Europe Advances A2A Payments with Instant Regulation

Hey Payments Fanatic!

Starting January 9th, 2025, all banks in the eurozone must implement instant payments capabilities, with transaction fees required to match standard credit transfer costs. This means any instant payment to a merchant's euro bank account must complete within ten seconds.

Jan van Vonno, Head of Industry and Wallets at Tink, notes the global context: "In recent years, we have seen instant payment services explode in markets such as Brazil, Thailand and India – with these three markets alone accounting for 179 billion transactions in 2023, according to central bank data." He emphasizes that this new requirement will standardize the previously fragmented European instant payments landscape.

The European Savings and Retail Banking Group reports that 96% of the EU population owns a bank account, making Pay by Bank widely accessible across the continent. Van Vonno adds: "That's why the implementation of IPR is a major innovation milestone for payments in Europe – taking us a big step closer to creating a pan-European payment solution that is available to everyone."

What's your experience with instant payments in your region? Share your thoughts in the comments!

I've compiled more updates from the global Payments industry for your perusal below👇

Cheers,

Stay Ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

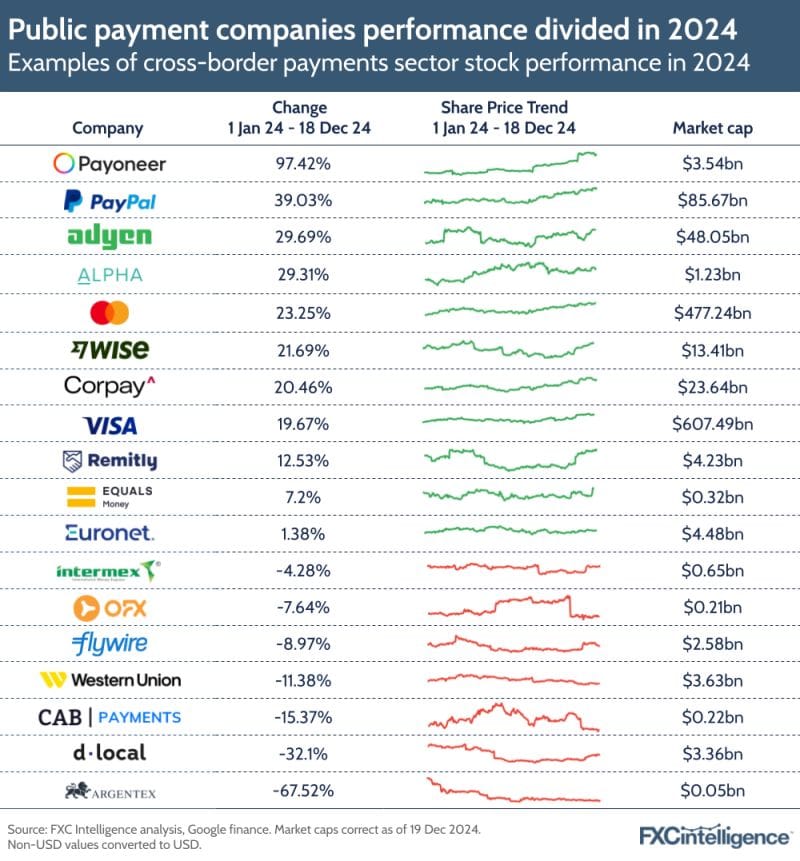

Which Payments stocks performed well in 2024?

Here is an overview made by FXC Intelligence👇

PAYMENTS NEWS

🇪🇺 Checkout.com and Noqodi collaborate to revolutionize payment services in the UAE. The integration will streamline the payment process, reduce friction, and boost overall operational efficiency for merchants across various sectors. The partnership represents a significant step towards advancing digital payments in the UAE, supporting economic growth, and fostering a more seamless online payment experience.

🇺🇸 X Plans to Launch ‘X Money’. The announcement was made by CEO Linda Yaccarino. X Money is expected to function as a versatile payment platform, potentially offering services such as peer-to-peer transfers, e-commerce integration, and even cryptocurrency transactions. Read More

🇺🇸 PSD3’s global reach brings new compliance challenges. In terms of consumer-related details, the proposals indicate that PSPs with online account features must create permission “dashboards” that enable users to consent to having their information shared with third parties, and where users can monitor who they’ve allowed that access. Read More

🇪🇺 Bank-backed EPI processes first e-commerce transactions, paving the way for a full-scale roll out later this year. This setup entailed the smooth integration of the EPI's Wero wallet into the online platform of the merchant and its acquiring partner, VR Payments, as well as in the online banking app of the end-customers.

Wise expands leadership for EMEA. Wise announced the appointment of Lauren Langbridge as CD for North America, and Manuel Sandhofer as its new GM for Europe, Middle East and Brazil. They will oversee and scale Wise Platform’s strategic partnerships, growth, and commercial strategy across the regions, as demand for its solutions rapidly grows.

🇫🇮 Tietoevry banking secures EPC registration for payment services. Tietoevry in partnership with Movitz Payments, will manage Verification of Payee solutions across Europe, providing client banks with a new service saving time and money while reducing fraud.

🇪🇺 Europe to scale A2A payments with new regulation. January 9th, 2025 is the implementation deadline for all banks in the eurozone to receive instant payments. This is arguably one of the most significant deadlines for European payments innovation since PSD2 came into force seven years ago. Continue reading

🇬🇧 Sticpay expands to over 100 countries. Its global network reaches more than 1 million consumers worldwide, spread across over 160 countries. Also, it is widely used by businesses and merchants that sell their services globally, with more than 5,000 businesses connected on the STICPAY e-wallet platform.

