Real-Time Payments Just Got Bigger—BNY Executes Largest $10M Instant Payment in U.S. History

Hey Payments Fanatic!

Real-time payments just hit a significant milestone! BNY Mellon and The Clearing House have successfully processed the largest instant payment in U.S. history—$10 million—following the RTP® network’s transaction limit increase from $1M to $10M.

This game-changing move highlights the growing demand for high-value, real-time transactions, offering businesses a faster, more efficient alternative to wires and checks. Computershare initiated the historic $10M transfer, showcasing how instant payments are transforming liquidity management, payroll funding, and large supplier transactions.

With 285,000+ businesses already using the RTP network monthly, this is just the beginning of a new era in corporate payments. Who will be next to push the boundaries of instant payments?

Stay tuned for more payments updates 👇 and I’ll be back tomorrow!

Cheers,

SPONSORED CONTENT

Aeropay's monthly newsletter provides an in-depth look at the evolving payments landscape in the United States. Subscribe now!

INSIGHTS

How do consumers pay in Mexico 🇲🇽?

PAYMENTS NEWS

🌍 Real-time payments set for massive growth. ACI Worldwide’s 2024 report projects that real-time transactions will rise to 575.1-billion by 2028 globally, demonstrating a compound annual growth rate of 16.7% from 2023. Find out more

🇺🇸 How to master payments in Noram. Low-stress payments drive conversions, but US localization goes beyond local methods. In this piece, Jim Cho, Head of Revenue for North America at Checkout. com, will cover three major topics to help master payments in North America. Learn more

🇪🇪 Revolut partners with Mercuryo. The launch of Revolut Pay introduces the service’s rollout across Mercuryo’s 200-plus merchant ecosystem. Revolut Pay will offer users of the non-custodial wallets a low-cost option for reliable and safe on-ramp service.

🇸🇪 Klarna partners with J.P. Morgan Payments to introduce Klarna’s BNPL options to businesses using J.P. Morgan Payments for payment processing. The partnership is expected to expand Klarna’s reach by making its payment solutions available to a wider range of merchants and consumers.

🇺🇸 Affirm plans to bring Buy Now, Pay Later debit cards to more users through deal with FIS. Any bank that partners with FIS will be able to provide its own version of the Affirm Card without asking customers to adopt a new piece of plastic. The company is making it possible for banks to offer that service to their customers.

🇺🇸 Stripe is considering arranging a sale of shares held by employees that would value the company at $85 billion or more. The transaction would extend a series of share buybacks, secondary sales and fundraises that have lifted the payments provider’s valuation close to its $95 billion peak.

🇬🇧 Currensea adds premium offer with cheap FX and eSIMs and discounts. The new Pro membership offers unlimited fee free spending on transactions abroad and up to £500 fee free withdrawals per month from overseas ATMs (1% FX fee applies above this). Its market-leading rates are available in all 180 currencies.

🇺🇸 Plaid is working with Goldman Sachs on a deal to allow early-stage investors and employees to sell existing shares, which will raise between $300 million and $400 million. The deal, known as a tender offer, is a type of process that allows some early investors and employees of closely held firms to sell their stakes.

🇪🇺 DNB signs up for Worldline's Swift Service Bureau. DNB will leverage Worldline's Connectivity to TIPS (TARGET Instant Payment Settlement) to enhance its payment infrastructure and provide seamless, reliable and real-time payment services to its clients.

