Liberty Mutual Investments Upsizes Partnership with Affirm

Hey Payments Fanatic!

Affirm has expanded its partnership with Liberty Mutual Investments (LMI), the investment arm of Liberty Mutual Group. The forward flow loan purchase program will see LMI buying Affirm installment loans, with up to $750 million outstanding through June 2027. Over time, LMI plans to invest up to $5 billion in the initiative.

This collaboration strengthens Affirm's access to capital for its flexible payment options, a relationship that began in 2019 and evolved into the forward flow program in 2023. Affirm’s Chief Capital Officer, Brooke Major-Reid, shared, “This step builds on our six-year partnership with LMI as we continue driving positive credit outcomes and advancing our growth plans.”

LMI’s John Kim, head of Alternative Credit, highlighted their flexibility: “Our single-client focus allows us to scale solutions for long-term partners like Affirm.”

With over $16.8 billion in funding capacity as of September 2024, Affirm’s diverse funding model supports more than 19 million active consumers, offering transparent payment options with no hidden fees. The company processed over $28 billion in GMV in the past year.

Stay tuned for more updates from the world of Payments below 👇. Catch you soon!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

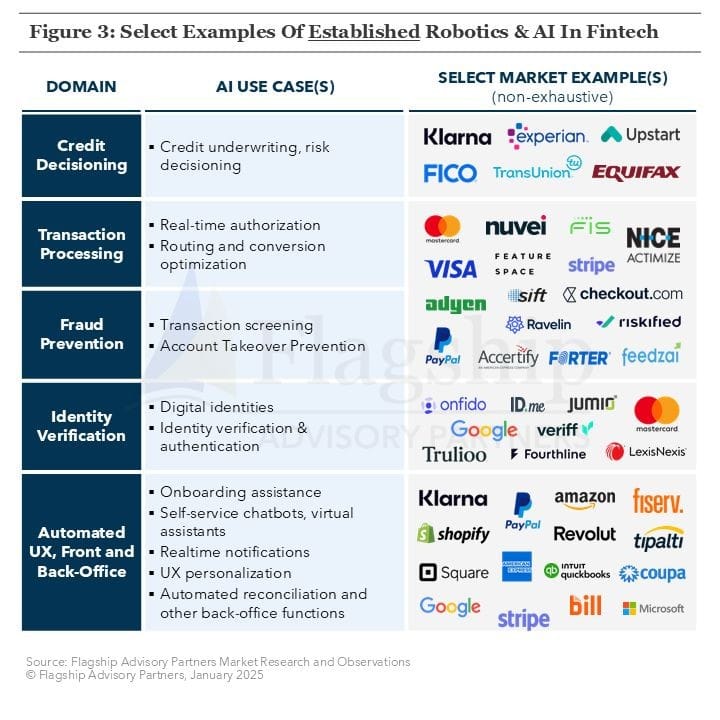

🤯 Artificial Intelligence (AI) and robotics are not new to Financial Services.

PAYMENTS NEWS

🇺🇸 JetBlue announced it is the first airline to accept Venmo, offering customers an easy and secure payment option when booking flights directly with JetBlue online. U.S. customers can conveniently purchase flights using their Venmo balance or linked bank accounts, debit cards, or credit cards when booking travel.

🇧🇷 PagBrasil received authorization from Brazil’s Central Bank to operate as a regulated Payment Institution (PI). This approval allows the company to act as an electronic money issuer, enabling it to manage prepaid payment accounts. With this license PagBrasil plans to roll out new products and features.

🇺🇸 PayPal’s New York penalty highlights cybersecurity’s payments significance. The DFS states that the firm did not use qualified personnel to manage key cybersecurity functions and failed to provide adequate training to address cybersecurity failures.

🌍 B2BINPAY welcomes TON, opening the door to scalable and affordable crypto payment solutions. With this integration, B2BINPAY, which already supports USDC on 10 blockchains and USDT on 10, now adds support for Toncoin (TON) and USDT-TON, enabling businesses to leverage TON's speed, efficiency, and scalability.

🇺🇸 Discover’s card charge-offs improve and delinquencies show stability. “Over the past several quarters, payment rates have stabilized,” said the CFO, adding that card sales were lower by 3%, due to “credit tightening actions.” The net charge-off rate on card loans were 5%, down from 5.3% in the third quarter.

🌍 dtcpay partners with BNB Chain. Through this integration, dtcpay will enable businesses and merchants to accept payments via the BNB Chain network, opening up new opportunities for users to pay with stablecoins like USDT and USDC on BNB Smart Chain (BSC) and opBNB.

🇨🇦 Core Payment Solutions launches new POS system for businesses. This system aims to improve operational efficiency and offer businesses real-time insights into their operations. It also includes features such as credit card processing, inventory management, invoicing, and sales tracking.

🇺🇸 Mastercard and Visa failed to stop payments for child sex-abuse content on OnlyFans. The complaint was filed in January 2023 with FinCEN, the U.S. Justice and, Homeland Security departments. When the content is child sexual abuse material, the card companies are “directly handling the proceeds of these illicit transactions,” said the complaint.

