Greetings from Bogotá: Yuno Partners with Nequi in Colombia

Hey Payments Fanatic!

Greetings from Bogotá, Colombia! I'm here this week and wanted to kick off this edition with some exciting local news from Yuno, a company I closely follow.

Yuno, a global leader in payment orchestration, has formed a strategic partnership with Nequi, a digital financial platform with over 20 million users in Colombia.

This collaboration will enable Nequi users to easily purchase products and services from a wide range of merchants, with the added assurance that their transactions are secured by Yuno’s advanced encryption technology.

By integrating Yuno's global payment methods and security protocols, Nequi aims to enhance the digital payment experience for its customers, both in Colombia and internationally.

This partnership marks a significant step in making financial services more inclusive and accessible in the region.

As I continue my visit here, I’m eager to learn more about the local FinTech landscape. If there are any other Colombian FinTech companies you think I should keep an eye on, please let me know! I'm always on the lookout for innovative players shaping the future of FinTech in this dynamic region.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

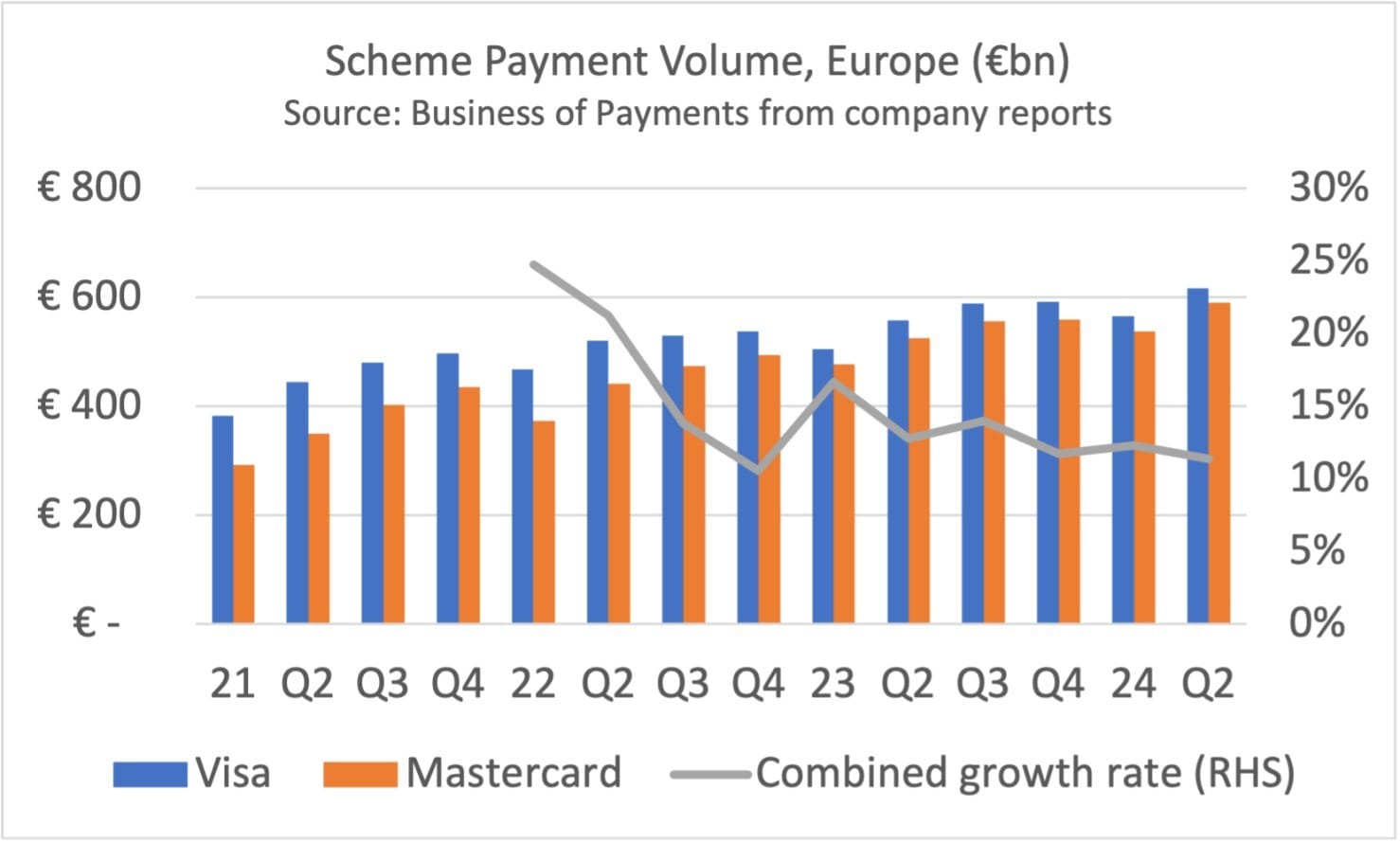

📊 Visa and Mastercard are thriving in Europe, with their total transaction volumes surging by 11% in the second quarter, reaching €1.206 trillion 🤯

PAYMENTS NEWS

🇸🇬 Thunes has announced that it has hit major growth milestones, exceeding $100m run-rate Revenue whilst remaining firmly on course to reach EBITDA break-even by year-end. Thunes' growth is driven by rising demand for its Direct Global Network, enabling real-time payments in over 130 countries and 80+ currencies.

🇩🇪 Ticombo selects Mangopay to transform the ticket-selling experience. Mangopay will manage Ticombo’s end-to-end payment flow from pay-in to payout as Ticombo works to provide a fair, trusted, and transparent experience for its users worldwide.

