Klarna Joins Apple Pay for Online and In-App Checkouts in Canada

Hey Payments Fanatic!

Klarna has expanded its reach to Canada, becoming the first BNPL provider available through Apple Pay in the country. The service allows eligible Canadian users to access Klarna's payment options when checking out with Apple Pay online and in apps, offering four interest-free installments or longer-term financing with competitive APRs.

This expansion follows Klarna's successful Apple Pay integration in the US and UK markets last month. Users can access the service by selecting 'Other Cards & Pay Later Options' during Apple Pay checkout on iOS 18 and iPadOS 18 or later, with authentication via Face ID or Touch ID.

Sebastian Siemiatkowski, Co-founder and CEO of Klarna states: "I am delighted that we are extending Klarna on Apple Pay to Canada. After the great reception we received from consumers in the US and UK last month, consumers in Canada will now have easier access to our fair, flexible and interest-free payments options when checking out on Apple Pay online and in apps."

Enjoy a long list of Payments industry news updates below, and I'll be back in your inbox with more tomorrow! 👇

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

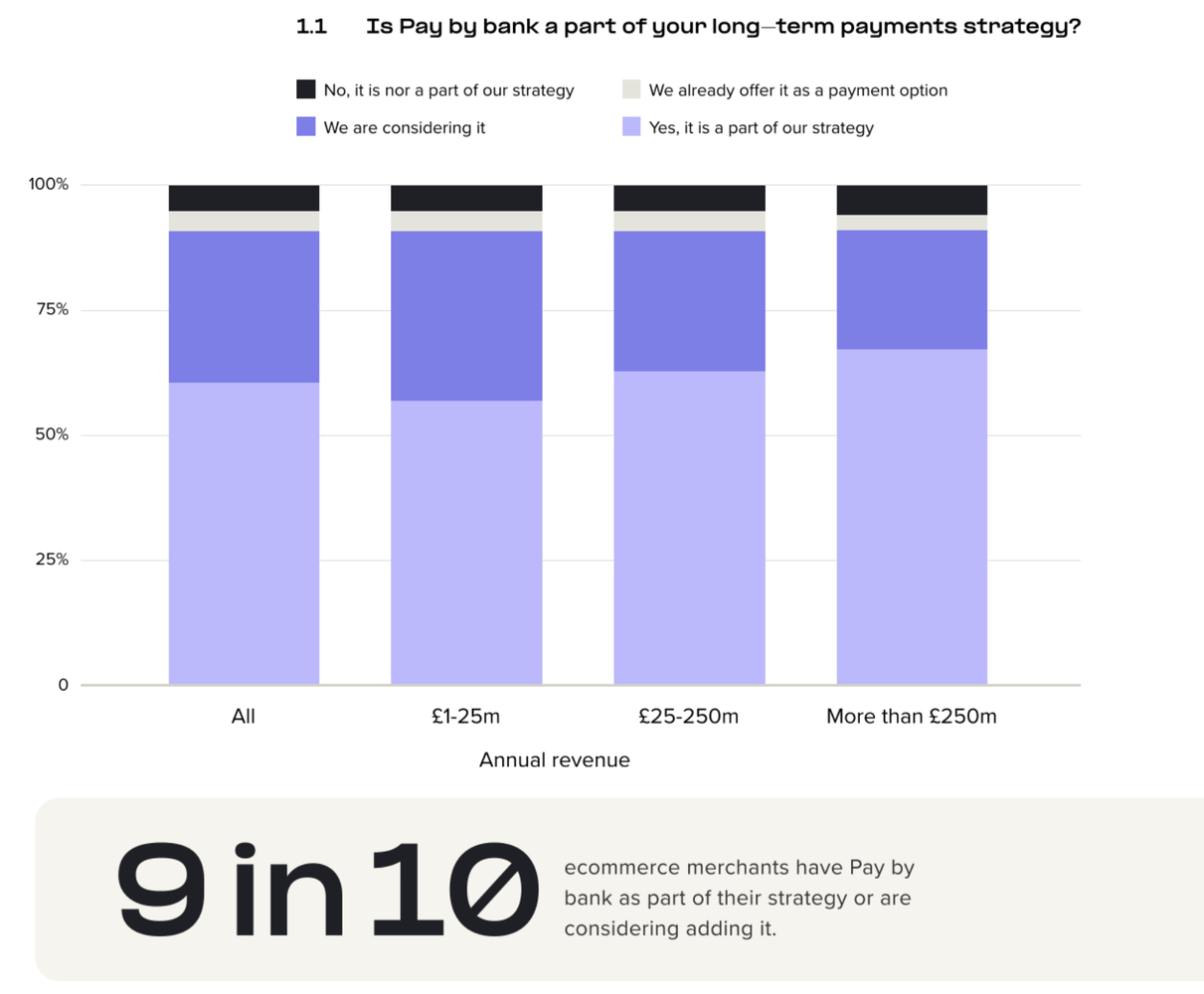

📊 Here is what online shoppers and Ecommerce Merchants think about Payments

In this report👇 you can find some insights from recent research by TrueLayer done in the U.K. 🇬🇧

PAYMENTS NEWS

🇬🇧 Curve optimizes fees to save £2.5 million a year with Checkout.com. Since 2020, Checkout.com has helped Curve overcome challenges, enhance payment performance, and cut costs. Looking ahead, Curve focuses on global expansion, new markets, and alternative payments, with Checkout. com as a key partner.

