Elon Musk's X Launches Digital Wallet with Visa Payments

Hey Payments Fanatic!

X, Elon Musk's social media platform, is entering the payments space through a partnership with Visa to launch X Money Account, a digital wallet and peer-to-peer payments service. Linda Yaccarino, CEO of X, announced this as the "first of many big announcements about X Money this year."

The collaboration will utilize Visa Direct to enable US X Money Account users to fund and transfer money in real-time using their debit cards. Users will be able to move funds between traditional bank accounts and their digital wallet, similar to services like Zelle or Venmo.

This marks X's first major move into financial services, partnering with Visa to power its payment infrastructure. The service enables instant peer-to-peer payments for U.S. users. In a statement, Visa confirmed: "Visa Direct allows U.S. X Money Account users to fund and transfer money in real-time using their debit cards."

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

📊 Unpacking the Commercial Payments Landscape. This report aims to help acquirers and issuers to better understand the potential that commercial payments can present to their business. Read the full report

PAYMENTS NEWS

🇬🇧 Mollie enables Tap to Pay on iPhone for businesses in the UK. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need to purchase or manage additional hardware. Continue reading

🇯🇵 IDEX Biometrics teams up with LIFE CARD. This partnership marks the introduction of biometric payment cards. It marks a significant step in the evolution of payment technology in Japan, offering consumers a glimpse into the future of secure, biometric-enabled payment systems.

🇿🇦 Noda delivers no-code payment pages. The tool enables gaming streamers and creators to design personalised payment pages in minutes using AI technology. It also eliminates the need for websites or complex integrations, enabling creators to focus on engaging with their audience and growing their brand.

🇫🇮 Former Holvi leader joins $30M instant payment startup Ivy as Managing Director. Sascha Bross will be responsible for the regulated business in Finland. The Helsinki-based subsidiary operates as a fully licensed payment institution throughout the European Economic Area and the EU.

🇬🇧 Vyne shuts down UK operations. Vyne says it will "cease all operations" on 22 April. It was acquired by Dubai-headquartered Tarabut in September, to bring the UK firm's A2A payment capabilities to the Middle East, starting with Bahrain, and expanding to Saudi Arabia and the UAE as Open Banking regulations evolve.

🇧🇷 Bybit launches Bybit Pay. The solution is live in Brazil and integrates with the Brazilian Pix instant payment system. It allows users to connect their crypto wallets for transactions across websites, mobile applications, and point-of-sale systems, offering an interface for deposits, withdrawals, and payments.

🇮🇳 Paytm Payments MD and CEO Nakul Jain quit. He will step down from his position at the close of business on March 31, 2025, or sooner if both sides agree. Jain plans to pursue an entrepreneurial venture, prompting his departure after joining Paytm in April 2022.

🇺🇸 Wells Fargo and Derivative Path bring global payments to regional banks. The partnership marks a major evolution in capabilities for these smaller banks, enabling them to overcome traditional market barriers to provide competitive, secure, and transparent FX payment services, akin to those offered by the largest financial institutions.

GOLDEN NUGGET

What is a SWIFT Payment? And how long do SWIFT Payments take?

Let’s dive in:

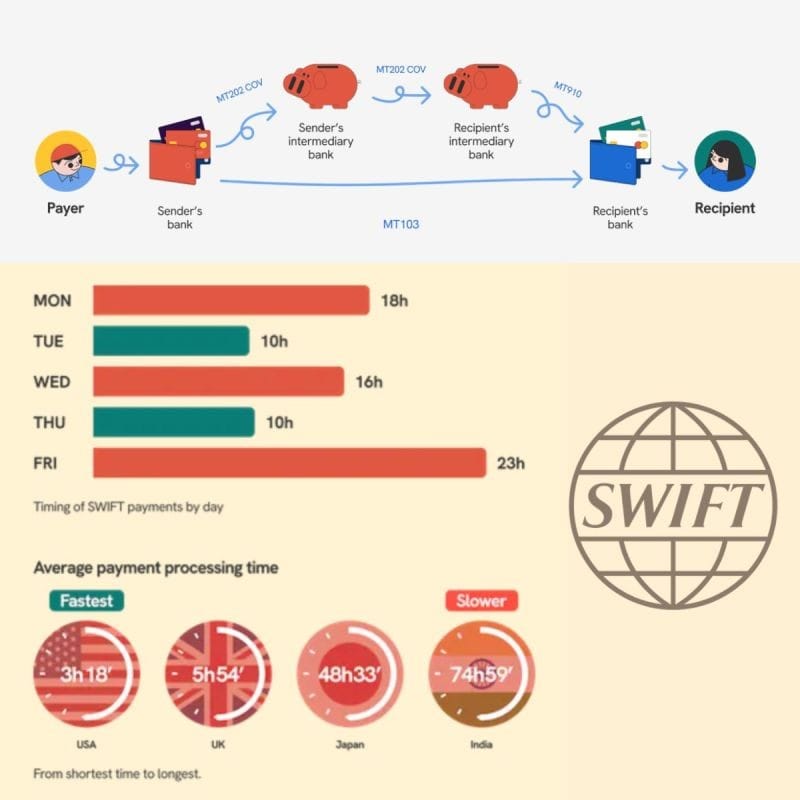

Despite the large number of cross-border payments being made daily, many people use SWIFT payments without fully understanding how it works and who is involved.

A SWIFT payment, also commonly known as a SWIFT transfer, is a form of international money transfer facilitated by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

It involves a message containing payment instructions sent from one bank to another.

These banks can be in different countries, and the payment typically follows a secure and standardized process.

Not all SWIFT payments are simple one-to-one transactions; sometimes, intermediary or correspondent banks may also be involved, which can affect both the time and cost associated with the transfer.

This interaction between banks largely determines the efficiency of the payment process.

Breakdown of Key Participants:

The Payer: The individual or entity initiating the payment.

Payer's Bank: The bank from which the payment originates.

The Receiver: The person or company receiving the funds.

Receiver's Bank: The bank where the funds are deposited.

Plus, Correspondent Banks or Intermediary banks play a significant role. They act as middlemen, helping to move funds between banks from different countries or dealing with different currencies.

For smooth and safe communication between banks, the SWIFT system uses specific messages:

► MT103: A message from the payer’s bank to the receiver's bank.

► MT202: A message that goes from the payer’s bank to intermediary banks, ensuring funds reach the right destination.

► MT910: A confirmation message indicating a successful credit transfer.

Statrys analysis of 500 SWIFT payments reveals that the average processing time was: 20 hours, 7 minutes, and 30 seconds.

Diving deeper into the payment processing durations segmented by currency:

💵 USD payments showcased an average processing time of 16 hours, 55 minutes, and 21 seconds.

💷 GBP transactions were quicker, averaging 5 hours, 54 minutes, and 41 seconds.

💶 Payments in Euros demonstrated the most prolonged average duration of 22 hours, 32 minutes, and 18 seconds.

Of the studied payments, 368 involved at least one intermediary bank.

On average, SWIFT payment involves 1.32 intermediaries, peaking at 4 for some.

Interestingly, they discovered that payments involving intermediaries did not necessarily take longer to process.

I highly recommend reading the complete deep dive article by Bertrand Theaud for more info and stats.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()