Klarna Powers Payments for FINN’s Car Subscriptions

Hey Payments Fanatic!

The car subscription market is picking up speed, expected to hit €8.5 billion by 2025 with 33% annual growth. Klarna is now entering the space, teaming up with Germany’s FINN to make car subscriptions easier. FINN’s customers can use Klarna to manage their monthly payments and settle final invoices, making the process of driving without owning even smoother.

Since launching in 2021, FINN has been pushing all-inclusive car subscriptions, including insurance, maintenance, and roadside assistance into one fee. With over €100 million in equity raised and a second ABS financing round of up to €1 billion, the startup is scaling fast.

Klarna, already powering payments for Uber, Flink, and Instacart, is expanding further into the mobility sector—now supporting subscription-based startups, where flexible payments mean fewer cancellations and a more seamless experience for customers.

“Bringing our flexible and intuitive payment solutions into the fast-growing car subscription market empowers drivers to manage their payments effortlessly,” said Nico Schenck, Klarna’s Head of Germany.

Also, I’ve got to give a huge shoutout to Arthur Bedel for being nominated as MPE Influencer of the Year 2025! I’ve always believed in lifting others up in this space, and seeing Arthur get the recognition he deserves is a great moment.

He’s been putting in the work, sharing valuable insights, and helping shape the conversation around payments. If his content has ever made you think, sparked an idea, or helped you navigate the industry, go show him some support and cast your vote here!

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

PAYMENTS NEWS

🇺🇸 Athia, DEUNA’s Aware AI, Presents Payment Optimization: Maximizing Bottom-Line Impact in Real Time. The unified platform to simplify global payments & power next-gen commerce, presents a feature that optimizes merchants' payment strategy in real time by enabling merchants to optimize payment acceptance with dynamic routing, supporting region-specific payment methods for higher conversion, and implementing adaptive fraud prevention.

"The complexity of global payment systems requires a smarter, more adaptive approach," said Matias Rodriguez, General Manager and Global VP of Sales at DEUNA. "With Athia, we are enabling merchants to optimize their payment strategies in real-time, ensuring transactions are routed efficiently, fraud is proactively mitigated, and revenue potential is maximized."

🇺🇸 Affirm and Shopify have announced an expanded global agreement. The renewed multi-year partnership cements Affirm’s position as the exclusive pay-over-time provider for Shop Pay Installments. It also extends this exclusivity into Shopify’s home market of Canada and enables the partnership to continue growing into new markets worldwide.

🇧🇪 ING Belgium and Mastercard introduce 'Click to Pay'. The new payment solution allows online shoppers to use their payment cards without the need to manually enter their 16-digit card number or remember passwords. Read more

🇨🇳 Adyen and Eats365 partner to streamline payment solutions for F&B businesses. This collaboration will simplify operations for Eats365 merchants and users throughout the supported regions. It will also introduce a consolidated financial reporting system for F&B establishments.

🇵🇹 Eupago has seen an impressive growth of 2000%, just 2 months after giving access to the Bizum platform in Portugal. Currently, 75% of Eupago's transactions via Bizum come from Portuguese merchants. This success boosts Bizum's popularity and solidifies its role as a key payment method.

🇹🇼 Thunes expands real-time payments network to Taiwan. This expansion provides a real-time alternative to traditional cross-border transfers. It also strengthens Thunes‘ global network by establishing direct connections with banks, enabling faster and efficient transactions.

🇺🇸 Remitly reports fourth quarter and full year 2024 results. “We delivered an exceptional fourth quarter and full year, exceeding expectations, as our product strength and customer loyalty drove durable growth and improving profitability,” said Matt Oppenheimer, co-founder and CEO, Remitly.

🇦🇪 Tether leads $10m funding round for cross-border FinTech provider MANSA. With the funding, MANSA wants to expand its services in Latin America and Southeast Asia, where liquidity issues often slow down cross-border payments, the firm explains.

➡️ Stripe merchant of record is coming - According to JR Farr: "The wait is almost over. The next iteration with Stripe is coming." Read more