GOLDEN NUGGET

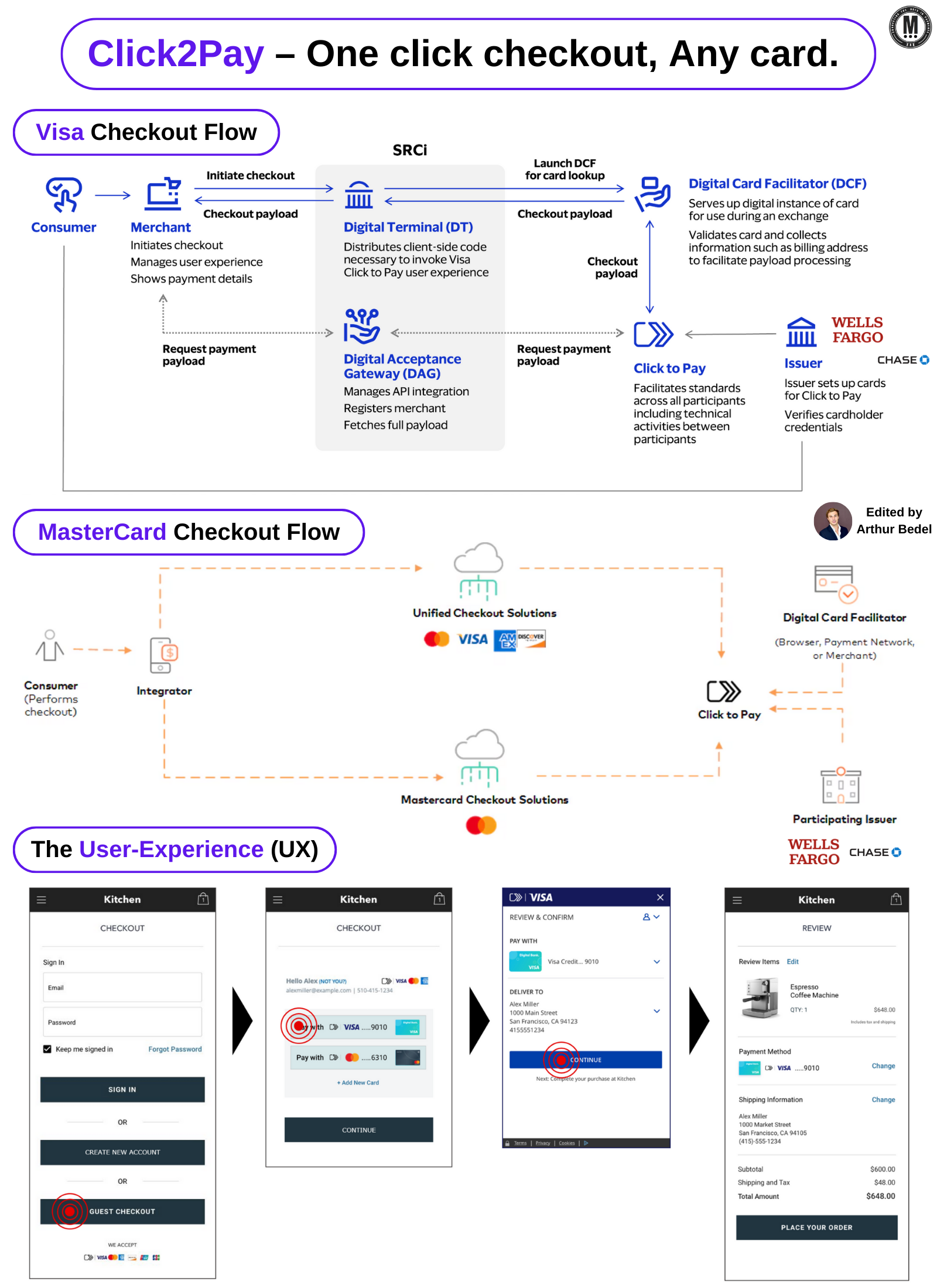

𝐂𝐥𝐢𝐜𝐤2𝐏𝐚𝐲 — the *One-Click Checkout* experience by Visa & Mastercard (card networks) to challenge ApplePay, Google Pay (wallets)👇

🔸 A significant showdown is occurring in the payments industry to dominate at checkout — 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 vs 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬:

► The success of platforms like ApplePay, PayPal, Amazon Pay, and Google Pay can largely be attributed to the simplicity, ease-of-use, fast, and user-friendly checkout processes.

► In response, the 4 primary card schemes (Visa, Mastercard, American Express, Discover Financial Services) are introducing 𝐂𝐥𝐢𝐜𝐤-𝐭𝐨-𝐏𝐚𝐲, a streamlined one-click payment solution.

🔸 𝐂𝐥𝐢𝐜𝐤2𝐏𝐚𝐲 — 𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐊𝐞𝐲 𝐀𝐭𝐭𝐫𝐢𝐛𝐮𝐭𝐞𝐬

► Click2Pay is a streamlined payment method designed to simplify the online checkout process for card payments. It aggregates all of one customers' cards into a single payment method, enabling them to complete transactions with just one click. It eliminates the need for manual entry of card credentials by converting consumer data into Tokens.

► The solution adheres to the EMV® Secure Remote Commerce (SRC), the global association representing the 6 major credit card networks.

► In the event of a data breach, the actual card number remains protected due tokenization, ensuring transactions remain secure & it includes built-in measures for verification and fraud prevention.

► Automatic recognition of customers’ devices (smartphones, tablets, PCs, laptops) enhances the user experience.

► The fee and cost structure for credit and debit cards remains unchanged.

𝐍𝐨𝐭𝐞: ApplePay, Google Pay are charging a fee to merchants. Click2Pay is looking to challenge that.

In essence, Click2Pay provides a card-based alternative to digital wallets. It was initially launched in the U.S. in 2019 and is now expanding globally (gaining popularity in Europe).

🔸 𝐇𝐨𝐰 𝐜𝐚𝐧 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 𝐛𝐞 𝐬𝐮𝐜𝐜𝐞𝐬𝐬𝐟𝐮𝐥?

► 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧, a simple & rewarding UX will be crucial. A strong collaboration with Issuers could create valuable incentives (rewards etc...) for customers, needed to disrupt their payments preference

► 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧, a straightforward implementation process with good documentation will be needed. Digital Wallets today are expensive, pricing will be crucial and issuer adoption

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫𝐬 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧, a program to reward enablers/gateways for providing this payment method over others

Noticing a trend? The majority of all new payment initiatives from the Card Networks are based on Tokenization. Other non-card initiatives are gaining momentum, for which data will be required to be shared across industry players securely.

𝐓𝐡𝐨𝐮𝐠𝐡𝐭𝐬 𝐨𝐧 𝐰𝐡𝐚𝐭'𝐬 𝐧𝐞𝐱𝐭? 🚀

Source: Visa, Mastercard

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()