Lagarde’s Vision for a Unified European Payment System

Hey Payments Fanatic!

“Visa, MasterCard, PayPal, and Alipay are all controlled by American or Chinese companies. We should make sure there is a European offer,” said Christine Lagarde, President of the European Central Bank. Her remarks reflect growing urgency within the EU to reclaim control over its digital payment infrastructure.

Lagarde linked this ambition to broader economic goals. A fully unified capital market, she noted, could add up to €3 trillion in value annually. But to get there, Europe must reduce its dependency on non-European platforms that process a large share of everyday transactions. The message is strategic: sovereignty in payments is a pillar of financial autonomy.

That’s where the European Payments Initiative (EPI) comes in. Backed by major European banks, EPI aims to build a single payment solution for the eurozone. In 2023, it acquired iDEAL and Payconiq—two existing systems already trusted by users in multiple countries. Their integration forms the backbone of EPI’s push to offer A2A payments as an alternative to card-based systems.

Wero, the first visible result of this work, is already live with over 30 millions users in Germany, France, and Belgium. Meanwhile, EuroPA is building a cross-border layer for southern European countries, linking over 50 million users, with full connectivity expected by June 2025.

Wero, EPI’s first rollout, is already live in Germany, France, and Belgium, with over 30 million users. Meanwhile, EuroPA is creating regional links in Southern Europe, connecting banks and 50 million users across Italy, Spain, Portugal, and Andorra.

Together, these projects signal clear intent—but intent alone won’t determine the outcome. Whether Europe moves toward a truly unified payment system or remains fragmented will depend on the depth of political will, the alignment among national institutions, and the appetite of banks and consumers to embrace a shared alternative.

If you want to catch up on the latest in Payments, keep scrolling!