🇸🇦 Saudi Central Bank (SAMA) has announced the launch of a government banking services digital platform named ‘NQD’. The platform provides ‘easy access’ for government entities to their accounts at SAMA to conduct financial transactions through a ‘secure and unified’ digital platform,’ according to the announcement. The central bank describes NQD as part of its strategy to ‘deliver banking services to government entities, as well as supporting digital development’.

🇺🇸 Scanco taps Nuvei to boost B2B payments for warehouse management systems. The partnership will enhance Scanco’s new Invoice2Payment (i2PAY) solution. By utilizing Nuvei’s global reach, Scanco will achieve its future international expansion plans.

🇱🇹 Switchere expands payment methods with Apple Pay and Google Pay. In response to the continuous growth of mobile payments adoption, Switchere, a prominent EU-based online cryptocurrency exchange service provider, has announced the integration of Apple Pay and Google Pay as new payment options.

🇸🇬 US-based crypto company BitGo has received a Major Payment Institution License from Singapore's MAS, allowing it to offer regulated payment token services. According to data from the MAS, BitGo is now one of 27 MPI-licensed firms alongside major industry companies.

🇰🇪 Conduit’s cross-border payments expand from LatAm into Africa with $6M round. Conduit serves over 50 direct clients; most are import and export businesses, payroll services, and other cross-border platforms. Access full article

🇧🇪 iBanFirst & SeedBlink team to improve payment terms for investors. The collaboration introduces a bespoke solution for fundraising start-ups and their private investors, ensuring faster onboarding and access to preferential FX rates. Read on

🇴🇲 Arab Financial Services introduces Samsung Pay to Oman. This partnership combines AFS's regional expertise in digital payment solutions with Samsung's innovative technology to provide Omani consumers with a secure and convenient contactless payment option.

🇧🇷 Nium expands operations in LatAm. This month Nium applied for a Payment Institution License in Brazil, which will enable the company to provide payment services to clients including managing funds locally in BRL and real-time payments through Pix.

🇦🇿 AzeriCard integrates Apple Pay and Google Pay with Akurateco’s expertise. This enhancement, facilitated by Akurateco’s payment solutions, marks a significant milestone in AzeriCard’s commitment to providing cutting-edge financial services.

GOLDEN NUGGET

Apple𝐏𝐚𝐲 — 𝐚 𝐬𝐢𝐦𝐩𝐥𝐞 𝐞𝐱𝐩𝐥𝐚𝐧𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐡𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬 👇

How to use Apple Pay

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐩𝐩𝐥𝐞 𝐏𝐚𝐲?

ApplePay is a mobile payment and digital wallet service by Apple that allows users to make payments using an iPhone, Apple Watch, iPad, or Mac. It digitizes & replaces the traditional credit card and debit card chip and PIN or magnetic stripe transaction at point-of-sale terminals.

𝐇𝐨𝐰 𝐀𝐩𝐩𝐥𝐞 𝐏𝐚𝐲 𝐖𝐨𝐫𝐤𝐬:

1️⃣ 𝐒𝐞𝐭𝐭𝐢𝐧𝐠 𝐔𝐩: Users add their credit or debit cards to the Apple Wallet app on their iOS devices. The card information is not stored on the device or on Apple servers. Instead, a unique Device Account Number is assigned, encrypted, and securely stored in the Secure Element on your device.

2️⃣ 𝐌𝐚𝐤𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

🔸 𝐈𝐧-𝐒𝐭𝐨𝐫𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Users hold their device near a contactless reader with their finger on Touch ID or double-click the side button and glance at their iPhone or Apple Watch to authenticate with Face ID.

🔸 𝐈𝐧-𝐀𝐩𝐩 𝐚𝐧𝐝 𝐎𝐧𝐥𝐢𝐧𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Users select Apple Pay at checkout and authenticate using Face ID, Touch ID, or their passcode.

3️⃣ 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: ApplePay uses tokenization, a method where sensitive information is replaced with a unique identifier or token (i.e. your payments information or data). When you make a purchase, the token, along with a cryptogram (a one-time use, dynamic security code), is sent to the retailer for payment.

4️⃣ 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬:

🔸 The token is sent to the card issuer (bank).

🔸 The bank verifies the token and cryptogram.

🔸 The bank authorizes the transaction.

𝐇𝐨𝐰 𝐭𝐨 𝐔𝐬𝐞 𝐀𝐩𝐩𝐥𝐞 𝐏𝐚𝐲

1️⃣ 𝐀𝐝𝐝 𝐚 𝐂𝐚𝐫𝐝: Open the Wallet app, tap the "+" button, and follow the steps to add a new card. Your bank or card issuer will verify your information, and you might need to provide additional verification.

2️⃣ 𝐈𝐧-𝐒𝐭𝐨𝐫𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭:

🔸 Hold your iPhone near the contactless reader.

🔸 Authenticate with Face ID, Touch ID, or your passcode.

🔸 A checkmark and "Done" will appear on the display, indicating the payment was successful.

3️⃣ 𝐈𝐧-𝐀𝐩𝐩 𝐚𝐧𝐝 𝐎𝐧𝐥𝐢𝐧𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭:

🔸 Choose ApplePay at checkout.

🔸 Confirm the payment using Face ID, Touch ID, or your passcode.

4️⃣ 𝐎𝐧 𝐀𝐩𝐩𝐥𝐞 𝐖𝐚𝐭𝐜𝐡: Double-click the side button and hold the display of your Apple Watch near the contactless reader until you feel a gentle tap and hear a beep.

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐀𝐩𝐩𝐥𝐞 𝐏𝐚𝐲

👉 Convenience

👉 Acceptance

👉 Security — Enhanced security features like #tokenization and biometric authentication.

👉 Privacy — Apple doesn't store or track transaction information.

Apple just hit $3T in market cap after their annual WWDC event. Next up, "Tap to Pay for Apple Cash" + AI 🚀

Source: Apple

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()