Klarna’s IPO Plans Take Shape

Hey Payments Fanatic!

After months of IPO speculation in the fintech industry, Klarna’s potential listing is one of the most talked-about topics, making headlines almost every week.

The Swedish payments firm is reportedly moving closer to a U.S. public debut, with plans to raise at least $1 billion and a valuation target exceeding $15 billion. A formal filing could come as soon as next week, marking a key milestone in its journey to the stock market.

Klarna first confidentially filed for an IPO with the U.S. Securities and Exchange Commission in November. While details remain undisclosed, the company’s progress suggests growing confidence in its market position.

Valuation swings have defined Klarna’s recent years. It peaked at $45.6 billion in 2021 before dropping to $6.7 billion in a 2022 funding round. More recently, shareholder Chrysalis Investments Ltd. estimated an implied valuation of around $14.6 billion.

With Klarna now preparing for a public debut, all eyes will be on how the market responds to one of fintech’s most closely watched listings. As volatility shakes up the IPO landscape, some firms are hitting pause—whether Klarna follows suit or stays the course could be the next twist in its journey to the public markets.

Check out more global Payments updates below👇, and I’ll see you again on Monday!

Cheers,

P.S. Next week, I’m heading to Las Vegas to attend FinTech Meetup. It’s all about networking (and, let’s be honest, a few good parties 🥂). Hope to see you there!

SPONSORED CONTENT

Hear from the top voices building pay by bank for the U.S. financial system. Find out what's new, what's unique and what the solution looks like at scale.

INSIGHTS

🇳🇱 The Ecommerce Playbook 2025 by Mollie. This comprehensive resource features more than 200 actionable tips designed to boost sales, enhance customer retention, and refine strategies. The playbook is available for immediate download with no forms or emails required, providing essential insights for success in the coming year and beyond.

PAYMENTS NEWS

🇺🇸 FinTech Meetup: The Must-Attend Financial Event of the First Half of the Year. FinTech Meetup is attended by CEOs and senior leaders from thousands of banks, credit unions, FinTechs, serving the US market.

The event hosts the sector’s most valuable and productive meetings program, using groundbreaking technology to power 50,000 one-to-one meetings. It offers unparalleled opportunities to build partnerships across the FinTech ecosystem.

The agenda addresses the industry’s biggest challenges and opportunities – across payments, lending, banking, AI, blockchain and more. The impressive line-up of speakers includes 135+ CEO’s from the leading financial institutions and FinTechs. Every session is meticulously curated to maximize attendees’ time and enjoyment. Get tickets here

🇦🇺 Airwallex removes complexity for the creator economy with embedded finance tools. Projected to reach a $525B valuation by 2030, the creator economy is rapidly growing. To support this, Airwallex is launching new tools to help platforms meet demand with seamless, intuitive financial solutions.

🇬🇧 Wise upgrades London office space as expansion continues. The money transfer business is moving into new global headquarters at Worship Square building in Shoreditch that offers flexible office spaces and in-house wellbeing amenities. Wise will occupy five of the eight floors for its over 1,000 local employees.

🇧🇷 Pix introduces new Security Measures and updates rules for Random Keys. These changes aim to enhance user safety and improve the overall security of transactions. The update includes stricter regulations for the creation and management of random keys, which are used for identifying payment accounts in the system.

🇦🇪 Verto secures payment licences in five regions. These licenses granted by the DFSA (UAE), individual US state regulators, and African financial authorities strengthen Verto’s ability to provide regulated money transfer services, foreign exchange, and local account solutions for businesses operating in these markets.

🇬🇧 Visa and Mastercard face UK regulatory action over lack of competition. The regulator’s plan to impose “remedies” on the card providers is the latest attempt to loosen the grip of Visa and Mastercard on the payments sector, following complaints about the fees from merchants and retailers, and calls for more competition.

🇦🇪 Visa launches Tap to Add card in UAE. The solution allows cardholders to add their Visa contactless cards to digital wallets. It also eliminates the cumbersome process of manual entry, a common source of errors and a vulnerability exploited by fraudsters seeking to compromise sensitive card

🇨🇭 Nexi Group enables Swiss merchants to accept payments via WeChat. The 900 million+ active users of WeChat Pay can now make mobile payments via QR code on compatible POS terminals in Switzerland, accessing a familiar and convenient payment method while travelling in the country.

🌍 Pan-African Payment and Settlement System goes live. KCB and Bank of Kigali customers will now be able to send and receive cross-border payments using PAPSS. The service is fully operational and accessible via the banks’ mobile applications and branch networks, enabling seamless transactions across African borders.

