Kustom.co Launches as Independent from Klarna Checkout

Hey Payment Fanatic!

Kustom.co, formerly known as Klarna Checkout, embarks on its next chapter as an independent company. With a renewed focus on being a merchant-first checkout solution, Kustom is setting out to help e-commerce businesses boost conversion rates and offer a highly customized checkout experience tailored to their needs.

With partnerships like Stripe powering its infrastructure, Kustom is expanding payment options, delivering faster and smoother integrations, and giving merchants the flexibility to personalize everything from payment methods to currencies and shipping options. The company is also investing in enhanced merchant support, ensuring that businesses have access to the help they need, exactly when they need it.

According to a LinkedIn post by Rasmus Fahlander, Kustom's Chief Product Officer, while Klarna will continue to be a key partner, Kustom's newfound independence unlocks faster innovation and enables a broader, more diverse range of offerings.

Congratulations to the entire Kustom team on this exciting new chapter!

For more insights and updates on the global payments industry, keep reading below👇. I’ll see you back here on Monday with even more news!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

How do consumers pay in Latin America?

Here's a breakdown:

PAYMENTS NEWS

🇬🇧 UK banks now have up to four days to check payments for scams. The UK government will give banks more time to investigate payments they suspect are fraudulent in a welcome reprieve for lenders as they prepare for new rules that will require them to reimburse many customers that fall victim to scams.

🇸🇪 Klarna CEO says a European tech brain drain is ‘number one risk’ for company ahead of IPO. “When we looked at the risks of the IPO, which is a number one risk in my opinion? Our compensation,” said Sebastian Siemiatkowski. He was referring to company risk factors, which are a common element of IPO prospectus filings. Click here to learn more

🇺🇸 Visa launches platform to help banks issue stablecoins globally. The product, which will be known as the Visa Tokenized Asset Platform or VTAP, will allow banks to “mint, burn and transfer” tokens. While still in the testing stage, the plan is to go live next year, according to a Thursday statement.

🇮🇳 Payoneer and Tech Mahindra collaborate to advance global crowdsourcing payments. This collaboration aims to optimize payment capabilities for Tech Mahindra’s innovative crowdsourcing platform, Populii, revolutionizing how businesses engage with the global crowdsourcing industry and manage financial transactions.

🇺🇸 Visa has introduced the Visa Commercial Solutions Hub, designed to streamline business payment management for financial institutions and businesses, providing a modern, personalized user experience focused on efficiency and ease of implementation.

🇺🇸 PayPal completes its first business transaction using stablecoin as a way to demonstrate how digital currencies can be used to improve often-clunky commercial transactions. PayPal paid an invoice to Ernst & Young LLP on Sept. 23 using PYUSD relying on an SAP SE platform to complete the transaction. More here

🇬🇪 UniPAY partners with TransferGo. This collaboration will introduce IBAN payout services from the UK and EU to Georgia, facilitating efficient international transfers directly to bank accounts, especially benefiting the Georgian diaspora in sending money back home.

🇩🇰 Danske Bank and Klarna are the first to offer recurring payments via Swish. Earlier in September, they announced the rollout of a highly anticipated service for recurring and automatic payments for Swish users. Now, the service is going live with the first two banks, Danske Bank and Klarna, offering the service to their business customers.

🇺🇸 PayPal CEO on crypto: We're just scratching the surface. Alex Chriss says that becoming an exchange isn’t in the long-term plan for the company. "For us, the real transformation is 'where am I in the world where I can create the right payment to any merchant.'"

🇦🇪 du Pay partners with Emirates NBD to elevate Digital Payment Solutions in the UAE. The partnership aims to simplify fund transfers for du Pay customers in the UAE by providing a unique virtual IBAN, offering enhanced convenience and security for sending and receiving funds directly through the app.

