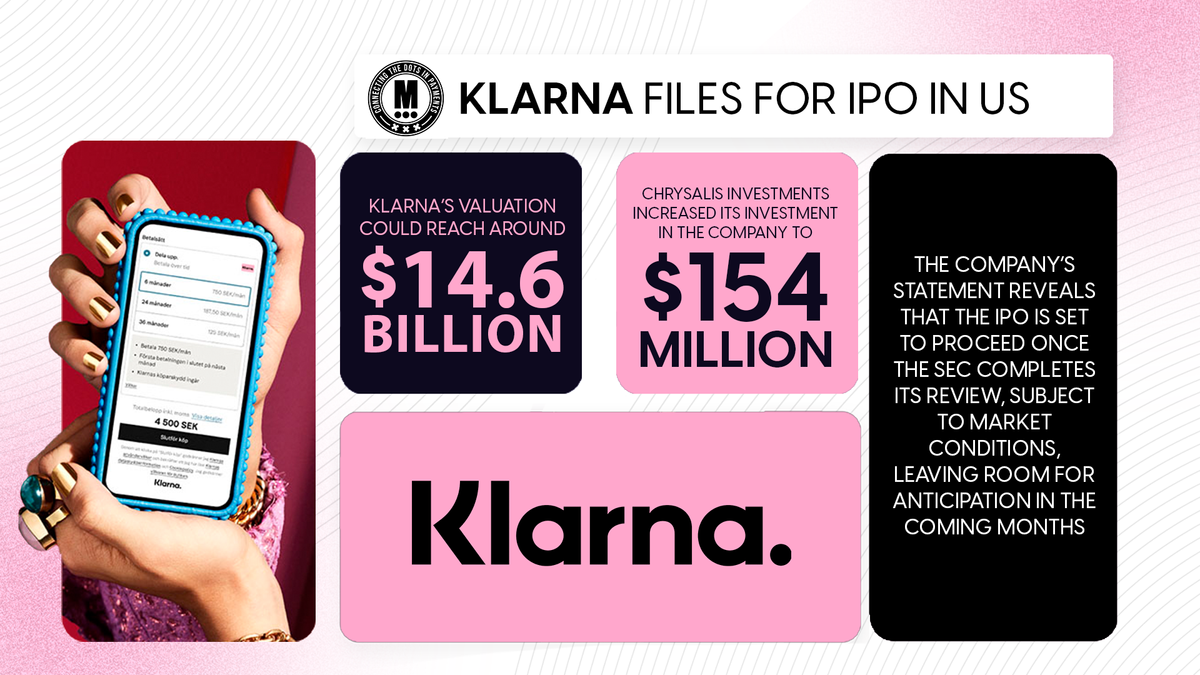

Klarna files for IPO in US

Hey Payments Fanatic!

Klarna, the BNPL powerhouse, has taken a decisive step towards the public markets by filing confidentially for an IPO in the US 🇺🇸. Months of speculation are now over, as Klarna submitted a draft registration statement to the Securities and Exchange Commission (SEC).

While the number of shares and price range remain undisclosed, recent analyst estimates suggest that Klarna’s valuation could reach around $𝟭𝟰.𝟲 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 after Chrysalis Investments raised its stake in the company to $154 million.

This is a marked recovery from its $6.7 billion valuation in the 2022 downround but still a far cry from the $45.6 billion it commanded at its 2021 peak.

The company’s statement reveals that the IPO is set to proceed once the SEC completes its review, subject to market conditions, leaving room for anticipation in the coming months.

Let's see how this plays out and if you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

P.s. Want to boost your brand's visibility in the digital banking, FinTech, and payments sectors? Join us as a partner and connect with a highly engaged audience eager for industry-leading insights. This is a unique opportunity. to showcase your brand directly to decision-makers and innovators in the space.

Ready to make an impact? Sign up here, and let's take your brand to the next level!

