Coinbase Commerce Joins Forces with Triple-A to Expand Crypto Payments

Hey Payments Fanatic!

Triple-A, a top licensed crypto payment provider for industries like fashion, luxury, travel, and gaming, has introduced a payment option tailored for Coinbase users. Soon, Coinbase users can make seamless payments at merchants in Triple-A’s global network, enjoying an upgraded crypto payment experience.

This integration enables merchants to offer a Coinbase-specific payment option, improving convenience for users and driving greater adoption of cryptocurrency payments.

“We’re excited to expand crypto solutions through this partnership,” said Eric Barbier, Triple-A CEO. “By integrating Coinbase Commerce, we’re enhancing payment options for Coinbase users across the US, Europe, and beyond.”

Known for its developer-friendly platform and APIs, Coinbase made integration effortless for Triple-A, creating an enhanced experience for users, Barbier added.

Coinbase is eager to connect its users with Triple-A's merchant network, emphasizing its commitment to secure, seamless transactions.

“This integration allows our customers to shop with more merchants accepting crypto via Triple-A,” said Nemil Dalal, Coinbase Developer Platform. “It aligns with our mission to drive crypto adoption for everyday transactions.”

Together, Triple-A and Coinbase are advancing global demand for secure, innovative crypto payment solutions, bringing us closer to a fully on-chain future.

Looking forward to sharing more exciting updates next time!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