GOLDEN NUGGET

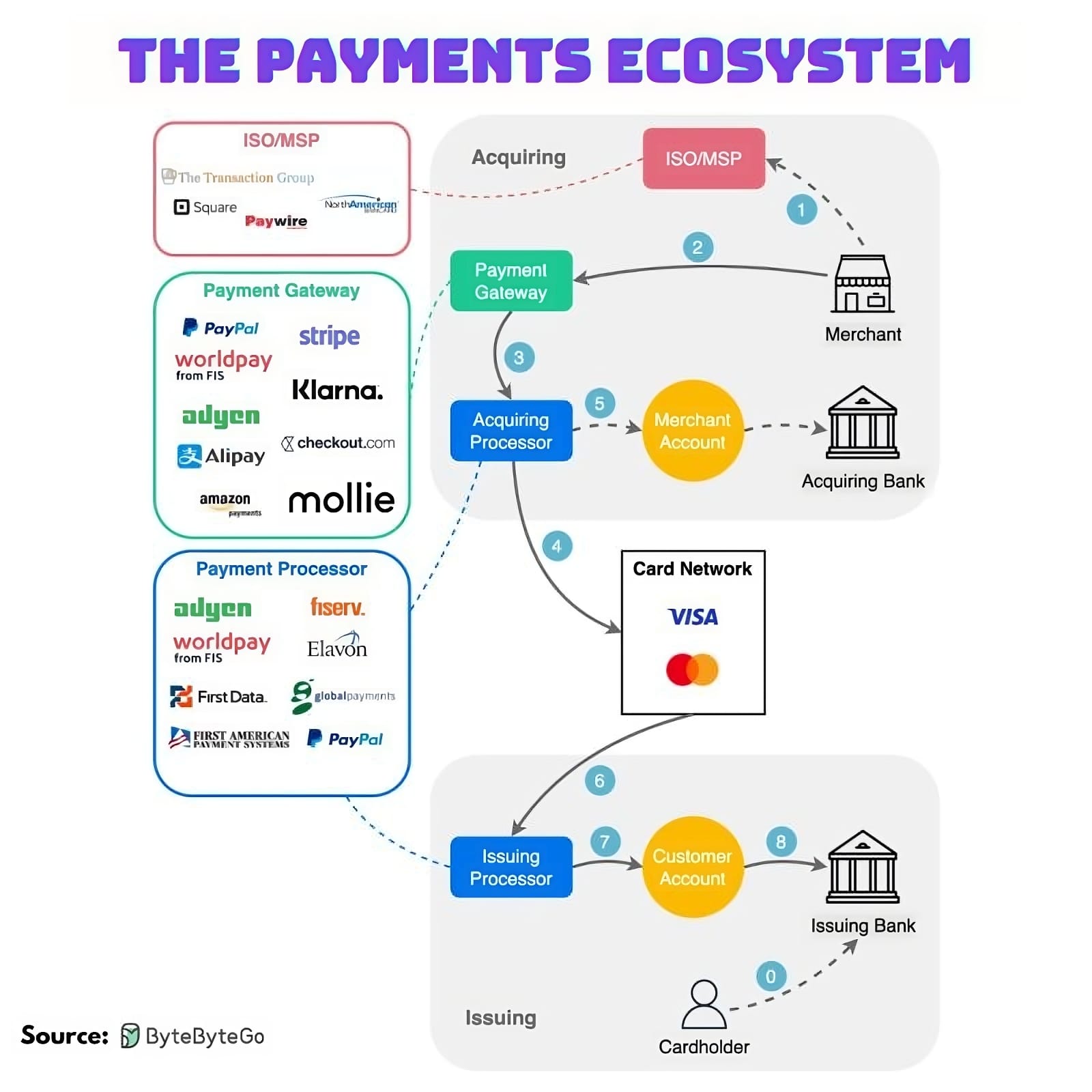

What do PayPal, Square, Mollie and other Payments companies do exactly?

Let’s dive into the 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 𝗘𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺:

The diagram below (made by ByteByteGo) shows a bird eyes views of the payments ecosystem👇

Steps 0️⃣-1️⃣: The cardholder opens an account in the issuing bank and gets the debit/credit card.

The merchant registers with ISO (Independent Sales Organization) or MSP (Member Service Provider) for in-store sales.

ISO/MSP partners with payment processors to open merchant accounts.

Steps 2️⃣-5️⃣: 𝗧𝗵𝗲 𝗮𝗰𝗾𝘂𝗶𝗿𝗶𝗻𝗴 𝗽𝗿𝗼𝗰𝗲𝘀𝘀.

The payment gateway accepts the purchase transaction and collects payment information.

It is then sent to a payment processor, which uses customer information to collect payments.

The acquiring processor sends the transaction to the card network. It also owns and operates the merchant’s account during settlement, which doesn’t happen in real-time.

Steps 6️⃣-8️⃣: 𝗧𝗵𝗲 𝗶𝘀𝘀𝘂𝗶𝗻𝗴 𝗽𝗿𝗼𝗰𝗲𝘀𝘀.

The issuing processor talks to the card network on the issuing bank’s behalf. It validates and operates the customer’s account.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: ByteByteGo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()