Klarna & Zoom Roll Out Flexible Payments in 16 Markets

Hey Payment Fanatic!

Klarna is partnering with Zoom to offer flexible payment options for Zoom Workplace across the US and multiple European markets. Now, customers in 16 countries can manage Zoom subscriptions with Klarna’s Pay Now feature, and Pay Later options are available in the US, Sweden, and Germany.

David Sykes, Klarna’s Chief Commercial Officer, shares: “Our goal is for Klarna to be at every checkout. With Zoom Workplace, we’re expanding access to collaboration tools without upfront costs, broadening our reach across markets.”

This initiative boosts both platforms’ ecosystems and aligns with the $1.5 trillion global subscription economy projected by 2025. Zoom joins brands like Airbnb and Uber in launching Klarna's services globally, making collaboration more accessible worldwide.

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

ACI Worldwide Study reveals Real-Time Payments to boost Global GDP By $𝟮𝟴𝟱.𝟴 𝗕𝗶𝗹𝗹𝗶𝗼𝗻, Create 𝟭𝟲𝟳 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 𝗡𝗲𝘄 𝗕𝗮𝗻𝗸 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 holders by 2028.

PAYMENTS NEWS

🇯🇵 Tokyo-based Credit Engine joins PayPay Group. The transition follows a share transfer agreement completed last week. The Credit Engine Group offers digital lending and debt collection services and will continue its operations within the PayPay Group.

🇺🇸 Zelle reportedly wants users to use its platform via banking apps instead of its own. An executive for the peer-to-peer payments provider told Reuters last week that while more than 2,200 banks and credit unions are part of its network, just 2% of Zelle transactions happen on its mobile app.

🇸🇬 HitPay launches single switch to 9 APAC real-time payment schemes, enabling flexible, cost-effective cross-border payments for businesses, while allowing them to offer preferred payment methods with seamless interoperability. Discover more

🇳🇬 Bamboo diversifies into remittances, launches Coins by Bamboo to crash remittance cost. The platform announced this in a statement seen by Technext. The move effectively marks Bamboo’s diversification from its primary investments business into remittances.

🇪🇺 Global payments FinTech Remitly expands Seafarers product experience to the EU, UK, Australia, and Singapore. With this launch, Remitly stated their aim is to provide even more seafarers with the reliable, secure, and accessible money transfer service they deserve.

🇸🇬 Bitget launches Bitget Pay, a 0-Fee peer-to-peer instant crypto payment service. This new service allows users to complete transactions in seconds, supporting a wide range of cryptocurrencies, including BTC, ETH, and USDT. More on that here

🇬🇧 Nick Candy-backed VibePay scoops £5M and pinches Klarna executive. The funds will be used to find its new insights unit and other product development. VibePay, which combines messaging with open banking-powered peer-to-peer payments, has appointed Klarna executive Conor Tiernan to head up its new insights unit.

🇺🇸 JP Morgan affiliates to pay $151 million to resolve SEC enforcement actions. The SEC charged J.P. Morgan Securities and J.P. Morgan Investment Management Inc., in five enforcement actions for misleading disclosures, breach of fiduciary duty, prohibited joint transactions, principal trades, and failing to act in customers' best interests.

🇺🇸 Fiserv and Clover serve up new tools for small businesses. The new solutions include new hardware, such as Clover Compact and Flex Pocket, that further build on the Clover hardware suite, providing business owners with greater freedom in how they accept payments.

🇺🇸 Credit and Debit Cards Ate Cash. So what’s eating cards? Card payments in the U.S. are no longer growing twice as fast as personal consumption: what that means for the business of plastic. Learn more in this WSJ article

