European Payments Initiative Launches Wero in Germany: What You Need to Know

Hey Payments Fanatic!

The European Payments Initiative (EPI) has introduced its new payment solution, wero, in Germany. Initially available to customers of German Sparkassen and Volksbanken, Raiffeisenbanken, the service will be extended to Deutsche Bank's Postbank later this year.

KBC customers in Belgium will gain access by the end of July, with France following in September or October after summer trials. EPI plans to have all member banks adopt the service within the next six months.

Wero's primary feature is person-to-person (P2P) transactions, which are completed within 10 seconds using phone numbers, QR codes, or email addresses. The service aims to expand its functionalities across Europe, starting with Belgium and France, then moving to the Netherlands and Luxembourg.

Future Developments

By 2025, wero plans to introduce payments to small businesses and merchants via QR codes, recurring payment management, and integration with merchant apps for in-store purchases. In 2026, enhancements will include Buy Now-Pay Later options, merchant loyalty programs, and expense sharing.

EPI officials regard the launch of wero as a significant step towards creating a unified, secure digital wallet for European consumers, which will enhance Europe’s financial autonomy. The involvement of DSGV and DZ Bank, representing regional savings banks and cooperative financial networks, is crucial for wero's integration and development across Europe’s financial landscape.

Now over to you: do you think this initiative will be a game changer in the European Payments industry?

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

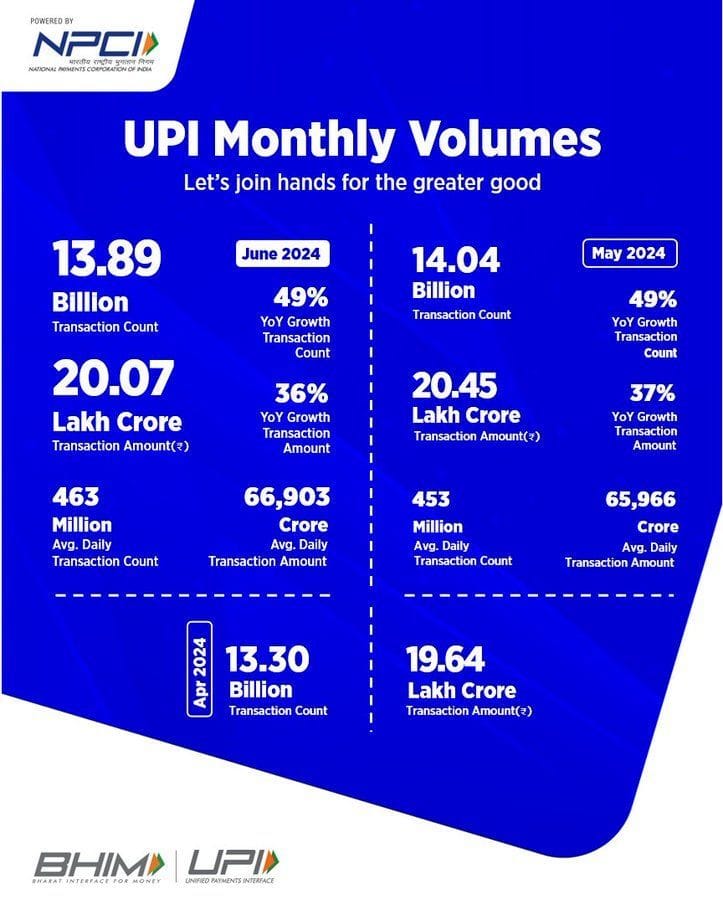

🇮🇳 Here are the latest UPI stats from India:

PAYMENTS NEWS

🇲🇽 Stripe and Cemex collaborate to digitize Mexico’s payments in the construction industry. The partnership, announced on June 26, 2024, aims to facilitate the adoption of e-commerce in a sector that has traditionally been slower to adopt technological innovations.