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

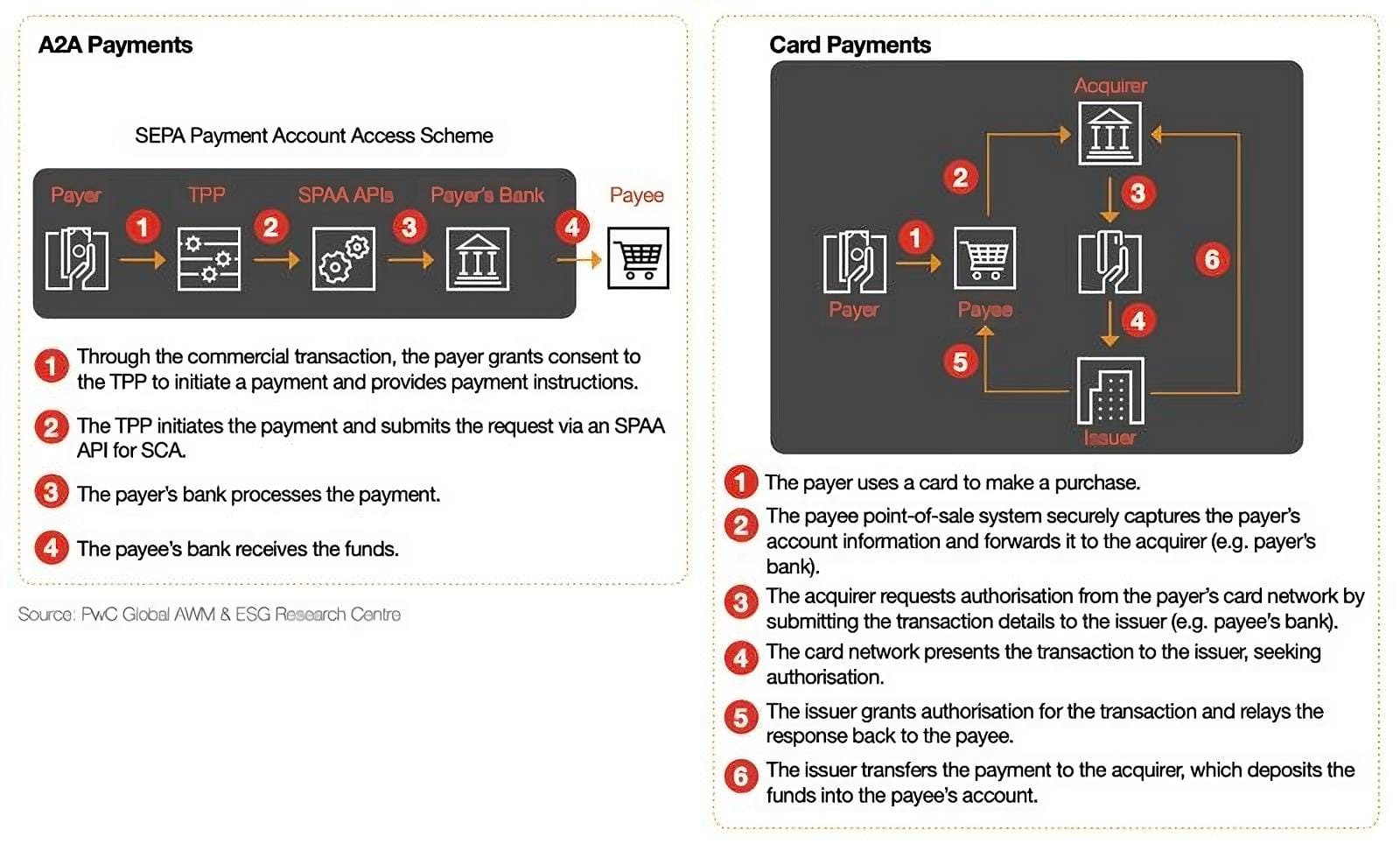

📊 Account-to-account (A2A) Payments emerge as a compelling alternative to the card payments landscape.

PAYMENTS NEWS

🇨🇦 Nuvei receives all regulatory approvals for going private transaction. The Company expects that, subject to the satisfaction of the remaining closing conditions at the time of closing, the Arrangement will be completed on or around November 15, 2024. Read more

🇳🇬 Ecobank, TransferTo forge strategic partnership for cross-border payments. The bank said the collaboration will create a safe, inclusive financial ecosystem that bridges markets, enabling swift reliable payments across borders and offers financial empowerment tools to millions of Africans and businesses.

🇦🇪 Mbank announces launch of Aani Instant Payment Platform. Aani’s Instant Payment Platform is set to transform digital payments in the UAE, aligning Mbank’s commitment with the UAE’s goal of offering trusted, secure, and instant payment solutions 24/7.

🇮🇪 Aryza forms deeper partnership with GoCardless. This collaboration evolves the existing technology relationship into a comprehensive partnership, including an introducer agreement across all Aryza platforms globally. More on that

🇺🇸 FIS and Oracle enhance utility billing experience. This collaboration aims to enable money to flow efficiently and securely while in motion, offering customers the flexibility and assurance they need in managing their utility bills.

