HSBC Launches Global Virtual Accounts for EUR and GBP Payments

Hey Payments Fanatic!

HSBC just introduced a virtual account solution for banks globally. This move allows e-commerce merchants to receive payments in EUR and GBP directly into their local bank accounts—no more cross-border headaches or foreign exchange costs.

In the past, businesses in certain regions could only access EUR and GBP funds through cross-border payments, which led to higher costs for e-marketplace platforms and merchants due to extra fees and unfavorable exchange rates.

Now, with the launch of the virtual account, Chinese businesses operating on e-commerce platforms can receive EUR and GBP payments directly through their local clearing system and into their own bank accounts, eliminating the need to set up foreign bank accounts in those regions.

Chinese businesses, in particular, stand to benefit as they can now receive payments in their own local clearing systems. According to Lewis Lei Sun, HSBC’s Global Head of Domestic and Emerging Payments, “We are delighted to be leading the way in this space and building truly innovative solutions for our clients. HSBC is committed to unlocking the potential of our expertise and network for our clients to help them succeed in a digital age.”

Keep reading for more payments news below, I'll be back with more tomorrow.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

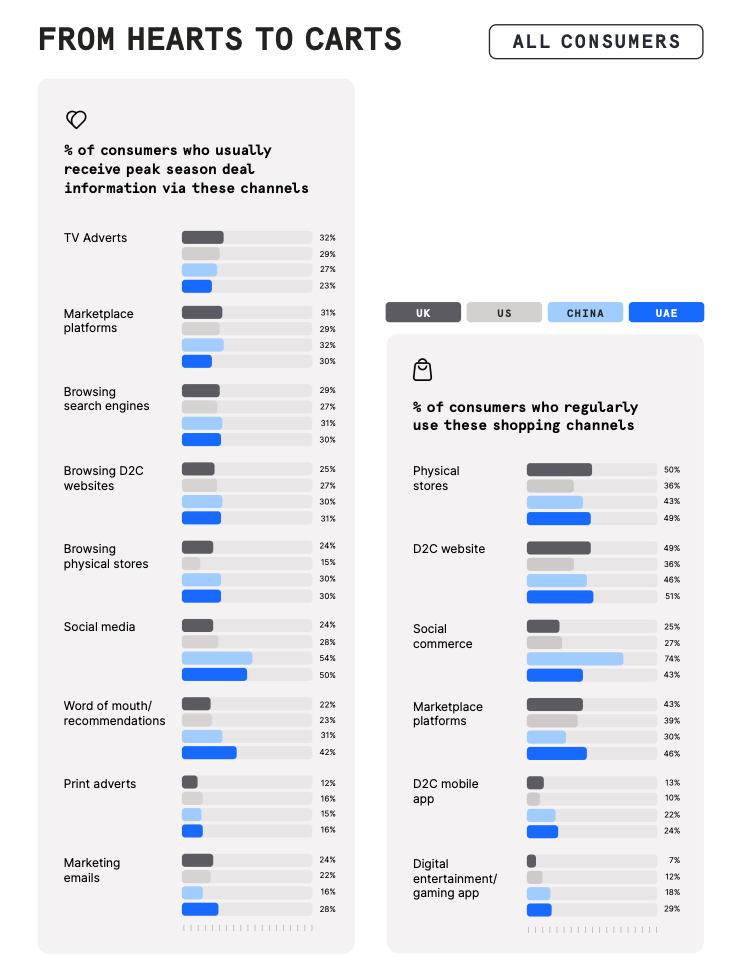

📊 Peak Season Trends 2024: How consumer behavior shapes the digital economy. This new report by Checkout.com analyzes the shopping patterns at play – and offers valuable insights to help businesses strategize for peak season and beyond. Get the full report here

PAYMENTS NEWS

🇺🇸 Ingo Payments and Sardine announced a new partnership to offer instant, risk-managed account funding via card and ACH, backed by an optional zero-liability fraud guarantee. Combined with Ingo’s leading check funding solution, this offers issuers a fast, secure solution for funding via check, card, and ACH.

🇸🇦 Mastercard launches local technology infrastructure in Saudi Arabia. This will enable ecommerce transactions processing, offering a seamless and secure payments experience for both Mastercard partners and consumers, while supporting the acceleration of the Kingdom’s digital commerce.

