iOS 18 will let you use Apple Pay on any browser on any PC

Hey Payments Fanatic!

Apple has announced that Apple Pay support at checkout will soon be available across all desktop web browsers on all platforms, including Windows.

During the recent WWDC event, Apple introduced a new strategy to extend Apple Pay support beyond the Safari browser and the Mac OS ecosystem.

However, this approach offers a different user experience than what Apple Pay users are used to.

When Apple's JavaScript object detects a non-Safari browser, it presents the user with an elegantly designed QR code to complete the transaction.

The user can then scan the QR code with their iPhone and use the familiar Apple Pay process to finalize the purchase.

This workaround is necessary as many browsers do not natively support Apple Pay and likely won't in the future.

Although it is a practical solution, it isn't as seamless as the traditional Apple Pay experience and requires some consumer adaptation.

One limitation is that this feature only works on iOS 18 and later. While this won't be an issue in the long term, in the short term, there will be many unsupported devices.

iOS 18 is expected to be released in September.

You can test this functionality in any environment by visiting this Apple-created page.

Cheers,

INSIGHTS

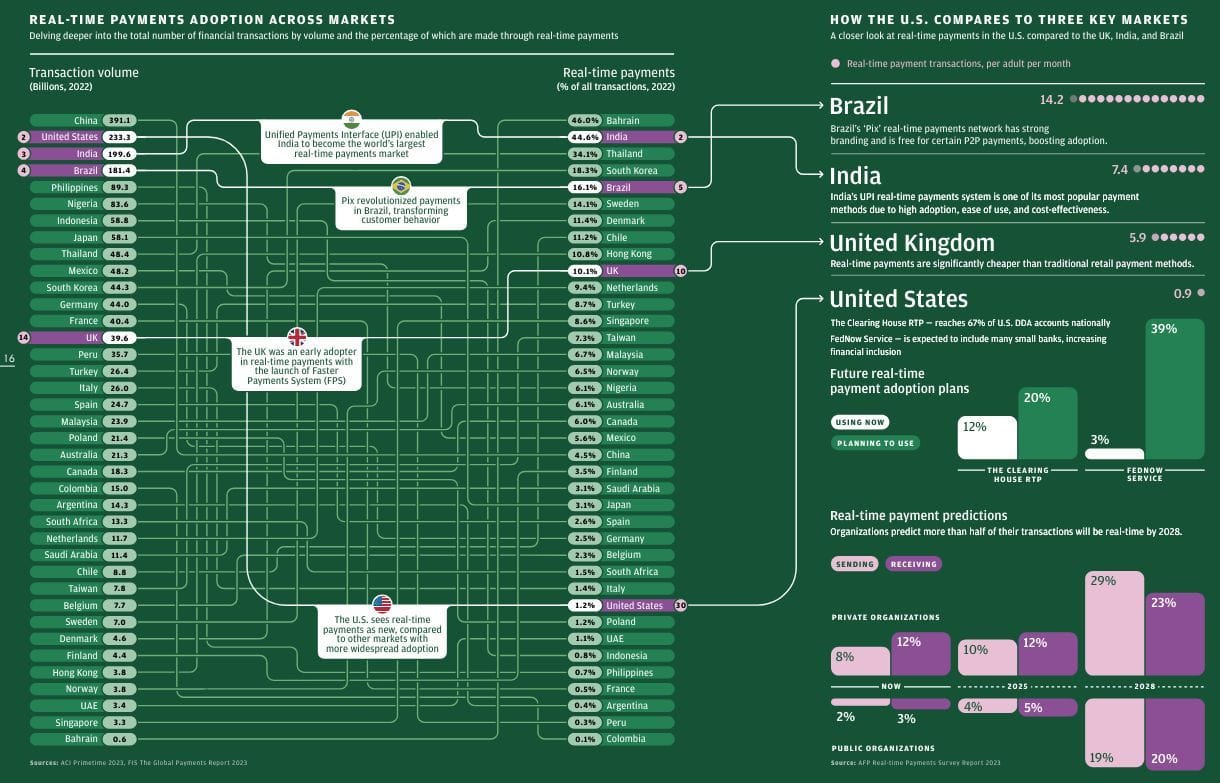

Over the past 15 years, over 50 markets have developed Real-Time Payment systems to reduce digital payment friction.

