India Sidelines Visa and Mastercard with UPI and RuPay Surge

Hey Payments Fanatic!

India is rewriting the digital payments playbook—and Visa and Mastercard are feeling the heat

Thanks to the Unified Payments Interface (UPI), India now processes over 13 billion real-time transactions monthly, making up 71% of all payments in the country. UPI directly connects bank accounts via QR codes and phone numbers, cutting out traditional card networks.

Enter RuPay, India’s homegrown card network, which is the only one allowed to process credit card payments through UPI. This exclusivity is paying off: RuPay handled ₹638 billion ($7.43B) in UPI credit transactions in just seven months, doubling from last year and claiming 28% of India's credit card market.

To make RuPay even more attractive, merchants only pay fees on transactions over ₹2,000 ($23), drawing in small businesses. Plus, banks must now offer RuPay the same perks as Visa and Mastercard—and RuPay issued half of all new credit cards in June 2024!

Visa and Mastercard are scrambling to adapt, partnering with fintechs to connect their cards to UPI terminals used by 10 million merchants. But with UPI’s explosive growth, their market share in India’s digital payments has dropped to 21%, down from 43% in 2018.

Now, let's not waste any more of your time and dive straight into today's Payments news, which I listed for you below👇. Have a great start to the week!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

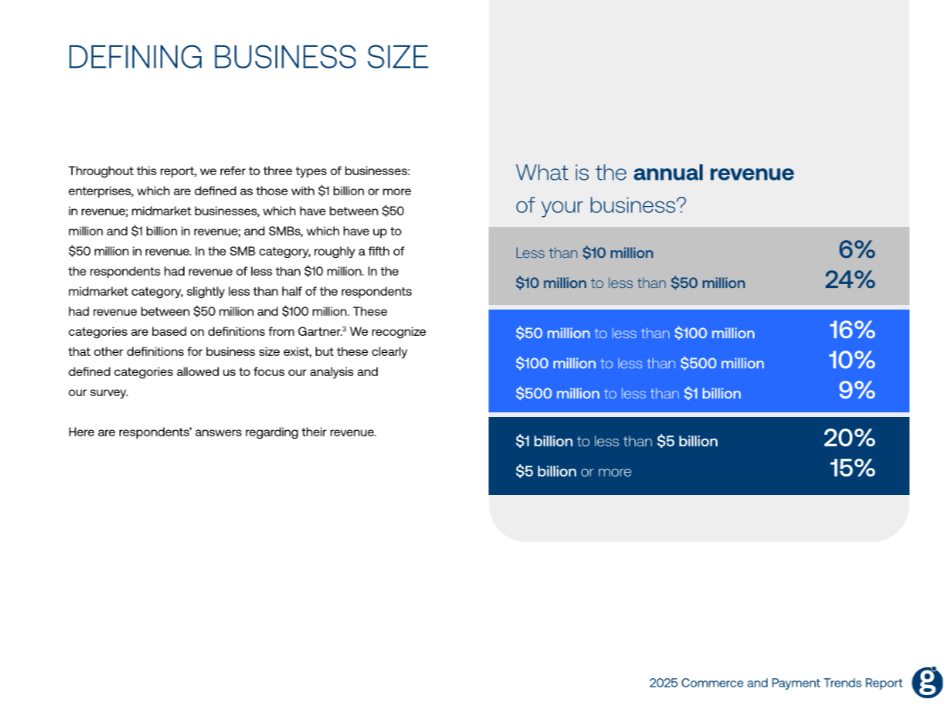

📊 Global Payments Inc.'s 2025 Commerce and Payment Trends Report👇

PAYMENTS NEWS

🇸🇦 MENA-focused HyperPay licensed from Sama. Through this step, HyperPay aims to enable businesses to benefit from secure and seamless payment services, in line with the goals of Saudi Arabia's Vision 2030 to improve the efficiency of the financial system and support digital transformation.

🇱🇻 Latvia’s Jeff App, billed itself as a “MoneySuperMarket,” targets $20m funding round and is testing the waters on a European launch. The company is looking to make a big push in India as well as launching in other South American countries like Peru, after recently launching in Colombia.

🇦🇪 Arcapita and Dgpays buy NEOPAY stake for $385M from Mashreq. This strategic partnership represents a milestone for NEOPAY as it aims to scale its operations, enter new markets, and enhance its innovative service offerings across the Middle East.

🇸🇬 Skyee receives In-Principle Approval (IPA) for Major Payment Institution License (MPI). “Being granted this IPA from the Monetary Authority of Singapore is a big milestone for Skyee, especially as we expand our reach and payment services across geographical borders, solidifying our position in one of the most significant financial markets globally,” said CEO of Skyee Singapore.

🇬🇧 ReFi™ from Paylink Solutions becomes part of Experian to enhance debt support for millions stuck in revolving debt trap. The technology bolsters Experian’s capabilities in helping consumers and lenders with debt consolidation and affordability challenges.

🇺🇸 New payment processing module for Treasury4 Platform unveiled. Treasury4 announced the launch of Payments4, a module for its software platform for treasury and finance practitioners designed to consolidate payment activities and help with cash and forecast management.

🇬🇧 Apaya partners with Telr. The partnership will combine Telr’s comprehensive and secure payment solutions in the regions of the UAE, KSA, Bahrain, and Jordan, with Apaya’s no-code commerce automation platform to enable merchants and businesses to build and scale optimised payment experiences for their clients in a fast and efficient manner.

🇪🇺 EU auditors concerned over price interventions in the card market. EU price interventions aim to reduce the harmful effects of unfair competition or to meet certain policy goals, potentially in consumers’ favour. The EU's digital payments system includes fee caps, surcharge bans, free open banking, SEPA, and cross-border euro price parity.

🇵🇰 Bank Alfalah acquires Jingle Pay. The bank announced its acquisition of a 9.9% equity stake in Jingle Pay. This collaboration leverages Bank Alfalah’s extensive infrastructure to amplify Jingle Pay’s impact on cross-border payments and digital banking, advancing its ambitious vision for the MENAP region.

GOLDEN NUGGET

The Payments Ecosystem.

How do fintech startups find new opportunities among so many payment companies? What do PayPal, Stripe, and Square do exactly?

Steps 0-1: The cardholder opens an account in the issuing bank and gets the debit/credit card. The merchant registers with ISO (Independent Sales Organization) or MSP (Member Service Provider) for in-store sales. ISO/MSP partners with payment processors to open merchant accounts.

Steps 2-5: The acquiring process.

The payment gateway accepts the purchase transaction and collects payment information. It is then sent to a payment processor, which uses customer information to collect payments. The acquiring processor sends the transaction to the card network. It also owns and operates the merchant’s account during settlement, which doesn’t happen in real-time.

Steps 6-8: The issuing process.

The issuing processor talks to the card network on the issuing bank’s behalf. It validates and operates the customer’s account.

Source: ByteByteGo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()