🇬🇧 Ecommpay Compliance expert names the themes shaping payments. The regulatory landscape for payments across Europe in 2025 is set to prioritise building trust, enhancing security and ensuring the reliability of payment ecosystems. With evolving technologies and increasing reliance on seamless payment systems, Willem Wellinghoff, Chief Compliance Officer at Ecommpay, says regulators are sharpening their focus on critical areas to safeguard the integrity of the payments infrastructure. Click here to access the full piece

🇪🇸 CloudPay & Banco Santander bring on-demand pay to SMEs in Spain. CloudPay's partnership with Banco Santander has brought Pay On-Demand to businesses of all sizes across Spain, enabling Santander’s SME customers to offer a service typically reserved for larger enterprises.

🇨🇦 Loop launches Canada’s first multi-currency credit card for SMEs. This will be one of the first corporate credit card solutions for Canadian businesses, allowing them to spend and settle credit balances in multiple currencies.

🇺🇸 Google Cloud and Swift have partnered to build an AI-powered fraud detection capability. The new tool aims to support the financial industry in tackling sophisticated financial crime and help prevent cross-border payments fraud. Rhino Health and Capgemini will support the partnership with secure AI tools and seamless integration.

🇺🇸 Klarna adds a dozen banks to US IPO roster as listing nears. Bank of America Corp., Barclays Plc, Citigroup Inc. and Deutsche Bank AG have been selected as so-called joint bookrunners on the Stockholm-based digital payments company’s listing, according to sources. Other banks have been tapped for junior roles on the IPO, sources said.

🇸🇪 Klarna fined $50mn and reprimanded by Swedish regulator. The regulator said on Wednesday that between 2021 and 2022 Klarna had “significant deficiencies”, such as not having any assessments of how its services could be used for money laundering or terrorist financing.

🇬🇧 Equals Group agrees to acquisition by investor consortium incl TowerBrook, J.C. Flowers, and Railsr shareholders, at approximately £𝟮𝟴𝟯 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 🤯 The deal, valued at approximately £283 million, will see Equals shareholders receive 140 pence per share, which includes a 135 pence cash consideration and a 5 pence special dividend.

🇳🇿 Fat Zebra acquires Pin Payments. This acquisition represents a significant milestone in Fat Zebra's commitment to providing exceptional payment solutions for businesses of all sizes across Australia and New Zealand. Continue reading

TikTok Shop Ireland 🇮🇪 and TikTok Shop Spain 🇪🇸 are both go for launch. TikTok Shop is giving local Irish sellers and Irish creators the ability to sell directly through shoppable content on the app. The Spanish community join the Irish gaining access to discover and shop directly from Spanish sellers and brands as TikTok Shop Spain opens for business. Read more