🇬🇧 RedCompass Labs launches Payments AI to save banks millions. AnalystAccelerator.ai, the first applied AI tool for payment modernization, helps banks tackle challenges with insights from over 300 projects and the most extensive global payments documentation library.

🇺🇸 PXP Financial partners with US payments company North. The partnership enables PXP Financial merchants and partners to access another U.S. acquirer, supporting diverse sectors and complementing PXP's ongoing expansion in the U.S.

🇨🇳 Citi & Bank of Shanghai unveil payments solution for foreign travelers in China. With Bank of Shanghai’s TourCard solution powered by Citi, travellers can get access to local currency in China by linking a Bank of Shanghai CNY virtual account to their respective digital wallets in the Bank of Shanghai TourCard mini-app.

🇨🇦 PayPal USD links with LayerZero for transfers between Ethereum and Solana. LayerZero said that PYUSD now uses its Omnichain Fungible Token (OFT) Standard to allow the crosschain transfers, which will “enable users who self-custody their tokens to seamlessly transfer assets between blockchains.

🇳🇱 Prosus eyes PayU IPO in 2025 after stellar Swiggy listing. On Wednesday, the company described the market as a pillar for its investment business after the stellar listing of food delivery and quick commerce firm Swiggy netted it gains of $2 billion.

🇪🇺 BANCOMAT, Bizum, and SIBS MB launch EuroPA. The companies have enabled interoperability between their services and completed the first instant payment transaction, improving how customers make instant mobile payments using their preferred solution and a European infrastructure.

🇺🇸 Coinbase is acquiring the team behind Utopia, a stablecoin and payments startup that pivoted away from its core product last year, the company tells Axios exclusively. The Utopia Labs team will focus on building stablecoin-based payments directly into the Coinbase Wallet, with cross-border likely to be part of the product.

🇺🇸 Morgan Stanley Expansion Capital makes $20 Million investment in NovoPayment. The funding aims to fuel NovoPayment's ongoing growth, driving its scaling efforts and expanding its network of commercial partnerships. Read the full piece

