Global Payments Strikes $22.7B Deal to Acquire Worldpay, Bets Big on Merchant Growth

Hey Payments Fanatic!

Global Payments is making waves with a $22.7 billion deal to acquire Worldpay, doubling down on its core merchant services business. The move combines Worldpay's enterprise and e-commerce strength with Global Payments' SMB focus—creating a payments powerhouse serving over 6 million customers and processing $3.7 trillion annually.

As part of the reshuffle, Global Payments will offload its issuer solutions unit to FIS for $13.5 billion, using the cash and $7.7B in new debt to fund the deal. GTCR, which bought a majority stake in Worldpay just last year, will walk away with a 15% stake in the new combined company.

"Today marks a defining moment for Global Payments," said Cameron Bready, CEO of Global Payments. "These transactions sharpen our strategic focus and simplify Global Payments as a pure-play merchant solutions business with significantly expanded capabilities, greater market access, and an enhanced financial profile. We're more excited than ever about what's ahead."

Expected to close in H1 2026, this deal puts Global Payments in stronger competition with Stripe, Adyen, and PayPal—and signals a bold bet on the future of merchant acquiring.

Read more global payment industry updates below 👇 and I'll be back with more on Monday!

Cheers,

INSIGHTS

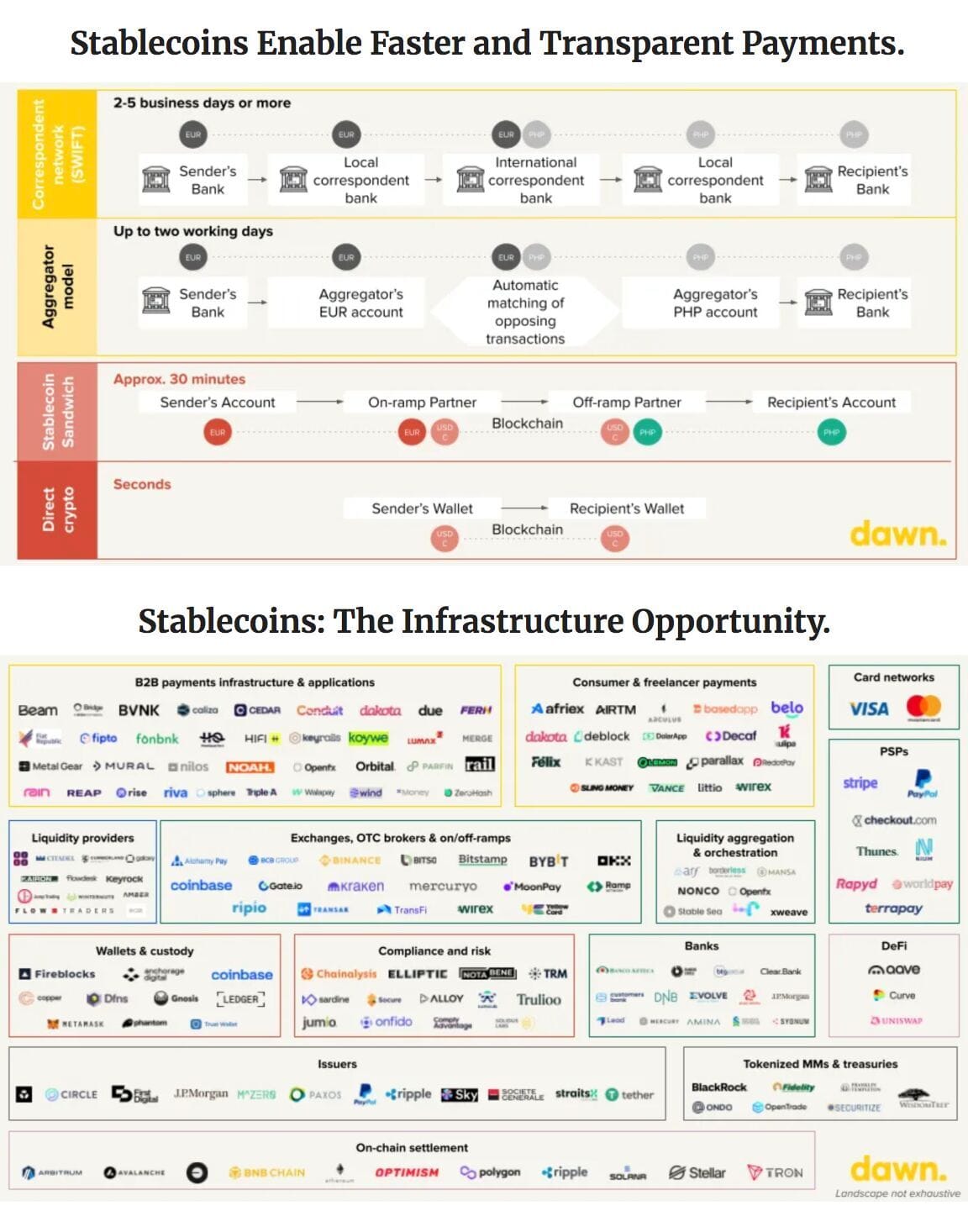

📈 Stablecoin transaction value in 2024 reached a five-year record high, hitting $15.6 trillion, and overtaking traditional payment firms Mastercard and Visa by more than 100% 🤯