🇦🇺 Google Wallet opened up for least-cost routing in Australia. ANZ and Suncorp Bank are the first two issuers live with eftpos multi-network debit cards in the Google Wallet, with other issuers to follow throughout 2025. Continue reading

🇦🇪 Adyen activates consumer donations in the UAE with Alshaya Group, Al Mana Fashion Group Sports Division and CAFU raising funds for UNHCR. This enables customers at select stores to effortlessly donate at checkout in support of UNHCR’s efforts to provide displaced families with safe shelter, meals, medical aid and more.

🇸🇬 Indian FinTech firm Razorpay expands into Singapore. The firm aims to support and scale the country’s thriving digital economy by offering seamless, secure and scalable payment solutions, powered by AI. This entry into Singapore follows the company’s successful operations in Malaysia, the firm states.

🇦🇱 Albania has entered the era of Open Banking with the successful completion of its first transaction under the new system. Open Banking allows for more transparent and efficient financial services by enabling secure sharing of financial data between banks and third-party providers.

🇬🇧 ProcessOut and Trustly team up to offer merchants smarter instant bank payments. This integration allows businesses to easily offer Trustly’s instant bank payment solutions, increasing conversion rates, reducing costs, and expanding into new markets.

🇺🇸 Finastra and i2c Inc. announce strategic partnership to offer debit card issuance and digital wallet solutions. Clients that move their processing to i2c will be able to offer their customers popular digital wallets such as Apple Pay, Google Pay, and Samsung Pay, as well as improved features such as cardholder alerts and controls.