🇿🇦 Absa and Ozow have partnered to offer a payment solution that leverages open banking technology to provide a fast, secure, and user-friendly payment option. Ozow and Absa are committed to enhancing the digital payments landscape through this strategic partnership, which is designed to simplify online payments.

🇮🇹 Paytech Nexi, has signed a new collaboration with Amazon. it, enabling customers to make purchases using Bancomat Pay. The partnership will also allow Nexi to take another step in supporting the digitization of payments in Italy. Read more

🇬🇧 Cardstream partners with Mastercard to roll out its new service, Click to Pay, to improve online shopping. Click to Pay gives merchants the option to benefit from an embedded and optimised checkout within existing integrations, and is primed to become as ubiquitous as contactless payments.

🇺🇸 Payments platform Qualpay announced that it has entered into a strategic partnership with Aevi, a platform provider for in-person payment orchestration. This integration will enable Qualpay to extend its existing e-commerce focused platform by offering a comprehensive card-present solution to a diverse customer base.

🇬🇧 Christian von Hammel-Bonten appointed as Non-Executive Director to the board of Token Inc. An industry veteran with over 20 years of international experience in the payment sector, Von Hammel-Bonten is an independent consultant for payment and digital transformation.

🇬🇧 MyPOS appoints Matt Komorowski as Chief Revenue Officer. Matt will lead all aspects of the company's revenue growth and sales strategy, and brings a wealth of payments experience at iconic companies such as PayPal, Groupon and the Boston Consulting Group.

🇨🇭 Marcus M. Dal Pont announced that Mastercard Click to Pay is now available in Switzerland. Click here for further insights

🇬🇧 App scams are the most dangerous type of fraud, according to The Payments Association report. Decision-makers from payments businesses across the UK have identified Authorised Push Payment (APP) fraud as the top threat to their businesses and consumers. Continue reading

GOLDEN NUGGET

What is a SWIFT Payment? And how long do SWIFT Payments take?

Let’s dive in:

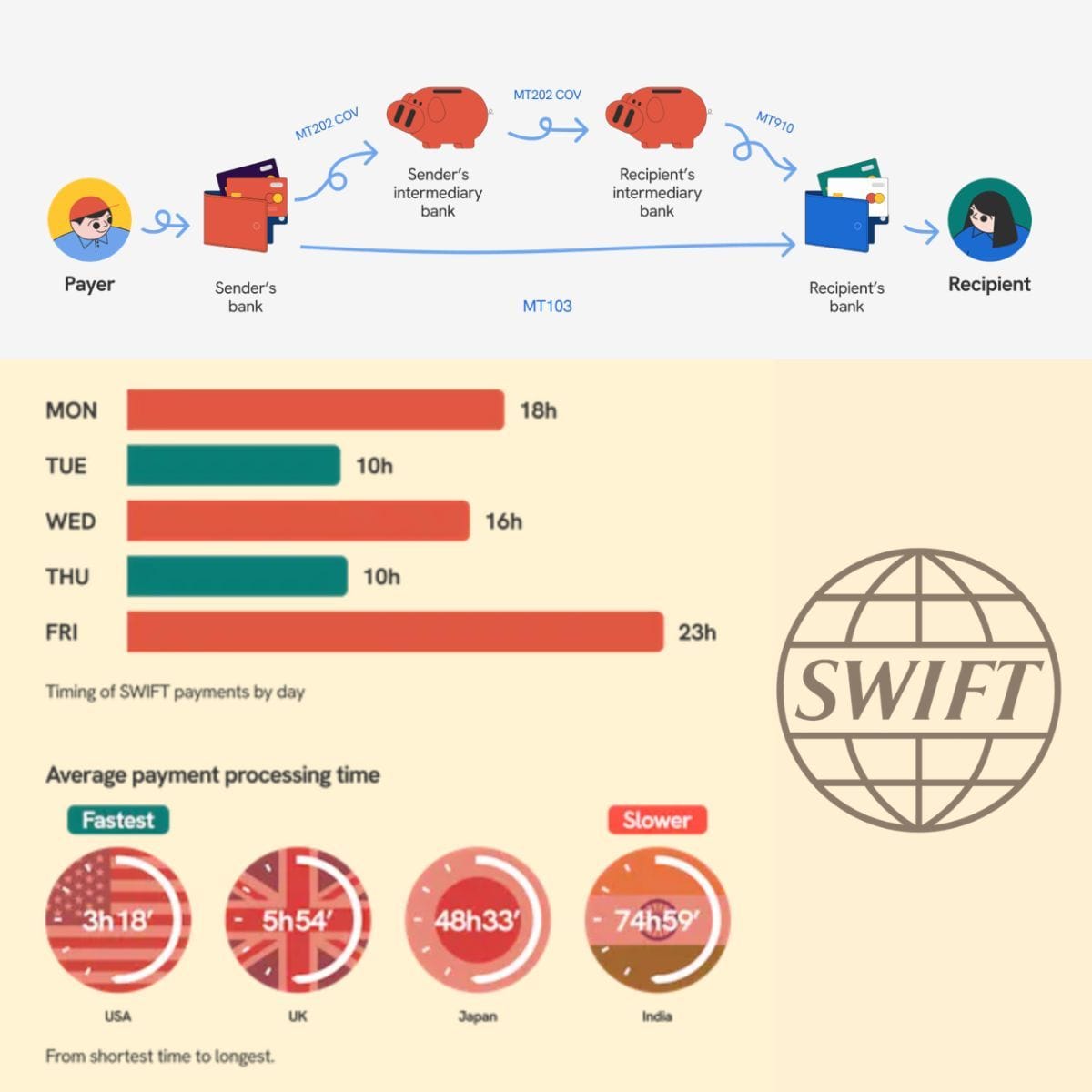

Despite the large number of cross-border payments being made daily, many people use SWIFT payments without fully understanding how it works and who is involved.

A SWIFT payment, also commonly known as a SWIFT transfer, is a form of international money transfer facilitated by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

It involves a message containing payment instructions sent from one bank to another.

These banks can be in different countries, and the payment typically follows a secure and standardized process.

Not all SWIFT payments are simple one-to-one transactions; sometimes, intermediary or correspondent banks may also be involved, which can affect both the time and cost associated with the transfer.

This interaction between banks largely determines the efficiency of the payment process.

Breakdown of Key Participants:

The Payer: The individual or entity initiating the payment.

Payer's Bank: The bank from which the payment originates.

The Receiver: The person or company receiving the funds.

Receiver's Bank: The bank where the funds are deposited.

Plus, Correspondent Banks or Intermediary banks play a significant role. They act as middlemen, helping to move funds between banks from different countries or dealing with different currencies.

For smooth and safe communication between banks, the SWIFT system uses specific messages:

► MT103: A message from the payer’s bank to the receiver's bank.

► MT202: A message that goes from the payer’s bank to intermediary banks, ensuring funds reach the right destination.

► MT910: A confirmation message indicating a successful credit transfer.

Statrys analysis of 500 SWIFT payments reveals that the average processing time was: 20 hours, 7 minutes, and 30 seconds.

Diving deeper into the payment processing durations segmented by currency:

💵 USD payments showcased an average processing time of 16 hours, 55 minutes, and 21 seconds.

💷 GBP transactions were quicker, averaging 5 hours, 54 minutes, and 41 seconds.

💶 Payments in Euros demonstrated the most prolonged average duration of 22 hours, 32 minutes, and 18 seconds.

Of the studied payments, 368 involved at least one intermediary bank.

On average, SWIFT payment involves 1.32 intermediaries, peaking at 4 for some.

Interestingly, they discovered that payments involving intermediaries did not necessarily take longer to process.

I highly recommend reading the complete deep dive article by Bertrand Theaud for more info and stats.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()