PAYMENTS NEWS

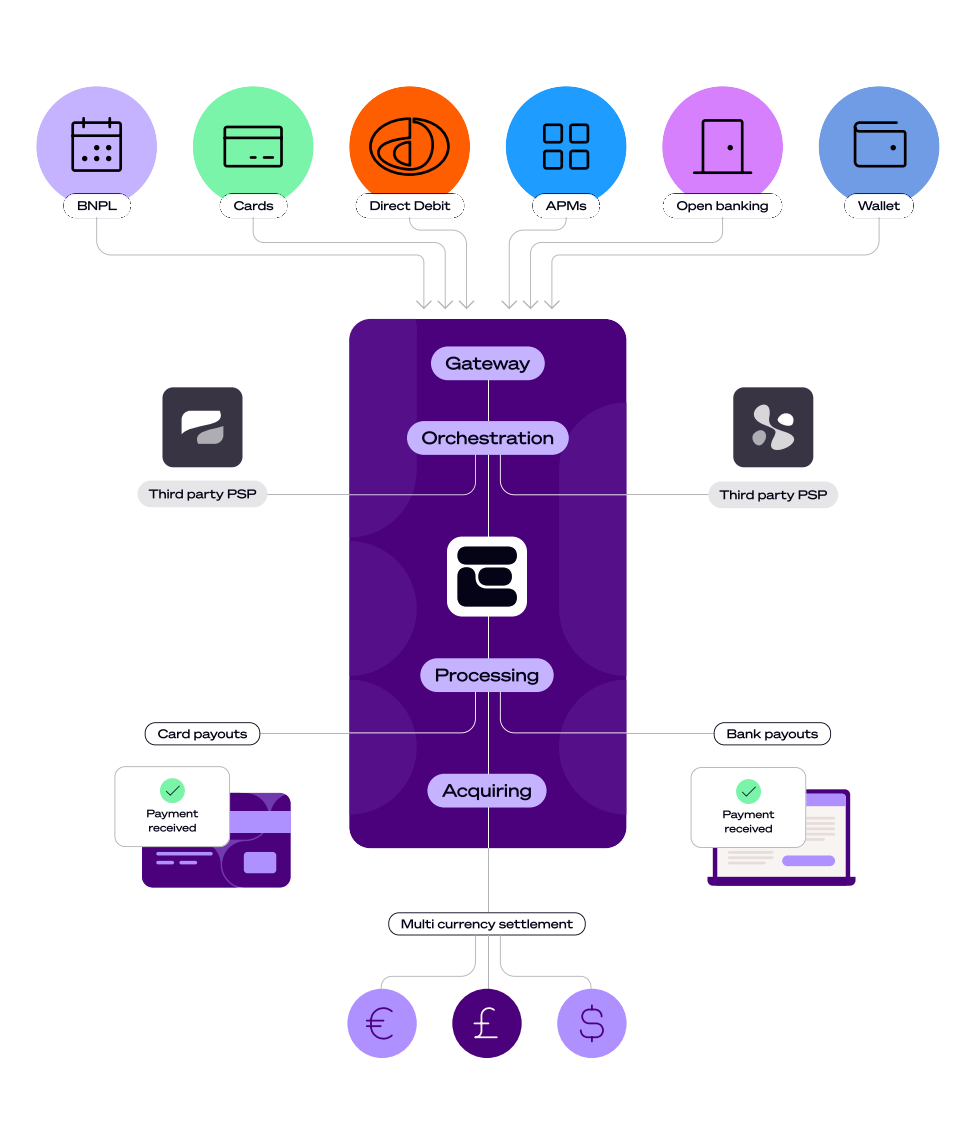

🇬🇧 Let’s grow with bespoke payment solutions by Ecommpay — from acquiring to open banking, direct debits, and 100+ APMs, all in a single integration. Discover how Ecommpay’s full-stack orchestration powers seamless transactions and drives business growth. Explore now

🇳🇵 NepalPay domestic card scheme goes live. NCHL had previously signed an agreement with ACI Worldwide to establish and operate the National Payment Switch, which enables interoperability of card-based transactions and includes the rollout of the NepalPay domestic card scheme.

🇨🇱 Santiago-based Toku has secured $39 million in new funding, which values the startup at more than $175 million, bringing Stripe-like Payments to LatAm. Toku is combining the $39M Series A with a previous $9M SAFE round into a total $48M Series A. With its new funding, the firm plans to focus on growing in Mexico and Brazil. Keep reading

🇩🇪 Pliant acquires hi.health, expanding into digital insurance payments. The acquisition enables Pliant to apply its payment expertise to the insurance sector while also gaining valuable industry-specific know-how. Continue reading

🇺🇸 Recurly rolls out suite of new products. The platform introduced its powerful new AI-powered growth engine, Recurly Compass, a Shopify integration that provides enterprise-grade support for ecommerce subscriptions, and new plug-and-play payments functionality designed to streamline global scale and conversion.

🇳🇵 Bolt launches SuperApp combining one-click crypto and everyday payments. The app is available for download at the Bolt website. Full access is expected to be granted selectively to iOS users early next week, and Android users will follow in the coming months.

