer funds from PayPal to Crypto.com to buy crypto tokens available in their market. This feature will soon be available in additional markets beyond the U.S. Read on

🇪🇨 Mercately raise a $2.6M seed round. Mercately is a B2B software that builds the infrastructure brands need to sell directly on WhatsApp. The company integrates with platforms like Stripe and HubSpot and uses AI agents to help brands communicate with customers, check inventory, take payments and create purchase orders without the customer having to leave WhatsApp.

🇮🇳 Mastercard selects India for the global launch of its Payment Passkey Service (which speeds up transactions using biometrics). During a keynote presentation at Global FinTech Fest in Mumbai, Mastercard announced the worldwide launch of its new Payment Passkey Service to make online shopping more secure and easier than ever.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()