Mastercard and Amazon to Boost Digital Payments in Middle East and Africa

Hey Payments Fanatic!

Mastercard and Amazon Payment Services have announced a new multi-year partnership to accelerate digital payment acceptance across the Middle East and Africa.

By integrating Mastercard Gateway—a secure and seamless payment solution—merchants in 40 markets, including key countries like the UAE, Egypt, Kuwait, and South Africa, will benefit from faster transactions and expanded payment options.

This collaboration promises to enhance digital commerce, especially as 95% of consumers in the region are considering emerging payment methods like digital wallets and biometrics.

The partnership opens the door for merchants, telcos, and governments to adopt innovative checkout solutions, bringing the region one step closer to a fully digitized payment ecosystem.

As part of the deal, Mastercard and Amazon Payment Services have also signed an innovation agreement to develop Secure Card on File, Click to Pay, and token authentication services, providing merchants with multi-rail checkout options and offering customers a faster, more secure checkout experience.

Digital commerce is booming in the region—keep reading for the latest updates in the payments industry.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

🔤 Open Banking Alphabets. Have you ever found yourself conversing with industry professionals, and it feels like they’re all talking in code? Here is a comprehensive alphabet:

Ready, set, go – from A all the way to Z! 🏁

PAYMENTS NEWS

🇴🇲 NBO taps PayByte to enhance digital payment solutions in Oman. The partnership marks a significant step towards providing more convenient, secure, and innovative payment solutions for businesses and consumers in Oman. Link here

🇫🇷 EPI launches Wero, its European digital payment wallet in France. The Wero payment solution will launch for French customers of major banks, including BNP Paribas, Crédit Agricole, and Société Générale, starting in the second half of October 2024. The first Wero brand campaign will be launched in France on October 14th.

🇺🇸 Jack Henry and Victor offer embedded payments platform for regional and community financial institutions to better support business customers. With this integration, financial institutions will have the opportunity to grow low-cost deposits and non-interest fee income. Read on

