Klarna to Launch on Google Pay

Hey Payments Fanatic!

Starting next year, Google Pay users in the U.S. can choose Klarna’s interest-free payment options at checkout.

Klarna on Google Pay will provide U.S. consumers the option to pay for purchases starting at $35 in interest-free installments, as well as access to financing plans with competitive APRs.

Sebastian Siemiatkowski, CEO of Klarna, said;“We’re thrilled to bring our fair, flexible, and interest-free payment options directly to Google Pay users. This announcement moves us closer to our vision of having Klarna available at every checkout, everywhere, for everything, all the time. Together with Google, we’re making it easier than ever for millions of shoppers to choose Klarna, empowering consumers to shop confidently with a smarter, more transparent way to pay right at their fingertips.”

Drew Olson, Senior Director from Google Pay said; "People shop on Google more than a billion times per day, and consumers are increasingly looking for more choice and flexibility when it comes to their payment options. By teaming up with pay over time providers like Klarna, we are able to give Google Pay users more payment options when checking out, while providing merchants with another tool to drive growth.”

A lot of interesting news today! Enjoy more Payments industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

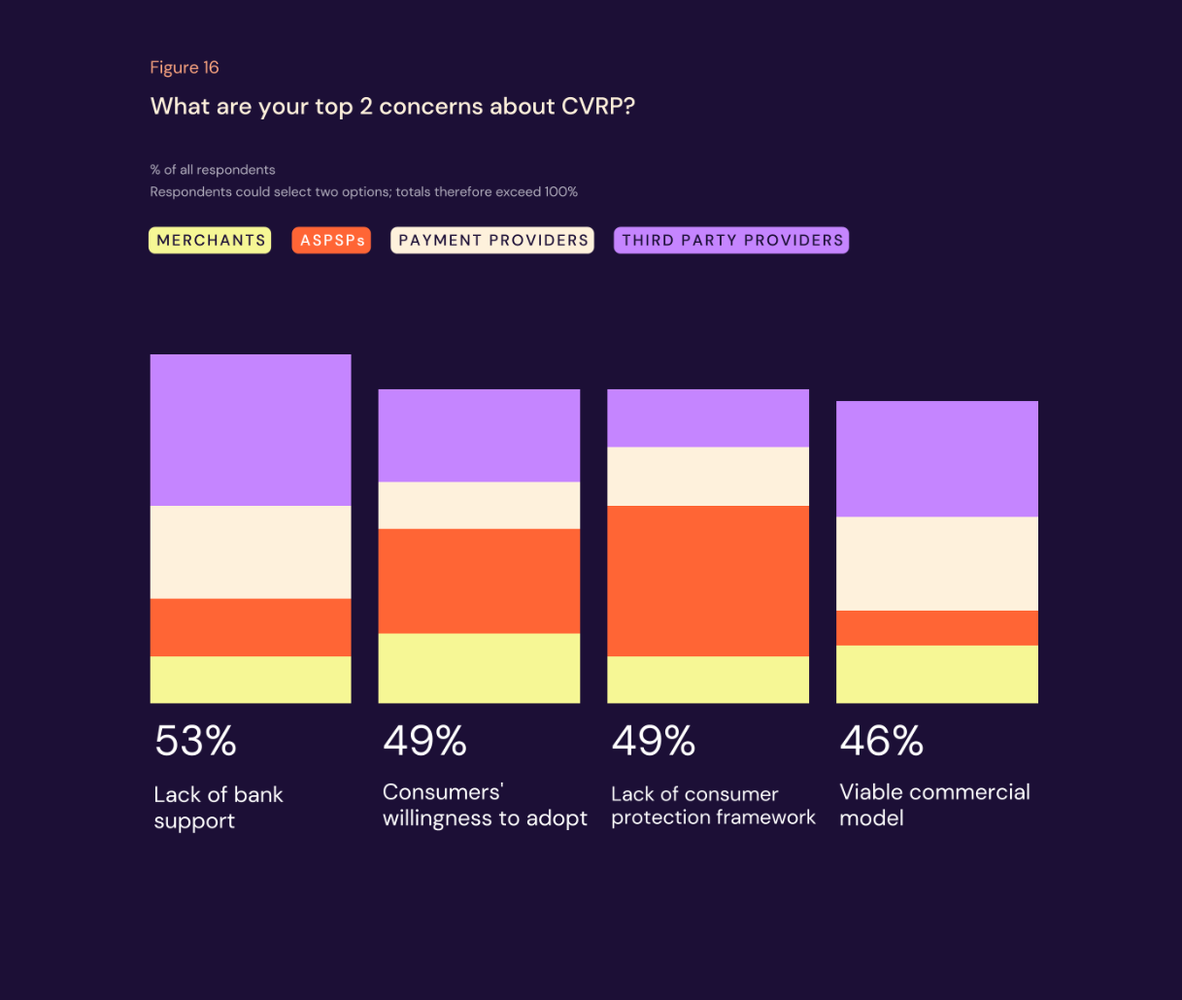

📊 Exploring the Future of Payments: Variable Recurring Payments (VRP), by Token.io👇

🇬🇧 Zing partners with Checkout.com to increase digital payment methods and support future product growth. The companies have partnered to integrate a suite of alternative payment methods into Zing's app, enabling members to top up using mobile wallets, Apple Pay, and Google Pay via Checkout.com’s global payment system.

🇦🇪 Stake implements AFTs to optimize costs and expands into new markets with Checkout.com. Stake, the first to implement Account Funding Transactions (AFTs) via Checkout.com in MENA, boosts payment efficiency and highlights Checkout. com’s leadership in enabling cross-border transactions to drive partner growth.