🇶🇦 QCB offers QPay payment through using 'FAWRAN' payment service. This platform allows merchants to register and accept payment transactions for customer purchases using the system. Read more

🇨🇦 Nuvei and BigCommerce partner for integrated payment solutions. The partnership aims to bridge the gap between online and in-store experiences, offering a single payment processing partner. Read the full piece

🇮🇳 Paytm's shares jump as nod for new UPI users clears key risk. Shares of the Indian FinTech firm jumped nearly 6% on Wednesday after the country's payments regulator allowed the company to sign new users for digital payments via UPI.

🇬🇧 USI Money, dLocal enter cross-border payment partnership. This collaboration will focus on addressing the challenges of high costs, slow speeds, and limited access in cross-border transactions.

🇬🇧 Moneybox and GoCardless join Revolut and Monzo in secondary share sale surge. Moneybox, valued at £550m after a £70m investment, is offering investors the chance to sell 10-15% of shares. Meanwhile, GoCardless plans a secondary share sale with up to $200m in stock changing hands and a £100m windfall for employees. More here

🇸🇬 Tribe Payments expands into APAC with new Singapore office. The move comes as part of Tribe’s strategic expansion into the Asia-Pacific (APAC) region, signalling its ongoing commitment to delivering world-class digital payment solutions across global markets.

🇺🇸 Marqeta has introduced two new products – UX Toolkit and Portfolio Migrations – to its card program management tools. These solutions leverage Marqeta's technology and expertise to enhance the success and scalability of its customers' card programs. Continue reading

🇺🇸 Dwolla partners with Plaid to Future-Proof Pay by Bank Payments. This will enable customers to onboard with Plaid through Dwolla's Open Banking Services, creating a modern A2A payment offering for mid- to enterprise-sized businesses.

🇳🇱 Tom Adams formally appointed as Adyen’s CTO and Management Board Member. Adams will oversee Adyen's vision for its single platform, covering payments, data, and financial products. The appointment has been approved by the Dutch Central Bank and awaits shareholder approval at an upcoming EGM.

🇺🇸 PayPal and Global Payments join forces to simplify checkout with Fastlane. This partnership allows Global Payments to provide U.S. merchants with enhanced PayPal and Venmo checkout solutions, along with Fastlane by PayPal for quicker guest checkouts, improving the shopping experience and increasing conversion rates