Despite the advantages, merchant adoption varies:

PAYMENTS NEWS

🇺🇸 𝗔𝗽𝗽𝗹𝗲 𝗸𝗶𝗹𝗹𝘀 𝗣𝗮𝘆 𝗟𝗮𝘁𝗲𝗿 𝗳𝗲𝗮𝘁𝘂𝗿𝗲. Two years after it was announced at WWDC, Apple’s U.S.-only Pay Later feature is no more. Here is a statement in which the company explains why the service is being discontinued in the U.S. and how installment loans will now be offered globally through Apple Pay in collaboration with banks and lenders.

🇺🇸 Momnt announces appointment of Chris Bracken as Chief Executive Officer. Bracken formerly served as Momnt’s Chief Revenue Officer and brings significant consumer lending experience and will help Momnt capitalize on recent disruptions in the moment-of-need lending industry.

🇺🇸 Elavon to provide BMO Bank with Payment Solutions Platform. The partnership allows for “the acceptance, enablement and optimization of credit, debit, and digital payment transactions.” Additionally, it aims to offer secure, scalable payment solutions for BMO’s U.S. SMBs, corporate enterprises, and capital markets clients.

🇲🇽 MercadoLibre's FinTech arm sees credit-card reader boom in Mexico. Latin American e-commerce giant MercadoLibre's FinTech arm, Mercado Pago, has seen adoption of its slim mobile credit-card readers more than double in the past year, gaining on competing options from banks and Clip, an executive said.

🇪🇸 Spain's Sabadell has postponed the completion of the sale of its retailers' payments business to Nexi, after becoming the target of a hostile takeover by BBVA. "The plans are expected to continue as soon as the outcome of the takeover bid is clarified," a source said.

🇮🇹 Nexi, a European PayTech, and Engineering Group will develop a business partnership in digital banking named NOVA, a technology platform designed for different business segments from SMEs to Large Corporate. This new solution will bring together the best of the expertise and proprietary solutions of the two leading companies in the industry.

🇵🇭 To bring the Bank of the Philippine Island’s (BPI) products and services closer to more Filipinos, it recently partnered with the 24-hour self-service payments company, Pay&Go. According to Dan Ibarra, CEO of BTI Payments, operator of Pay&Go, Filipinos can now conveniently apply for BPI products directly at select Pay&Go kiosks nationwide.

🇩🇪 Shift4, the leader in integrated payments and commerce technology, has acquired a majority stake in Vectron Systems AG, one of the largest European suppliers of point-of-sale (POS) systems to the restaurant and hospitality verticals. The acquisition will give Shift4 a broad customer base in Europe and a network of around 300 POS resellers.