🇺🇸 FinTech unicorns are watching Klarna’s debut for signs of when IPO window will reopen. Last week, Klarna filed confidentially to go public in the U.S., ending months of speculation. While FinTech circles are buzzing, founders are watching the market, focusing on pricing and stock performance. Explore more

🇺🇿 TBC Uzbekistan announced the opening of an in-house processing centre as part of its continued investment in core infrastructure. This state-of-the-art centre will provide full control over payment processing workflows, enabling TBC to bring new products to market more quickly.

🇮🇳 LTIMindtree bags contract extension from Europe-based Nexi group. As part of this partnership, LTIMindtree will optimize Nexi's core platforms for better performance and scalability, while managing its hybrid infrastructure to seamlessly integrate on-premise and cloud solutions.

🇨🇦 FINTRAC registers Navro to operate its payments curation platform in Canada. This will enable the company to provide money transfer services to businesses in the country while continuing to focus on meeting the needs, preferences, and demands of clients in an ever-evolving market.

🇬🇧 Cardstream appoints Gurinder Sumra as new CFO. Gurinder will deploy “the art of the possible”, where partnerships and mergers and acquisitions can accelerate Cardstream’s impressive organic growth thanks to its game-changing products. Read on

🇬🇧 Modulr acquires accounts payable automation disruptor Nook. The acquisition deepens Modulr’s focus on developing comprehensive solutions that address the evolving needs of businesses. Following a short period of integration Modulr AP, powered by Nook, will launch in the first quarter of 2025.

🇬🇧 PayPal PYUSD to bring speed and reduced costs to cross-border payments with Xoom. PayPal announced it will be enabling disbursement partners to use PayPal USD (PYUSD) to settle cross-border money transfers made with Xoom, A PayPal Service.

🇬🇧 Payhawk partners with J.P. Morgan to drive payment innovations. “Our strategic focus on medium-sized and large companies in traditional industries requires the highest standards and trust in our banking partners,” Payhawk CEO and co-founder Hristo Borisov said. Read more