GOLDEN NUGGET

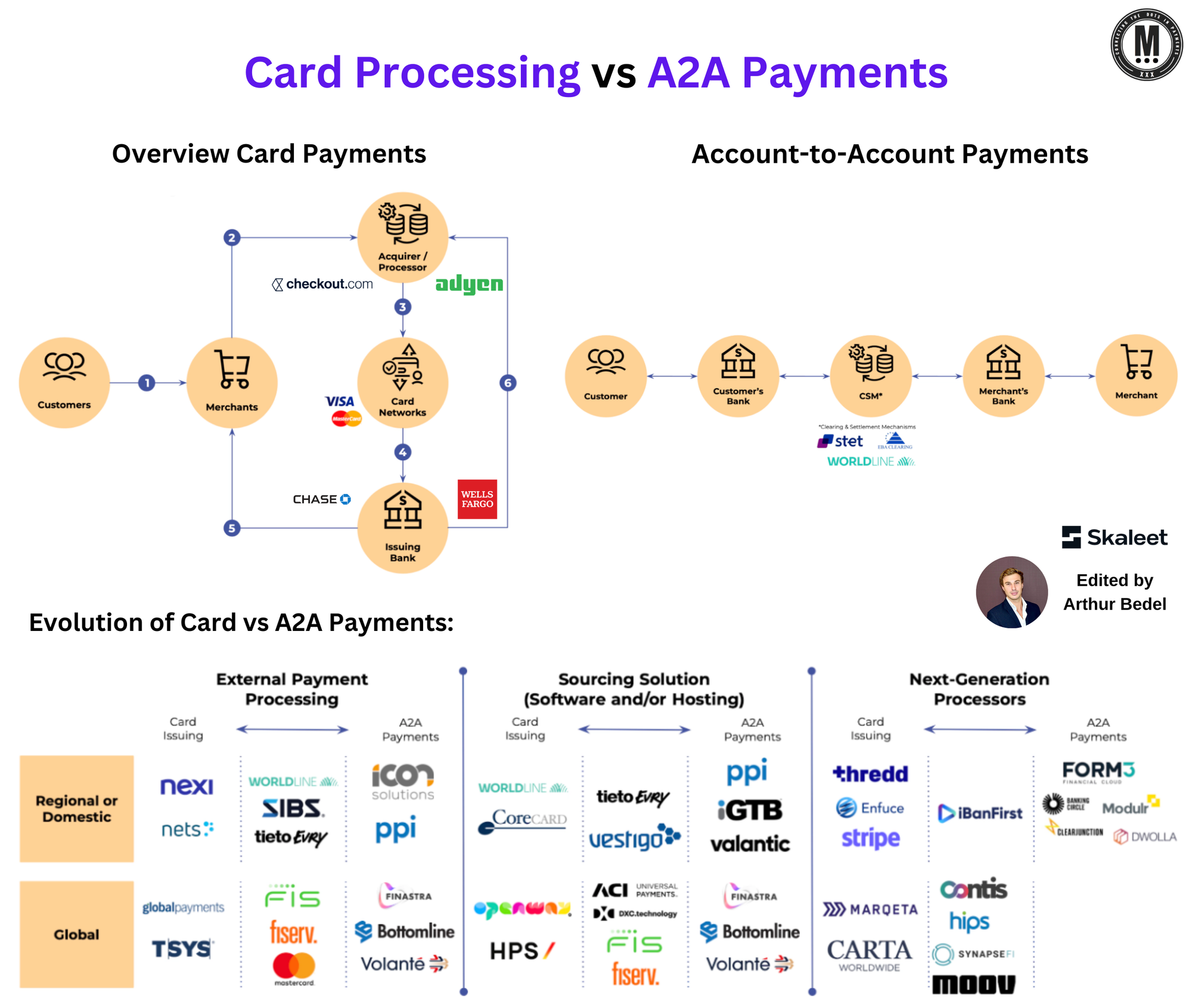

𝐂𝐚𝐫𝐝 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 𝐯𝐬 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐭𝐨 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 👇

The payment landscape remains dynamic. Card transactions and Account to Account payments are undergoing significant changes in technology and business models whilst witnessing a rise in new market entrants.

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 101:

Card payments involve several parties:

► Customer

► Merchant

► Acquirer

► Card networks (Visa/Mastercard)

► Issuing banks

When a customer makes a purchase, the merchant sends the transaction to the acquirer. The acquirer contacts the card network, which forwards the request to the customer's issuing bank for authorization. After approval, funds are transferred from the issuing bank to the merchant's account through the acquirer. The process, though secure, can take a few days due to multiple intermediaries and often incurs processing fees at each stage.

𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐭𝐨 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 101:

👉 A2A payments transfer money directly between the payer's bank and the recipient's bank, bypassing intermediaries like card networks. The process involves a customer initiating a payment that their bank processes, transferring funds to the recipient's bank. Clearing and settlement mechanisms (CSMs), such as Worldline or STET, ensure the transfer is executed securely and in real-time or near-real-time. Unlike card payments, A2A transactions are cheaper and faster since fewer parties are involved, eliminating traditional interchange fees and long settlement times.

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐂𝐚𝐫𝐝 𝐚𝐧𝐝 𝐀2𝐀 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠:

👉 Card-based payments have been the backbone of global commerce for decades. However, with advancements in technology and regulatory changes, the landscape has shifted. Card payments have evolved to include innovations like contactless payments, mobile wallets, and tokenization. At the same time, A2A payments have emerged as a viable alternative, driven by the rise of Open Banking and real-time payment infrastructures. Next-generation processors, like Stripe and Marqeta, are reshaping card payments with digital-first, API-based platforms, while A2A leaders like Form3 and Modulr are pioneering direct bank transfers.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐚𝐜𝐭 𝐨𝐟 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐨𝐧 𝐀2𝐀 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

👉 Open Banking allows third-party providers (TPPs) to access bank accounts securely through APIs, enabling A2A payments without needing card networks. Consumers authorize these payments directly through their banks, which then securely transfer funds to merchants or other recipients. By facilitating the seamless exchange of financial data between banks and TPPs, Open Banking has reduced the friction in payment processes, allowing A2A payments to thrive.

The payments ecosystem continues to be dominated by card payments but A2A payments are rapidly gaining ground. The rise of Open Banking has propelled A2A as a viable alternative, cutting out intermediaries and speeding up payment processes. The leaders in card-based payments have and are investing in Account to Account payments. The race continues

Source: Skaleet

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()