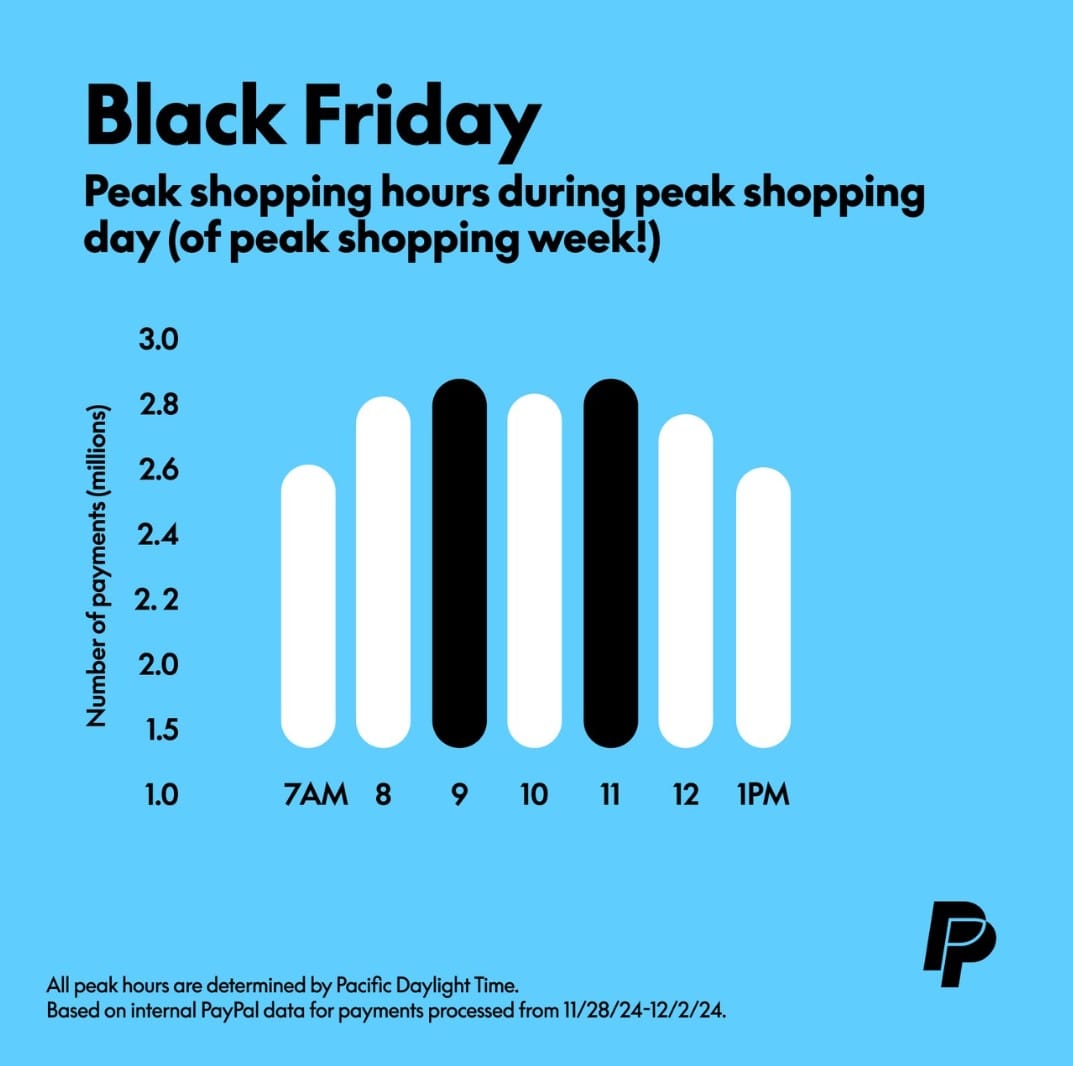

Let's run the numbers on this year's Cyber Week trends across PayPal businesses👇

PAYMENTS NEWS

EQT is working with investment bank Financial Technology Partners / FT Partners to find buyers for payments-services provider Banking Circle, which could fetch $𝟯 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝘁𝗼 $𝟰 𝗯𝗶𝗹𝗹𝗶𝗼𝗻. A sales process for the Luxembourg-based company is slated to kick off in the first quarter of 2025, according to a source who spoke to Bloomberg on condition of anonymity, the details are not public.

🌐 Airwallex expands EMEA presence with new offices: 271% Q3 revenue surge. The firm achieved over $100 billion in global processing volume and $500 million in revenue. It expanded staffing in Tel Aviv and Vilnius and appointed senior executives in London and Amsterdam.

🇧🇷 CloudWalk raises $444M to fund merchant payment advances. This funding comes 6 months after a $313M FDIC in May 2024, and is the largest in CloudWalk’s history. The company will use the funds to provide upfront payments to merchants for their credit card sales, ensuring they get paid faster.

🇲🇽 Klar acquires Tribal assets in Mexico. Klar announced its entry into the business sector through the acquisition of assets (SMB payment and financing tools) in Mexico from Tribal, a finance company specializing in business services. Klar’s stated goal is to establish a financial operating system for small and medium-sized enterprises (SMEs).

🇬🇧 Dojo signs new agreement with American Express to simplify payment processes for small businesses. The strategic agreement will enable Dojo’s small business customers to accept AmEx payments seamlessly with a unified contract, offering consolidated statements, simplified onboarding, and a single point of contact for support.

🇺🇸 Energy Capital Credit Union (ECCU) partners with Velera for debit card processing. This partnership aims to enhance ECCU's card services and support, optimize vendor relationships, and improve processes to benefit both members and employees. Read on

🇨🇿 Škoda and Parkopedia enhance valued in-car payment service. This functionality reduces stress by eliminating reliance on traditional payment methods like cash or cards, avoids issues like out-of-order machines, and minimizes distractions.

🇺🇸 BlueSnap named a preferred payments partner for Zuora. By integrating Zuora with BlueSnap, businesses can automate global payments acceptance for their subscription and recurring billing processes, accepting payments all over the world with local card acquiring in 40+ countries.

🇬🇧 Visa blocks 410% more suspected fraud this Black Friday, as fraudsters target UK shoppers. As consumers hunted for bargains, fraudsters were also looking for their own payday. Throughout the weekend, the network blocked 117% more suspected fraud compared to the previous Black Friday weekend.