GOLDEN NUGGET

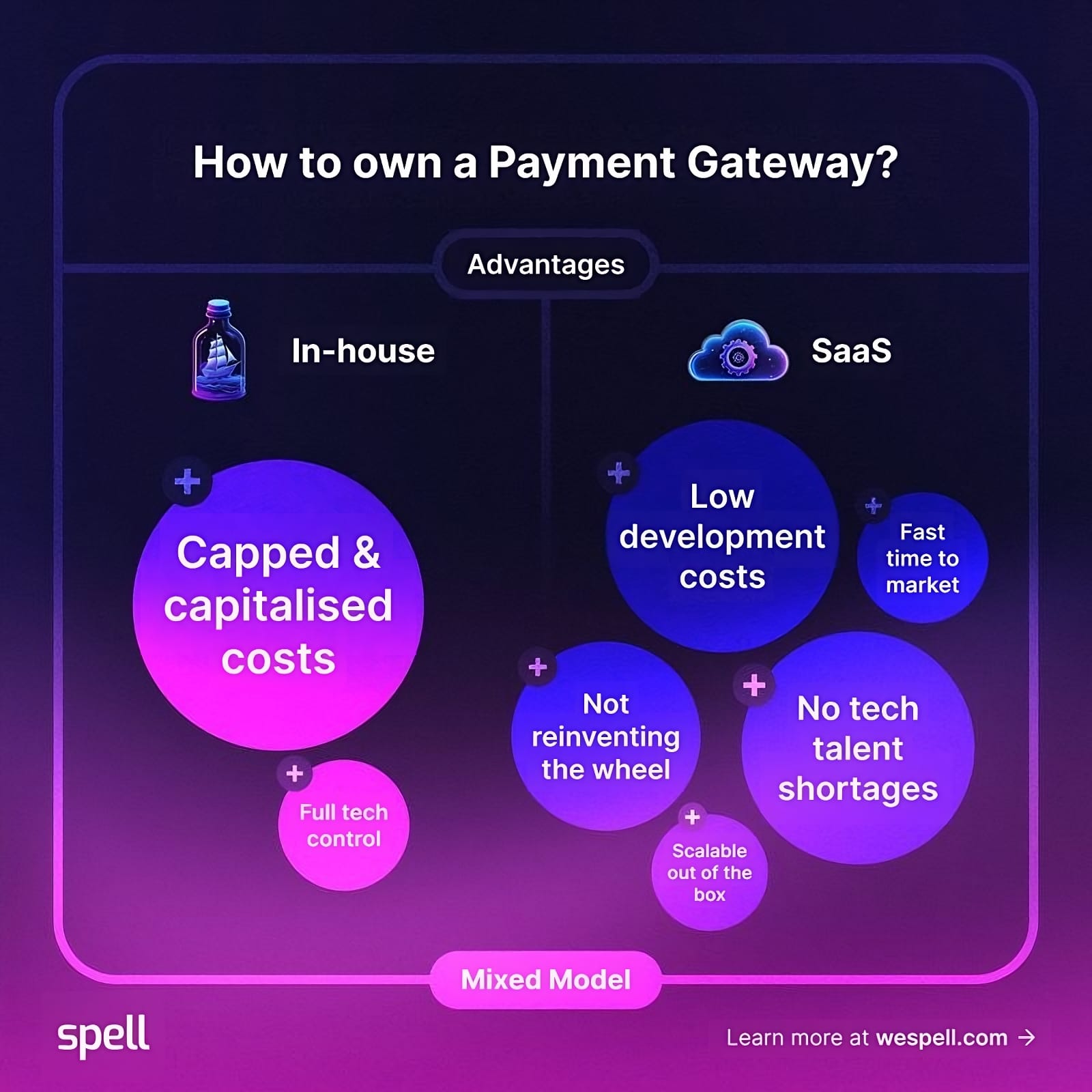

In House Payment Gateway 🆚 White Label SAAS.

Let's dive in:

Deciding between building an in-house Payment Gateway or using a white-label SaaS solution can be pivotal for businesses looking to launch their payment processing services or layer.

In short, there are basically 𝟯 𝗼𝗽𝘁𝗶𝗼𝗻𝘀 to consider:

1️⃣ 𝗜𝗻-𝗛𝗼𝘂𝘀𝗲 𝗚𝗮𝘁𝗲𝘄𝗮𝘆: Full control but with high costs, long development & go-to-market time, IT talent challenges with IT talent, security, and tech compliance.

2️⃣ 𝗪𝗵𝗶𝘁𝗲-𝗟𝗮𝗯𝗲𝗹 𝗦𝗮𝗮𝗦: Fast deployment, cost-effective, and scalable IT talent challenges with IT talent, security, and tech compliance.

3️⃣ 𝗠𝗶𝘅𝗲𝗱 𝗠𝗼𝗱𝗲𝗹: Start with SaaS and transition to in-house components over time using a unique set of Spell API, getting the best from both models when you need it, keeping control of your IP, and capping SaaS costs.

I highly recommend the complete deep dive article by Spell for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()