GOLDEN NUGGET

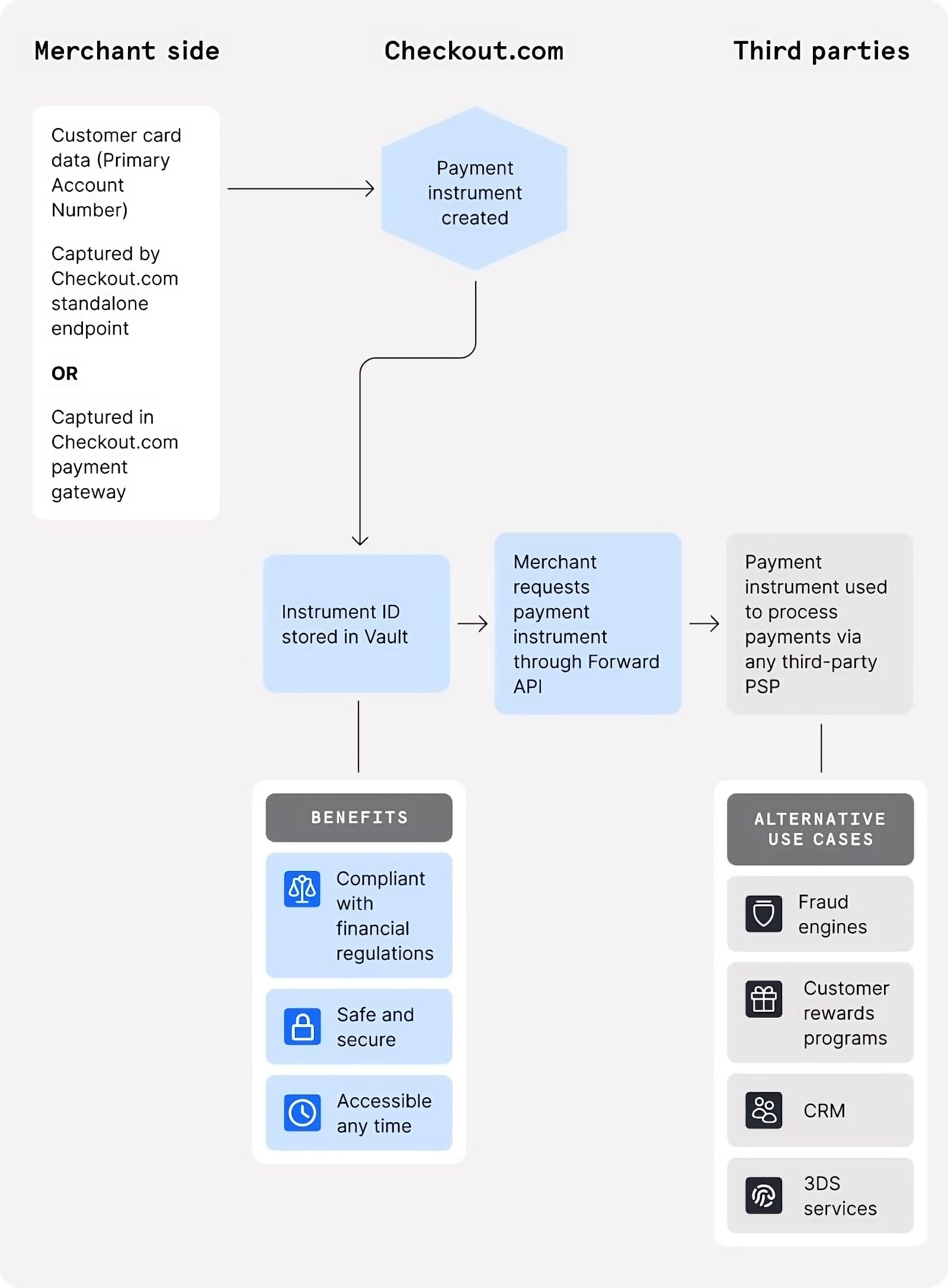

How to use a vault in Payments?

Let's break it down in 6 simple steps:

Instead of storing customer payment data on your own servers, you can contract a third party to do it for you.

This is sometimes referred to as a payment vault service.

Not directly handling customers’ primary account number (PAN) during the payment flow ensures you remain at lower levels of PCI and other relevant regulations.

Here are the steps of using the Checkout.com Vault in your transaction lifecycle:

1️⃣ Payment details (PAN) captured via a payment gateway integration or standalone endpoint.

2️⃣ Checkout.com creates a Payment Instrument via the Checkout.com API. It’s then stored in the Vault, and assigned a particular ID.

3️⃣ The token is used in the payment, instead of the customer’s PAN.

4️⃣ The Real Time Account Updater automatically checks for updated card details (for instance, if the customer’s card is lost or expired).

5️⃣ The rest of the transaction lifecycle takes place.

6️⃣ Response delivered to the merchant. Additional data are available through API requests, to guide retry strategy if the payment fails.

You can also request the Payment Instrument for use in third-party services at any time via the Forward API.

Above you can see an illustration of the Payment Instrument creation, storage and retrieval flow.

I highly recommend the complete deep dive article by Checkout.com for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()