🇬🇧 Zilch shares Black Friday shopping data. Zilch reported a 116% year-on-year sales growth on Black Friday and a 93% increase after Cyber Monday, more than doubling last year’s figures. The total transaction amount on its platform was not disclosed.

🇺🇸 Red River Bank selects Allied Payment Network for real-time payments integration. Partnering with Allied enables Red River Bank to deliver advanced real-time payment solutions while reinforcing its dedication to innovative digital services and superior customer support for its customers and communities.

GOLDEN NUGGET

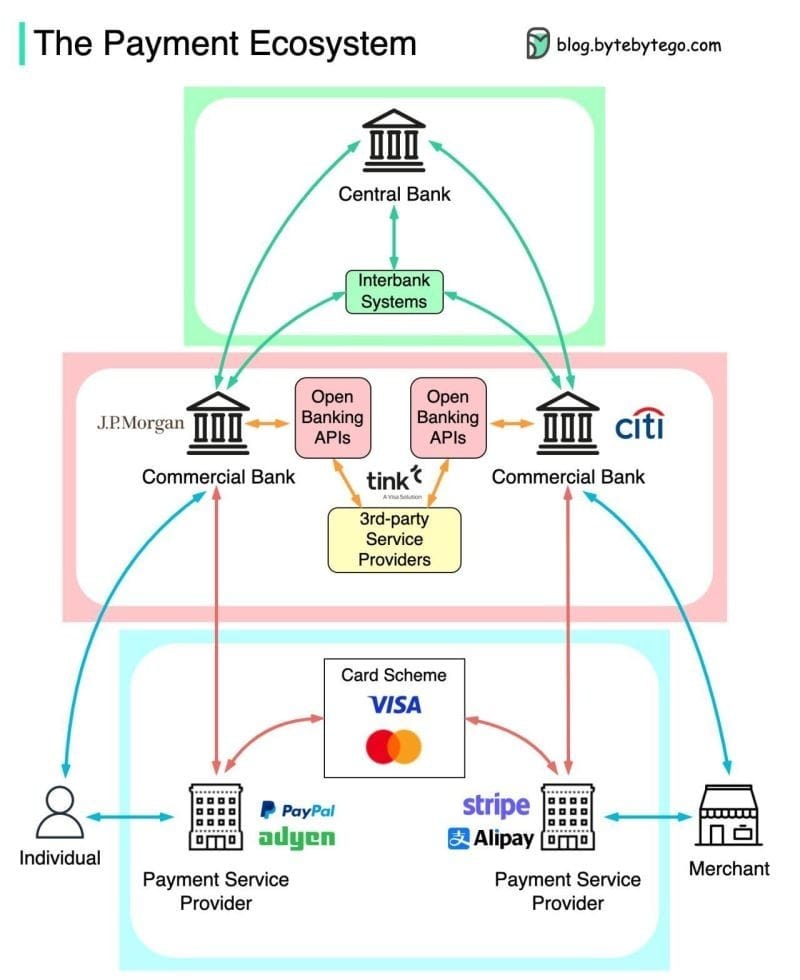

How do PayPal, Visa, banks, and Open Banking interact with each other?

Here is how the Payment Ecosystem works from a bird’s eye:

From bottom to top:

‣ A bank or a PSP (Payment Service Provider) provides payment services to merchants and cardholders.

‣ The card schemes such as VISA and Mastercard connect to PSPs on both card acquiring and issuing sides. They do clearing for credit/debit card transactions.

‣ The commercial banks have reserve accounts in the central bank, where the actual money movement happens.

‣ Open banking provides universal APIs for 3rd-party service providers to access bank accounts and create transactions. By creating a 𝐬𝐡𝐨𝐫𝐭𝐜𝐮𝐭 in the current systems, open banking APIs are already fostering innovations.

In payment systems, the information flow and settlement flow are separated. So although there are layers of systems in the diagram, they don’t need to happen at the same time.

Source: Hua Li from ByteByteGo (👈 follow these accounts for more great payment insights like this piece👌)

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()