Cheers,

INSIGHTS

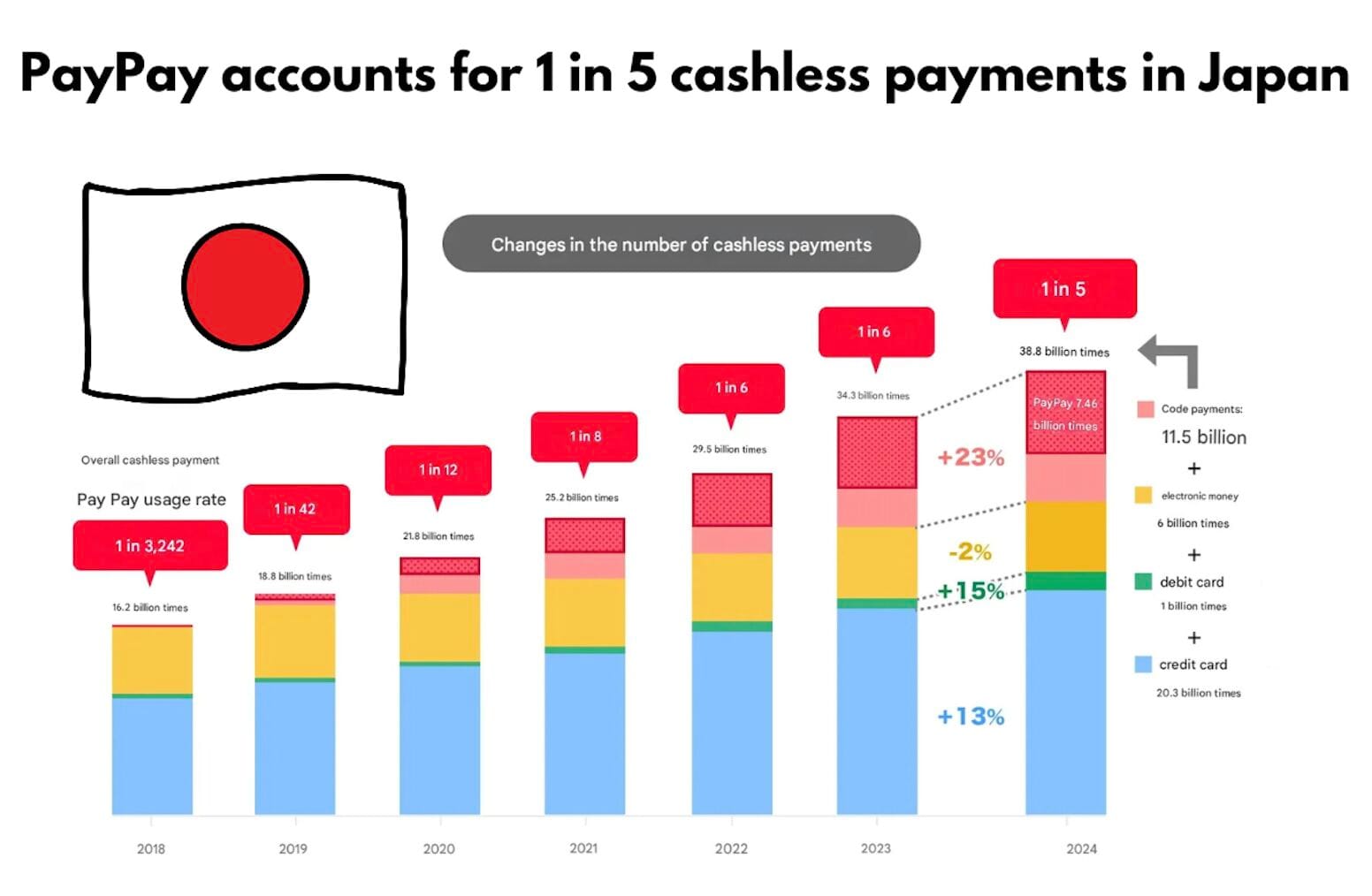

🇯🇵 PayPay Corporation accounts for 1 in 5 cashless payments in Japan. The firm announces that the number of "PayPay" payments in 2024 has exceeded 7.46 billion, accounting for approximately 1 in 5 of the total 38.8 billion cashless payments in Japan.

PAYMENTS NEWS

🇬🇧 Sabre and CellPoint Digital strengthen airline payments ecosystem with strategic agreement. Thanks to this integration, airlines now have the freedom to choose from an extensive range of payment options, including international card networks commonly used for global transactions, digital wallets, and other non-card-based methods that offer consumers more flexibility at checkout.

🇦🇷 Pomelo’s CEO Gastón Irigoyen has been included in the Thought Leaders 100 Argentina ranking — a data-driven list that measures real influence through media presence, digital engagement, networking, and events. Click here for more info

🇺🇸 ACI Worldwide and NationsBenefits partner to expand health and retail benefits for millions of consumers. Through this collaboration, millions of health plan members using the NationsBenefits Flex Card will now have access to a growing network of participating retailers, including supermarkets, pharmacies, and convenience stores.

🌍 Mastercard and Kraken have announced a partnership that will enable users of European cryptocurrency exchanges to spend Bitcoin and other cryptocurrencies at 150 million merchants globally. The next expected step will be the introduction of digital and physical debit cards linked to Kraken accounts, thanks to the Mastercard infrastructure.

🌍 Kraken launches Kraken+, a premium membership program designed to power the investing experience. The program provides access to enhanced features such as lower fees, priority customer support, advanced trading tools, and higher account limits.

🇦🇺 GoCardless and Optty partner to bring global bank payments to Australian businesses. This will allow customers to collect bank payments directly within the Optty platform without the need to build their own integration or manage multiple providers.

🇹🇷 Turkey’s Sipay raises $78M to expand its Stripe-like services into emerging markets. This round is significant, as Sipay plans to expand into markets outside of Turkey, offering additional services like remittances that Stripe currently does not offer in those regions.

🇺🇸 Fiserv announced it acquired Pinch Payments, a payment facilitator (PayFac) enhancing payment services for business partners in APAC. This acquisition provides Fiserv with a payment orchestration platform that supports flexible service options and speed to market for PayFacs, ISVs, BPSPs, ISOs, and Enterprises.