GOLDEN NUGGET

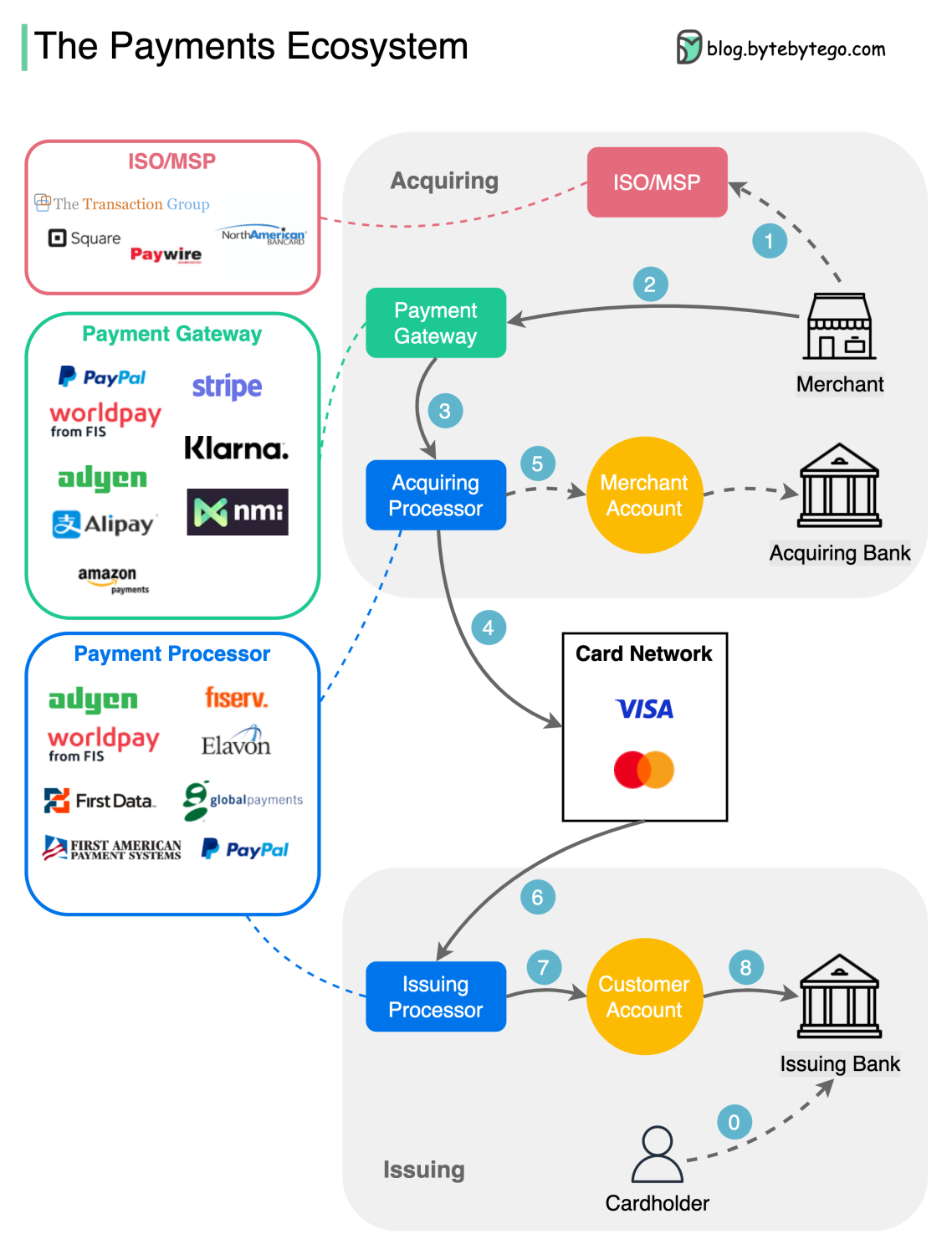

What do PayPal, Stripe, and Square do exactly? Let’s dive into the Payments Ecosystem!

The diagram below by ByteByteGo shows a bird eyes views of the payments ecosystem👇

Steps 0️⃣-1️⃣: The cardholder opens an account in the issuing bank and gets the debit/credit card.

The merchant registers with ISO (Independent Sales Organization) or MSP (Member Service Provider) for in-store sales.

ISO/MSP partners with payment processors to open merchant accounts.

Steps 2️⃣-5️⃣: The acquiring process.

The payment gateway accepts the purchase transaction and collects payment information.

It is then sent to a payment processor, which uses customer information to collect payments.

The acquiring processor sends the transaction to the card network. It also owns and operates the merchant’s account during settlement, which doesn’t happen in real-time.

Steps 6️⃣-8️⃣: The issuing process.

The issuing processor talks to the card network on the issuing bank’s behalf. It validates and operates the customer’s account.

I highly recommend signing up for ByteByteGo’s newsletter to get more great updates like this in your inbox.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()