GOLDEN NUGGET

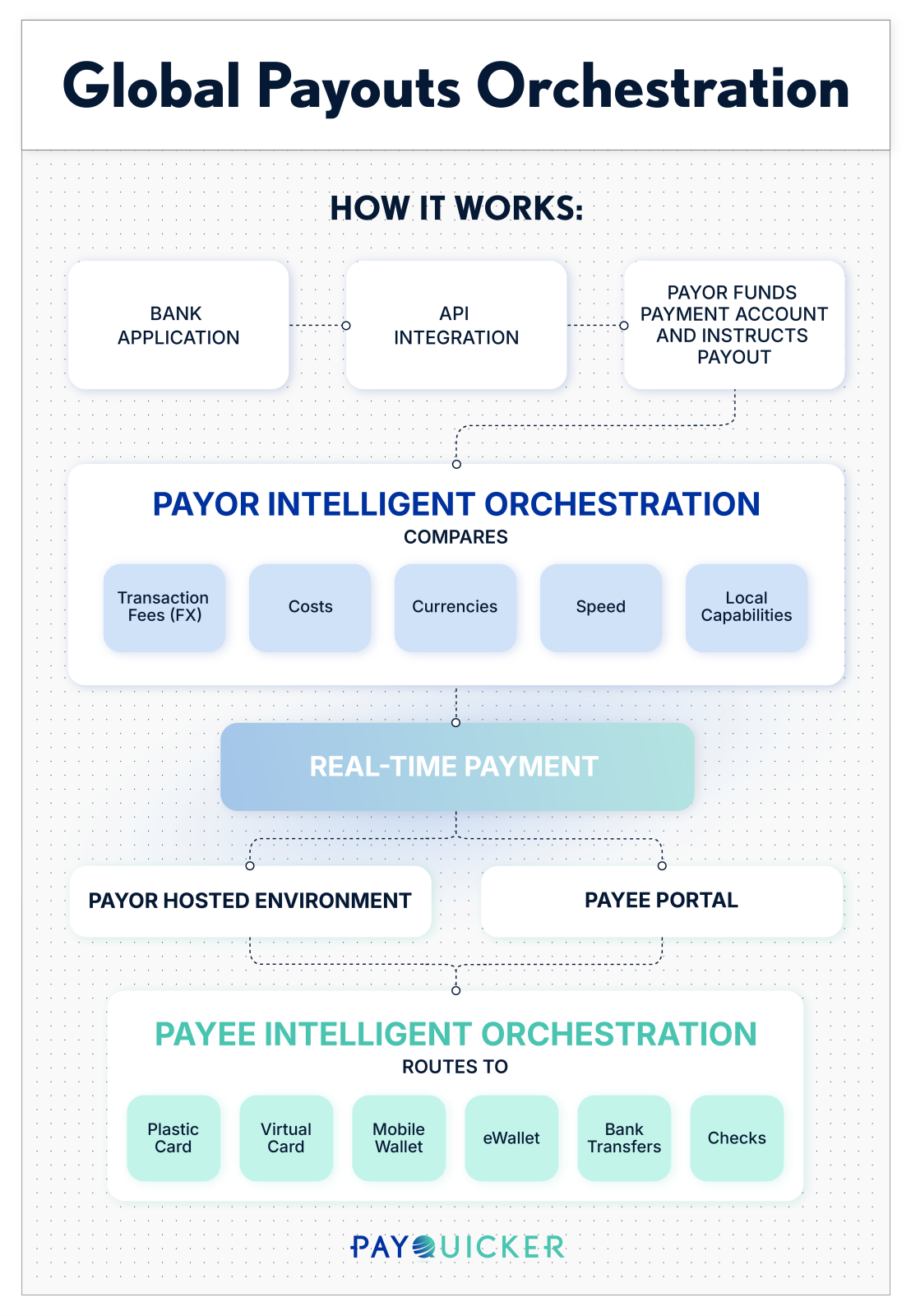

💳 What is Global 𝗣𝗮𝘆𝗼𝘂𝘁𝘀 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 and how does it work?

PayQuicker explains it best:

What is Payouts Orchestration?

Payouts orchestration is the seamless coordination of multiple payment processes and methods across different countries and currencies, managed through a single platform, and API.

This process is designed to make global payouts smarter, faster, more efficient, and cost-effective, regardless of where the payee (end recipient) is located.

Think of global payouts orchestration as the conductor of an orchestra, ensuring every part of the payment process works in perfect harmony to deliver payments swiftly and securely.

Who is it for?

Payouts orchestration is designed for businesses of any size that need to send payments to a global audience instantly and efficiently.

It caters to a diverse range of industries, including affiliate networks, direct selling, the on-demand economy, the creator economy, platforms and marketplaces, clinical trials, and global workforce payouts.

Whether you’re a multinational corporation managing payouts to a global workforce or a small business handling international contractors, payouts orchestration simplifies the complex process of managing global transactions.

What Problem is it Solving?

The traditional process of making global payments is often riddled with challenges, such as high fees, slow transaction times, regulatory compliance issues, and currency conversion complexities.

One of the more significant challenges businesses face is the need to onboard multiple payment providers to cover the diverse needs of their global payments.

Each provider may specialize in different regions, currencies, or payment methods, requiring businesses to manage several accounts, integrations, and compliance checks.

This fragmentation is not only time-consuming and costly but also complicates the payment process, increasing the risk of errors and delays.

Payouts orchestration solves these challenges by aggregating the payment process into a single streamlined system that simplifies and intelligently optimizes every step of the payout experience.

By connecting businesses to an extensive network of payment providers through one platform and single API integration, payouts orchestration simplifies global payouts, reducing costs, minimizing errors, and ensuring faster, more efficient transactions.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Gabriel Grisham, MBA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()