iPhone Tap-to-Pay with USDC Coming Soon as Apple Opens Up NFC Technology

Hey Payments Fanatic!

iPhone users will soon be able to pay with USDC by tapping their device as Apple opens up development on its smartphone's secure payment chips to third-party developers.

Circle CEO Jeremy Allaire recently took to X to share the news, stating, “Tap to pay using USDC on iPhones incoming soon. Wallet devs, start your engines.”

The announcement follows Apple’s release of iOS 18.1, which includes a groundbreaking update: developers can now offer NFC contactless transactions using the Secure Element within their apps on iPhone, independent of Apple Pay and Apple Wallet.

This update paves the way for crypto developers to integrate blockchain-based payment solutions directly into iPhone apps. Allaire highlighted that, before this change, only Apple's Wallet app and the Apple Pay feature could access the NFC functionality on iPhones.

Now, a point of sale can communicate directly with an iPhone to specify a blockchain address for accepting USDC payments or the amount to be paid. The iPhone’s wallet app can then prompt the user for payment confirmation, utilizing features like FaceID, and initiate a blockchain transaction to settle the USDC.

By granting developers access to the NFC chip, Apple is also opening doors for the integration of other Web3 technologies, including NFTs and additional stablecoins, according to Allaire.

Apple has announced that its new APIs will be available to developers in Australia, Brazil, Canada, Japan, New Zealand, the United Kingdom, and the United States.

However, the company has yet to include the European Union and its 27 member states in this rollout.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📱 Stripe’s payments APIs: The first 10 years

Michelle Bu breaks it down for us:

🔸 Supporting card payments in the US (2011-2015)

🔸 Adding ACH and Bitcoin (2015)

🔸 Seeking a simpler payments API (2015 - 2017)

🔸 Designing a unified payments API (late 2017 - early 2018)

🔸 Introducing PaymentIntents and PaymentMethods (2018)

🔸 Launching PaymentIntents and PaymentMethods (2018 - 2020)

Explore the complete story here

PAYMENTS NEWS

🌐 D24 partners with Yuno to drive cross-border ecommerce. UK-based payment solutions provider D24 has joined forces with payments orchestrator Yuno to drive digital payments for cross-border businesses in LATAM, Asia, and Africa.

🇬🇧 Volt’s co-founder and Chief Growth Officer Jordan Lawrence steps down. In a LinkedIn post, Lawrence announced his decision to step down from his role to focus on family and explore new opportunities.

🇺🇸 Unit21 unveils new anti-fraud feature bundle for Automated Clearing House (ACH) transactions. These features use Generative AI (GenAI) and machine learning (ML) to help banks, credit unions, payments companies, and FinTechs proactively detect and block risky transactions.

🇺🇸 D-Tools launches embedded payments solution for D-Tools Cloud. D-Tools Payments, free for D-Tools Cloud users, offers a seamless, secure, and compliant payment system with intuitive onboarding, transparent transaction fees, and faster ACH payments.

🇦🇺 Limepay, the recently acquired company of Spenda, has executed a master services agreement with Lessn to acquire and process its entire payment volume, utilising Limepay’s transaction processing gateway. The agreement immediately lifts Limepay’s payment volumes by around 40% to about $167 million per annum, and further underpins Spenda’s strategic rationale in acquiring the Limepay business.

🇺🇸 Mastercard plans to cut 3% of staff worldwide amid overhaul. That would work out to about 1,000 people, based on its reported employee count at the end of last year. Read the full article for further information

🇳🇬 Waza, a Nigerian Y Combinator-backed B2B payment and liquidity platform has secured $8 million in equity and debt funding to expand into new markets. This significant capital injection is expected to bolster Waza’s efforts in expanding its operations and enhancing its platform.