🇨🇭 CPMI boosts ISO 20022 for cross-border payments. The steps aim to clarify the medium-term governance and maintenance of these requirements during the global transition to the ISO 20022 messaging standard. The CPMI's actions also encourage industry-led efforts to develop guidelines for cross-border fast payments.

🇧🇷 Paysafe expands into Brazil with new payment license. This license allows Paysafe to expand its partnerships with iGaming operators in Brazil and offer eCommerce payment solutions to merchants across various industries. Also, Paysafe strengthens its presence in the Latin American iGaming market, including Argentina, Colombia, Mexico, and Peru.

🇮🇳 Briskpe launches cross-border payments. By combining A2A transfers with card- and wallet-based collections, BRISKPE offers MSMEs unparalleled flexibility to cater to diverse client preferences, broaden market reach, and accelerate growth. With this integration, businesses can tap into a global network of users and unlock new opportunities.

GOLDEN NUGGET

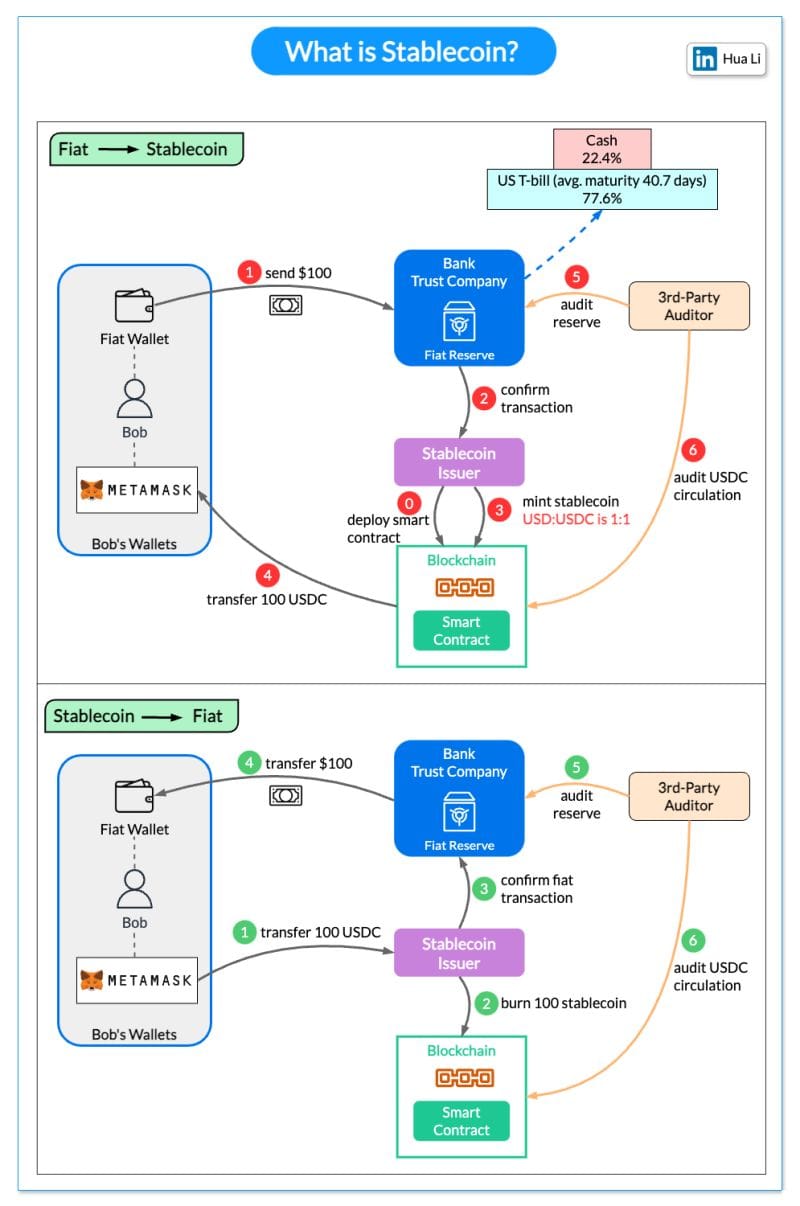

What is a 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧?

Is it going to change the payment flow? 👇

The diagram above shows how fiat-backed stablecoin USDC is created and destroyed.

𝐅𝐢𝐚𝐭 → 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧

Step 0 - A ERC-20 smart contract is deployed on the blockchain, with stablecoin token detail.

Step 1 - Bob transfers $100 from his fiat wallet to the custodian (a bank or a trust company) who maintains the fiat reserve for the stablecoin issuer, in exchange for 100 USDC.

Step 2 - The custodian confirms the transaction and asks the stablecoin issuer to mint and transfer stablecoins.

Steps 3 and 4 - The stablecoin issuer mints new tokens and transfers them to Bob’s crypto wallet. It is called “𝐬𝐭𝐚𝐛𝐥𝐞” because it is 1:1 pegged to USD.

Steps 5 and 6 - A 3rd-party auditor audits the reserves in the custodian and the tokens in the smart contract. It makes sure the tokens are fully backed by fiat money or short-term bills. In USDC’s case, the reserve contains 22.4% cash and 77.6% T-bills (low risk) as per the audit report.

𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 → 𝐅𝐢𝐚𝐭

Steps 1 and 2 - Bob transfers 100 USDC to the issuer in exchange for $100. The issuer burns 100 USDC by calling the smart contract.

Steps 3 and 4 - The issuer confirms the transaction and asks the custodian to transfer $100 to Bob’s fiat wallet.

👉 How does stablecoin change the payments?

Bob can easily transfer the 100 USDC to his friend’s crypto wallet via blockchain transaction. There is no need to go through the banking systems or payment gateways/processors. Then Bob’s friend can exchange the USDC tokens for his local currency via an exchange.

👉 Over to you - How does a stablecoin issuer make money in this business model?

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()