GOLDEN NUGGET

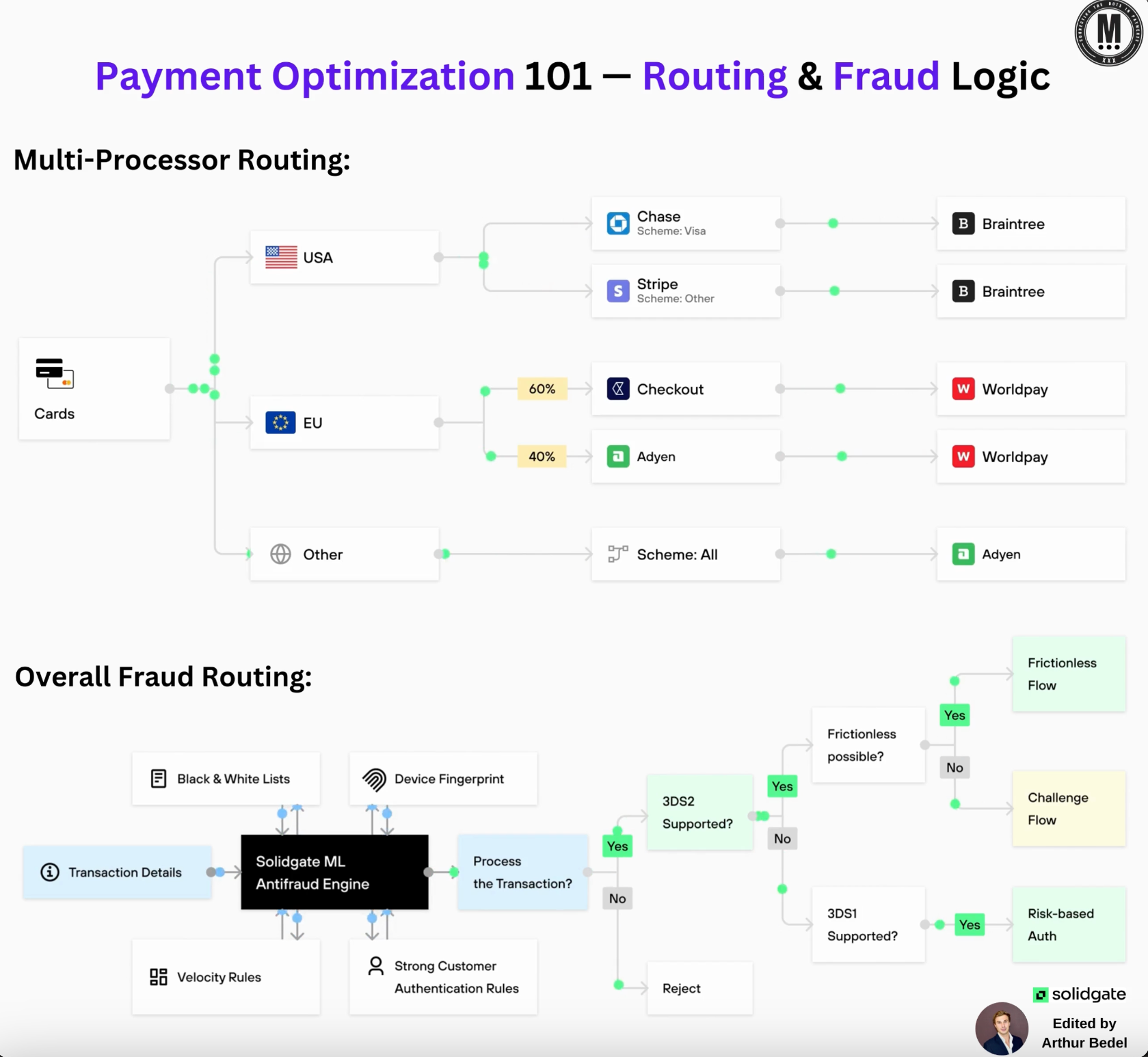

Payment Optimization 101 — Optimize routing, Improve Conversion, Beat Fraud

For any business, accepting payments is a must. Everyone needs to and yet not every business focuses on optimizing their payment strategy and stack in general. Payment optimization is a never-ending process. Perfection may not exist but optimization does.

𝐀𝐜𝐡𝐢𝐞𝐯𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧: 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐚𝐧𝐝 𝐏𝐫𝐨𝐜𝐞𝐬𝐬

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞: To optimize payments, businesses must first establish a robust infrastructure capable of handling high volumes of transactions reliably and securely. This means using a scalable and flexible payments platform that supports multiple payment gateways, Payment Service Providers (PSPs), and processors. Such a setup enables businesses to dynamically select the best routes for transactions.

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧: Streamlining processes such as reconciliation, settlement, and dispute management is critical. By using automated tools for transaction management and real-time reporting, businesses can reduce manual errors, speed up payment processing times, and reduce costs.

𝐇𝐨𝐰 𝐭𝐨 𝐁𝐮𝐢𝐥𝐝 𝐑𝐞𝐝𝐮𝐧𝐝𝐚𝐧𝐜𝐲 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

► 𝐌𝐮𝐥𝐭𝐢-𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫 𝐒𝐞𝐭𝐮𝐩: Instead of relying on a single payment processor, businesses should integrate with multiple Payment Service Providers (PSPs) and payment processors. The key is to develop a smart routing engine that can switch between these providers based on availability, transaction success rates, or specific business rules

👉Automatic Fallback: In cases where the primary processor is unavailable or experiencing downtime, the system should automatically route transactions to a backup processor.

► 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐑𝐚𝐢𝐥𝐬: Having redundancy at the infrastructure level also means leveraging multiple payment rails. For example:

👉 Card Networks (Visa, Mastercard, etc.)

👉 Bank Transfers (ACH, SEPA, etc.)

👉 Alternative Payment Methods (e-wallets, BNPL options) By having the option to route payments across these different rails, you can reduce dependency on any one system.

► 𝐌𝐨𝐧𝐢𝐭𝐨𝐫𝐢𝐧𝐠 & 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬: Implement robust real-time monitoring systems to track the performance of each processor and payment rail. Payment orchestration platforms often have built-in tools to automatically redirect transactions based on latency, decline rates, or technical failures.

𝐌𝐢𝐧𝐢𝐦𝐢𝐳𝐢𝐧𝐠 𝐅𝐫𝐚𝐮𝐝 𝐰𝐢𝐭𝐡 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 𝐋𝐨𝐠𝐢𝐜

Fraud minimization is another important aspect of payment optimization, and this can be achieved through intelligent routing logic. This involves:

► 𝐃𝐲𝐧𝐚𝐦𝐢𝐜 𝐅𝐫𝐚𝐮𝐝 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧: Routing logic can integrate with fraud detection tools that assess each transaction in real-time. Depending on risk factors like transaction amount, customer location, and past behaviors, payments can be routed to processors with specialized fraud protection protocols.

► 𝐆𝐞𝐨𝐥𝐨𝐜𝐚𝐭𝐢𝐨𝐧-𝐁𝐚𝐬𝐞𝐝 𝐑𝐨𝐮𝐭𝐢𝐧𝐠: By identifying the geolocation of transactions, payments can be routed through processors that have specific fraud mitigation capabilities for that region. Additionally, region-specific compliance, such as 3D Secure in Europe, can be applied to reduce the risk of fraudulent transactions.

► 𝐁𝐞𝐡𝐚𝐯𝐢𝐨𝐫𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐌𝐚𝐜𝐡𝐢𝐧𝐞 𝐋𝐞𝐚𝐫𝐧𝐢𝐧𝐠: Using advanced AI-driven analytics, businesses can track suspicious patterns in payment behavior and route high-risk transactions through stricter fraud filters while sending low-risk transactions via faster, cost-effective routes.

Start optimizing your payment stack and strategy today, there are millions / billions at hand.

Source: Solidgate

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()