GOLDEN NUGGET

Welcome back to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 2👇

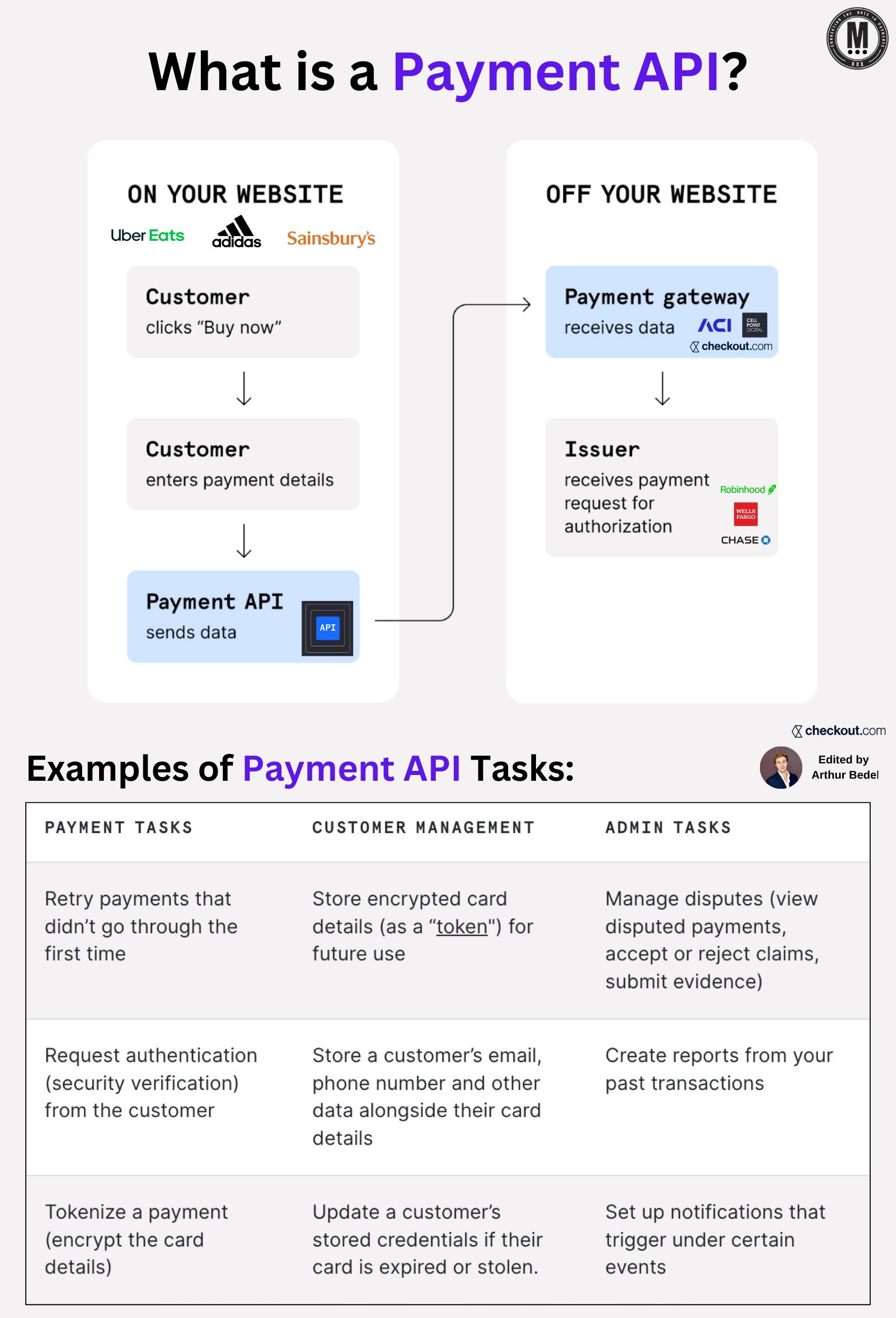

Topic #2: 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈?

► A 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈 is a technology that enables businesses to process digital transactions by seamlessly integrating with payment processors, gateways, and banks. It allows merchants to accept and manage online payments securely and efficiently by transmitting payment data between a website or app and financial institutions

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈 𝐰𝐨𝐫𝐤?

► When a customer makes a purchase, the Payment API securely transmits their payment details, enabling the following process:

1️⃣ Customer initiates a payment by clicking "Buy Now" and entering their payment details.

2️⃣ Payment API encrypts & transmits the data from the merchant’s website to a payment gateway.

3️⃣ Payment gateway forwards the request to the card issuer for verification.

4️⃣ Issuer authenticates the transaction, checking for sufficient funds and security validation.

5️⃣ Transaction is approved or declined, and the response is sent back via the payment gateway to the merchant.

6️⃣ Merchant notifies the customer of the successful (or failed) payment.

𝐖𝐡𝐚𝐭 𝐝𝐨𝐞𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈 𝐝𝐨?

► A robust Payment API offers more than just transaction processing. It helps businesses with:

✔ 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 — Accepting cards, e-wallets, & bank transfers

✔ 𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 — Implementing security checks and authentication

✔ 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 — Encrypting card details for secure storage

✔ 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧 & 𝐑𝐞𝐜𝐮𝐫𝐫𝐢𝐧𝐠 𝐁𝐢𝐥𝐥𝐢𝐧𝐠 — Managing automated payments

✔ 𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 — Handling chargebacks and payment conflicts

✔ 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 — Providing transaction reports and analytics

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈 𝐝𝐢𝐟𝐟𝐞𝐫 𝐟𝐫𝐨𝐦 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲?

While both are essential in digital payments, they serve different functions:

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈 — Acts as the technology bridge that allows businesses to integrate payments into their platform, offering flexibility and customization.

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 — A service that securely transmits transaction data between the merchant’s website and financial institutions, often offering plug-and-play solutions.

𝐓𝐡𝐞 𝐛𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐮𝐬𝐢𝐧𝐠 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐏𝐈:

✔ More control over the payment experience

✔ Seamless integration with business platforms

✔ Enhanced security & compliance

✔ Scalable for global transactions

✔ Supports multiple currencies & payment methods

Stay tuned for the next episode of 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 📚by Checkout.com.

I highly recommend following my partner Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()