GOLDEN NUGGET

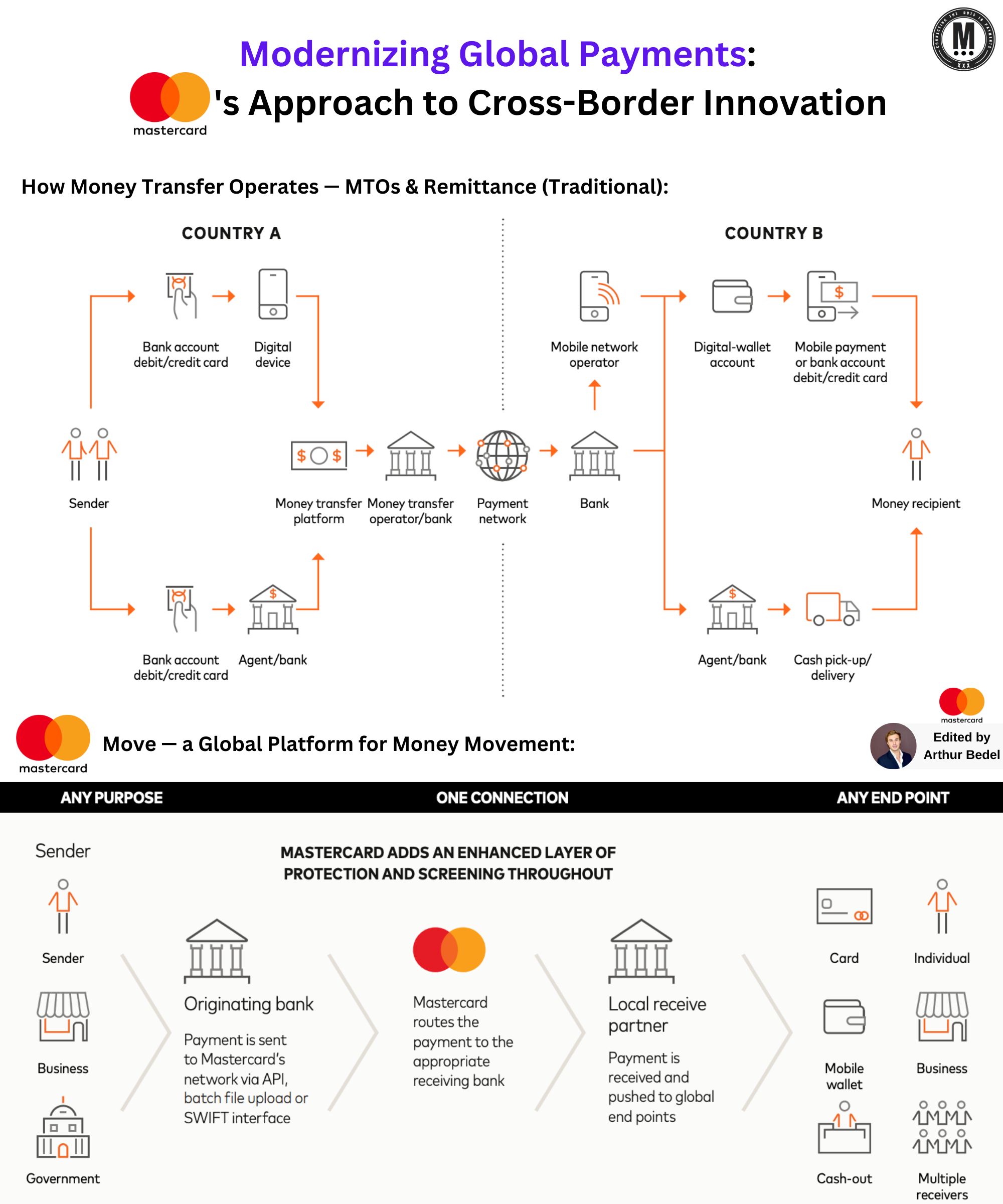

Mastercard 𝐌𝐨𝐯𝐞 — 𝐚 𝐧𝐞𝐰 𝐚𝐩𝐩𝐫𝐨𝐚𝐜𝐡 𝐭𝐨 𝐦𝐨𝐝𝐞𝐫𝐧𝐢𝐳𝐢𝐧𝐠 𝐜𝐫𝐨𝐬𝐬-𝐛𝐨𝐫𝐝𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬👇

Traditional cross-border payments are often slow, costly, and lack transparency— issues that can hold back global e-commerce, marketplaces and revenue in general. Mastercard Move is stepping up to address these challenges with real-time speed, lower costs, and clear, upfront fees.

𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬:

► 𝐁𝐚𝐧𝐤/𝐖𝐢𝐫𝐞 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬: Secure and widely used, but often costly, slow, and lacking fee transparency.

► 𝐌𝐨𝐧𝐞𝐲 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫 𝐎𝐩𝐞𝐫𝐚𝐭𝐨𝐫𝐬 (MTOs): Fast and accessible but with high fees and increased fraud risk, especially in cash-based transfers.

► 𝐂𝐚𝐬𝐡-𝐁𝐚𝐬𝐞𝐝 𝐑𝐞𝐦𝐢𝐭𝐭𝐚𝐧𝐜𝐞𝐬: Essential for areas with limited banking infrastructure, but prone to fraud and higher costs.

These legacy systems have long created delays and additional costs for businesses and individuals alike. Now, Mastercard Move offers a fresh approach, designed to empower global marketplaces and improve cross-border payments.

𝐖𝐡𝐲 Mastercard 𝐌𝐨𝐯𝐞 𝐢𝐬 𝐚 𝐆𝐚𝐦𝐞-𝐂𝐡𝐚𝐧𝐠𝐞𝐫:

► 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬: Enables same-day to real-time transfers across 10 billion+ endpoints like bank accounts, wallets, and cash-out locations.

► 𝐓𝐫𝐚𝐧𝐬𝐩𝐚𝐫𝐞𝐧𝐜𝐲 & 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲: Provides clear FX rates, upfront fees, and fast delivery with real-time status updates.

► 𝐆𝐥𝐨𝐛𝐚𝐥 𝐑𝐞𝐚𝐜𝐡: Operates in 180+ countries and 150+ currencies, making it accessible to millions.

► 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Mastercard's trusted network offers advanced fraud protection, ensuring safer transactions.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞:

Imagine a global marketplace enabling vendors in one country to receive payments from international buyers instantly, with lower fees and greater transparency. This improved payment experience means vendors get their funds faster, which strengthens trust and supports growth.

eBay / Etsy / StockX / Wayfair / Instacart / DoorDash / Uber

As the demand for digital payments soars, Mastercard Move is setting a new standard for seamless, secure, and fast cross-border payments, positioning global businesses for success!

Source: Mastercard

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()