GOLDEN NUGGET

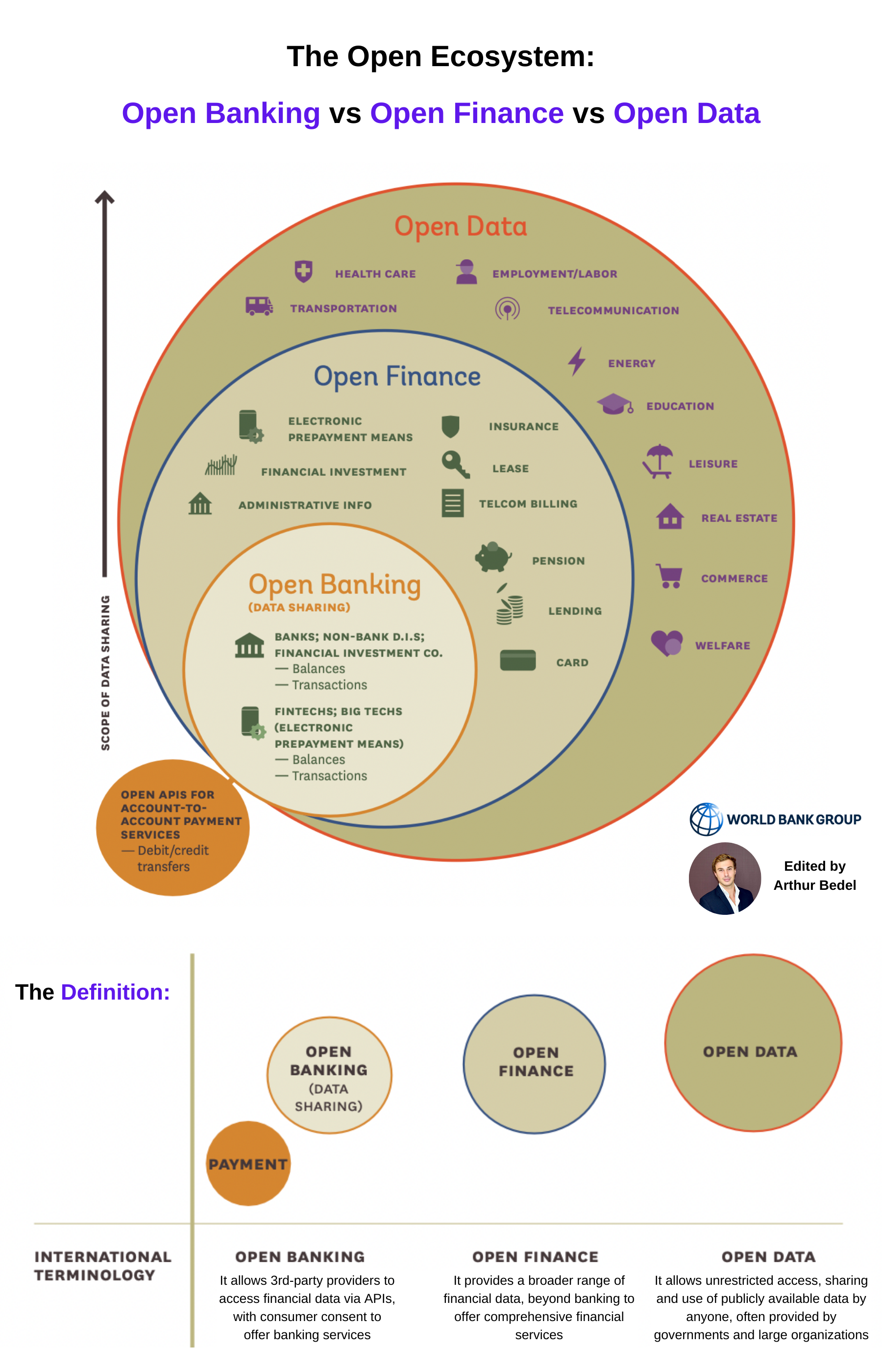

The "Open Ecosystem" — Open Banking, Open Finance, and Open Data transform Payments & Financial Services altogether👇

It's all about data — by enabling seamless data sharing, open banking, open finance, and open data supercharge financial services, stimulate global economic growth, foster innovation and increase competition in FinTech & Payments.

Open Banking vs Open Finance vs Open Data 👇

🔸Open Banking — it refers to the practice of allowing 3rd-party providers to access financial (mostly banking-related) data via APIs, with consumer consent, and offer banking services.

Key Features:

👉 Standardized APIs for data sharing and payment initiation

👉 Secure data sharing with robust consumer protection measures

👉 Participation from a wide range of financial institutions, including traditional banks and FinTech companies

🔸Open Finance — it extends the principles of Open Banking to a wider range of financial sectors, including insurance, investments, pensions, credit, cards, lending and more.

Key Features:

👉 Broad data sharing beyond banking data, covering insurance policies, pension plans, investment portfolios, and more

👉 Greater consumer control over their financial data

👉 Enhanced regulatory frameworks for secure data sharing and consumer protection

🔸Open Data — it allows unrestricted access; sharing and use of publicly available data by anyone, often provided by governments and large organizations impacting all industries, i.e. — health care, energy, commerce, real estate...

Key Features:

👉 Availability of data from various sources, including government and private entities

👉 Data provided in machine-readable formats for easy access and use

👉 Regulations to ensure data quality, privacy, and security, beyond financial

Leveraging in Payments:

🔸Open Banking — Use APIs to facilitate seamless, low-cost and faster payments via account-to-account payments, creating new payment solutions

🔸Open Finance — Integrate broader financial data to offer comprehensive financial management tools and improve payment services through better risk assessment and personalized financial products

🔸Open Data — Utilize diverse data sources to develop innovative payment products, enhance predictive models, and create new business opportunities in the payments industry

All and all, Open Banking, Open Finance, and Open Data are interconnected concepts that collectively aim to transform the financial sector by promoting innovation, competition, and transparency. They provide benefits for consumers, financial institutions, and the global economy by enabling better financial management & fostering new business opportunities

Don't sleep on the "Open" concept, data is everything 🚀

Source — The World Bank, Korea Institute of Finance, Korea Financial Telecommunications & Clearings Institute (KFTC).

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()