CloudWalk’s AI Revolution: Profits Soar & US Expansion Begins

Hey Payments Fanatic!

CloudWalk, the Brazilian payments firm, saw its profits skyrocket in 2024, fueled by AI-driven automation. The company posted a net income of $63 million on $497 million in revenue, with AI “agents” handling customer service, sales, and back-office operations. With 3 million clients and revenue per employee doubling year-over-year, CloudWalk is setting a new standard in FinTech efficiency.

Founder & CEO Luis Silva shared: “The idea is to keep slowly hiring the best people who want to work with AI agents and put them to work together so we can scale to the US and other countries.” The company expanded to the US under the name Jim.com and plans further growth in 2025.

With its unique AI-powered model, CloudWalk stands apart from competitors like Mercado Pago, Klarna, and Stripe. Silva describes it as a “blue ocean” opportunity: “Who are the companies scaling AI agents to handle financial needs across Brazil, the US, and beyond? There aren’t many. This is the beginning of a new wave.”

If you’re interested in reading more about what’s been happening in Payments, keep scrolling!

Cheers,

Level up your banking knowledge. Subscribe now for the latest in digital banking, delivered weekly.

INSIGHTS

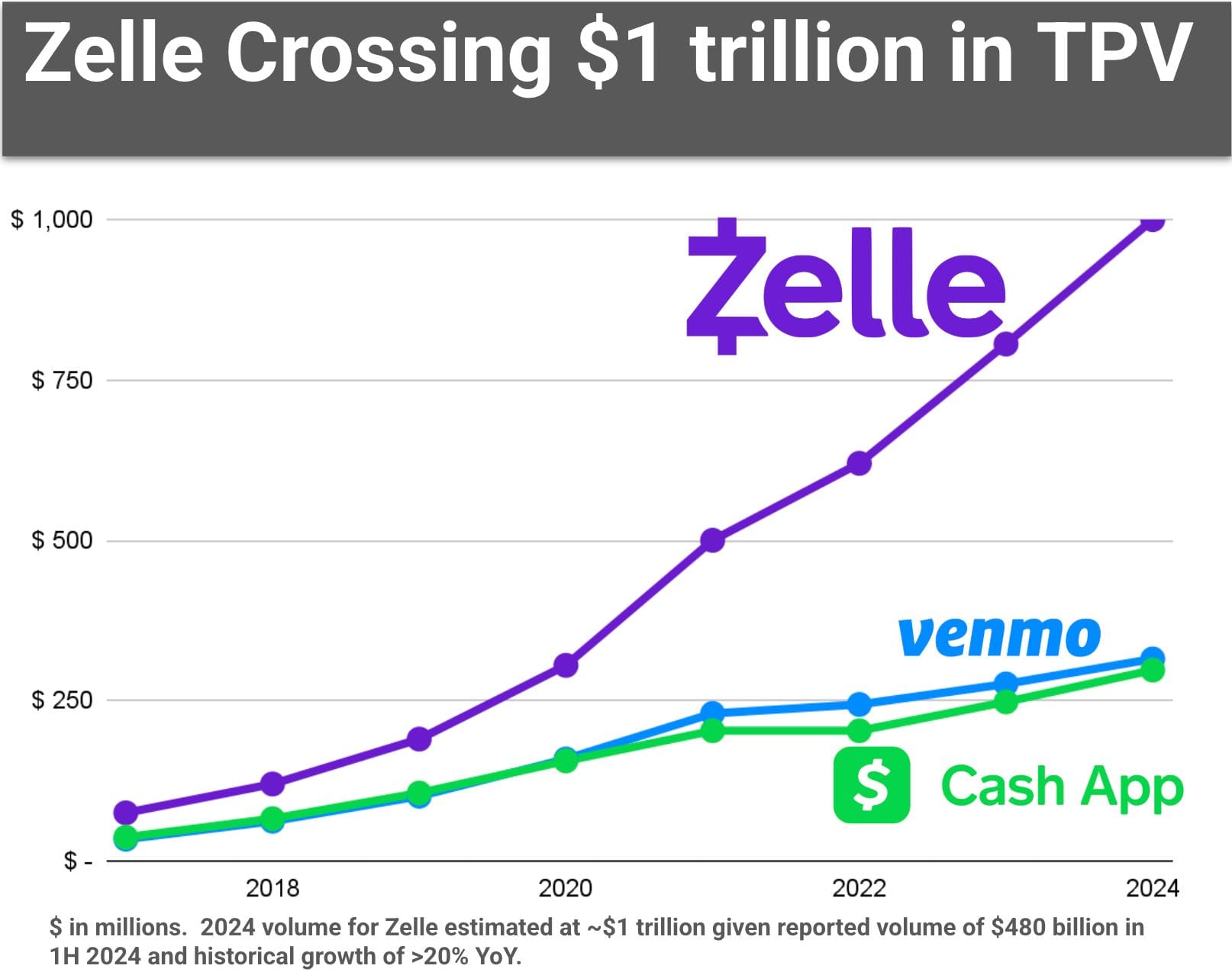

𝘿𝙞𝙙 𝙮𝙤𝙪 𝙠𝙣𝙤𝙬? Zelle is the first P2P payment app to cross $𝟭 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in TPV and it's growing much faster than its rivals 🤯

PAYMENTS NEWS

🇦🇺 Ishan Agrawal joins Airwallex as Head of Engineering. Ishan is joining Airwallex with a mission to drive innovation in AI, Data Platforms, and Growth. He cited the company’s business impact, technical ambition, and strong engineering culture as key motivators for his decision.

🇺🇸 Stripe brings aboard new head of ‘startup and VC partnerships’. Asya Bradley, a former FinTech founder and investor, has joined payments giant Stripe as its new head of Startup & Venture Capital Partnerships. Read more

🌍 Viva.com merges e-money and banking licenses across Europe. The company will provide businesses a single value-driven platform for payments acceptance, card issuing, and banking that will accelerate the adoption of the latest technology, with unmatched convenience and efficiency.

🇮🇳 Yuze expands into India. The company aims to expand its impact by leveraging the nation’s growing FinTech ecosystem. Supported by government initiatives such as Digital India and increasing investments, the Indian market provides fertile ground for Yuze to foster financial inclusion.

🇸🇦 Egypt’s Khazna banks $16M for its financial super app and expansion. The investment will support its expansion plans as it prepares to apply for a digital banking license in Egypt and expand into Saudi Arabia. Read More

🇦🇪 Dubai Duty Free partners with TerraPay. This strategic partnership enables travelers to make purchases using their home-country digital wallets, driving a new era of convenience and accessibility in payment solutions. Read more

🌍 AFS and Nsano partner to transform Card Payments. The partnership will enable Nsano to expand its offerings by integrating AFS’s state-of-the-art card processing services into its existing mobile money infrastructure. This collaboration is set to transform the payment ecosystem.

🇬🇧 Money Squirrel partners with Moneyhub for open banking. Moneyhub’s Open Banking-enabled API technology powers Money Squirrel’s platform. It empowers businesses to make the most of their money by automating the saving of future VAT payments into market-leading interest accounts.

🌍 Payment startups battled interest spikes and a funding drought. A combination of increasing compliance requirements, interest rate rises and a funding drought hit the sector hard. And annual VC funding in recent years has yet to crack the $2bn mark as some of its biggest players struggle to reverse losses.

🇿🇦 Paycorp acquires Pilot Software. This strategic move strengthens Paycorp's market presence and enhances its product offering, enabling businesses to benefit from a diverse range of payment solutions. The acquisition reaffirms its commitment to delivering innovative, cost-effective and a collaborative payment offering.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()