Exclusive: Yuno Founder Juan Pablo Ortega Talks Payments Orchestration

Hey, Payments Fanatic!

I’m excited to introduce the first edition of a new interview series we're launching on the Connecting the Dots in Payments platform, in collaboration with my business partner, Arthur Bedel.

In this inaugural edition, we feature an insightful conversation with Juan Pablo Ortega, discussing Payments Orchestration and his company, Yuno.

We hope you enjoy this engaging interview, and we’d love to hear your suggestions for future guests!

Cheers,

Marcel

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

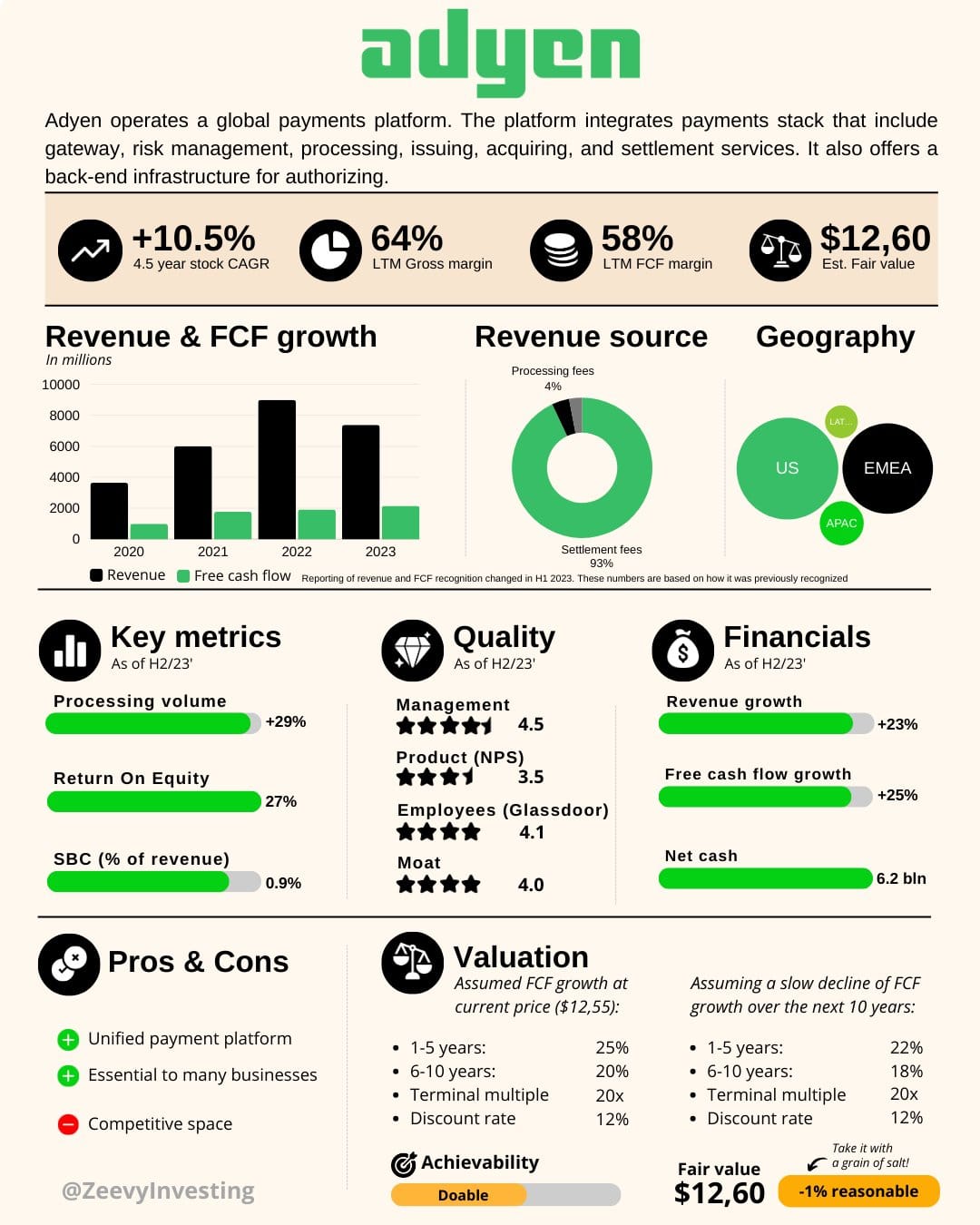

Adyen's H1 2024 Financial Results are out.

Key Stats:

PAYMENTS NEWS

🇬🇧 Miranda Mclean, CMO at Ecommpay, shortlisted in Women In Tech Employer Awards. Winners will be announced at a prestigious event in London on 12th November 2024. For several years, Miranda has advocated for women and other minority groups in the tech community. In her current role, she is driving change to make the company's payments platform as accessible as possible for broader financial inclusivity.

🇮🇳 Paytm shares drop after report on regulatory scrutiny. Paytm shares fell Monday on news that India’s markets watchdog has sent its founder notices over alleged misrepresentation, a move the FinTech pioneer said was not a “new development.”