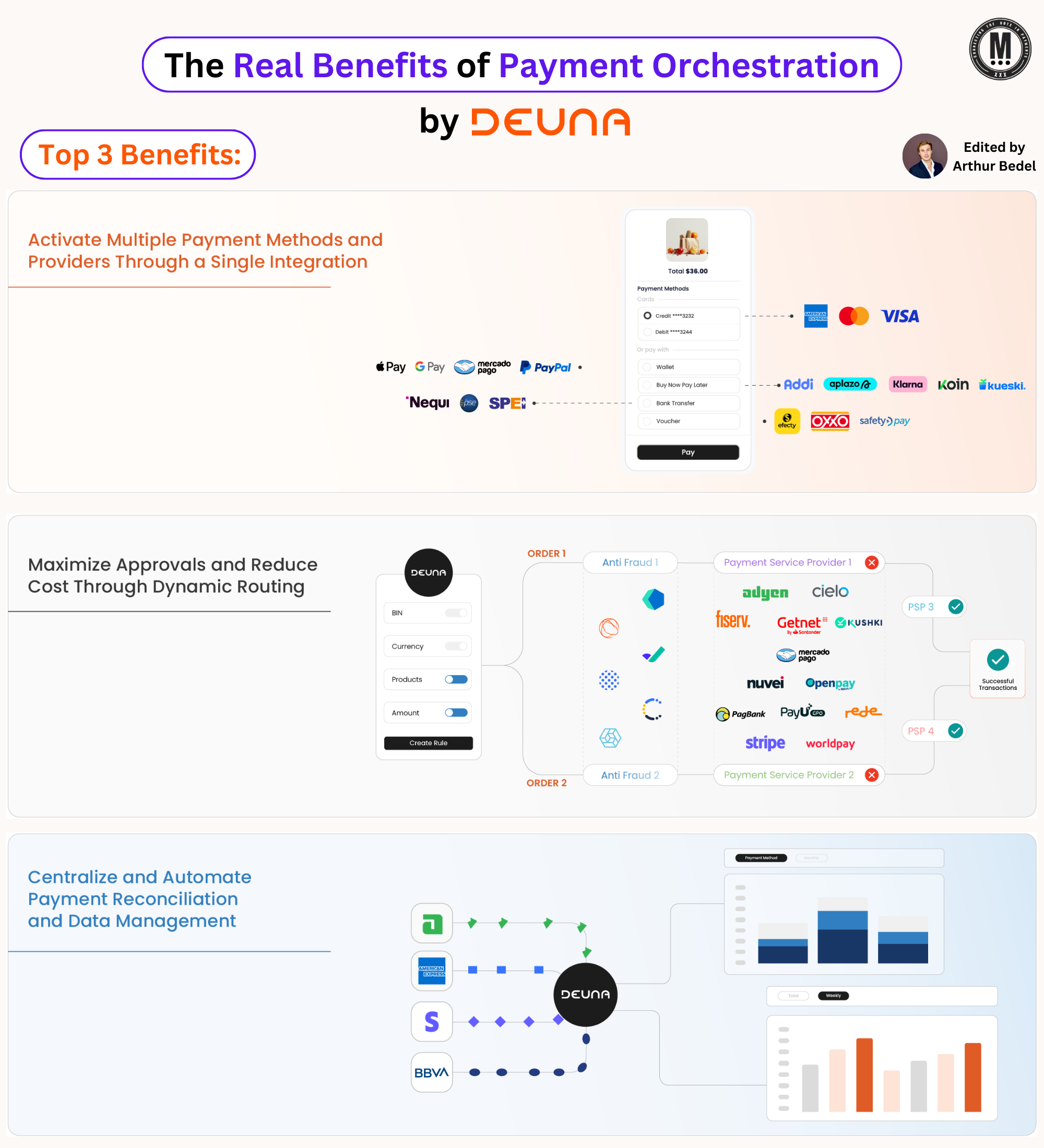

GOLDEN NUGGET

The 𝐑𝐞𝐚𝐥 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 of 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 (Hint: it's about about Data...)👇

Today's dynamic payments ecosystem requires more than just processing transactions. 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 goes beyond enhancing transactions — it's about enabling businesses to operate smarter and more efficiently across global markets.

► 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? — by DEUNA

At its core, it is the central nervous system for payments. It integrates multiple payment methods, gateways, fraud tools, and processors into a single, intelligent platform (sometimes intelligent). Ultimately, it is a super-gateway enabling:

🔸 𝐒𝐞𝐚𝐦𝐥𝐞𝐬𝐬 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐩𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠: Optimize routing and reduce latency across payment providers

🔸 𝐒𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲: Quickly adapt to new markets or integrate emerging payment methods

🔸 𝐃𝐚𝐭𝐚 𝐜𝐞𝐧𝐭𝐫𝐚𝐥𝐢𝐳𝐚𝐭𝐢𝐨𝐧: Collect standardized payment data for insights & decision-making

► 𝐇𝐨𝐰 𝐭𝐨 𝐁𝐮𝐢𝐥𝐝 𝐭𝐡𝐞 𝐁𝐞𝐬𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧

To unlock the full potential of Payment Orchestration, data must take center stage.

🔸 𝐂𝐞𝐧𝐭𝐫𝐚𝐥𝐢𝐳𝐞𝐝 𝐚𝐧𝐝 𝐒𝐭𝐚𝐧𝐝𝐚𝐫𝐝𝐢𝐳𝐞𝐝 𝐃𝐚𝐭𝐚 𝐂𝐨𝐥𝐥𝐞𝐜𝐭𝐢𝐨𝐧

* Consolidate payment information across regions, payment methods, and processors

* Standardized data structures allow for easier analysis, reporting, and strategic decision-making

🔸 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐃𝐚𝐭𝐚 𝐟𝐨𝐫 𝐒𝐦𝐚𝐫𝐭𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬

* Use real-time data to make informed decisions about transaction routing, fraud detection, and approvals

* Minimize failed transactions by dynamically selecting the most optimal payment routes

🔸 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐚𝐭𝐭𝐞𝐫𝐧 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

* Dive deeper into customer behavior by analyzing payment patterns

* Use insights to predict future trends, personalize experiences, and refine your payment strategy

🔸 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲 𝐚𝐧𝐝 𝐂𝐨𝐬𝐭 𝐒𝐚𝐯𝐢𝐧𝐠𝐬

* Reduce the burden of managing multiple integrations and technical connections

* Avoid downtime or bottlenecks with an architecture designed for resilience and scale

🔸 𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐝 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 𝐚𝐧𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐢𝐧𝐠

* Stay on top of regional and industry regulations with built-in compliance tools

* Automate reporting to save time and reduce the risk of costly errors

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 isn't just a technical solution. By integrating systems, centralizing data, and leveraging actionable insights, Payment Orchestration x AI has the potential empowers businesses at their core

The future of payments is data-driven, how far can this go with near unlimited transactional data available? 🚀

Source: DEUNA

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()