GOLDEN NUGGET

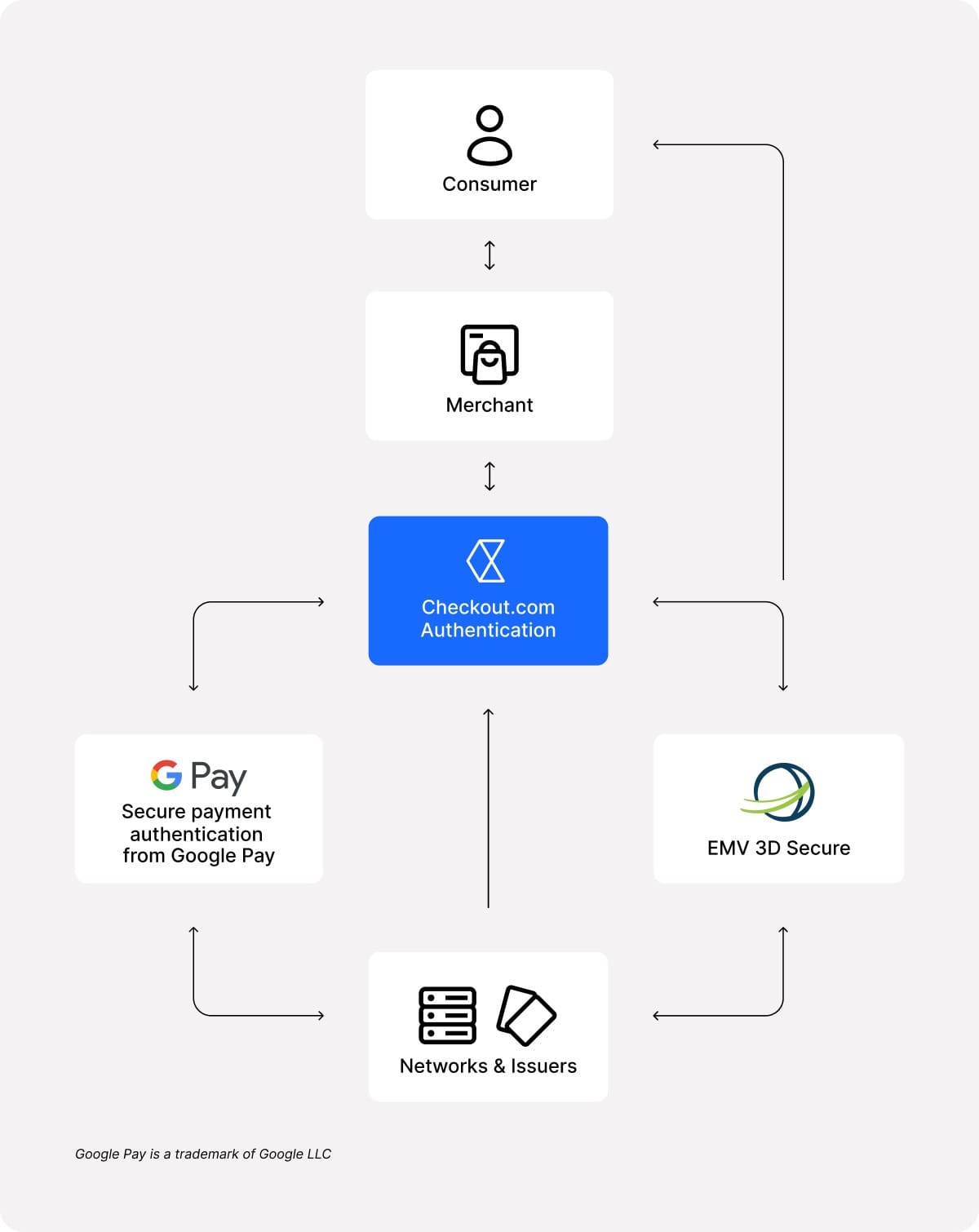

Google Pay to bring its biometric-based secure payment authentication service to merchants via Checkout.com 👇

Today, Payment Service Providers (PSP) are able to offer authentication services to merchants (3DS). Google Pay is bringing a new authentication service to its user experience seeking to increase digital payments performance and speed up authentication for customers. Checkout.com is the first payment provider selected by Google Pay to bring those authentication services to the payment method.

New Google Pay + Authentication Flow:

🔸 A cardholder goes to a merchant website and makes a purchase

🔸 Checkout.com routes the authentication request during Google's API

🔸 Cardholder selects verify now

🔸 Cardholder is verified using on device native biometrics

🔸 Cardholder completes purchase

✔️

This process offers a streamlined alternative to other authentication methods, where a customer verifies their identity with a one-time passcode and, in the process, is often redirected to multiple different pages.

By integrating with the secure payment authentication service from Google Pay, Checkout.com will offer device biometric checks like a PIN, password and facial recognition to speed up the checkout process for merchants, increase acceptance and authentication performance, and drive higher conversion rates at the checkout. In its initial roll-out, the integration with the secure payment authentication service has already proven successful.

eSky Group, a B2B travel booking company on Checkout.com's platform, reported a 14 second reduction in checkout time, as well as a 5 percentage point uplift in authentication rate and 3 percentage point uplift in the authorization success rate, compared to the 3DS alternative.

Digital Wallets are bringing new authentication solutions and continue to be disruptive and innovative. ApplePay has been a pioneer to bypass 3DS. The space keeps moving!

——

Source: Checkout.com

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()