🇦🇺 Shift, a provider of credit and payment products to Australian businesses, has secured $23.7m in Series D Equity led by Peak XV Partners. This funding round follows the completion of a $230 million Asset Backed Securitisation in May 2024 and comes as the company marks 10 years in operation.

🇳🇴 IDEX Pay biometric card solution certificated by Visa. The Visa certification is the ultimate result of comprehensive biometric performance testing and ensures that payment’s scheme functional and security specifications are met. It also confirms that IDEX Pay is ready for scaled commercialization on the Visa payment network.

🇺🇸 US-based Orlando Credit Union has unveiled its new merchant services through Fort Point Payments to help businesses streamline their payment processes. The new merchant services will enable businesses of all sizes to accept a variety of payment methods.

🇺🇸 Wyoming is pushing crypto payments and trying to beat the Fed to a digital dollar. The state is creating its own U.S. dollar-backed stablecoin, called the Wyoming stable token, which it plans to launch in the first quarter of 2025 to give individuals and businesses a faster and cheaper way to transact while creating a new revenue stream for the state.

🇬🇧 Revolut Business Payment Gateway integrates with BigCommerce. The integration will make online businesses’ payment processing smoother and offer their customers a seamless checkout experience, Revolut said in an Aug. 15 blog post.

🇬🇧 Visa is reportedly considering a $𝟵𝟮𝟱 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 bid for fraud-prevention firm Featurespace. Sky News has learnt that Featurespace, which was founded in 2008 and is headquartered in Cambridge, is in advanced negotiations about a deal. Explore the full article

🇬🇧 Tom Adams to join as new Adyen Chief Technology Officer. In the role as CTO at Adyen, Adams will oversee the strategic and technological vision of Adyen’s single platform which encompasses payments, data and financial products.

🇦🇺 Zeller unveils the first next-generation payments and POS solution designed and engineered in Australia. The FinTech announced the launch of Zeller Terminal 2, which offers premium design and unparalleled customisation at an affordable price point, setting a new benchmark in payments and POS technology.

GOLDEN NUGGET

𝗛𝗼𝘄 𝗱𝗼𝗲𝘀 Visa / Mastercard 𝗺𝗮𝗸𝗲 𝗺𝗼𝗻𝗲𝘆? - deep dive into the most successful payments companies👇

Let's take a look at the current payment ecosystem today:

Core:

🔸Issuers - Citi, Revolut, Marqeta, Bilt Rewards

🔸Acquirers - Checkout.com, Nuvei, Stripe, Adyen

🔸Card Schemes - Visa, Mastercard, American Express, Discover Financial Services

Additional:

🔸Payment Orchestration - Yuno, Gr4vy, Inc, Spreedly

🔸Payment Methods - Klarna, Paze℠ Trustly

🔸Payment Aggregators - Payouts.com, PPRO, Payoneer

🔸Token Vaults - VGS, Basis Theory

🔸Crypto Solutions - Zero Hash, Mural, Lightspark

This 6-step diagram shows the economics of the credit card payment flow (by Alex Xu):

1️⃣ The cardholder pays a merchant $100 to buy a product.

2️⃣ The merchant benefits from the use of the credit card with higher sales volume, and needs to compensate the issuer and the card network for providing the payment service.

The acquiring bank (Nuvei / Checkout.com) sets a fee with the merchant, called the "𝐦𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐝𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐟𝐞𝐞."

3️⃣-4️⃣ The acquiring bank keeps $0.25 as the 𝐚𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐦𝐚𝐫𝐤𝐮𝐩, and $1.75 is paid to the issuing bank (Citi / Revolut) as the 𝐢𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐟𝐞𝐞.

The merchant discount fee should cover the interchange fee.

The interchange fee is set by the card network (Visa / Mastercard) because it is less efficient for each issuing bank to negotiate fees with each merchant.

5️⃣ The card network sets up the 𝐧𝐞𝐭𝐰𝐨𝐫𝐤 𝐚𝐬𝐬𝐞𝐬𝐬𝐦𝐞𝐧𝐭𝐬 𝐚𝐧𝐝 𝐟𝐞𝐞𝐬 with each bank, which pays the card network for its services every month.

For example, Visa charges a 0.11% assessment, plus a $0.0195 usage fee, for every swipe.

6️⃣ The cardholder pays the issuing bank for its services.

Why should the issuing bank be compensated?

► The issuer pays the merchant even if the cardholder fails to pay the issuer.

► The issuer pays the merchant before the cardholder pays the issuer.

► The issuer has other operating costs, including managing customer accounts, providing statements, fraud detection, risk management, clearing & settlement, etc.

Traditional card payments have been around for decades, ruling the overall payment space. They aren't going anywhere buuuut other forces are driving innovation & need to be brought into your payment stack for cost efficiency, higher acceptance and speed:

🔸Real Time Payments

🔸Open Banking

🔸Buy Now Pay Later

🔸Digital Wallets & Super Apps

🔸Embedded Payments (whitelabeling)

🔸Digical Currencies and CBDCs

🔸Crypto Payments

Technology is driving & disrupting payments continuously! Open Banking, Embbeded Finance, rise of digital currencies, AI boom and many more forces are the future 🚀

eBay | Deel | Coinbase | Intuit

Source: Alex Hu from ByteByteGo

And I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()