🌍 Swift rolls out investigation tool to track late payments. The tool claims could save its member banks millions of dollars in operational costs and significantly reduce the time it takes to identify and resolve issues when international payments are delayed.

🇺🇸 MoneyGram and Plaid partnership drives seamless global payments. Customers in the United States can now use Plaid's technology to help authenticate their bank accounts, enabling fast and secure funding for both domestic and cross-border payments.

🇵🇹 TAP announces partnership with FinTech Klarna for the adoption of flexible payments. Customers booking flights through TAP's official website can choose to pay in three equal, interest-free installments or opt for the traditional full payment. This initiative aims to provide travelers with greater control over their travel budget.

🌏 AEON partners with Stellar to expand web3 mobile payments across Southeast Asia and beyond. This collaboration enables AEON Crypto Payment solution to support $XLM and Stellar-native USDC, allowing users to pay seamlessly with these tokens, whether checking out online or shopping at local retail stores.

🌎 BlueSnap partners with Shopware to unlock seamless payments for North American businesses. Shopware selected BlueSnap to deliver secure transactions, flexible payment methods, and seamless integrations tailored for its United States and Canada merchants.

🇬🇧 Inflation down further to 2.6%, raising hopes for bank rate cut in May. The Bank of England is thought likely to cut the rate to stimulate economic activity in the face of a global slowdown triggered by increased trade tariffs. Read more

🇺🇸 Unstoppable Domains and the Bitcoin Cash have joined forces to launch .BCH, marking a major step forward in simplifying blockchain-based payments. The new domain extension gives Bitcoin Cash (BCH) users a personalized, secure, and user-friendly way to manage their crypto presence.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()