🇺🇸 Knot teams with PayPal to help streamline checkouts. The solution helps merchants bolster customer satisfaction while driving higher conversion rates. It follows partnerships between Knot and other financial institutions and FinTech companies, including American Express, Bilt, and Step.

🇺🇸 BNPL FinTech Affirm and REVOLVE to streamline fashion checkout with flexible payments. This collaboration allows REVOLVE shoppers to utilize Affirm's flexible payment options, enabling them to split purchases into manageable, interest-free installments.

🇩🇪 Mondu expands B2B payment network across Europe with Payin3 and Lemonway. Payin3 has partnered with Mondu to bring the same flexibility and smooth checkout experience to business buyers and with Lemonway to simplify payments for marketplaces and alternative finance platforms in France.

🇲🇾 Malaysians can now use local bank apps for QR Payments in Cambodia. Malaysian travelers can use their local mobile banking apps to scan Cambodia’s KHQR codes and make payments directly. The linkage is expected to benefit over seven million merchants across both countries.

🇵🇰 Pakistani FinTech firm Haball secures $52m pre-series A. The funding will help Haball strengthen its position in Pakistan and expand into the GCC region, starting with Saudi Arabia in 2025. The company also plans to enter the UAE, Qatar, and other Middle Eastern and Asian markets.

GOLDEN NUGGET

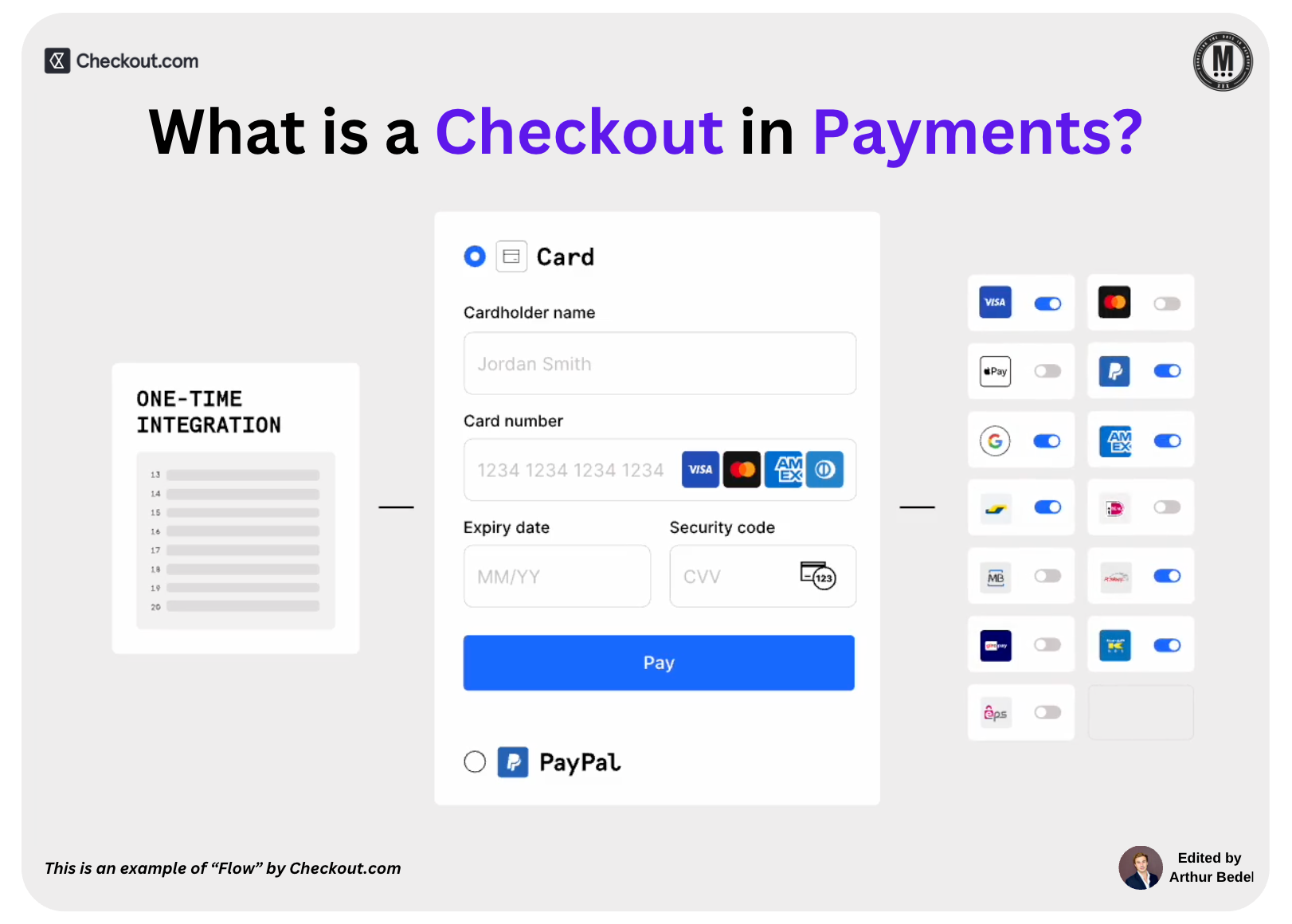

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 9 👋

What is a “𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭” 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

► A 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 is the digital experience where customers finalize their purchase and submit payment. Whether embedded into a site or hosted externally, the checkout experience directly impacts conversion, compliance, and customer loyalty.

𝐓𝐡𝐞 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭:

1️⃣ Hosted Payment Page (HPP)

2️⃣ Embedded Fields

3️⃣ Frames + APIs

4️⃣ Universal Checkout (Merchant-built or PSP-built interoperable with multiple acquirers).

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐇𝐨𝐬𝐭𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐚𝐠𝐞?

► A 𝐇𝐨𝐬𝐭𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐚𝐠𝐞 is a fully managed, secure payment experience where a PSP handles most of the PCI compliance, Payment Method Display, UI rendering, and fraud checks — while your customer completes their purchase on a separate checkout page. Today, those HPPs can be dynamic, tailorable to each customer locally and remembering customers across merchants if using a universal HPP interoperable with various acquirers.

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬:

► Conversion

✔️ Automatically adapts to the customer’s device, language, & preferred methods

✔️ Optimizes layout and flow to reduce cart abandonment

► Compliance

✔️ PCI DSS Level 1 certified

✔️ Built-in 3DS2 and Strong Customer Authentication support

✔️ Reduces regulatory burden on merchants

► Reach

The hosted checkout dynamically surfaces local payment methods based on the customer’s geolocation, increasing trust and familiarity:

🇪🇺 SEPA Direct Debit (Europe)

🇧🇷 Boleto Bancário and Pix (Brazil)

🇮🇳 UPI and RuPay (India)

🇵🇪 Yape (Peru)

🇹🇭 Promptpay Solution (Thailand)

🇮🇩 GoPay Indonesia and Dana (Indonesia)

🇲🇽 OXXO and SPEI (Mexico)

🇸🇬 PayNow (Singapore)

🇹🇷 TROY (Turkey)

🇰🇷 카카오페이 (kakaopay) (South Korea)

🇳🇴 Vipps (Norway)

This hyper-local experience helps merchants scale globally with a checkout that feels local in every market.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐔𝐧𝐢𝐯𝐞𝐫𝐬𝐚𝐥 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭?

► Universal Checkout is a modular frontend component that plugs directly into a merchants site or app — delivering a seamless payment experience that supports:

✔️ Cards

✔️ Digital wallets (ApplePay, Google Pay)

✔️ APMs

✔️ Installments

All through a single integration.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 — 𝐩𝐨𝐰𝐞𝐫𝐞𝐝 𝐛𝐲 𝐭𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 👇

► When a customer pays for the first time, their card details are encrypted and stored as a token. For future checkouts, the customer sees their saved method and only needs to confirm the payment

Checkouts keep evolving and are the interface in between the consumers and merchants. Optimizing it is extremely complex, a lot more than meets the eye.

Source: Checkout.com x Connecting the dots in payments...

I highly recommend following my partner Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()